Impossible Research - Crypto Options Market

Sector Breakdown & Insights

Crypto options are financial derivatives that provide the holder with the right, but not the obligation, to buy or sell a cryptocurrency at a specified price (strike price) before or at a certain future date (maturity date). They offer traders and investors opportunities to speculate on the price movements of cryptocurrencies, hedge their portfolios, and employ various trading strategies. These options can be traded on both centralized and decentralized platforms, and they come in various types, including call and put options, providing flexibility in trading strategies.

CEX VS DEX

The crypto options landscape encompasses two main facets:

- Centralized exchanges offer the deepest liquidity and good pricing, at the cost of custodying user funds, and relying heavily on Market Makers.

- Decentralized protocols emphasize self-custody and transparency while providing different solutions to aggregate liquidity within AMM pools and through RFQ systems.

These two components cater to diverse trading preferences and collectively shape the evolving crypto options market. Understanding both sides is key to navigating this dynamic space.

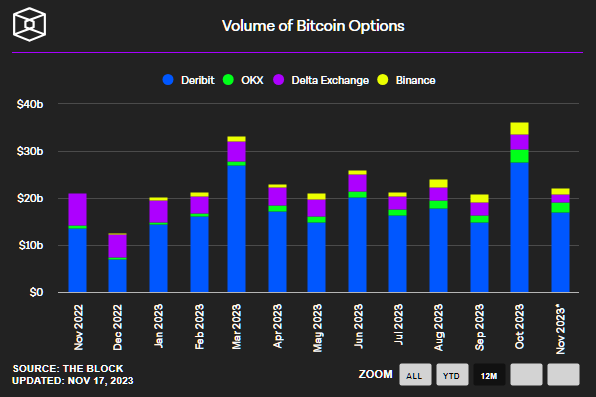

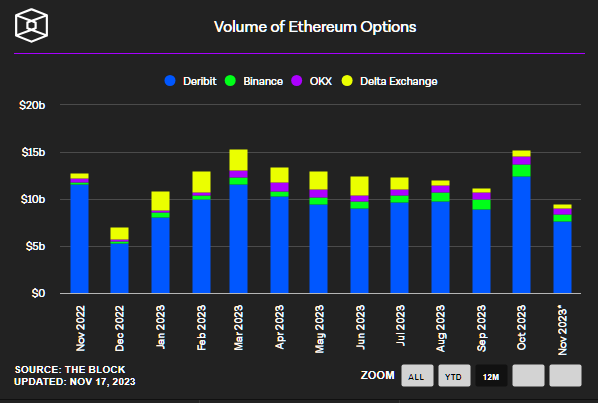

In terms of trading volume, centralized cryptocurrency options exchanges still outperform significantly their decentralized counterparts.

Analyzing the data, it becomes evident that Deribit stands out as the dominant player in the centralized crypto options market.

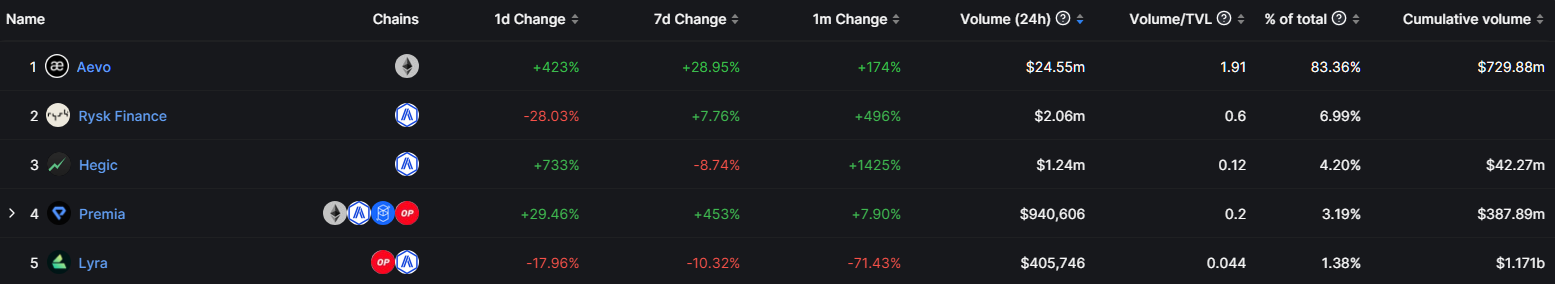

On the other hand, within the decentralized crypto options space, Aevo Finance takes the lead, followed by Rysk Finance, Hegic, Premia and Lyra.

The division between centralized exchanges (CEX) and decentralized exchanges (DEX) in the crypto options market is remarkably skewed.

This notable disparity underscores the overwhelming prevalence of centralized platforms in the crypto options trading landscape, yet the significant untapped potential for expansion and growth of the decentralized options space.

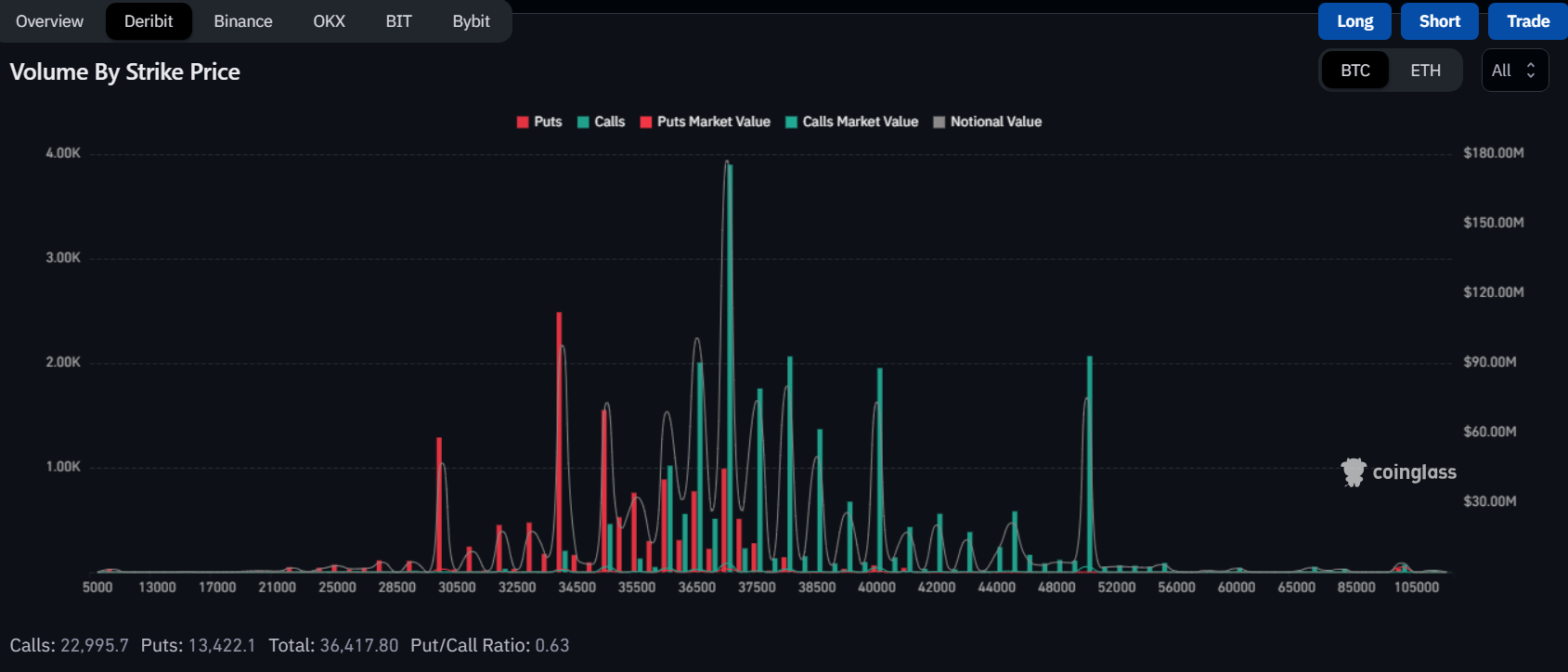

When we delve into maturity data and strike prices, centralized crypto options exchanges offer greater liquidity and accessibility. Users have the option to purchase contracts with expirations extending well into the next year, signifying the market's depth and flexibility.

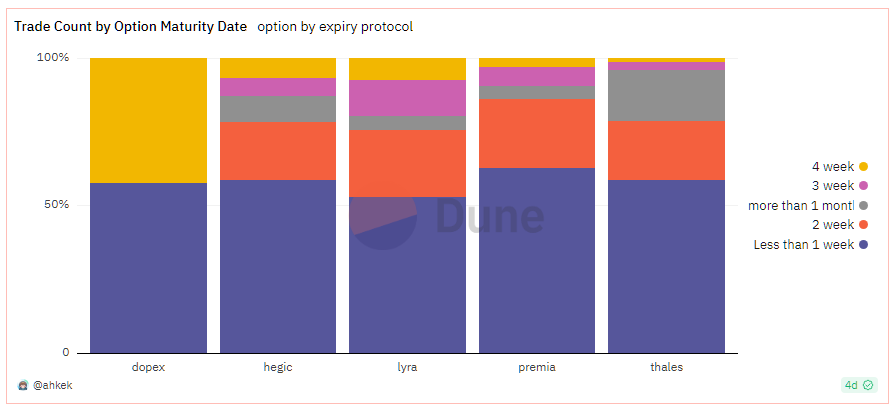

In contrast, the decentralized crypto options space, as depicted in the graphs, exhibits a distinct pattern. Here, the majority of users engage in options with much shorter durations, typically within a one-week timeframe.

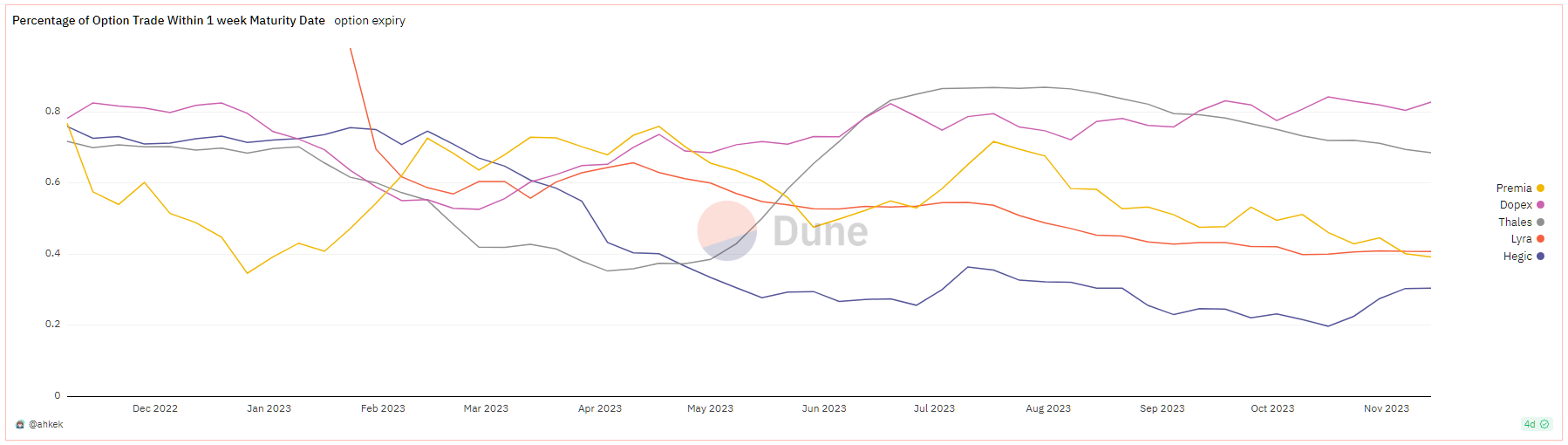

When assessing the distribution of options traded by their maturity dates, a notable trend emerges, though:

There is a reduction in the percentage of options traded within a week of maturity.

This decline implies that more users are now engaging in the trading of options with longer maturity dates. As investors seek to mitigate risks and make more calculated decisions in an uncertain market environment, they may opt for options that provide greater time horizons for price movement, reflecting a nuanced adaptation to market dynamics.

Another significant distinction between centralized and decentralized crypto option exchanges is the distribution of trading volumes between Bitcoin (BTC) and Ethereum (ETH).

In the centralized crypto option exchange domain, there is a notable skew towards BTC options, with considerably higher trading volumes in comparison to ETH.

Conversely, within the decentralized crypto option exchange landscape, the situation is reversed, with ETH options experiencing higher trading volumes than BTC.

This divergence probably highlights the versatility and variety of options available to cryptocurrency traders across various platforms, together with preference of the options .

Total Value Locked (TVL)

Total Value Locked (TVL) stands as a pivotal metric in gauging the vitality and appeal of options markets. Together with volume, this indicator is crucial for assessing the overall health, success, and user demand within these markets. By influencing liquidity across various strike prices, TVL directly affects the pricing dynamics of option premiums.

Whether the protocol structure is based on a Central Limit Order Book (CLOB), an Automated Market Maker (AMM), or Discretized Options Vaults (DOV), the significance of TVL remains paramount. Its role in providing a comprehensive view of market engagement and robustness makes it an indispensable tool for understanding and navigating the complex landscape of options protocols

Top 9 competitors in the options niche by TVL:

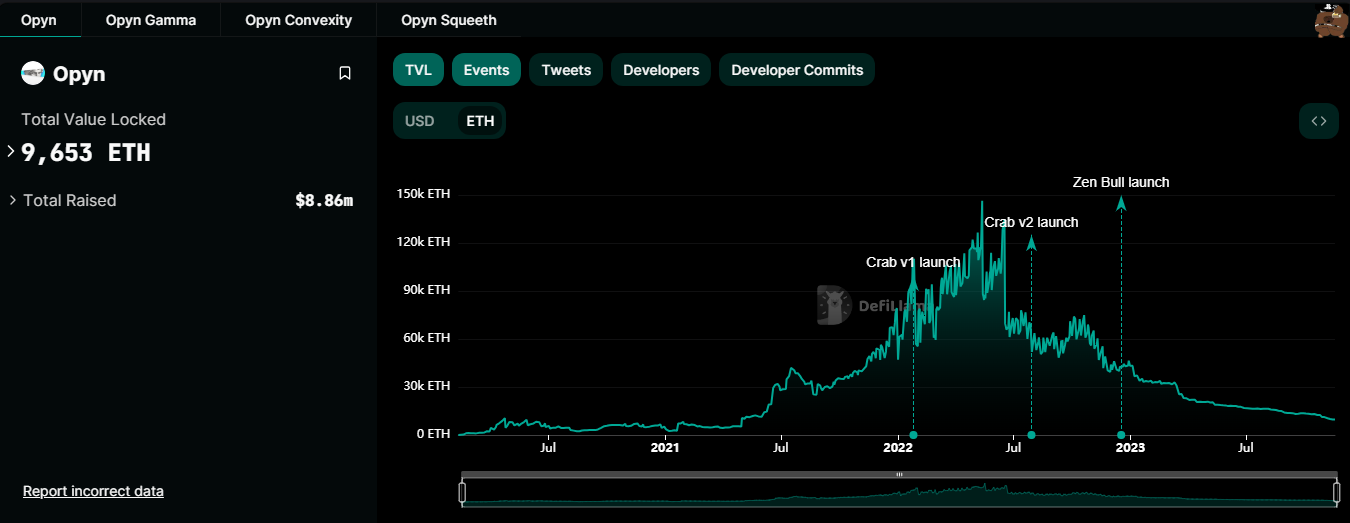

Opyn

Live on: Ethereum, Avalanche, Polygon

Opyn focuses on developing open finance by leveraging DeFi methodologies and perpetual options. It established the first options protocol in the DeFi space and has progressed to introduce the pioneering perpetual option, Opyn Squeeth.

Opyn Links

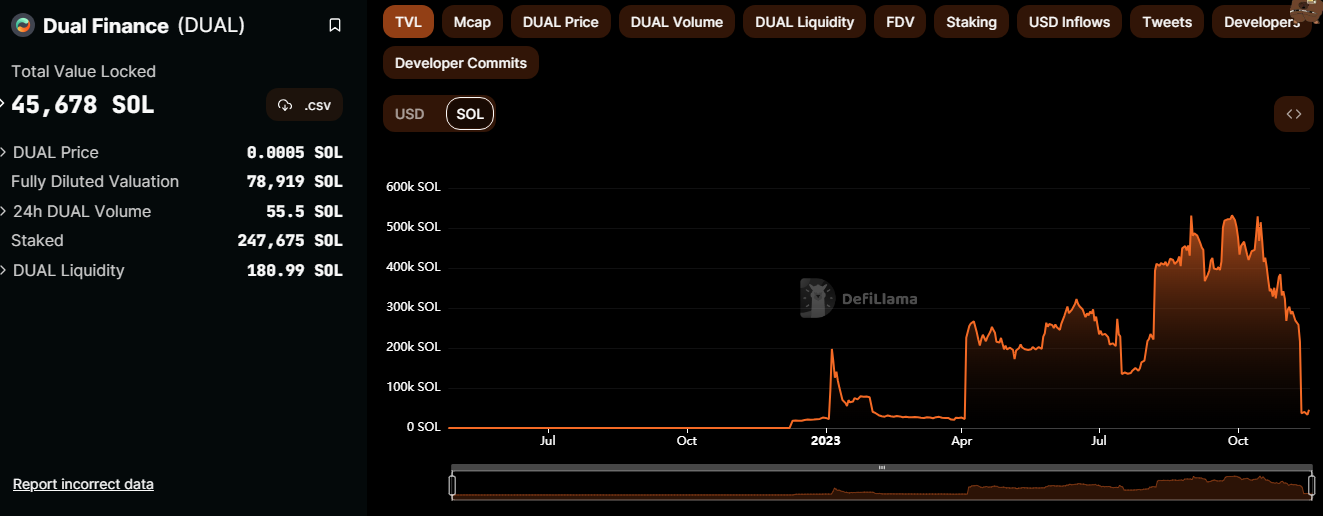

Dual Finance

Live on: Solana

Dual Finance provides DAOs with sustainable ways to generate value from their treasuries and enhance community participation through liquid option based incentives, tools and services. They facilitate the sunsetting of inflationary token rewards in favour of Staking Options.

Partner projects can use Staking Options via Dual Finance to sustainably incentivize their communities.

The distribution of the DUAL token was also conducted in a fully transparent and fair manner through an airdrop of Staking Options.

Staking Options further serve to bolster their token liquidity by utilizing a DAO owned liquidity service, the Risk Manager.

Dual Finance Links

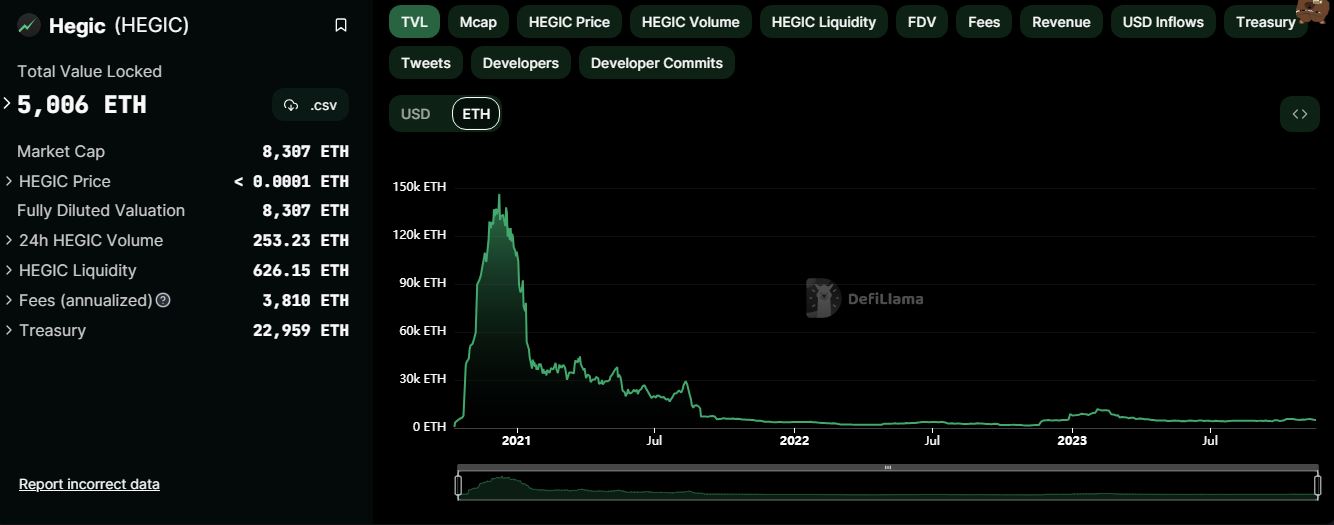

Hegic

Live on: Arbitrum, Ethereum

Hegic is an Options protocol live on Arbitrum facilitating peer-to-pool options trading with a one-click process for various strategies. The cost of an option is solely represented by its premium with no additional trading or taker fees.

Hegic Links

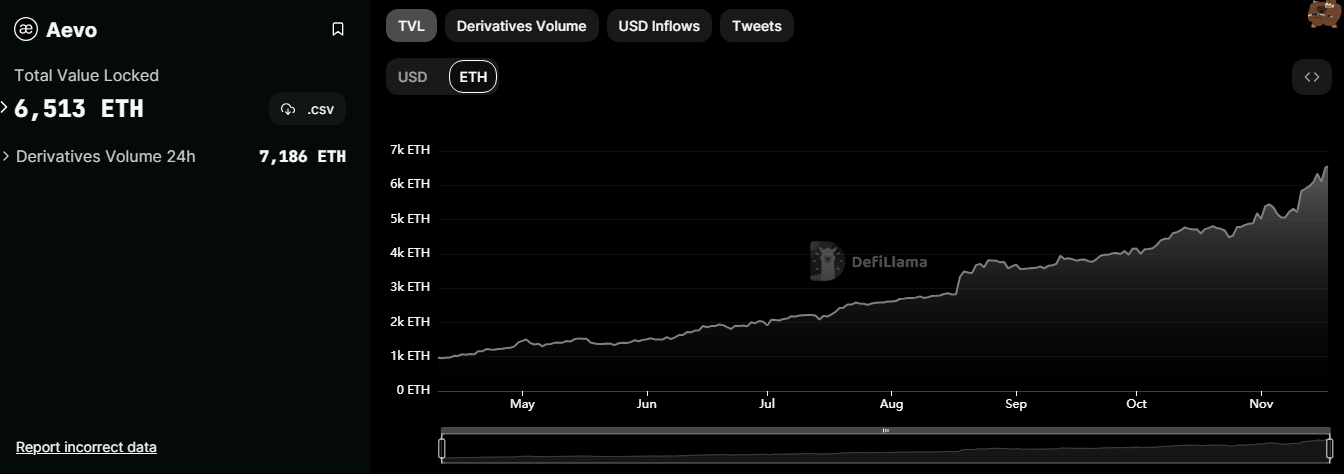

Aevo/Ribbon

Live on: Arbitrum, Ethereum, Optimism

Built by the same team, Ribbon Finance and Aevo are one of the bisggest players in the options niche.

Aevo is a Derivatives L2 or app-chain, offering both options and perps trading through an CLOB, CEX-like experience.

Ribbon, their first product, was the first Decentralized Options Vault(DOV) protocol, offering tokenized structured products and strategies.

Aevo and Ribbon Links

- Twitter - Aevo, Ribbon

- Website - Aevo, Ribbon

- Data Source 1, Data Source 2

Lyra

Live on: Optimism, Arbitrum,Ethereum

Lyra operates as an automated market maker (AMM) for options, facilitating traders in the buying and selling of cryptocurrency options through a shared liquidity pool.

The advent of their V2 will bring significant advancements in both capital efficiency and composability of their product.

Lyra Links

Premia

Live on: Arbitrum, Ethereum, Optimism, Fantom, BSC

Premia V3 is a decentralized options protocol and a Uni V3-based Options Aggregator platform, featuring a Hybrid Orderbook where each pool equates to a specific strike and liquidity tick. The protocol supports a Margin system for better capital efficiency and also includes Vaults for tokenizing exotic or structured strategies, incentivized with PREMIA and governed by vxPREMIA stakeholders.

Premia Finance Links

Rysk Finance

Live on: Arbitrum

Rysk Finance is an options trading market offering European, cash-settled and auto-exercising options.

It combines the elements of an Automated Market Maker (AMM) and a Request for Quotation (RFQ) system through its Dynamic Hedging Vault (DHV) that offers uncorrelated and delta-hedged yields for its liquidity providers, together with competitive pricing and unified liquidity across all strikes and expirations for its traders. The platform is non-custodial and transparent and its interface is designed for efficiency and user-friendliness.

Rysk Finance Links

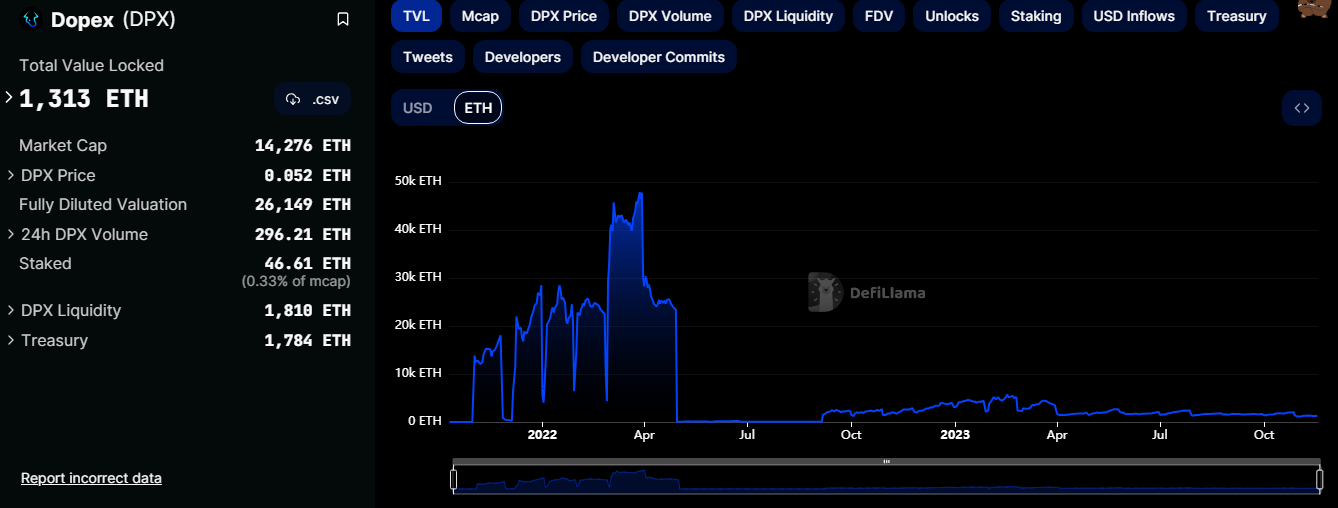

Dopex

Live on: Arbitrum, BSC, Avalanche, Ethereum

Dopex is a decentralized options exchange that features Single Staking Options Vaults (SSOVs) and European-style options. SSOVs enable liquidity providers to engage in covered calls and cash-settled puts, allowing them to earn premiums and rewards from farming. Additionally, Option Liquidity Pools (OLPs) provide SSOV purchasers the flexibility to exit their positions mid-epoch by trading against a liquidity pool. The platform is underpinned by a dual token system: $DPX for governance and $rDPX as a rebate token, which compensates writers for their losses. This dual token framework is designed to enhance the liquidity and efficiency of the ecosystem, with the aim of refining options trading within the decentralized finance sector.

Dopex Links

Opium

Live on: Ethereum, Polygon, BSC, Arbitrum

Opium provides a versatile decentralized escrow system, one of its applications being the offering of options as a financial product. This system enables parties to engage in contracts that operate similarly to futures or options, securing assets as collateral with payouts contingent on market conditions. Beyond financial derivatives, Opium's platform is adaptable to various use cases, such as sports betting, where participants can place wagers on events like soccer matches, with the escrow determining payouts based on the event's outcome. The escrow system is designed for ease of use, requiring no technical expertise and allowing repeated use for similar contract types.

Opium Links

Attracting the Movers: Incentive-Driven Decentralized Crypto Options

Incentive programs play a pivotal role in the flourishing landscape of decentralized finance. At their core, they serve as a catalyst for enhancing community engagement and fostering a vibrant ecosystem. These incentives, often manifested as token rewards, ignite a palpable excitement among users, encouraging deeper interaction and participation within protocols.

The Arbitrum Short Term Incentive Program (STIP) is an example of this, and has been a significant boon for the options markets live on the Arbitrum network. With the program's conclusion, 29 projects were carefully selected for stimulus in the form of ARB tokens.

Key beneficiaries of this program include Dopex, Premia and Rysk Finance that saw significant TVL and Volumes increase.

The program is still live and the ARB token rewards can still be collected by interacting with the above mentioned platforms.

Another example of these strategies is employed by Lyra, one of the biggest Defi options markets. Lyra stakers enjoy enhanced trading rewards and vault rewards, creating an appealing proposition for those participating in Lyra's ecosystem. In addition, Lyra has secured grants from Optimism and Arbitrum, enabling the distribution of tokens to their top users via airdrops. These strategic incentives contribute to a vibrant and engaged user community within the Lyra network.

A further example comes from Premia, which recently introduced a novel feature that benefits its stakers by allowing them to share in the protocol's commission rewards. This strategic enhancement not only strengthens the sense of community within the Premia ecosystem but also aligns incentives for active user participation. Users who stake Premia tokens can enjoy the dual advantages of protocol commissions and traditional staking rewards, fostering a more engaged and vibrant network.

Thales Market, instead, has implemented a multifaceted incentive system that seeks to motivate its stakers in various ways. These incentives extend to not only staking but also encompass trading volume and vault fees, creating a holistic approach to fostering user engagement.

By rewarding stakers for both their contributions to trading activity and participation in vault management, Thales Market encourages a deeper level of involvement in its ecosystem, which ultimately benefits all participants and contributes to its growth.

Breakthroughs in the Decentralized Crypto Options space

To tap into its unexpressed potential, the decentralized options space has yet a lot to innovate.

The emerging field of Liquidity Provisioning Derivative Finance (LPDFi) is seeing a wave of new contenders, addressing some of the core challenges that have plagued Automated Market Makers and Liquidity Providers in the DeFi ecosystem such as LP compensation and subsequent Liquidity depth of derivatives markets.

These Liquidity issues, in fact, arise from the inconveniences of LPs’ payout profiles, which have recently been correctly reframed as options and volatility sellers through the AMMs, a risk that today, though, has not been fairly compensated.

Protocols like Panoptic, InfinityPools, Smilee Finance, Frax Finance, Limitless Finance, Itos are spearheading novel mechanisms to better reward LPs while enhancing market efficiency by allowing the short side of the LPing market to go live, thus making it whole.

Unlocking the short-side of LP positions, by allowing them to be borrowed and sold through Uniswap V3, is a change that could make Impermanent Loss (IL) an attractive proposition for borrowers/shorters, or as recently coined by the team at Smilee Finance, an 'Impermanent Gain'.

These new dynamics could greatly enhance LP profitability profiles, combining trading fees and lending fees or premiums, reducing the sting of IL and allow DeFi markets to work in a less RFQ and Market Makers oriented fashion.

Conclusion

The crypto options market, characterized by a dynamic interplay between centralized and decentralized exchanges, stands at the cusp of transformative growth. While centralized exchanges like Deribit currently dominate with a significant market share, the decentralized space, though nascent, is brimming with untapped potential.

We believe that decentralized platforms, currently grappling with challenges like lower option volumes, are well positioned to capture opportunities for growth and innovation.

As these platforms explore strategies to enhance user engagement, we are also witnessing the early stages of innovative trends such as the LPDFi evolution, that are potentially poised to redefine the attractiveness of decentralized crypto options compared to centralized competitors.

Moreover, the commitment to offer a more transparent and secure service, together with the gradual improvements in user experience and capital efficiency, will undoubtedly accelerate the adoption of decentralized crypto options.

In our upcoming piece, we will delve deeper into the LPDFi sector, further illuminating how these developments are reshaping the landscape of crypto options markets.

At Impossible FInance we know that the future of crypto options, particularly within the decentralized space, is bright, and the next few years are poised to be transformative, heralding a new era of growth, innovation, and widespread adoption.

Sources

Note: Kindly ensure to validate the data and references, considering the dynamism and rapid evolution within the DeFi space.

About Impossible Finance

Impossible is an on-chain native, research advisory firm with a DeFi launchpad and accelerator. We help projects kickstart, fundraise, scale and launch their tokens while enabling users to learn, discover and invest in high quality crypto opportunities.

Website | Twitter | Discord | Telegram | Blog

Terms & Conditions:

- DISCLAIMERS, TERMS, and RISKS

- Impossible reserves the right in its sole discretion to amend or change or cancel this announcement at any time and for any reasons without prior notice.

- There is no financial advice in this post and it's sole purpose is to educate readers