Hemi Research Report

Context

The blockchain space has long struggled with interoperability challenges between Bitcoin and other chains. Ethereum, in particular, looks like the most vibrant ecosystem that could enrich the Bitcoin DeFi landscape with new exciting use cases once the two chains will become seamlessly interconnected. Various approaches have been proposed, with each facing its own limitations, typically involving the introduction of withdrawal delays, reliance on centralized sequencers, trapped funds and various other types of centralization risks.

In this context, Hemi positions as a novel and promising solution, unifying Bitcoin and Ethereum by wrapping a full Bitcoin node within an Ethereum Virtual Machine (EVM).

The project is built by an OG team with core Bitcoin and quantum devs, with tremendous experience. The CEO, Jeff Garzik, worked alongside Satoshi Nakamoto himself during the early days of Bitcoin.

By treating Bitcoin and Ethereum as components of a unified supernetwork, Hemi aims to maximize the utility of both Bitcoin and Ethereum, leveraging the strengths of both to build a secure and scalable Layer 2.

With an announced round of $15 million, led by Binance Labs, Breyer Capital and Big Brain Holdings, Hemi’s vision offers a promising way to overcome some of the limitations of previous scaling and interoperability solutions, providing a robust foundation for future innovations, together with a positive prospect of growth for its chain’s ecosystem.

Overview

Hemi is a modular Layer-2 protocol for superior scaling, security, and interoperability, powered by Bitcoin and Ethereum.

With the Hemi Virtual Machine (hVM) and the Hemi Bitcoin Kit (hBK), developers can create seamless interoperability solutions between Bitcoin and Ethereum.

Hemi’s novel consensus mechanism, Proof-of-Proof (PoP), combines aspects of PoS and PoW. It leverages Bitcoin's PoW security by posting Hemi block headers directly to the Bitcoin blockchain to reach “superfinality”, while also publishing Hemi’s state on Ethereum, where it can be challenged via fault proofs.

The decentralized Bitcoin-Secure Sequencer (BSS) finally, collects Bitcoin headers, to publish them in batches on Ethereum alongside the state of the Hemi L2, closing the loop that fully intertwines the Bitcoin and Ethereum L1s.

This system provides dApps built on Hemi with a complete view of Bitcoin’s state and full EVM compatibility, without any need for third-party relayers or centralized oracles, full access to both Bitcoin and Ethereum assets, while preserving security even beyond Bitcoin’s standards to protect against reorgs and network censorship.

Traction

Since July, the launch of Hemi’s incentivized testnet has seen a remarkable traction, with over 200k PoP miners taking part.

At the same time, community trials of Hemi's cross-chain asset transfer system, "Tunnels," dominated activity on Ethereum’s Sepolia testnet, accounting for up to 88% of total network traffic and driving base gas fees to an unprecedented high of over 10,000 Gwei.

Testnet Statistics:

- Total txs: 20M

- Total Wallets: 914K

- Total Contracts: 280K

- Source: https://testnet.explorer.hemi.xyz/

Socials’ traction:

Protocol Ecosystem:

Hemi has already established key partnerships with major players in the blockchain ecosystem, including:

Sushi, Pendle, Pyth, The Graph, Redstone, Swell, Symbiotic, AjnaFi, Vesper, Metronome, Quantstamp, Alchemy, Tenderly, Planet Atmos, Odyssey, LayerZero, and much more.

More than 35 protocols are poised to launch on the Hemi mainnet.

For a detailed overview of Hemi's growing ecosystem, also visit: https://hemi.xyz/ecosystem/

Project Breakdown

The Hemi Network

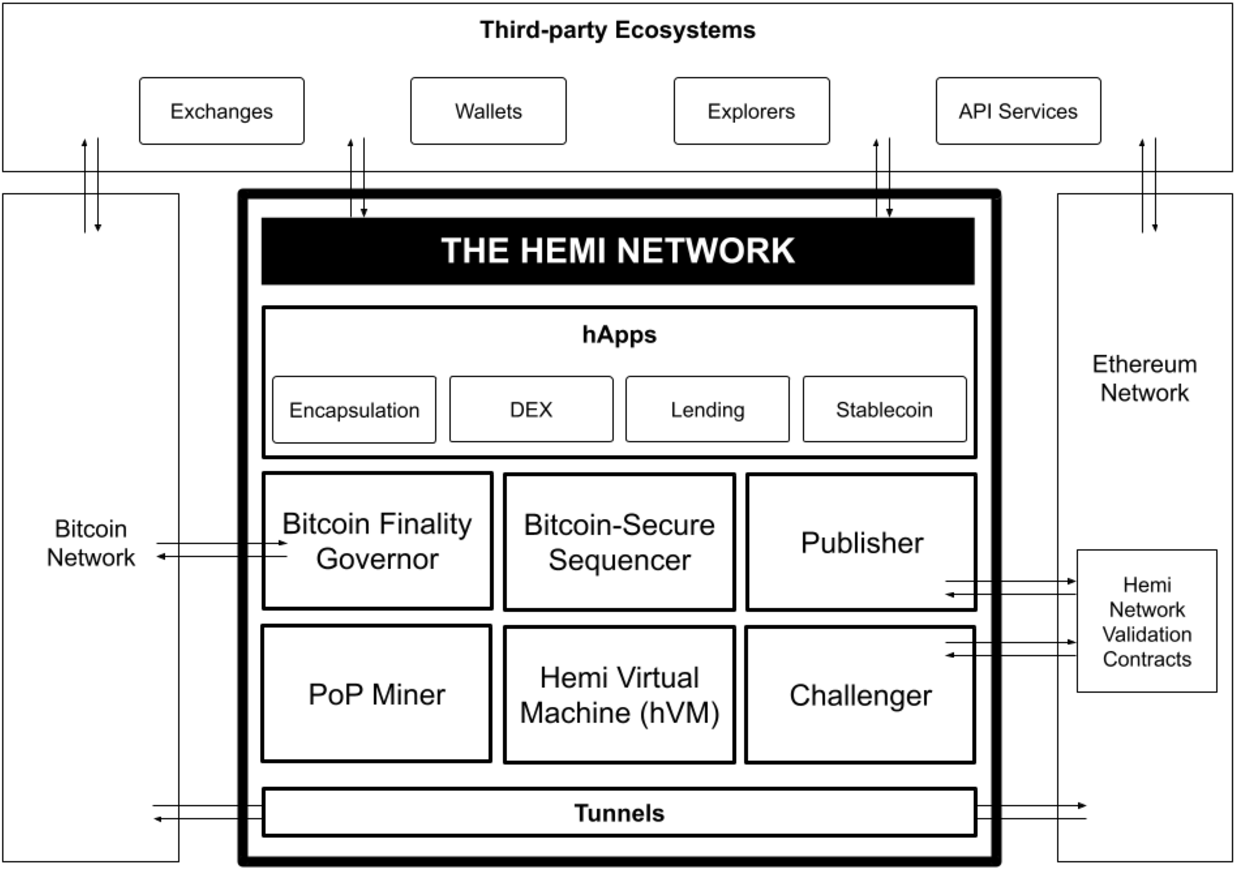

As a system, Hemi is the result of the interaction of many different components that, collectively, manage:

- Decentralized Blockchain Progression

- Synchronizes hVM state with Ethereum and Bitcoin, processes transactions, and publishes Hemi blocks for data availability (DA).

- Bitcoin PoW Security

- Uses Bitcoin Proof of Work (PoW) to secure Hemi through PoP transactions and resolves forks.

- EVM-Level Bitcoin Awareness

- hVM tracks Bitcoin state and exposes it to the EVM via precompiled contracts.

- Ethereum & Bitcoin Asset Tunnels

- Tunnels manage cross-chain deposits, withdrawals, and fault proofs for Ethereum-Bitcoin interoperability.

Hemi supports a dual-asset gas model, allowing fees in either ETH or native tokens.

Participants in roles that require payment of BTC/ETH fees supply these assets themselves, and the protocol economics are engineered to reward participants sufficiently to cover the cost of acquiring these assets.

By default, users pay in ETH, which the protocol converts to native tokens via on-chain DEXes. A small conversion fee applies to ETH gas payments.

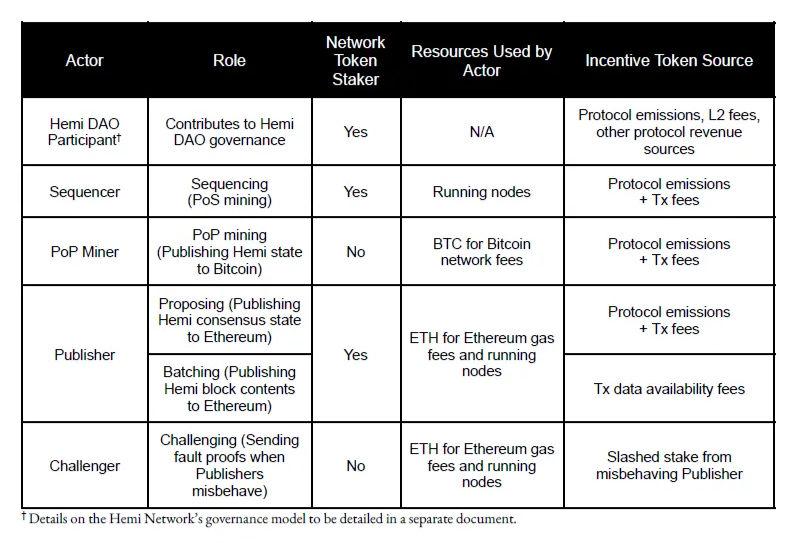

Following is a breakdown of the main Network participants:

Let’s analyze all the roles and their functions in the system with the following chapters.

Bitcoin-Secure Sequencer (BSS)

The Bitcoin-Secure Sequencer (BSS) manages Hemi's consensus and communication with Ethereum through two daemons that:

- Handle Sequencer staking, unstaking, and slashing operations

- Communicate with hVM to gather Bitcoin headers and mempool transactions for block construction

- Perform block validation and resolve forks to maintain consensus

- Derive the Hemi chain from Ethereum-published batches

- Provide the Publisher and Challenger with consensus and Bitcoin security data

This system ensures efficient integration and security across both networks.

Proof-of-Proof (PoP) and Superfinality

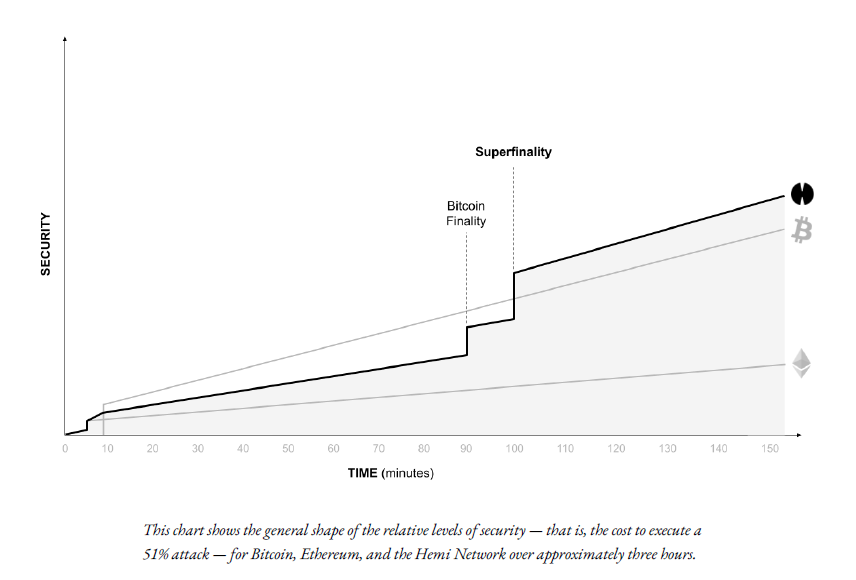

Proof-of-Proof (PoP) allows Hemi to inherit Bitcoin’s Proof-of-Work security in a decentralized, trustless and permissionless way.

PoP Miners publish Hemi consensus data to the Bitcoin blockchain. After publication, the Hemi network detects these updates, rewarding PoP Miners with native tokens. This mechanism is used for fork resolution, leveraging Bitcoin’s security to prevent reorganizations.

Hemi blocks achieve full “Bitcoin finality” after nine Bitcoin blocks (approximately 90 minutes), making network reorganization nearly impossible without a 51% attack on Bitcoin itself.

Hemi achieves Superfinality due to its hybrid consensus protocol, because an attacker would need to control the majority consensus power on both the Bitcoin and Hemi networks simultaneously to initiate a reorganization.

This dual security layer makes it statistically improbable for a reorg to occur, providing robust finality and securing the Hemi network with Bitcoin’s Proof-of-Work strength.

This becomes particularly meaningful in the context of cross-chain applications and real-world service provides like exchanges and payment processors, which get provided with security guarantees above the Bitcoin standard to safeguard large-scale financial operations.

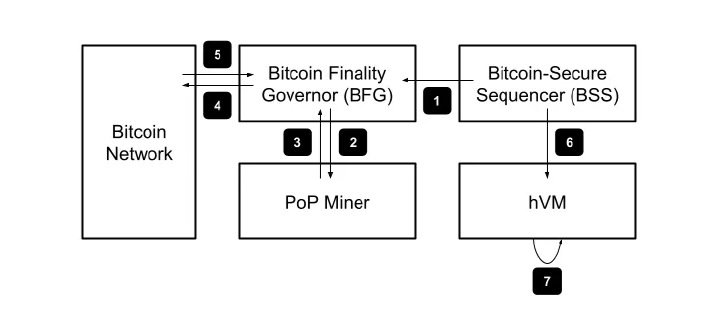

PoP Mining Process Flow

This diagram illustrates how Hemi's components interact to enable the inheritance of Bitcoin's security:

- A Bitcoin Secure Sequencer (BSS) creates a block and shares it with other BSS nodes, which send the header to Bitcoin Finality Governor (BFG) nodes.

- BFG nodes forward the header to PoP Miners.

- PoP Miners encode the header into signed Bitcoin PoP transactions and return them to BFG nodes.

- BFG nodes send the PoP transactions to the Bitcoin network.

- BFG nodes detect the inclusion in a Bitcoin block and update security statistics.

- A new block is mined by a BSS node, updating the Bitcoin state in hVM.

- hVM calculates and rewards PoP Miners post-mining.

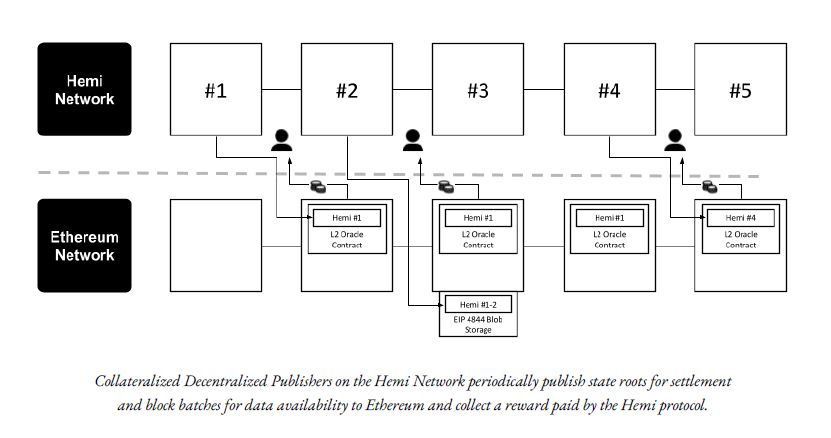

Decentralized Publication and Validation

Anyone can participate in publishing Hemi data to Ethereum by staking native tokens.

Publishers compete for rewards, paid in the protocol’s native token, by publishing data to Ethereum. Hemi's validation contracts manage these rewards to ensure publishers are sufficiently incentivized, even during fee market spikes.

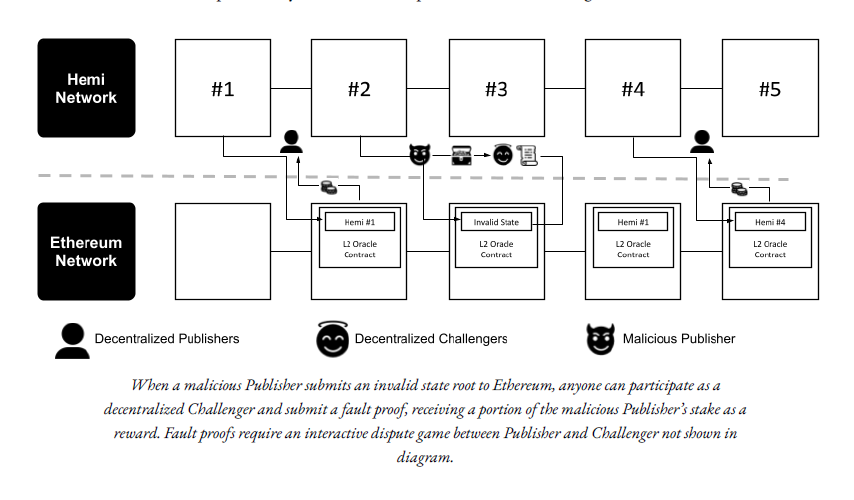

Hemi introduces decentralized "Challengers" who oversee Publisher activity and can challenge invalid data publications using fault proofs

If a Challenger proves a publication is invalid, the Publisher’s stake is slashed. A portion of the stake is burned, while the rest is awarded to the successful Challenger.

This system helps maintain integrity by penalizing dishonest behavior and rewarding those who ensure correct data publication.

This system strongly discourages misbehavior and motivates users to run verification nodes that actively look for and challenge invalid data.

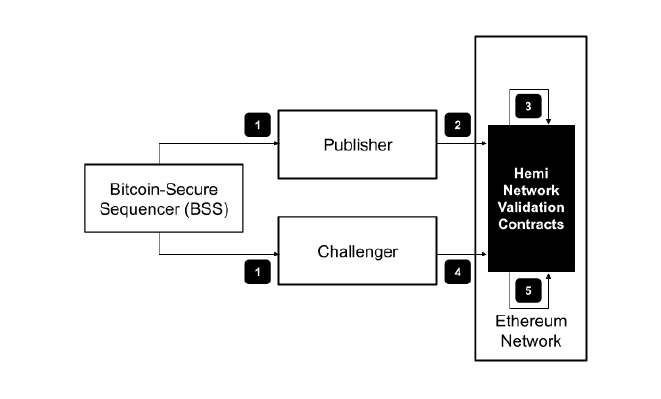

The Ethereum Hemi Validation Contract

To ensure secure cross-chain transactions and contract calls between Hemi and Ethereum, Hemi validation contracts on Ethereum need up-to-date information about Hemi’s consensus and canonical state.

This diagram shows how Hemi’s components work together to perform decentralized publication and verification of Hemi state and security to the Ethereum-side contracts:

- BSS nodes send Hemi consensus data to Publishers and Challengers.

- Publishers verify the data and publish updates to Ethereum via a transaction.

- Hemi validation contracts process new information to update their view of Hemi state and Bitcoin security.

- Challengers check the published data, submitting a fault proof if any discrepancies are found.

- If a fault proof is submitted, the validation contracts correct the information, slash the Publisher's stake, and reward the Challenger.

Tunnels

"Tunnels" refer to the mechanisms that enable the bridging of digital assets between Hemi and the Bitcoin and Ethereum networks.

Most early solutions, like wrapped tokens, are centralized in nature and born as tradeoffs to address the architectural differences between Bitcoin and Ethereum

Hemi’s consensus-level knowledge of both Bitcoin and Ethereum states enables diverse secure methods for asset transfer across these networks, beyond the limitations of conventional bridges.

Bitcoin Tunnels

Hemi’s Bitcoin state knowledge enables flexible approaches for Bitcoin asset portability, balancing risk, speed, and cost.

These include low-value vaults secured by overcollateralized multisig for faster transactions and high-value vaults secured by BitVM for maximum security:

- High-Value Vaults: using a BitVM-based system with multiple validators securing large BTC deposits. They ensure strong security through a Optimistic Network of Overcollateralized Validators, Fault Disputed through ZK proofs. Withdrawals from this system are slower (2-4 weeks) and more expensive, making them ideal for high-value assets where capital efficiency is key.

- Low-Value Vaults: Still using overcollateralized custodianship, these vaults use a multisig model (2-of-3 thirds), offering faster withdrawals with lower fees.

Combined with atomic swaps for quick asset redemption, this system supports a liquid and efficient way to move Bitcoin assets, including Ordinals and BRC-20 tokens, to Hemi and Ethereum.

Developers can also create additional Bitcoin Tunnel systems to further optimize interoperability and security.

Ethereum Tunnels

Hemi's Ethereum Tunnels allow Ethereum assets to move to and from Hemi, similar to other optimistic rollups but with faster settlement due to Bitcoin Finality and decentralized Challengers.

Users deposit assets by locking them in Hemi’s Ethereum contracts, minting representative tokens on Hemi. For withdrawals, tokens are burned, and after Bitcoin finality and an updated rollup state, assets are reclaimed on Ethereum.

The system also supports tunneling Hemi-native assets (including Bitcoin-tunneled assets) back to Ethereum, ensuring efficient and secure cross-chain transfers with quick settlement times.

As a result, dApps on Ethereum or any Ethereum L2 can utilize Bitcoin-native assets protected by Hemi’s tunnel system.

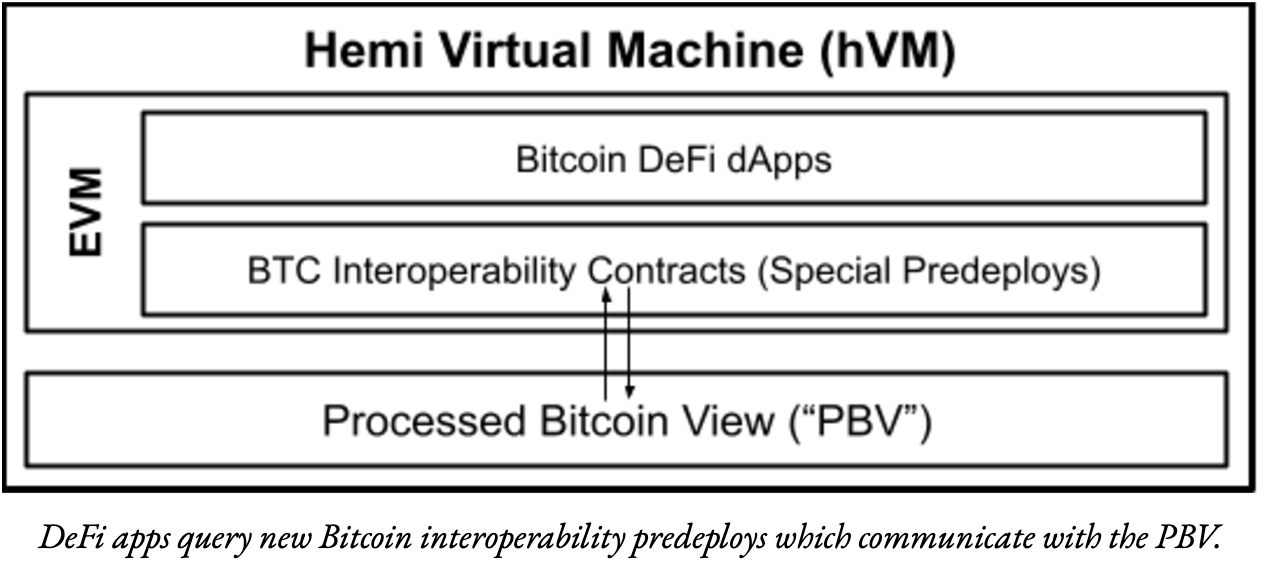

Hemi Virtual Machine (hVM)

The hVM is an Ethereum Virtual Machine enhanced with Bitcoin interoperability, integrating a fully indexed Bitcoin node.

It allows developers to build decentralized Bitcoin DeFi applications securely and efficiently by exposing the Bitcoin state and data to smart contracts without the need for costly proofs or trusted oracles.

The hVM’s design enables automatic smart contract callbacks triggered by Bitcoin events, allowing for the creation of sophisticated, gas-efficient applications and infrastructure that conventional Bitcoin interoperability solutions couldn’t previously support.

The hVM handles smart contract execution, maintains EVM state, and manages transaction communication.

The hVM:

- Syncs hVM's Bitcoin state by fetching full Bitcoin blocks.

- Processes transactions provided by the BSS.

- Provides smart contracts access to Bitcoin data via new precompile contracts.

- Extracts PoP transactions for PoP payout calculations.

- Manages Hemi's mempool, validating and propagating pending transactions for BSS block creation.

Processed Bitcoin View (PBV)

The Processed Bitcoin View (PBV) is a deterministic Bitcoin state maintained by hVM, tracking the UTXO table, address history, and Bitcoin meta-protocols like Ordinals and BRC-20.

It also includes an event subscription system for smart contracts, triggering automatic callbacks when relevant Bitcoin events occur.

Once a Bitcoin block receives sufficient confirmations, it’s processed by the hVM’s full node, updating the PBV. The PBV ensures smart contracts are notified and executed based on Bitcoin state changes in real time.

Hemi Bitcoin Kit (hBK)

The Hemi Bitcoin Kit (hBK) simplifies Bitcoin interaction for smart contracts by abstracting low-level precompile operations.

The hBK:

- Converts smart contract queries into precompile calls.

- Transforms raw precompile data into user-friendly structures.

- Provides endpoints for complex queries through multiple precompile calls.

In other words the hBK allows developers to call simple high-level Solidity functions to receive back Bitcoin data in the form of convenient structures.

Additionally, hBK integrates with popular development tools, making it easier for developers to build Bitcoin-aware hApps, without necessarily requiring deep expertise in the specifics of the hVM.

Tokenomics*

The $HEMI token is expected to be used both as a gas token (alongside ETH) and function as a governance token, as well as grant participants access to perform roles that secure the network in exchange for a share of network emissions and protocol fees.

Token Supply (Not Including Yearly Emissions): 10B

Inflation: There is expected to be yearly emissions of 3-7% to compensate PoP Miners, Sequencers, Publishers, and Challengers.

Fundraising

Investors:

Binance Labs, Breyer Capital, Big Brain Holdings, Crypto.com, Web3.com Ventures, HyperChain Capital, Salt, Sunflower, DNA, Quantstamp, Alchemy, Artichoke Capital, UTXO, TRGC, SNZ, 0xBE, Impossible Finance, Cypher Capital, Protein Capital, SSV, IBG, Gate Ventures, Morningside Ventures (MON).

Roadmap

2024 Q4:

- Mainnet Launch + TGE

- hVM + hBK: Phase 0 (Fully trustless, secure smart contract queries for Bitcoin UTXOs, balances, transactions, fees)

- hVM + hBK: Phase 1 (Bitcoin event notifications/protocol-driven callbacks to smart contracts on Bitcoin event triggers)

- Bitcoin Tunnel v0 (Overcollateralized multisig leveraging Swell/Symbiotic Bitcoin restaking for economic security)

- Bitcoin (Re)Staking System v0 (Staking tunneled BTC on Hemi)

- Bitcoin Kit Demo Code (developer examples)

- Hemi hVM ZK Provability for hVM Verification in Fault Dispute Game for ETH Settlement

2025 Q1:

- Decentralized Sequencer

- Decentralized Publisher & Challenger

- hVM + hBK: Phase 2 (Ordinals metaprotocol support)

- Hemi Full ZK Provability

- Bitcoin Tunnel v1 (BitVM2-based Bitcoin Tunnel)

- Bitcoin (Re)Staking System v1 (Truly Decentralized on-Bitcoin BTC Staking without Covenant Emulation)

- Chainbuilder Phase 1 (Hemi Ecosystem Chains)

Competitive Landscape

Team

Extended team composition

Core Team

Jeff Garzik:

Jeff is the co-founder and CEO of Bloq and leader of the Hemi Network project. He has long been at the center of developing and commercializing open source software related to Bitcoin and blockchain technology.

Previously, he spent five years as a Bitcoin core developer and ten years at Red Hat. His work with the Linux kernel is now found in every Android phone and data center running Linux today. Jeff also served as a board member of The Linux Foundation.

Max Sanchez:

Prior to leading technical architecture on Hemi, Maxwell was the co-founder and CTO of VeriBlock where he co-invented the Proof-of-Proof (PoP) protocol for decentralized and permissionless Bitcoin security inheritance, architecting an entirely new PoP-optimized blockchain protocol. Passionate about blockchain technology since 2011, Max also launched the first testnet to use post-quantum cryptography, has discovered and responsibly disclosed chain fragmentation and stake amplification consensus vulnerabilities for multiple blockchain projects, and developed several open-source GPU miners.

Investment Thesis

Besides the incredible traction gained by the testnet, and strong institutional backing and positioning, Hemi sits at the most convenient spot, potentially unlocking the most seamless, and secure, interoperability use cases between the two highset-value ecosystem in the blockchain space.

We believe these use cases could easily extend from DeFi to other niches like payments or AI, with L3s built on top of Hemi, further reducing Tx costs overheads and increasing throughput.

The strong security guarantees enabled by superfinality, are going to represent true value for real-world financial use cases and high-value transfers, and the rise of increasingly complex and high-value applications, particularly in decentralized finance and cross-chain transactions, will amplify the demand for secure and tamper-resistant finality.

We trust the vision and expertise of the team, who wants to provide robust infrastructure for the integration of Bitcoin and Ethereum through Hemi's technology. We believe this will unlock opportunities for more developers and enterprises to overcome the current challenges and drive innovation in decentralized applications beyond today's limits.

Risk Evaluation

Security

- Example: Network attacks.

- Mitigation: Hemi will implement gradual decentralization with sufficient economic security, a pause feature to block malicious activities until full security is achieved and use PoP for long-range security with Ethereum and Bitcoin features for enhanced anti-censorship protections.

Technical

- Example: Vulnerabilities in core software or smart contracts.

- Mitigation: Hemi will launch a bug bounty programs, work with auditors, and open-source the code for peer review, following the industry’s best practices.

Economic

- Example: Bitcoin tunnel attack.

- Mitigation: Initially, if the network captures any misbehavior, Hemi will slash large amounts of restaked Bitcoin, transitioning later on to a 1-of-N trust model with BitVM for fully permissionless security.

About Hemi

Hemi is a modular Layer-2 protocol for superior scaling, security, and interoperability, powered by Bitcoin and Ethereum.

While other projects approach these two networks as ecosystem silos, Hemi views them as components of a single supernetwork. This means more-powerful-than-Bitcoin security and better interoperability between Bitcoin & Ethereum, unlocking new levels of programmability, portability, and potential.

Website | Blog | Discord | Twitter

About Impossible Finance

Impossible is an on-chain native, research advisory firm with a DeFi launchpad and accelerator. We help projects kickstart, fundraise, scale and launch their tokens while enabling users to learn, discover and invest in high-quality crypto opportunities.

Website | X | Discord | Telegram | Blog

Disclaimers

Composed and presented by Impossible Finance Research Team based on information provided by Hemi team.

- Risk Warning: Trading and/or generally investing in any cryptocurrency involve significant risks and can result in the complete loss of your capital. You should not invest more than you can afford to lose and you should ensure that you fully understand the risks involved. Before investing, please consider your level of experience, objectives, and risk tolerance, and seek independent financial and legal advice if necessary. It is your responsibility to ascertain whether you are permitted to use the services of Impossible Finance based on the legal and regulatory requirements of your country of residence and/or applicable jurisdiction(s).

- The information provided on this memo does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such. Impossible Finance does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

- The details provided in this document are summarized from materials provided in due diligence from Hemi's team to Impossible Finance

- Disclaimers, Terms, and Risks