Aethir Research Report

Context

Decentralized Physical Infrastructure Networks (DePIN) represent a transformative approach in constructing and scaling infrastructure networks, which are categorized into two primary types: physical and digital. DePIN projects are unified by a core philosophy aimed at fostering a more open, decentralized, and transparent infrastructure network across various sectors. This methodology presents clear advantages over traditional web2 models for several key reasons:

- Resource Utilization and Cost Efficiency. DePin projects leverage two key facts to gain this key competitive advantage: a) using existing under-utilized equipment, and b) reducing upfront costs and risks for new hardware investors (with token incentives and already secured demand).

- Localized Service Provisioning: Distributed resources within the DePIN framework are adept at understanding and catering to the specific needs and demands of local markets. For example, in a decentralized cloud gaming framework, recognizing regional gaming preferences allows for the provision of popular, on-demand games, enhancing service flexibility and user satisfaction.

- Reliability and Reduced Failure Risk: Decentralized networks inherently diminish single point of failure risks, leading to increased reliability and resilience of the services offered.

- Accelerated Innovation: The decentralized and permissionless nature of DePIN networks fosters a rapid pace of innovation. The further alignment of multiple parties behind a common goal (and asset) incentivizes third-party development.

In 2023, the DePIN sector experienced explosive growth, surpassing 755 projects and a $32 billion market capitalization. This surge underscores robust demand and investor confidence in decentralized infrastructure. It is worth highlighting that, generalized-compute structures have shown increasing demand for their services, reaching utilization rates in the range between 40-70% over the past year. This has converted the subsector into the highest revenue generator within the DePin sector achieving $27.5 million of annual revenue in 2023.

Furthermore, it is important to remark the growth of the GPU-compute sector beyond DePin. Currently, the demand for processing power is outpacing the available supply, mainly driven by emerging technological fields such as Artificial Intelligence (AI), telecommunications and cloud gaming, which necessitate vast amounts of computing power. This issue is pushing a global race for the acquisition of GPU resources led by players like Meta, OpenAI, Alibaba and others; with the main focus being oriented towards processors in the highest performance bracket, specifically the H100 GPUs developed by Nvidia.

As a consequence, the North American GPU cloud market, serving as a leader for this trend, is expected to undergo a rapid rise from $3.2 billion in 2023 to an impressive $25.5 billion by 2030, charting a Compound Annual Growth Rate (CAGR) of 34.8%.

Project Overview

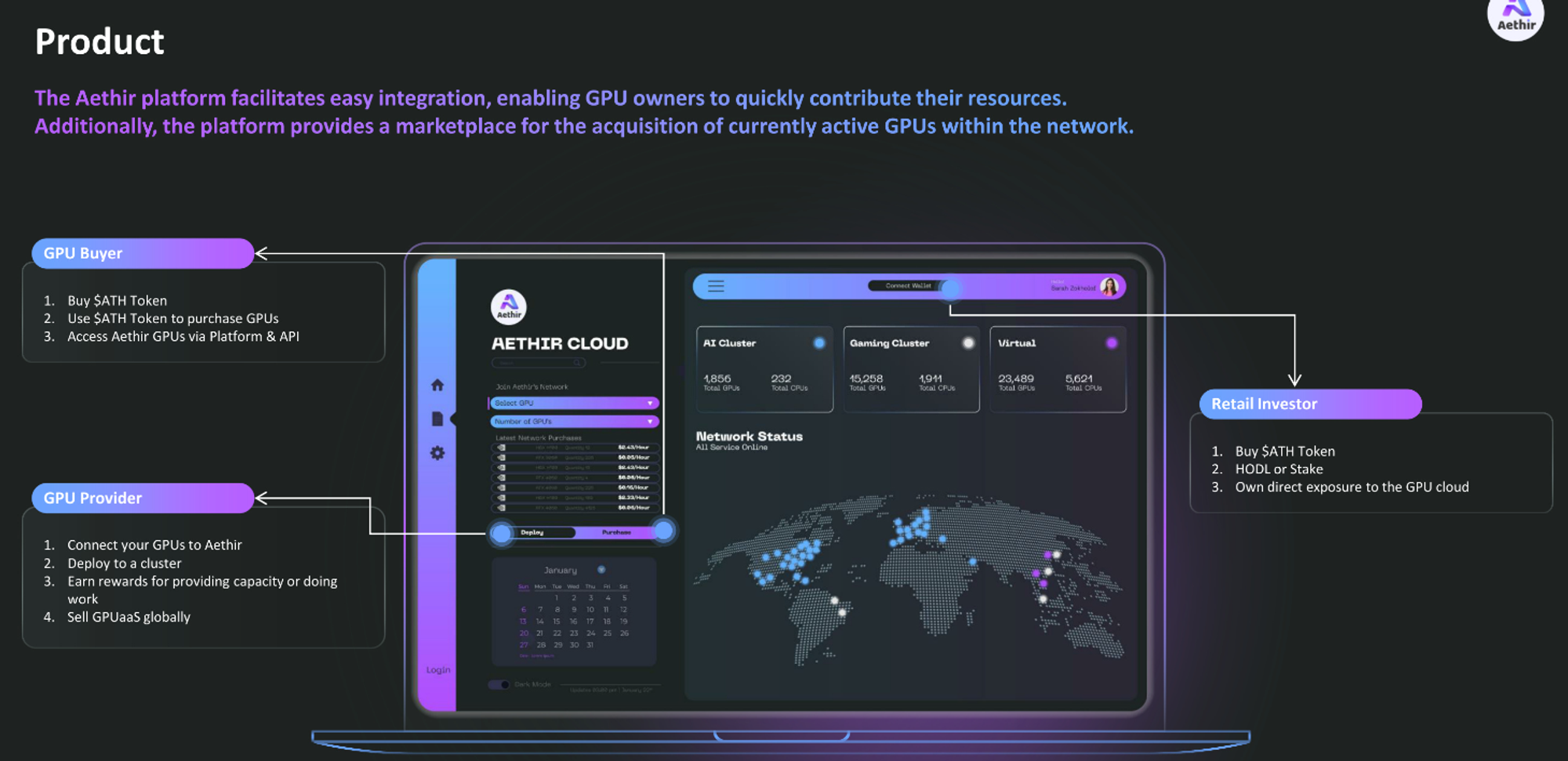

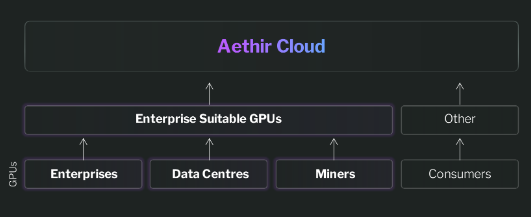

Aethir Cloud is a decentralized platform that connects computational processing service providers and consumers with a focus in compute-intensive applications reliant on GPU hardware - aiming to be an aggregator of GPUs for the masses.

On the GPU-compute supply side, Aethir Cloud is composed by a network of enterprises, data centers, miners and retail GPU providers. On the GPU-compute demand side, Aethir is targeting the enterprise segments of the following verticals: AI Training, AI Inference, Gaming, and Virtualized Devices (primarily phones).

One of the key innovations that enables Aethir’s strategy to address enterprise markets is resource pooling; aggregating distributed contributors under a united interface to serve large-scale clients globally. One key implication of resource pooling is that GPU providers can freely connect or disconnect from the network, enabling data centers with idle hardware to participate in the network in their downtimes. This flexibility leads to higher utilization rates for GPU providers, while enabling Aethir to offer reduced prices for their consumers.

Additionally, Aethir’s alignment with web3 ethos and the introduction of $ATH token will enable the network participants to co-own the platform and reduce the financial risks for network participants at early stages. This will allow Aethir to scale rapidly, especially in the early stages of its life cycle.

The core of Aethir’s ecosystem runs on three central pieces of back-end infrastructure that are crucial to operations:

Containers: Fundamental to the Aethir network, the Container is where the actual use of the cloud takes place. It acts as a virtual endpoint, executing and rendering the application (e.g., rendering the game for a player, executing an inference task for an AI consumer, powering a virtual phone). The Container's purpose is to ensure that the cloud experience is immediate and responsive, offering a "zero lag" experience. This is achieved by shifting the workload from the local device to the Container (e.g., shifting all game execution and command processing).

Checkers: The Checker ensures the integrity and performance of Containers within the Aethir network. Verifying container specifications as provided by the Container Providers is essential to maintain the network's Quality of Service (QoS).

Indexers: Core to Aethir’s network, the Indexer matches consumers with suitable Containers, ensuring a swift launch of cloud-based apps & services. The goal is to deliver a “second on” service - the transition from a consumer’s request to the actual delivery (e.g. a player making a request to a game screen) should occur in the shortest possible time. This requires succinct signaling and efficient scheduling.

Together, these three foundational elements—Containers, Checkers, and Indexers—work in tandem to ensure the smooth operation of Aethir’s ecosystem. More information regarding these three key roles can be found in their gitbook

Key Value Proposition for Aethir Ecosystem Players

GPU Supply: Existing infrastructure providers

- User example: Tele-communication companies, hardware intensive digital enterprises.

- User pain point: Under-utilized hardware.

- Aethir’s value proposition:

- Enable selling hardware capacity using GPUaaS model, increasing utilization rate.

- Global reach - enterprise-level contracts achieved through economies of scale by pooling resources with Aethir network.

- Flexible terms for hardware operators looking to connect to the network.

- Token incentives derisk CapEx.

GPU Supply: New infrastructure investors

- User example: Mining infrastructure investor.

- Aethir’s value proposition:

- Access to enterprise clients at a global scale.

- Ecosystem support to simplify and assist in operations.

- De-risked CapEx:

- Ability to make progressive investments.

- High utilization network rates due to serving global demand, access to token rewards.

- Higher returns: obtaining service fees + token rewards.

GPU Supply: Retail Contributors

- User example: Retail users with idle hardware.

- Aethir’s value proposition:

- Obtain returns for contributing GPU processing power to the network.

- Hold / stake $ATH to get direct exposure to the growth of Aethir’s ecosystem.

- Run checker nodes and obtain rewards for contributing to network decentralization and service quality.

GPU Consumer

- User types:

- AI Training

- AI Inference

- Gaming

- Virtual Compute

- Aethir’s value proposition:

- Improved performance

- Low-latency global service

- Local compute option

- High-performance platform and API integrations

- Competitive and dynamic pricing that will further reduce with adoption and scale.

- Global coverage, large and dynamic supply.

- Improved performance

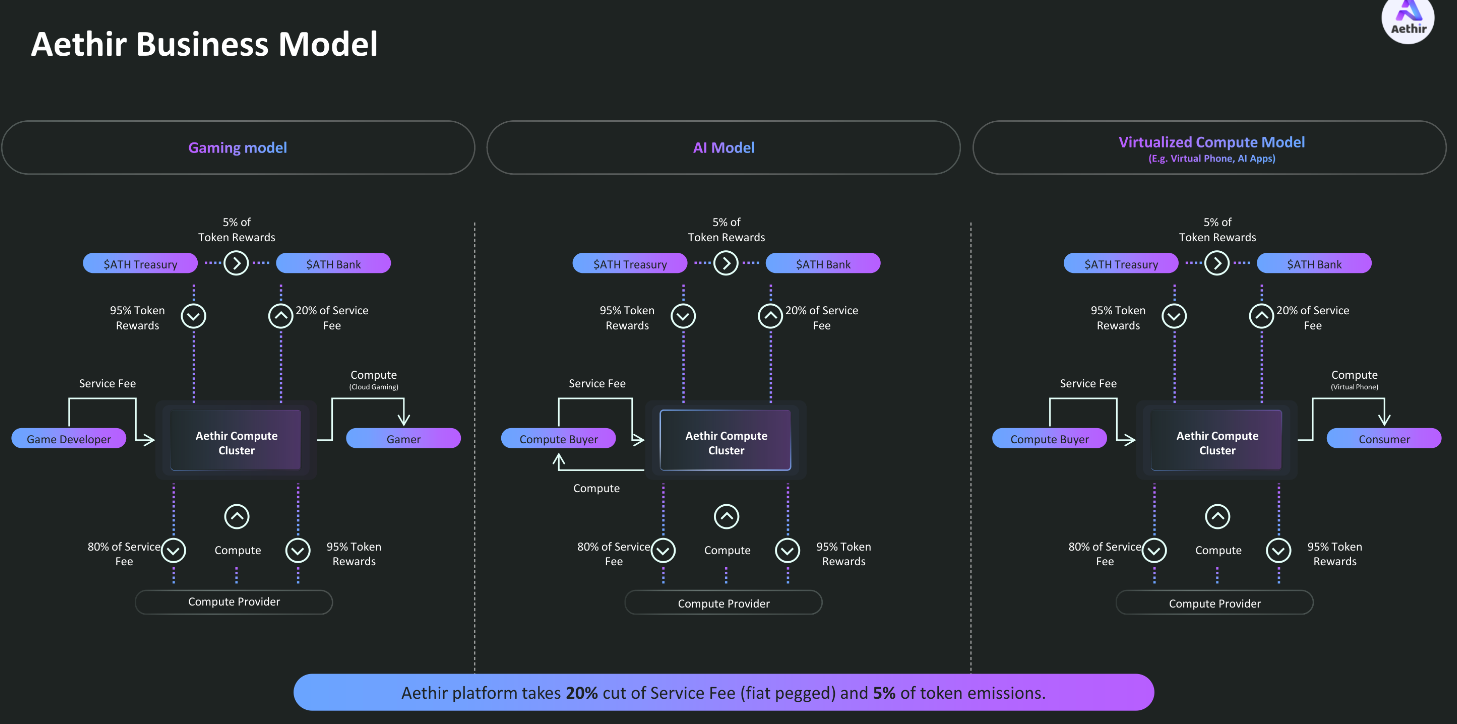

Business model

Aethir functions as a marketplace and aggregator, facilitating the connection between supply-side participants—such as node operators and GPU providers—and users and organizations from computing-intensive sectors like AI, virtualized compute, cloud gaming, and cryptocurrency mining. By providing institutional and retail users access to these computing resources, Aethir offers a cost-effective alternative to traditional web2 counterparts and competitors. Revenue generation within Aethir's ecosystem follows a structured model, where a 20% service fee, denominated in $ATH tokens is applied to payments made by customers to suppliers. Additionally, as part of its grants and operations program for indexers, Aethir receives 5% of the total $ATH annual token emissions. To ensure fairness and competitiveness, Aethir allocates 50% of total ATH tokens for token incentives, benefiting node operators and supply-side entities, ensuring that APRs are attractive for entering a nascent ecosystem, as well as overall sustainability for the ecosystem long term.

Node Operators within Aethir’s Ecosystem have multiple avenues for revenue generation, which are split into three forms of rewards:

- Service Fee: Compute buyers or demand-side entities pay a service fee to purchase computing power. Payments are converted into ATH tokens, with 80% of the fee passed onto the Node Operator, while Aethir retains a 20% platform cut.

- Proof of Rendering Work: Token incentives are provided to node operators as an additional reward for completing computing tasks within the ecosystem. This encourages supply-side entities to join Aethir’s ecosystem and provide valuable processing and computing work. Proof of Rendering Work is exclusively distributed to containers upon completing computing tasks.

- Proof of Capacity: Compute Providers earn Proof of Rendering Capacity for demonstrating readiness to provide compute services. Even in the absence of active work, providers receive rewards to incentivize onboarding onto the ecosystem, thus mitigating participation risks.

Aethir operates within three primary sectors, with the same business model applying across all three:

- Cloud Gaming Model: Catering to the growing cloud gaming industry, Aethir offers computing resources optimized for gaming experiences.

- AI Model: Aethir's platform provides specialized infrastructure for AI applications, enabling users to harness the computing power required for training and inference of complex AI models.

- Virtualized Compute Model: With a focus on virtualized compute, Aethir offers flexible and scalable computing resources suitable for various virtualization applications and workloads.

Traction

GPU Demand

Aethir has validated market demand for Enterprise-grade GPUaaS customers within the AI Model Training, Virtual Compute and Gaming sectors, with 3 live contracts representing over 20m projected ARR for Q1 2024 and an extensive pipeline.

Specifically, Aethir has achieved:

- Contract with world’s largest gaming studio for 5m to 7m ARR, with 150m MAU player-base.

- Contract with WellLink for 5m to 7m ARR, largest cloud gaming company with over 64m MAU.

- Contract with world’s largest telecom company for 5m ARR (potentially rising to 13.9m in the near future).

- Pipeline of 10 additional contracts in the gaming space expected to close within Q1 2024

GPU Supply

Aethir has leveraged it’s strong value proposition to unlock GPU capacity from existing infrastructure sources while also being able to attract commitments for direct hardware investments to be network participants.

Aethir’s Cloud currently features $24M worth of equipment providing services distributed across 25 locations and 13 countries. Additionally, Aethir has secured over an equivalent of $10M worth of equipment to grow the infrastructure during 2024.

It is worth to highlight that Aethir has strategically focused its efforts to secure access to H100 units. With AI picking up a lot of traction within both web2 and web3, and thus the demand for H100 chips has also grown exponentially, Aethir has been able to amass over 4000 nodes, which are already connected to Aethir’s network. They are also in the midst of further agreements to boost this number up to 50,800 units within the next 6 months. This would make Aethir the only decentralized provider with access to this type of scale to hardware.

Here is the summary of the current equipment Aethir possess:

Social Traction

Community support is a clear indicator of Aethir's growing popularity, with over 170,000 followers across various social media platforms garned thus far. Furthermore, with the continued growth of Aethir’s platform alongside the contracts onboarded, it is projected that Aethir will have 10 million Monthly Active Users (MAUs) in 2024. The anticipated user growth underscores the market's enthusiasm for Aethir's innovative cloud computing solutions.

Investors & Partners

On the investment front, Aethir has successfully raised $9 million from a wide array of investors, including venture capitalists and family offices like Animoca, Maelstorm Fund, IVC, Framework, Sanctor Capital, and Merit Circle. This investment demonstrates the confidence these entities place in Aethir's vision for transforming the cloud computing landscape.

Additionally, Aethir has stablished strategic partnerships with key players within the industries it operates:

- Nvidia partnership through the Inception Program,

- Partnered with Well Link, world’s largest telecommunications company and other key players in the telecommunications space (under NDA),

- Partnered with top gaming studios including world’s largest studio (NDA),

- Deployment on Arbitrum and partnership with key web3 players such as Impossible Finance, Gam3s.gg and Seedify.

Funding events

Seed (Token round, early 2022) - $60M Valuation

Pre-A (Token round, early 2023) - $150M Valuation

Technical Differentiation

Network Access Variety: Aethir introduces a range of network access options for its container-based services. This includes both peer-to-peer direct connections and server-assisted connectivity for diverse operational scenarios, providing a more adaptable solution compared to traditional cloud rendering offerings.

Transparent Evaluation Framework: Aethir has established a transparent and objective evaluation framework for assessing the specifications of containers and the quality of services provided. This represents a shift towards a more dynamic evaluation approach, with Aethir having a system to assess computing power specifications for different services. It sets standardized evaluation frameworks for applications and containers to ensure consistency across various uses. Additionally, Checkers within the network ensure quality is delivered to users in a consistent manner. Lastly, a thorough service quality assessment protocol, that monitors quality from the beginning of a sessions till exit - covering the entire process end-to-end.

Enhanced Low-Latency Technologies: Aethir has achieved notable progress in minimizing end-to-end latency, crucial for delivering real-time cloud rendering experiences. Key innovations include:

- Utilization of predictive algorithms, such as Kalman filtering, to ensure stable input of events, achieving a reduction in delay by 7~15ms against competitors.

- Implementation of advanced video capture techniques directly from the GPU, minimizing VSync delay (16.6ms reduction in the case of 60 frames.

- Adoption of a Region of Interest (ROI) encoding strategy to optimize video encoding processes on Aethir’s platform, allowing bit rate and network transmission capabilities to be more balanced compared to competitors, improving user experience.

- Application of terminal super-resolution technologies and integration of Google's Oboe to enhance image and audio quality, further reducing latency for users within poor network conditions, which are highly apparent within developing countries.

- Custom adjustments in video rendering and playback to accommodate a variety of chips and operating systems, ensuring control over latency.

Hardware Access Diversity: Aethir has an extensive range of hardware access that enables them to surpass many of the currently supported hardware by incumbents.

Aethir’s scale of supported hardware include:

This strategic enhancement of Aethir’s cloud rendering services elevates the platform’s capability to offer unparalleled hardware compatibility, innovative network connectivity solutions, and a robust evaluation system, all while ensuring a high-quality, low-latency user experience.

Roadmap

Aethir's roadmap is strategically crafted to prioritize rapid advancements in four crucial domains in the future:

- Platform Development: Aethir will focus on the ongoing development of its platform, with upcoming developments set to broaden hardware support and refine the platform's token economics. The roadmap also outlines the decentralization of critical roles, such as checkers and indexers, and the extension of GPU-as-a-Service (GPUaaS) alongside Software-as-a-Service (SaaS) applications, aiming to solidify the platform’s infrastructure and broaden its use-case scenarios.

- Aethir Air: Within the cloud gaming vertical, Aethir is focused on refining the gaming experience for both users and developers. Innovations include the integration of gyroscopic controls from terminal devices to enhance interactivity, providing players with a more immersive and intuitive gaming experience, such as tilting a device to steer in a racing game. Additional improvements target in-game communication, aiming to ensure smooth and uninterrupted audio interaction among players.

- Aethir Earth: Dedicated to the bare metal business aspect, Aethir Earth caters to large-scale customer requirements for H100 GPUs. The roadmap envisions augmenting the efficiency and adaptability of order management and resource allocation. The development of open API interfaces is a key objective to streamline these processes, positioning Aethir as a versatile provider capable of serving a diverse clientele, ranging from niche players to industry giants, with a commitment to evolving these offerings over the ensuing two years.

- Cloud SmartPhone Services: Technological advancements in this sector are directed toward the establishment of a borderless Cloud SmartPhone Platform-as-a-Service (PaaS) with an emphasis on user security and privacy. Future developments include the facilitation of user migration capabilities, allowing for seamless cross-node data transfer within the Aethir infrastructure network. For instance, users will be able to effortlessly migrate their cloud phone services internationally, exemplifying Aethir's vision for a globally interconnected and user-centric cloud service experience.

Competitive Landscape

As described above, Aethir is building a distributed, GPU-based compute infrastructure for dynamic, enterprise use cases across the AI, Gaming and Virtualized Compute sectors.

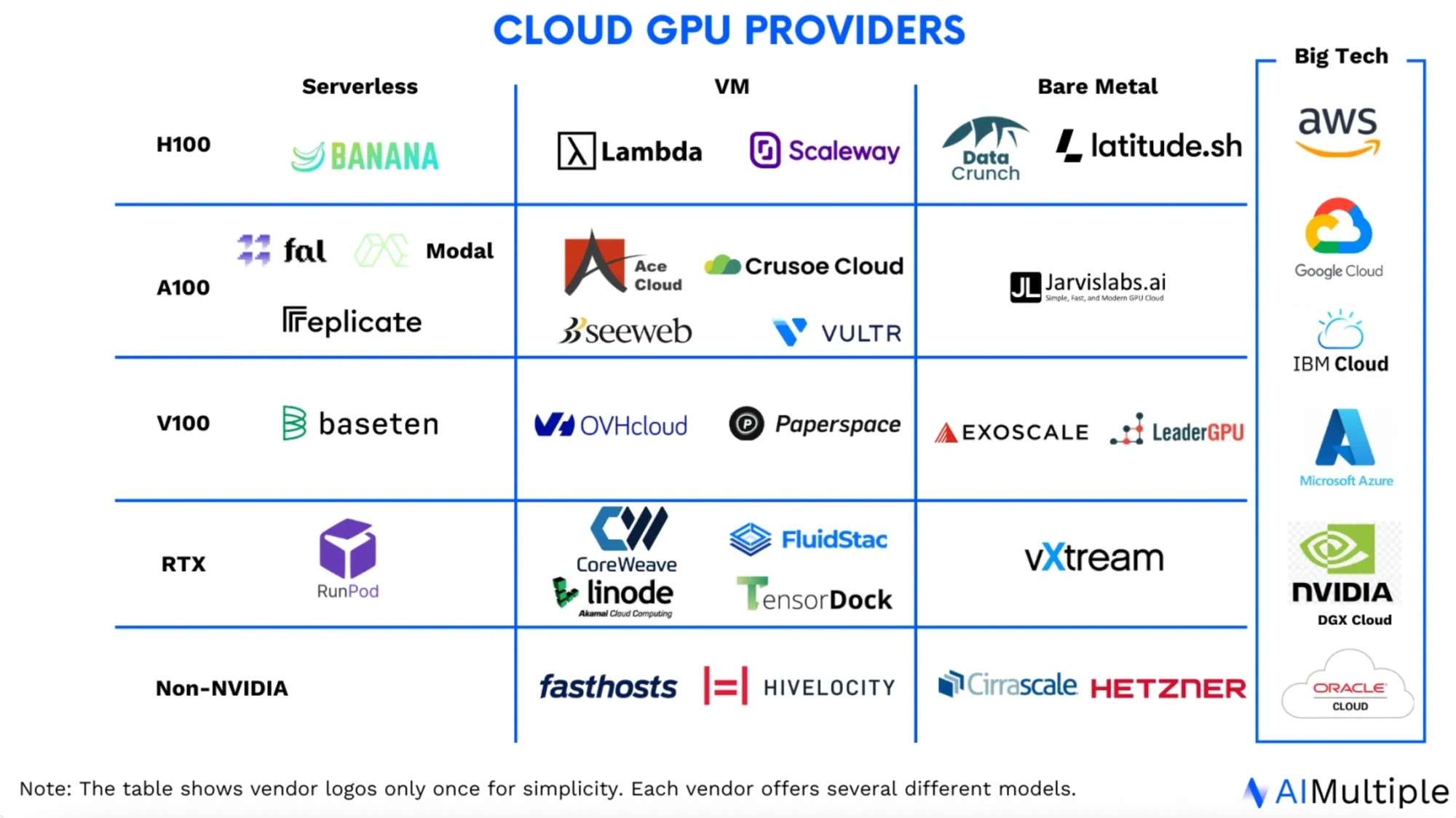

Within this context, Aethir will be competing head-to-head with traditional and decentralized cloud GPU providers. The following image offers an overview of current landscape within centralized providers.

Although in this section the focus is on the DePin GPU landscape, we highlight the following key challenges that centralized providers are facing, that are being addressed by Aethir and DePin competitors could lead to a sustained edge in the competition:

- Pricing and Cost structures: Centralized providers offer high prices with confusing pricing structures, particularly for on-demand usage. Hidden costs, such as needing to pay for both the cloud provider and an additional service (like in the case of NVIDIA DGX Cloud).

- Service Availability: Service availability is not complete for a subset of machine types, which makes it challenging to scale services that meet enterprise-level or intensive computational demands.

- Service Scalability: scaling centralized structures require massive upfront costs.

- Infrastructure and Integration Limitations: Some services require GPUs to be attached to specific standardized VMs of different providers, leading to potentially inefficient setups. Limitations in integration with other cloud services or in-house systems.

- Limited GPU Options and Specializations: Many providers are highly specialized and offer limited GPU models and configurations, making the offer not suitable when flexibility is required.

On the other hand, focusing on the decentralized competitive landscape it is worth highlighting the complementary role of both storage-focused and GPU-focused networks.

Within the first group, projects like Arweave and Filecoin are choosing to not compete in the GPU Cloud Computing sector but rather build synergies to compliment the output of players within the space. During Filecoin Day at Lab Week 2023, Filecoin Foundation stated that Filecoin’s focus on AI will be from the data that AI generated and the growth of AI Data is beneficial for Filecoin. Fair protocol, a Decentralized AI model and compute Marketplace built on Arweave would be a complementary layer for under-verified data from AI Computing platform, while a similar logic is already built within Aethir ecosystem.

Regarding the latter, in this report we will focus the analysis on direct competitors within the decentralized GPU networks space reviewing Render, Akash, Gensyn and io.net as benchmarks.

Render

Render Network is majorly focused in rendering services, displaying 4367 GPUs currently connected to the network and representing over 82k TFLOPS.

The latest approval of Render Network Proposal 004 (RNP-004) signal the project’s initial interest in leveraging Render Network nodes for AI / ML workloads. Recent approval of RNP-007, RNP-008 and partnership with io.net, further signifies Render’s effort in increasing the Network’s usage by supplying under-utilized GPU’s under their belt for additional computing tasks.

Akash

At the time of writing of February 2024, according to Cloudmos and Akash Stats, Akash Network has a current capacity of 150 GPUs, with a line-up of almost 100 units of A100’s chips along with several RTX 3000s and 4000s series which is useful for consumer-grade AI/ML Trainings and rendering tasks.

During Akash’s announcement of building a Cloud GPU Network for AI in June 2023, they stated:

“The Akash GPU Testnet has already received interest from providers with NVIDIA H100s, A100s, and other leading datacenter and consumer GPU models.”

At the time of writing, no H100 GPU was listed for lease on the Akash Network Platform.

Gensyn

Gensyn.ai is a decentralized GPU network focused in AI applications.

Gensyn is built on top of their own network, folowing a layer-1 trustless protocol structure. Additionally, for the verification and validation of the computational work Gensyn adopted a combination of Probabilistic proof-of-learning, Graph-based pinpoint protocol and Truebit-style incentive game technologies. Gensyn also leverages incentive mechanisms of staking and slashing to ensure honest behavior of network participants.

Gensyn network is currently in Devnet mode, and no statistics are publicly available regarding their network size.

IOnet

IOnet’s decentralized application is built on top of Solana, with a major focus on consumer and enterprise-grade AI/ML. The network verification follows a Proof of Time-Lock mechanism to ensure the service quality provided by connected GPU suppliers.

Based on publicly available information, IOnet network has over 18k GPUs connected, representing over 483k TFLOPs. It is worth to highlight that IOnet counts with 460 H100 GPUs already available. IOnet is currently targeting AI/ML Engineers and companies as main users of their services.

Summary

The following tables highlight the design trade-offs and current network states for Aethir, Gensyn and IOnet.

It is worth highlighting that Aethir exclusively onboards Enterprise-graded GPUs with a high barrier of entry to their network. As a result of this strategy, Aethir has proven to be capable of closing service deals with major enterprise clients and taking in the acquisition of H100 chips. In the other hand, Io.net’s approach has allow them to take the lead in raw number of connected GPUs.

Finally, the efficiency of Aethir’s approach is allowing them to offer the best rates for renting A100 equipment with a cost of $0.33 per hour.

Team

Leadership

- Mark Rydon - Co-founder and CCO

Mark has held key roles at NOTA Platform, Flux Capital, Gaas LTD, Kulture Athletics, Inc., and Bechtel Corporation. - Daniel Wang - Co-founder and CEO

Prior roles at IVC (Venture Partner), YGG SEA (CIO), Riot Games (Head of International Publishing Mgmt), Riot Games - China (Head of Operations). - Kyle Okamoto - CTO

Kyle has served as the CEO & General Manager at Ericsson's IoT, Automotive, and Security businesses, CEO of Edge Gravity, and Chief Network Officer at Verizon Media. - Paul Thind - CRO

Paul, currently the CRO at Aethir, previously co-founded and served as CEO at Triggerspot Inc and was an advisor at Creadits and Trick Studio.

Tokenomics

Token Utility

- ATH Token as Central to Aethir's Ecosystem

- Acts as the primary currency for transactions within Aethir, facilitating payments for AI applications, cloud gaming, and virtualized compute.

- Governance Role

- With the progression towards a DAO, ATH allows token holders to propose, debate, and vote on changes, emphasizing Aethir's commitment to decentralization.

- Staking by Node Operators

- New node operators stake ATH tokens to join the ecosystem, aligning economic interests with Aethir's goals and demonstrating commitment to quality service.

- Security and Quality Assurance

- Staked ATH tokens serve as collateral against misconduct, with the potential for slashing in cases of malpractice, ensuring a high-quality, reliable cloud experience for users.

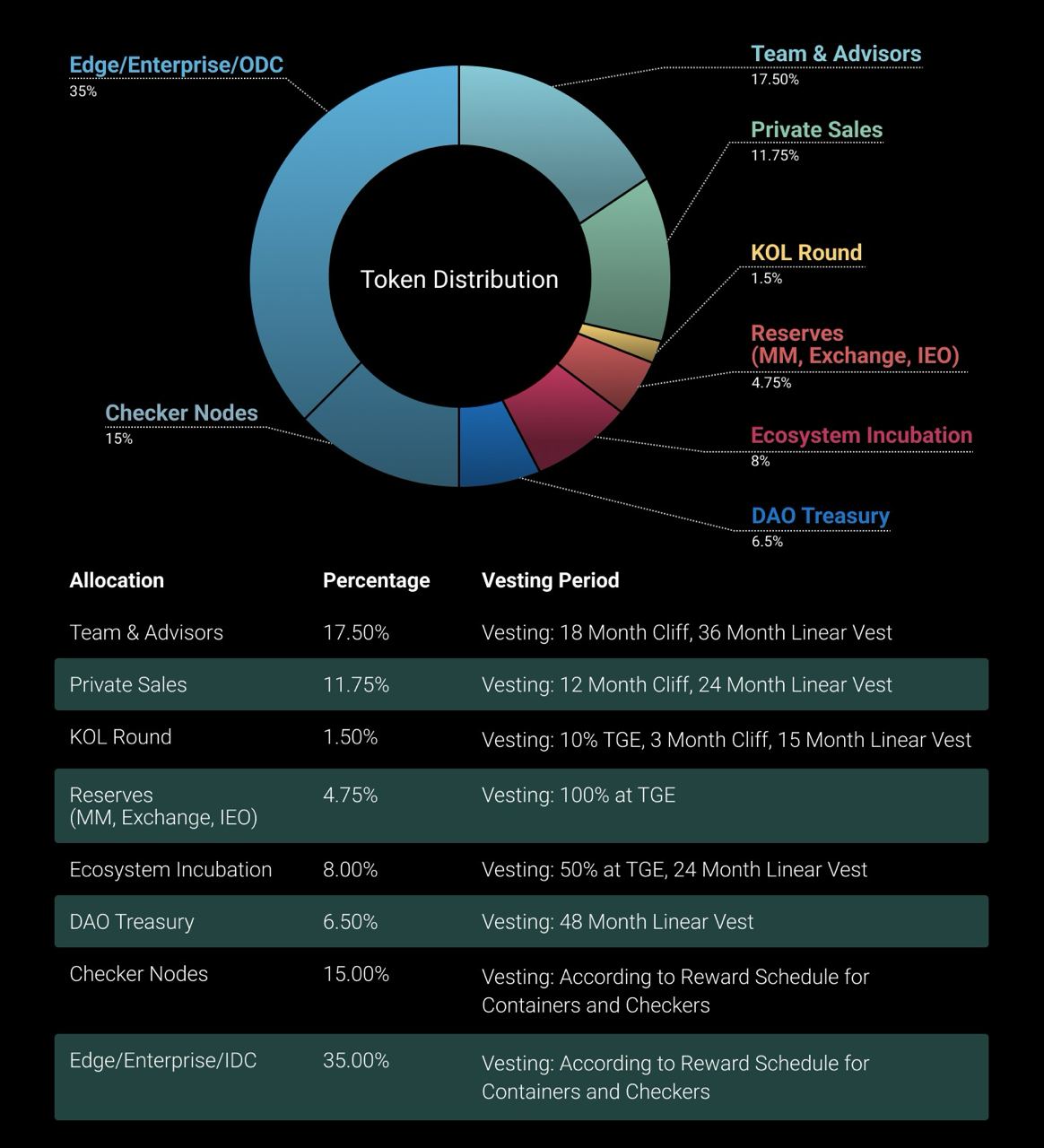

Token Distribution

Risk evaluation

Token Volatility

A primary challenge inherent in Decentralized Physical Infrastructure Networks (DePIN) is the significant impact of the native token's price action and volatility on the ecosystem's supply of hardware and computing resources, as well as on user demand. With supply-side participants being incentivized through token rewards, they face the reality that price fluctuations can considerably affect their profitability and the returns. This variability also extends to the demand side, especially when payments for services are transacted using the native token. As such, Aethir addresses this challenge by allowing for payments in fiat currency while transactions are completed in ATH tokens, ensuring that despite the ecosystem's growth and ATH's price fluctuations, end-users can still access compute resources and services at competitive rates, relative to both Web2 and Web3 counterparts.

Network Readiness: Aethir's Approach to GPU Integration

DePIN projects often encounter a growth hurdle as the integration of GPUs into the network depends largely on consumer contributions, and the bootstrapping of consumer hardware, which tends to delay network maturity. This makes it harder for networks that only target retail supply only to be able to meet demand. Aethir circumvents this issue by partnering with institutional resource providers, such as Internet Data Centers (IDCs), thereby overcoming the initial network setup challenge and ensuring a consistent availability of online nodes. This strategic move not only expedites network maturity but also maintains high-quality service standards from the onset.

Moreover, while many cloud computing competitors focus on leveraging retail consumer GPUs to augment computing power, Aethir navigates potential risks related to the decreased demand for retail GPUs and the consequent underutilization of these resources. Given that a substantial portion of computing demand, particularly for AI training, requires enterprise and institutional-grade GPUs, Aethir's strategic alignment with its three core business models—Cloud Gaming, AI, and Virtualized Compute—effectively ensures the optimal utilization of computing resources. Additionally, existing contracts with major players in the gaming and mobile industries secure a balanced demand sufficient to match the supplied resources.

Aethir’s Dedication to Execution

Execution risk also looms large as Aethir continues to address multiple complex challenges within the sector, as well as juggling multiple business models, in Cloud Gaming, AI and Virtualised Compute. Despite the potential complexities of such an expansive operation, Aethir has demonstrated its capacity for effective execution and delivery, with over 40,000 nodes currently active in its ecosystem. Even with the track record of onboarding nodes into the ecosystem, having three different operations simultaneously, is a big feat and will be challenging to ensure that all parts are able to be delivered on.

Summary key points

Global AI Demand & Web3 Solutions: The demand for AI services is surging, notably for enterprise-grade GPUs like the H100, with investments in AI reaching $68.7 billion in 2023. This trend, along with the $600 billion potential market, indicates a promising crossover into web3 AI spaces. Aethir stands out by bridging the gap between high-performance computing needs and web3 AI technologies.

Right product at the right time: the current landscape is marked by a clear unmet demand in processing capacity, and Aethir’s has demonstrated product-market-fit to fulfil this need.

Aethir's Strategic Advantages: Aethir has been able to onboard 4,000 H100s, with a projected increase to 50,800 H100s through current discussions by H2 of 2024. Partnerships with major telecom providers, gaming publishers, and WellLink, provide access to potentially 10m MAUs on Aethir’s platform.

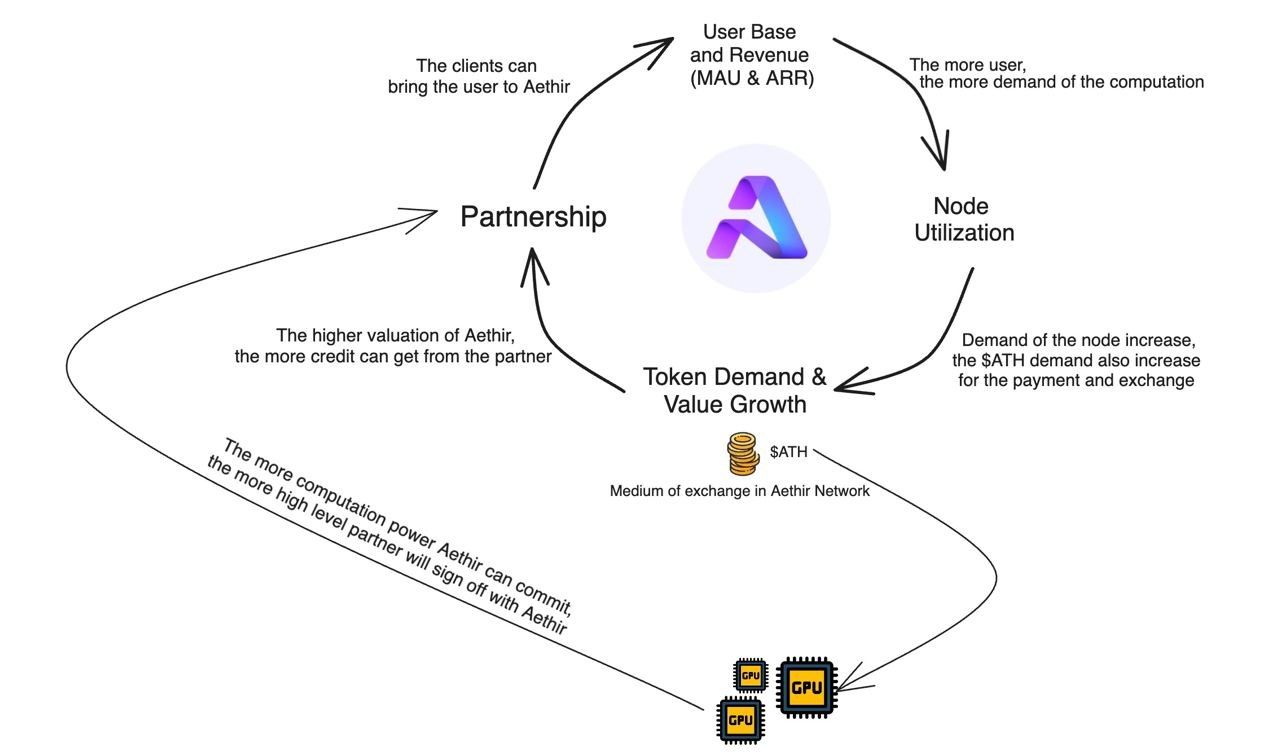

The Aethir Flywheel: Partnerships propel Aethir to over 20M in Annual Recurring Revenue (ARR) projected for Q12024, with a $114m end-of-year forecasted ARR as current contracts scale and new contracts for cloud computing are announced - comparatively the entire DePin sector generates only $24m ARR. With the aforementioned partnerships in place it enables Aethir to boost node utilization, token demand, and further attracts more contracts and investors, creating a sustainable and self-reinforcing growth loop.

Founder-market fit: Aethir founders are experienced managers with a track record of success within AI, Cloud Computing, Web3, and Gaming.

Cloud Gaming in Developing Regions: Aethir targets underdeveloped/developing regions, leveraging cloud gaming to bridge the hardware affordability gap. Focusing on South East Asia and South America, Aethir capitalizes on a vast user base and introduces renowned IPs to new markets, emphasizing digital inclusivity and market expansion.

Disclaimer

The above content is our view for educational and informational purposes, other than the content sourced from the project team and public sources. Please refer to our terms and conditions below.

About Impossible Finance

Impossible is an on-chain native, research advisory firm with a DeFi launchpad and accelerator. We help projects kickstart, fundraise, scale and launch their tokens while enabling users to learn, discover and invest in high quality crypto opportunities.

Website | Twitter | Discord | Telegram | Blog

Terms & Conditions

- Notes: DISCLAIMERS, TERMS, and RISKS

- Risk Warning: Trading and/or generally investing in any cryptocurrency involve significant risks and can result in the complete loss of your capital. You should not invest more than you can afford to lose and you should ensure that you fully understand the risks involved. Before investing, please consider your level of experience, objectives, and risk tolerance, and seek independent financial and legal advice if necessary. It is your responsibility to ascertain whether you are permitted to use the services of Impossible Finance based on the legal and regulatory requirements of your country of residence and/or applicable jurisdiction(s).

- The information provided on this memo does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such. Impossible Finance does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.