Everything you need to know about Fluid

Intro

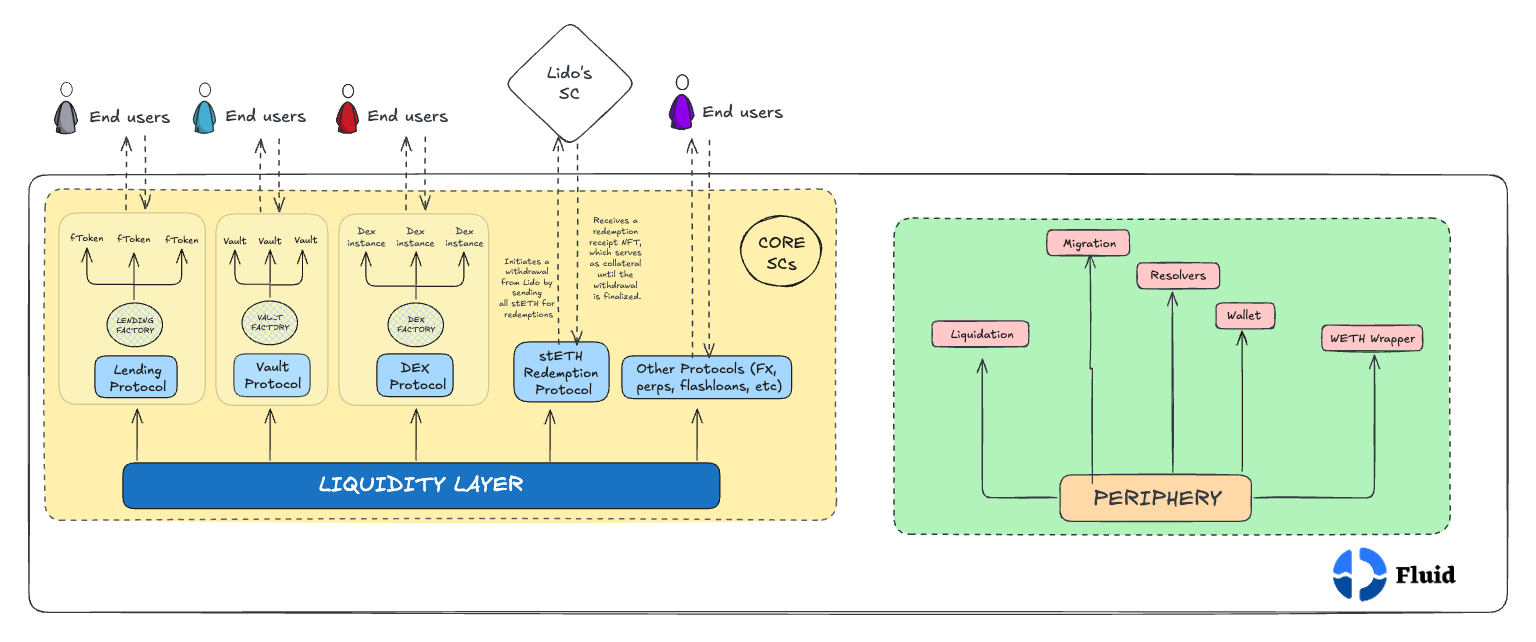

Fluid is a DeFi protocol that aims to raise exponentially the bar for capital efficiency by creating a liquidity layer which can simultaneously support multiple financial activities, including lending, spot leverage, and spot DEX services at the moment (but other financial services will be surely added in the future). This infrastructural architecture enables the protocol to address and overcomes the pervasive challenge of liquidity fragmentation that has long hindered DeFi platforms, while ensuring a very high level of capital efficiency, security, and user-friendliness.

The project represents the rebranded version of Instadapp, a middleware protocol that has always been focused since its inception (2019) on optimizing lending services in DeFi through its product suite (Instadapp PRO, Instadapp Lite, Avocado), from flashloans to solutions cutting the gas costs of different DeFi operations through capital efficiency improvement strategies.

Key Features

Capital Efficiency w/o Fragmentation --> thanks to its infrastructural design which relies on the Liquidity Layer, the foundational component of the Fluid protocol, designed to aggregate and manage liquidity across the different protocols built on top of it. This architecture addresses the prevalent issue of liquidity fragmentation in DeFi by providing a unified pool of assets that multiple protocols can access, thereby enhancing capital efficiency, security and UX at the same time.

Extremely high security standards --> through risk isolation and automated limits which regulate and keep balanced the collateral-to-debt ratio on the different protocols integrated on top of Fluid to foster organic growth of the borrowing side while avoiding any whale manipulation.

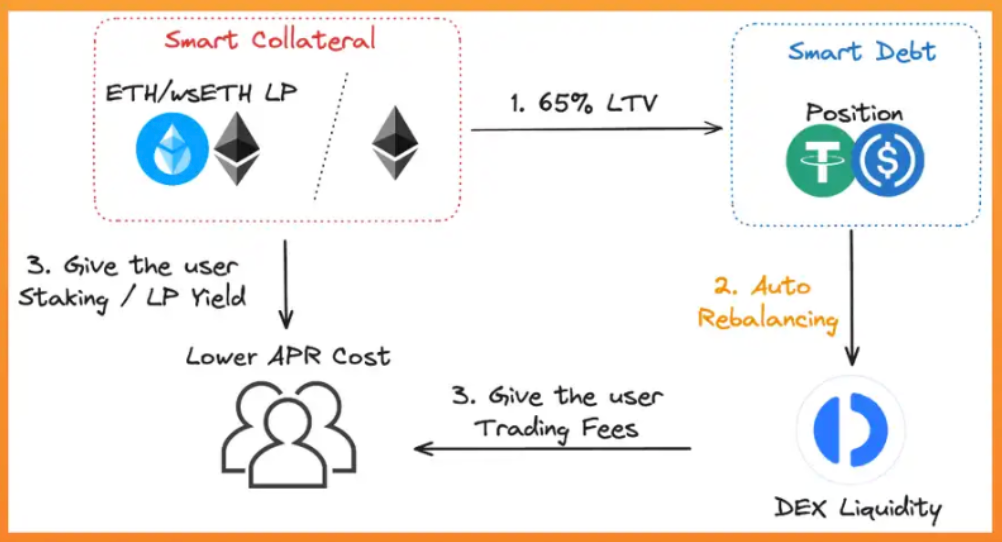

Smart collateral & Smart Debt --> Fluid's Smart Collateral and Smart Debt mechanisms offer a paradigm shift in DeFi, transforming passive assets and liabilities into active, yield-generating components. Smart Collateral allows LPers to use their positions as collateral within Fluid while simultaneously deploying them as liquidity into the DEX AMM. This dual (in the future multiple) utility allows users to benefit:

a) the native collateral yield (if interest bearing);

b) lending rates,

and c) trading fees.

Smart Debt redefines the traditional concept of debt in DeFi by turning liabilities into productive assets. In Fluid's system, borrowed funds are not left idle but are instead deposited into the DEX as liquidity. This strategy allows the debt itself to participate in trading activities, generating fees that can potentially offset borrowing costs. Fluid's dex is the point of convergence of the 2 features: since it is embedded in the Liquidity Layer, it ensures that liquidity remains active and productive within the ecosystem instead of being extracted and then used on other protocols (as always happens on other lending markets).

Simulation Mode --> A must-have for every complex protocol. It s a feature allowing users to emulate transactions and strategies within a controlled environment, utilizing real-time Mainnet data without deploying actual assets. This functionality is extremely useful for users aiming to familiarize themselves with the platform logic or assess potential strategies without financial exposure.

A novel liquidation mechanism with unparalleled efficiency in both gas costs (3-4x) and liquidation penalties (up to 10-15x) because distressed positions are not liquidated individually (as they are in all other lending protocols), but rather bundled and offered as discounted dex liquidity, which becomes very attractive to dex aggregators (lower prices = better prices for end users).

Incredibly smooth UX --> the complexity of the infrastructure design does not burden the UX, which remains extremely fluid thanks to Vault strategies, which bundle multiple operations within a single transaction to streamline the interaction process (some strategies, however, require the DeFi Smart Account or Avocado as SCA solutions, in-app and multi-chain, respectively).

A whole spectrum of groundbreaking products and tools, complementary to Fluid --> Instadapp has been a breeding ground for financial primitives since its inception. It was the first to introduce a smart contract wallet solution (the DSA), the first to offer position optimization tools on lending markets (Instadapp Pro), the first to introduce automated risk management features (such as Protection Automation, which reduces the size of the debt when a predefined health factor is reached), one of the first to provide access to automated yield-generating strategies through tokenized vaults, one of the first to work on the topic of Chain Abstraction (with Avocado).....and so on.

Infrastructure Design

Fluid's design architecture is both highly complex and elegantly crafted, effectively hiding its sophisticated underlying code. This results in a system that is secure, highly flexible, and seamlessly integrates with existing third-party infras. To fully understand its functionality, we need to break down the whole stack and look at each component individually.

Liquidity Layer --> At the core of the Fluid protocol lies the Liquidity Layer, the foundational infra within its DeFi ecosystem, consolidating liquidity across all integrated protocols. This design addresses the prevalent issue of liquidity fragmentation by providing a unified pool that enhances capital efficiency and ensures seamless interactions among different DeFi protocols, simultaneously. At its core, the Liquidity Layer is a straightforward contract that securely holds the combined liquidity from all associated protocols. It lacks complex algorithms or intricate logic, focusing instead on asset security and efficient liquidity management. Advanced functionalities and algorithms are implemented within the individual protocols built atop this layer, ensuring that any vulnerabilities are isolated, resulting in minimal losses for affected users. This design ensures that when users transition between protocols built on top of the Liquidity Layer, the underlying liquidity remains unaffected, and interest rates remain stable. Consequently, users can immediately access new features and protocols without causing liquidity fragmentation. For example, if an updated protocol version offers higher LTV ratios for borrowers, they can seamlessly migrate to the enhanced version, while lenders benefit from improved rates without the need to move their capital.

One of the standout features of Fluid's Liquidity Layer is its implementation of Automated Limits. These dynamically adjust debt and collateral ceilings on a per-block basis (i.e. in real time) as funds approach predefined thresholds. This mechanism allows for organic borrowing activities while curbing abrupt, large-scale txns, thereby mitigating potential risks associated with sudden market movements or exploits. In scenarios involving code vulnerabilities or economic manipulations, the Liquidity Layer restricts unusually large borrowings and withdrawals, limiting potential losses and providing a critical window for the community multisig to step in and pause the affected protocol, allowing governance to implement appropriate remedial actions.

As protocols and assets mature within the Fluid ecosystem, their borrowing and supply limits will be methodically expanded. Conversely, newly introduced protocols are subjected to stringent initial limits. This graduated approach allows for the secure onboarding of new protocols without exposing the overarching Liquidity Layer to undue risk. Automated limits are determined by the following key params: base ceiling; max ceiling; rate; limits in %. Initially, there's a base borrowing limit, known as the baseDebtCeiling. This limit can increase incrementally by a specified % (expandPercentage) over set time intervals (expandDuration) until it reaches a predefined maximum limit (maxDebtCeiling).

Now let's break down all the protocols built on top, starting with a premise: on Fluid, each protocol is associated with one or more resolvers, i.e. read-only SCs that act as intermediaries by facilitating access to protocol data without altering the chain state; they are basically designed to enhance UX and devs interaction by providing efficient data retrieval mechanisms across Fluid protocols. For instance, the Lending Protocol utilizes the Lending Resolver to offer information about fTokens, rewards, and user positions; similarly, the Vault Protocol employs the Vault Resolver and Vault Positions Resolver to facilitate access to detailed vault and position data, and so on.

Lending Protocol --> The first and simplest protocol on Fluid is the lending market, a “deposit and earn” solution that adopts the ERC-4626 standard (and is thus easily composable within other DeFi platforms through its fTokens) and focuses on the UX to offer users one of the most attractive yield opportunities in the whole crypto financial landscape and a direct access ito the Liquidity Layer. The protocol is associated with the lending resolver, which has some key functionalities:

Auth Verification --> ensures that queries and interactions are performed by authorized entities, maintaining the security and integrity of the protocol; Rewards & Rates --> provides up-to-date details on reward distributions and IRs, allowing users to make informed decisions about their lending activities.

fToken Information Retrieval --> offers comprehensive data on fTokens, including their current status, exchange rates, and other pertinent metrics; User Positions --> allows users to access infos about their lending positions, such as deposited amounts, accrued interest, and potential rewards.

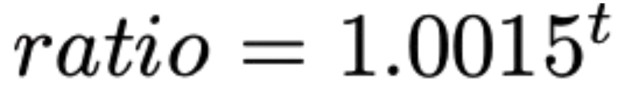

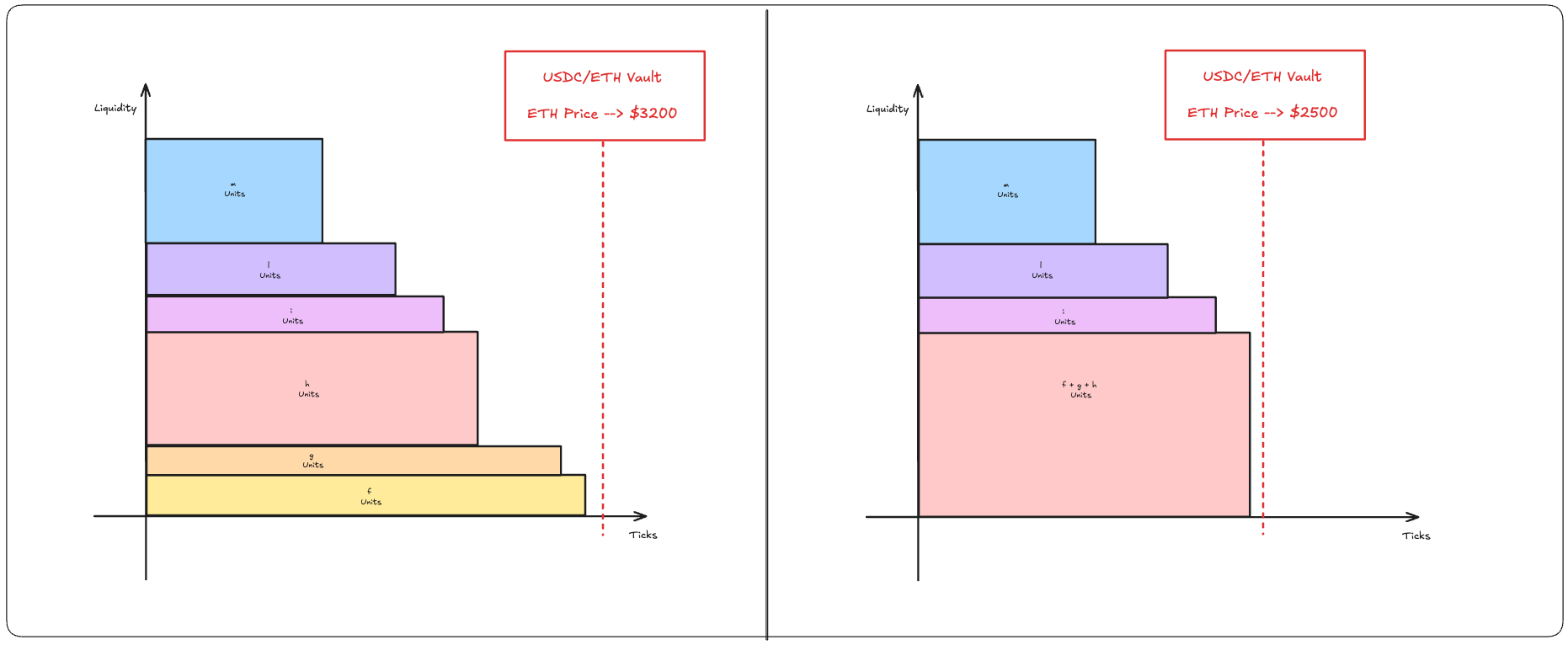

Vault Protocol --> borrowing protocol designed to maximize capital efficiency with a cutting-edge liquidation mechanism, drawing inspiration from Uniswap v3’s design principles. By aggregating users' liquidity into slots (or ticks) and using a multi-oracle system with multiple TWAP checkpoints, the Vault protocol manages to offer the highest LTV in the whole DeFi landscape while charging the lowest liquidation penalties, without compromising (and rather enhancing) the protocol's security. What's hiding under the hood? At the core of Fluid's liquidation mechanism lies the concept of ticks, which act as structured liquidity slots where borrowers' positions are assigned based on their debt-to-collateral ratio. The tick is calculated using the formula:

where "t" represents the tick index. Each borrower’s position is placed into a specific tick based on their collateralization level (i.e. on their debt-to-collateral ratio), grouping users with similar risk profiles together. Unlike traditional liquidation systems where each position is liquidated individually in a costly and slow manner, Fluid’s approach allows all positions within a tick range to be liquidated in a single operation, drastically improving efficiency and reducing gas costs. To mitigate the computational burden of these calculations (which is high) on overall efficiency, the team developed a specialized TickMath library (still inspired by Uni) that optimizes the conversion between ratios and tick values. When a liquidation occurs, the system must retrieve the user’s position in real time. Instead of processing every liquidation individually, Fluid uses a branch-based mechanism to track and manage liquidations in a gas-efficient way. A branch is a structured sequence of ticks that acts as a history of liquidations, ensuring efficient tracking and retrieval of positions. Each user’s liquidity position is tied to a specific tick, representing the price level at which they provided liquidity. In the event of a liquidation, the system records the user’s pre-liquidation tick as a reference point. This reference is crucial for structuring the subsequent liquidation process, ensuring that past liquidations do not need to be reprocessed individually. Upon liquidation, a branch is created to store all relevant liquidation data associated with that user’s position. By iterating through the branch, the system determines the total liquidation impact and identifies the minimum tick (minima), which represents the lowest tick reached due to liquidations. As the price of collateral fluctuates, liquidity positions dynamically adjust. When prices increase, new users enter the system at higher ticks, strengthening their positions. However, when prices decline, users at higher ticks are progressively liquidated and shifted to lower ticks, reflecting the changing market conditions. The lifespan of a branch extends until it reaches its minima tick, which corresponds to the lowest tick within its connected structure. Once this point is reached, the branch merges with the base branch, effectively consolidating liquidation data and preventing excessive fragmentation within the system. This ensures that the whole process remains gas-efficient, high-performing and computationally scalable even during periods of extreme market volatility, eliminating the need to scan all previous liquidations when retrieving a user’s most recent position.

A state-of-the-art liquidation process can only have an equally advanced oracle system: Vault implements three separate TWAP checkpoints alongside Chainlink data. These independent data points are then cross-referenced with the current Uniswap price, ensuring that the reported value remains within a valid range. This multi-layered validation process makes it extremely difficult for malicious actors to manipulate the price feed, thereby enhancing protocol security and reducing undue liquidation risks.

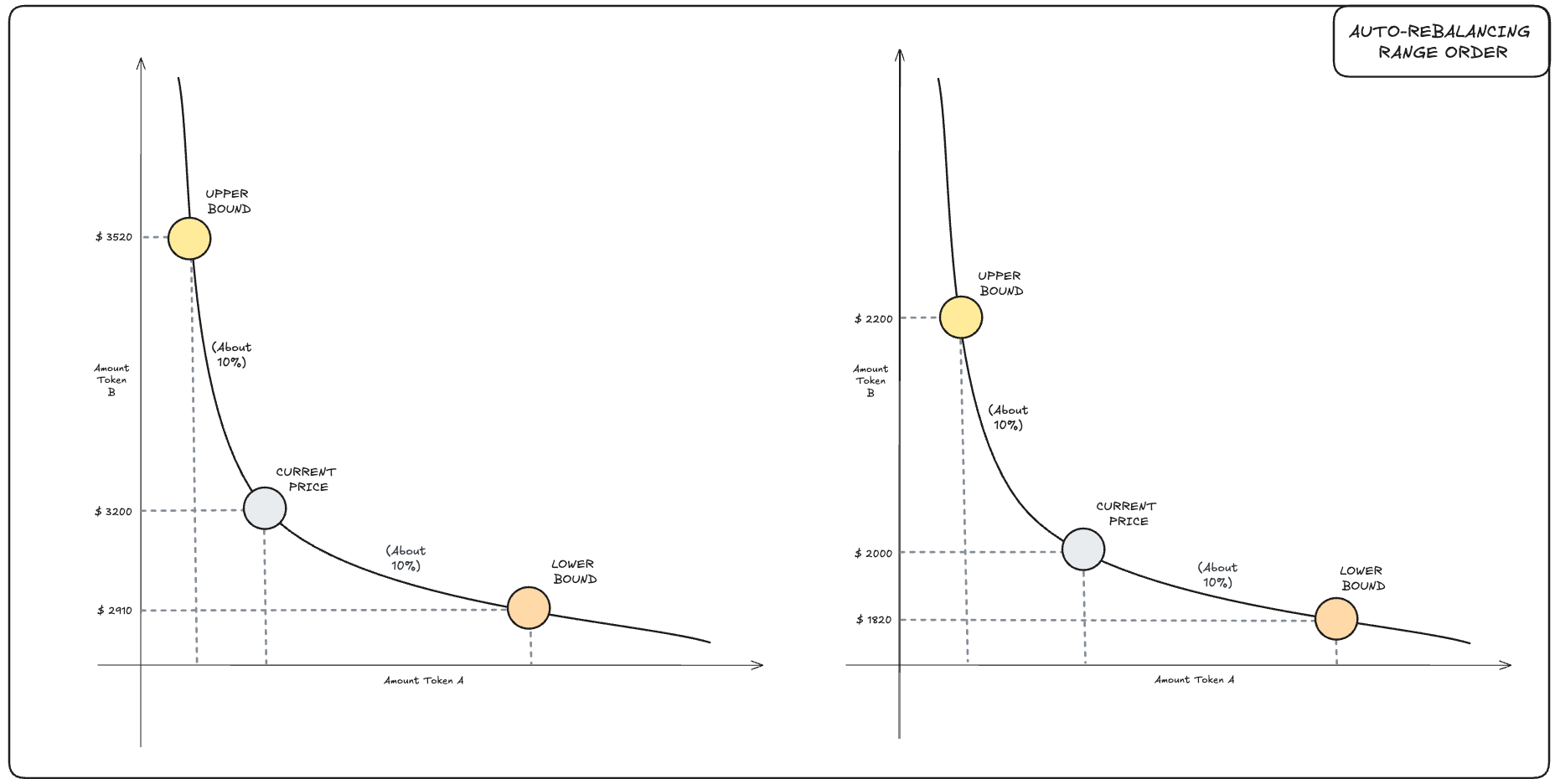

Dex Protocol --> Another protocol built on top of the Liquidity Layer working in synergy with the Vault protocol to enable features never seen before across the DeFi landscape, smart debt and smart collateral. These new features allow users to use both liabilities and collateral as liquidity for trading purposes, thus providing assets with multiple yield sources (because multiple activities are performed by liquidity simultaneously on Fluid). The dex is easily integrated by aggregators and meta-dex aggregators, which will be able to access the best-ever quotes for their users on the pairs listed by Fluid because prices are subject to discounting from liquidation penalties. Suppose a user takes out a loan of $2,000, borrowing $1,200 in USDC and $800 in USDT. Instead of sitting idle, these funds are automatically deposited into the DEX as liquidity. When a swap takes place (let’s say $400 USDC is swapped for $400 USDT) the user’s debt in USDC drops to $800, while their USDT debt rises to $1,200. Although the total borrowed amount remains at $2,000, the deposited liquidity earns trading fees, turning debt into a yield bearing asset rather than just a liability. Fluid's approach is highly effective because, as we've seen, it turns debt into a productive mechanism. This integration ensures that every trade not only keeps liquidity within the DEX but also gradually reduces the borrower’s outstanding debt burden. Features like Smart Collateral and Smart Debt further optimize capital efficiency, enabling both collateral and borrowed assets to serve multiple functions (from earning staking rewards and lending IRs to accumulating trading fees). Namely: Smart Collateral allows LPers to use their LP positions as collateral within Fluid while simultaneously deploying them as liquidity on the DEX's AMM. This dual utility enables users to generate: Collateral yield (if collateral is yield bearing); Lending Yield (boostable through looping strategies, which are favored by an infrastructure design ensuring a very high LTV); Trading Fees (because collateral assets also act as liquidity within the DEX, thus serving multiple purposes at the same time). Smart Debt is a feature that allows debt positions to be recycled as liquidity on the DEX, thereby transforming liabilities into interest-bearing assets that can potentially wipe out borrowing costs. The design architecture of V1 is based on a CL-AMM model with moderate width range that self-rebalances itself to reflect a bonding curve similar to Uni V2 (CP-AMM) but with the capital efficiency of V3. V2, which is still in the design phase, will probably be based on Uniswap V4. Pool specs are fully customizable in range width and % of fees charged (although the user does not have a free choice and must adapt to the design options of the protocol).

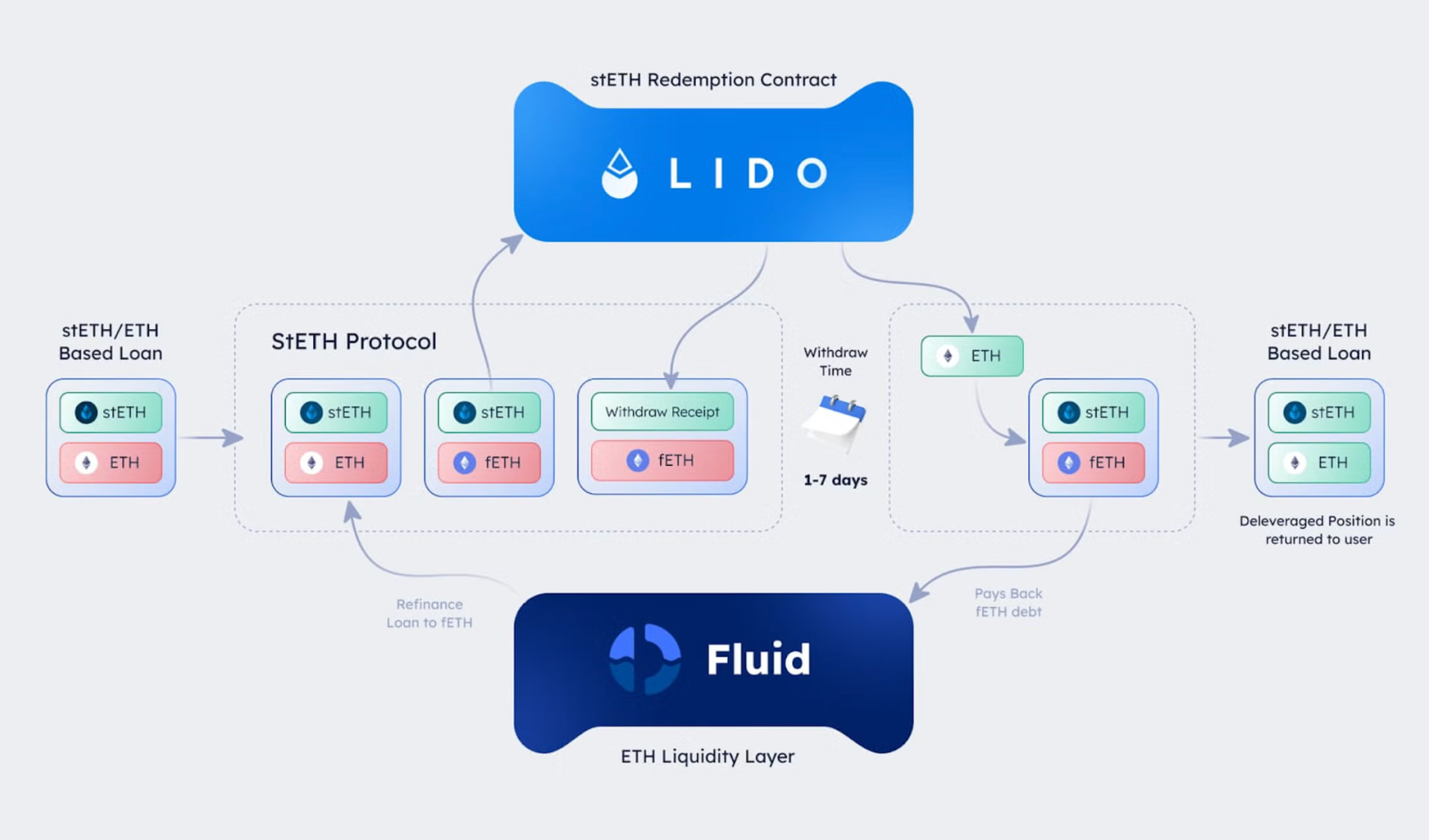

stETH Redemption Protocol --> novel and cost-effective solution within the Fluid ecosystem, designed to facilitate the deleveraging of leveraged stETH/ETH positions at a 1:1 rate with Lido. By directly redeeming stETH for ETH from Lido's SC, this protocol significantly reduces on-chain slippage and market inefficiencies, cutting deleveraging costs by up to 10x compared to traditional market-based methods.

Efficiency Obsession --> Fluid extremely optimizes capital efficiency by enabling up to 39x effective liquidity through the strategic use of correlated asset pairs, such as wstETH and ETH. This is primarily achieved through high LTV ratios, reaching up to 95% for assets with strong price correlations, as well as an innovative mechanism allowing collateral and debt to act simultaneously as liquidity in narrow-range and auto-rebalancing LP positions, aka SD & SC. The process begins with an initial 1x collateral, which, under a 95% LTV, allows the borrower to take on 0.95x debt. This borrowed amount is subsequently redeployed as collateral, permitting an additional 0.9025x borrowing. This recursive borrowing and redeployment cycle keeps going, exponentially increasing both collateral and debt positions until they reach 20x and 19x, respectively. Once the 20x collateral and 19x debt are fully integrated into the liquidity provisioning process, the resulting total effective liquidity reaches an impressive 39x relative to the initial capital input. The maniacal focus on efficiency emerges even more clearly in the solutions Fluid devised to lower gas costs. Fluid strategically reuses memory slots by leveraging a temporary variable prefix (temp_) within its code which greatly lowers the computational load on EVM. This approach reduces the need for additional memory allocations by allowing multiple variables to share the same memory space. While this technique introduces complexity in code readability, Fluid compensates by incorporating detailed comments to maintain clarity. To further minimize gas costs and cut down on expensive storage operations, Fluid implements storage variable packing, a technique that efficiently compresses multiple values into a single storage slot by using bitwise operations. Lastly, Fluid employs a custom BigMath library to handle huge numbers in a way that optimizes storage efficiency. In other words, instead of storing full numbers directly, BigMath breaks down values into coefficients and exponents, allowing for compact storage without the risk of overflow errors.

About Business Model

Fluid’s business model is all about optimizing revenue while keeping the ecosystem sustainable for traders, liquidity providers, and token holders. Instead of relying on a fixed fee structure, Fluid uses governance-controlled fees, dynamic pricing models, and algorithmic buybacks to maximize efficiency and capital flow across the protocol.

At its core, Fluid’s DEX pools have flexible trading fees that can be adjusted by governance. This means the community can vote on fee structures, allowing different pools to tweak fees based on liquidity depth, market demand, and volatility. On top of that, Fluid can activate a revenue-sharing mechanism, where a percentage of trading fees or Smart Vault fees flows back into the protocol to support long-term development and incentives.

One of the smartest innovations is dynamic trading fees, which automatically adjust based on market conditions. A great example is the USDC/USDT stable pool, where fees change based on price deviations from the 1.0 peg. If the pool price is stable, trading fees stay at 0.003%, encouraging high-volume trades and arbitrage activities. But when price deviations increase, fees ramp up to a maximum of 0.01%, discouraging rapid price swings and protecting LPers. The fee adjustment follows a 3x² - 2x³ curve, meaning fees scale smoothly with volatility, keeping trading fair while ensuring a steady revenue stream.

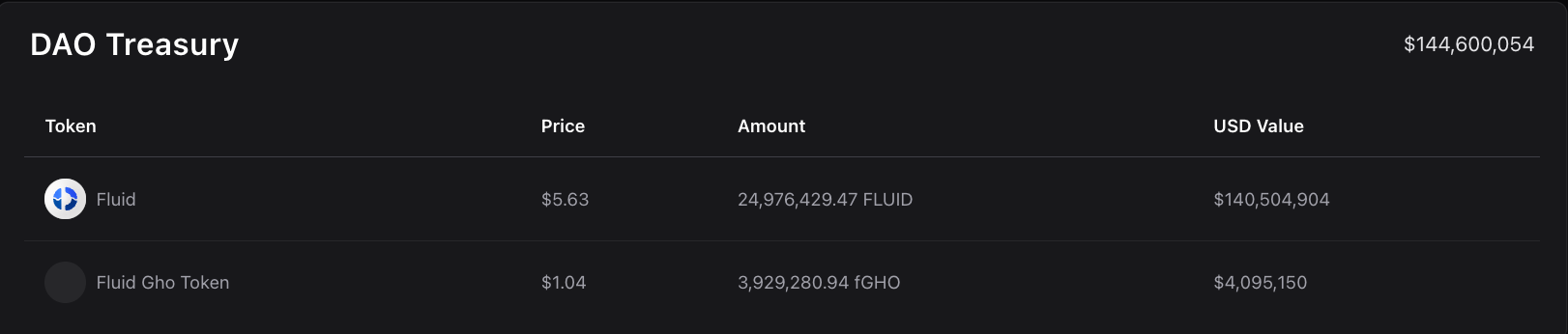

Fluid doesn’t just collect fees: it reinvests its earnings through an algorithmic buyback program designed to boost $FLUID’s price action over time. Once the protocol hits $10M in annual revenue, a dynamic buyback system kicks in, following an x * y = k model.

When the $FLUID token price is low, the protocol spends a higher % of revenue on buybacks, absorbing excess supply and stabilizing the market. When prices are high, buybacks slow down, ensuring capital is used efficiently. All bought-back tokens stay iwithin the governance treasury, where the community decides whether to burn, redistribute, or reinvest them into other growth initiatives.

Outlook

If Fluid’s present is already shining (backed by strong on-chain metrics and growing TVL, along with an increasing market share against category leader Uniswap) its future looks even brighter. Here are some of the hottest upcoming developments:

- The team worked in collaboration with Redstone to develop the most gas-optimized oracle flow in the whole EVM lending space as well as to implement one of the first Oracle Extractable Value (OEV) solutions aimed to capture value leaking with liquidations, currently grabbed mostly by MEV bots. This new feature will basically allow Fluid to add a new revenue stream without changing the code base.

- Multi-chain expansion goes on with the upcoming deployment on Polygon network, which follows launch on Base and Arbitrum.

- Dex V2 launch expected to dramatically improve capital efficiency.

- In the coming months/years, new protocols built on top of the Liquidity Layer will be launched, to increase financial activities simultaneously supported by the protocol, such as: Forex, CDPs, Interest Rate Swaps, perps, RWAs and so on.

Showcased Products

Instadapp PRO —> premier middleware platform designed to simplify DeFi interactions by providing a unified interface for managing assets across multiple protocols. It acts as a bridge between users and leading DeFi platforms such as MakerDAO, Compound, Aave, and Uniswap, enabling seamless lending, borrowing, and trading operations—all within a single dashboard. At its core, Instadapp Pro runs on self-custodial smart wallets, like Avocado Wallet and DeFi Smart Accounts (DSA). These smart wallets act as a personal DeFi hub, letting you interact with protocols directly without manually signing every txn. This makes managing your DeFi PF smoother, more efficient, and way less of a headache. The platform is live across major networks including Eth Mainnet, Polygon, Avalanche, Arbitrum, Optimism, and Fantom, meaning you can move assets and execute strategies across multiple chains without friction. For devs and power users, Instadapp Pro also comes with a powerful SDK that lets you automate DeFi transactions, integrate smart contract interactions, and build custom yield strategies—without dealing with protocol-level complexities.

Fluid Lite —> Instadapp Lite, now evolving into Fluid Lite, is a set of smart contract vaults designed to autonomously execute DeFi yield strategies while optimizing capital efficiency. Unlike traditional yield farming platforms which implement multiple strategies, Lite vaults focus on a single strategy at a time. By leveraging stETH (Lido Staked Ether) in combination with major lending protocols like Aave, Compound, and Morpho, Lite vaults allow users to amplify their staking yield on ETH while maintaining seamless liquidity management. The Lite system is built on Instadapp’s DeFi Smart Accounts (DSA), which serve as programmable wallets interacting with DeFi protocols in a gas-efficient manner.

Avocado Wallet —> next-gen smart contract wallet built for seamless, secure, and gas-efficient DeFi transactions across multiple blockchains. Created by the Instadapp team, Avocado makes it easy to manage assets across different networks without juggling multiple wallet addresses—you get one address that works on every chain. Unlike traditional wallets, Avocado is fully self-custodial, meaning you own your funds at all times (no middlemen, no centralized risks). When you sign a transaction, Avocado’s backend Broadcasters verify your signature (from MetaMask or another wallet) and send it to the right smart contract on the correct blockchain. This setup ensures fast, secure, and fully decentralized transactions without requiring manual network switching.

On-chain Data

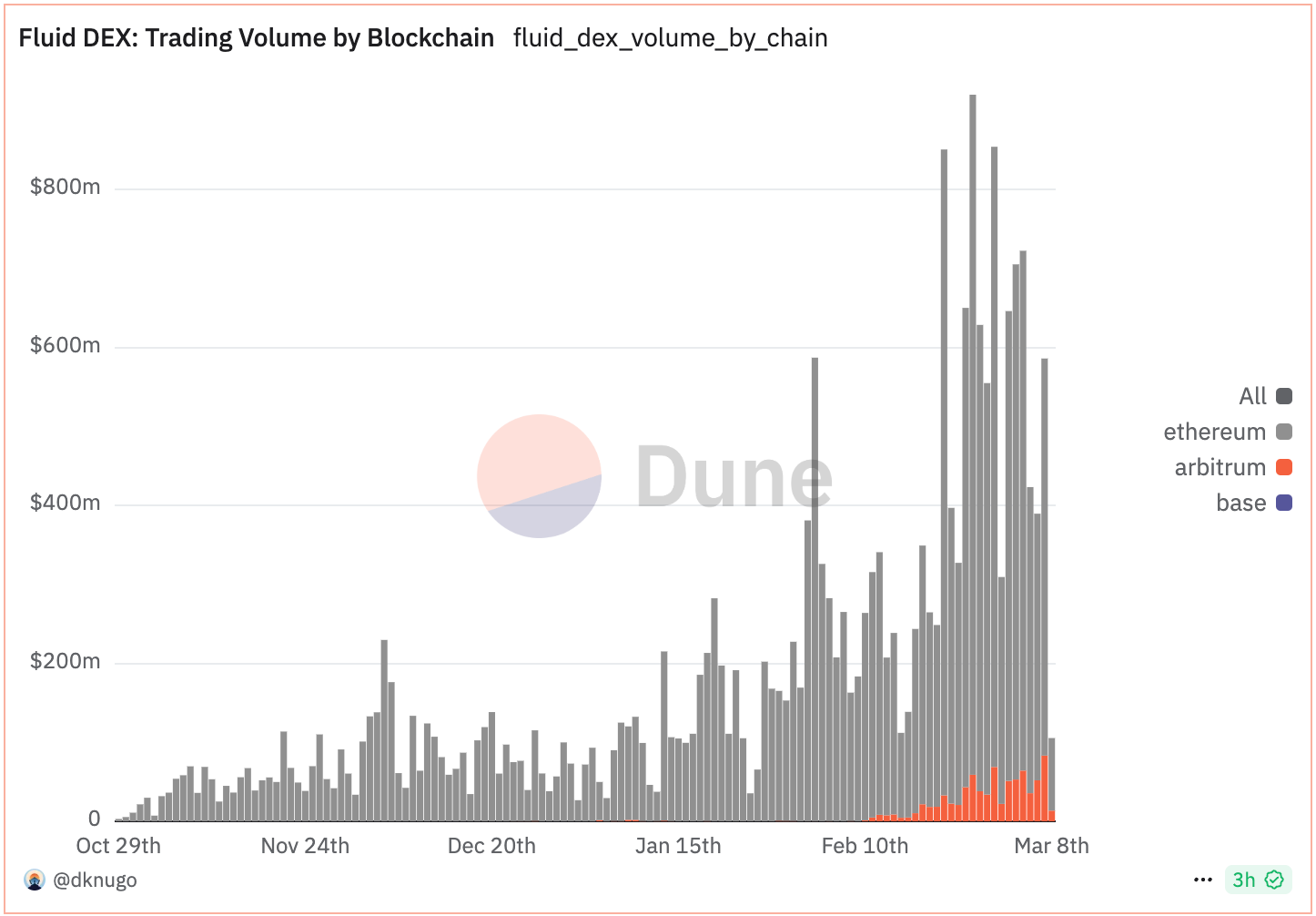

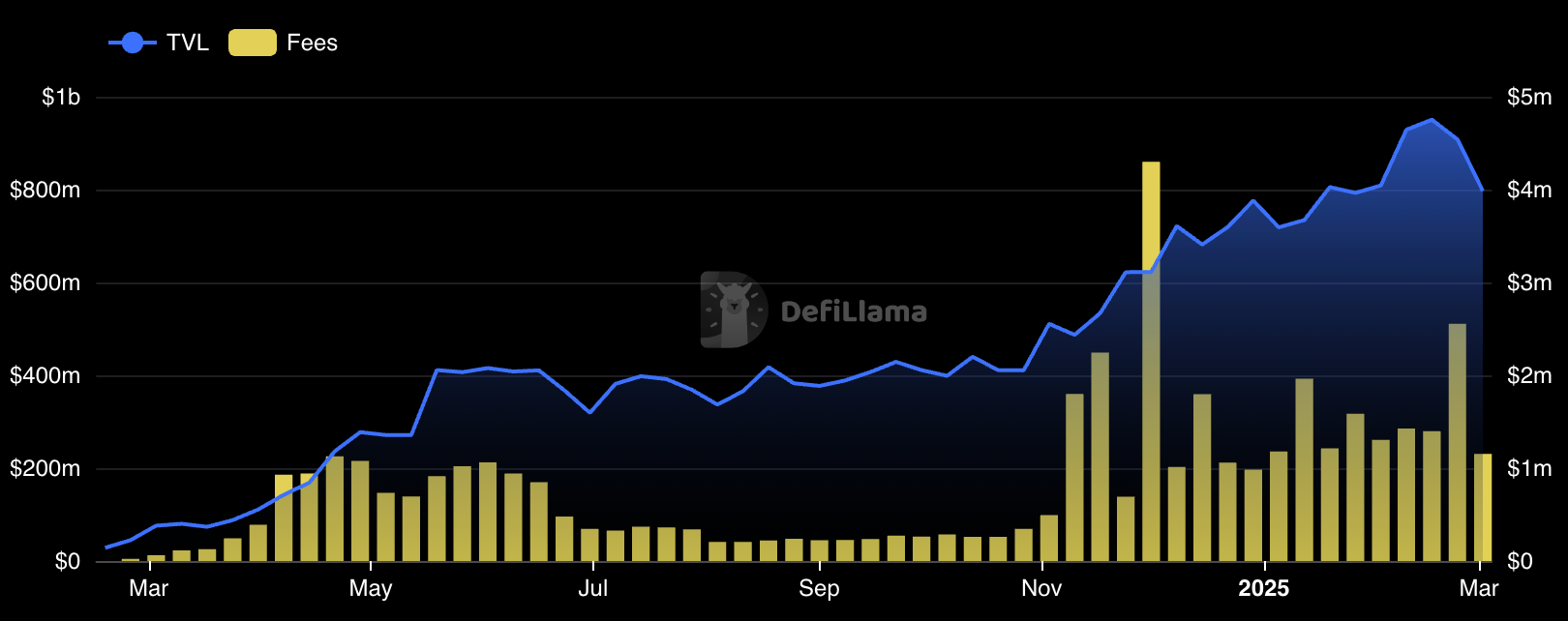

On-chain metrics report steadily increasing activity on Fluid, with the TVL updating new ATH almost every month and trading volumes following.

Fees collected by the Protocol also increased sharply, from about $200/400 K weekly ($10.4 M/20.8 M annualized) to 1 M/1.5 M weekly (52 M/78 M annualized). Current data shows that the project has a very low P/E multiple indeed, about 9-10x (570 M FDV - 52/78 M annualized revenues).

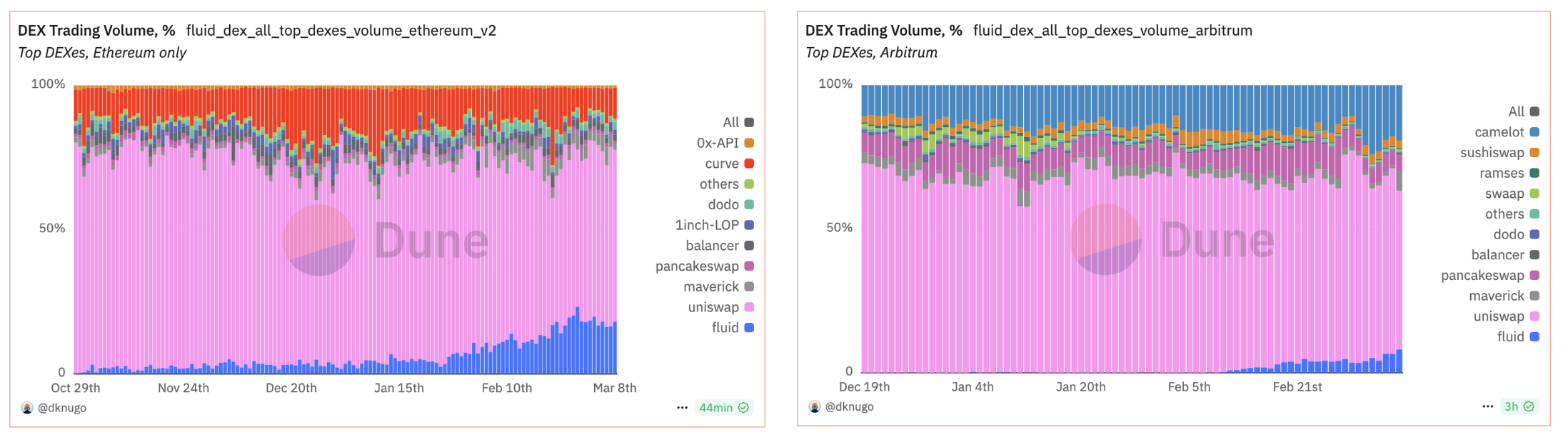

The success of the protocol is also evidenced by the dominance it has been gaining over its main competitors in recent months on the different networks.

Personal Thoughts

Fluid is a masterpiece of on-chain financial engineering, redefining the rules of DeFi by creating a unified, multi-purpose, and efficiency-driven liquidity hub that is both highly accessible and optimized for maximum capital efficiency.

The upcoming protocol expansions will further boost Fluid’s revenue, paving the way for the launch of its buyback campaign on a token that already has a relatively low circulating supply.

On top of that, if we factor in the potential sale of $MORPHO tokens—with 1.4 million airdropped and currently held by the Treasury, valued at approximately $2.13M at current prices—and the reinvestment of those funds into an additional buyback initiative to support FLUID’s price, the long-term outlook for the token looks increasingly bullish.

Resources

Fluid’s technical docs. Link

Fluid’s general docs. Link

Medium blog article announcing Fluid. Link

Medium blog article introducing Fluid DEX. Link

“Instadapp Overview” (2022, published by Jayden Lee on its medium page. Link

Dune Dashboard. Link

Proposal to divest Instadapp’s $MORPHO position and use the proceeds to buyback $FLUID. Link