LST-Backed Stablecoins and Their Dynamics in the DeFi Space

In the realm of DeFi, decentralized stablecoins have become a cornerstone for various financial operations, such as trading, lending, and borrowing. Stablecoins backed by Liquid Staking Tokens (LSTs), sit at the cutting edge of innovation and play a pivotal role by providing borrowers, or holders, of the stablecoin with the lowest available risk in DeFi: the Ethereum staking rate, which is a necessary parallel to the risk-free rate found within traditional financial (TradFi) markets.

Simultaneously, these stablecoins offer a stable medium of exchange, unit of account, and store of value, all while mitigating many risks — such as blacklisting and freezing — presented by centralized stablecoins.

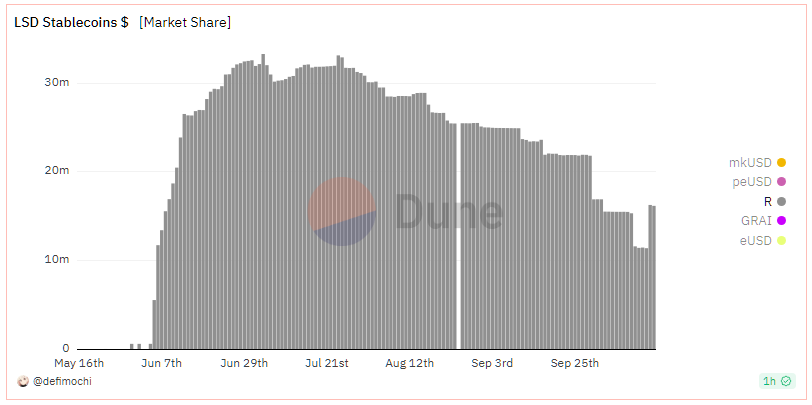

Key Players and Analytical Insights:

1. Lybra Finance | eUSD

Lybra is a notable presence in the DeFi sector as an overcollateralized stablecoin. It is backed by wstETH, rETH, and wbETH, and provides stablecoin holders the opportunity to earn a passive yield, directly sourced from the stablecoin collateral. This unique feature has significantly contributed to its success in bootstrapping TVL.

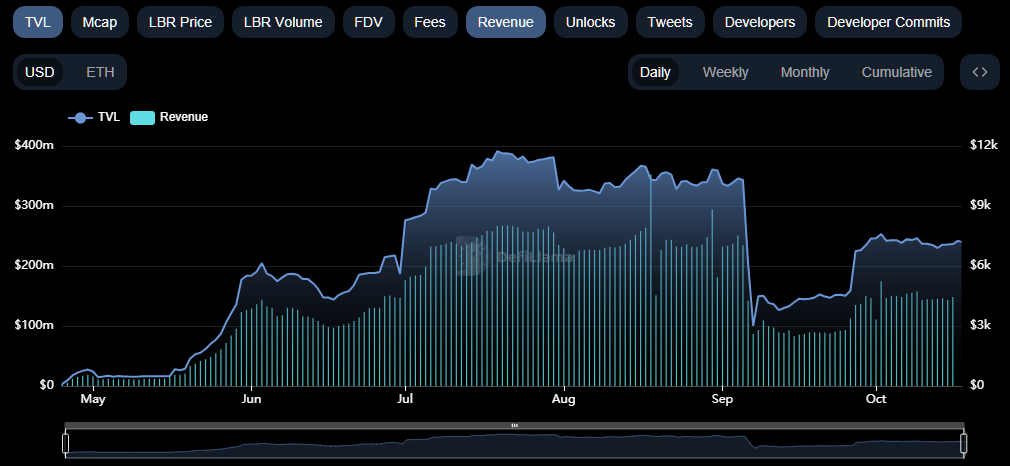

Impressive TVL Stats: Lybra achieved a 246 million USD TVL with an all-time high (ATH) of 391 million USD. A notable drop occurred due to the rollout of V2, though it is currently on a recovery trajectory.

Revenue Insights: The annualized revenue sits at $1.48m according to Defillama.com.

Market Capitalization: Almost $99m in Mcap for the eUSD Stablecoin.

Pegged Value: Lybra is currently sitting above peg at 1.02 USD.

Liquidity: $11 million of liquidity are available on Curve.

Yield Opportunities: Lybra offers the highest available yield through rebasing at 8% for holders, with composability through various DeFi platforms, such as Convex and Pendle.

Borrowers’ Yield Utilization: The utilization of the borrowers’ yield to reward stablecoin holders aligns incentives in such a way that the stablecoin is consistently sitting above it’s peg (i.e. Hodling demand< CDPs supply).

Interest Rates: The interest rate is fixed at 1.5%.

Minimum Collateral Ratio: Lybra has a minimum collateral ratio (Min CR) of 150%, serving as a hard-ceiling for the peg at 1.5 USD.

Redemptions: Redemptions are permitted with a 0.5% redemption fee, establishing a hard-floor for the peg at 0.995 USD.

2. Prisma Finance | mkUSD

Prisma Finance is the issuer of the mkUSD stablecoin, collateralized by wstETH, rETH, frxETH, and cbETH. Supported by the influential developer community of the Curve ecosystem, it has notably emerged as the number one competitor in its niche, particularly in terms of stablecoin market capitalization.

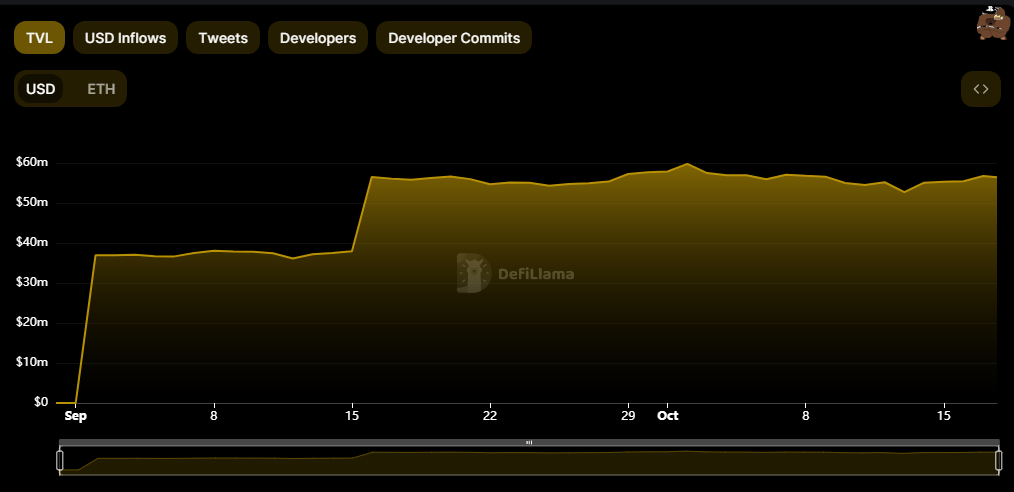

TVL: Currently sitting at 56 million USD in TVL, with an all-time high (ATH) of 59 million USD, according to data from DeFiLlama.com

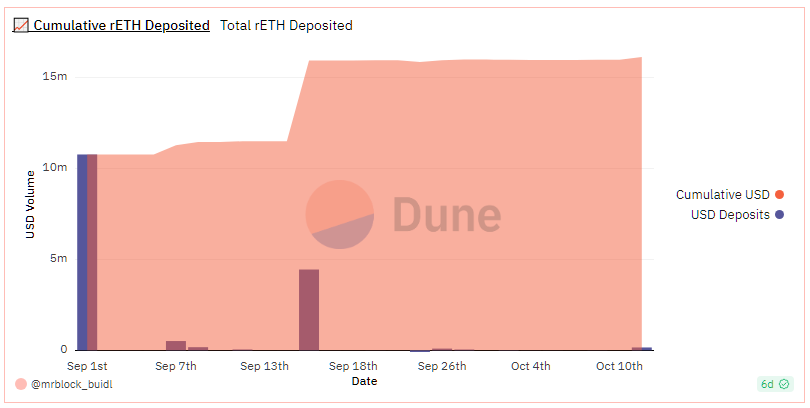

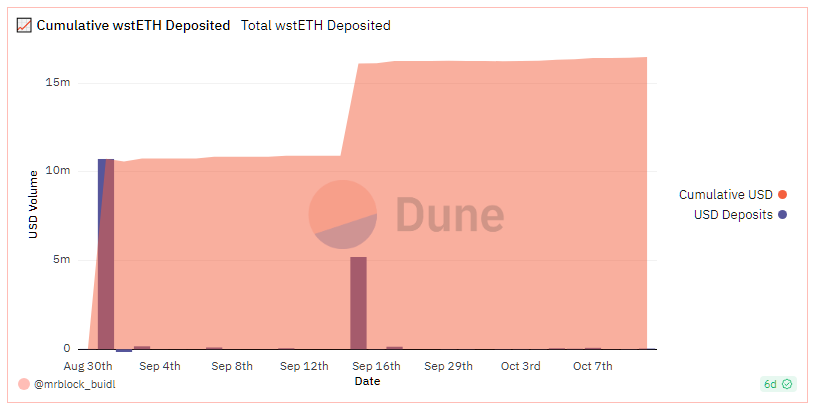

Collateral Distribution: Prisma Finance features approximately 16 million USD each for rETH, wstETH, and frxETH, as evidenced by the following graphs:

Pegged Value: Since its launch, mkUSD has consistently maintained its peg at 1 USD.

Market Capitalization: Prisma Finance takes the lead in its niche with a market capitalization of almost 30 million USD for the mkUSD stablecoin.

Liquidity: Boasts 15 million USD in liquidity, divided between the crvFRAX and crvUSD pools on Curve.

Yield Opportunities: Offers the highest available yield at 9.74% (mkUSD+crvUSD on Convex).

Interest Rates: Interest rates are determined by governance decisions.

Minimum Collateral Ratio: A minimum collateral ratio (Min CR) is set at 120%, increasing to 150% in Recovery Mode. The collateral ratio can be changed pending a governance vote, as other parameters as well.

Redemptions: Permitted, with a dynamically set redemption fee.

Additional Notes: Prisma Finance is undergoing a guarded launch so the minting is caped at 30 million for now otherwise it will be more. Additionally, they will be launching their reward & governance token PRISMA soon which will allow users to vote on the parameters. For more details, refer to this announcement article.

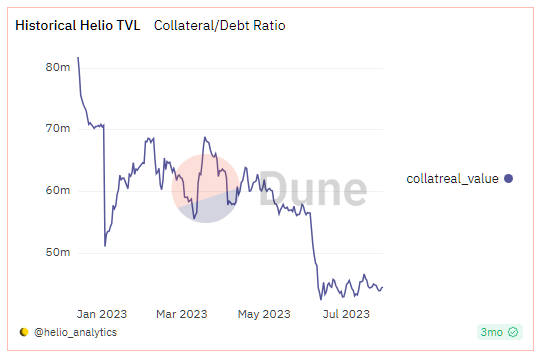

3. Helio | HAY

The HAY stablecoin, issued by Helio Protocol and live on the BNB chain, is an overcollateralized stablecoin incubated by Binance Labs. It currently supports BNB, ETH, as well as all BNB's LSTs—such as snBNB (Synclub), stkBNB (Pstake), and wBETH (Binance)—as collateral.

TVL: Currently sporting a Total Value Locked (TVL) of $39m

Market Capitalization: With a robust market capitalization of $19m.

Pegged Value: HAY is currently sitting at the 1 USD peg.

Liquidity: The deepest pool is the Smart HAY (HAY/USDT/USDC) pool on Wombat Exchange, total TVL more than $13m.

Yield Opportunities: Attractive yield opportunities prevail with >10% available on Thena and Planet Finance.

Interest Rates: The borrowing rate is fixed, currently set at 0% for all collateral types.

Minimum Collateral Ratio: Currently set at 152% across all collateral types.

Liquidations: Redemptions are not permitted, but Dutch Auctions are utilized for liquidations, carrying a 13% penalty.

4. Raft Finance | R

Raft Finance is the issuer of the R stablecoin, fundamentally derived from Liquity and strategically building upon its robust protocol dynamics. Notably, Raft accepts a range of collaterals including wstETH, rETH, cbETH, swETH, WETH, and WBTC. Furthermore, it leverages CHAI and the DAI Savings Rate (DSR) from MakerDAO, providing a stable yield pool for its stablecoin, R, and thereby ensuring steady and attractive returns for its users.

TVL: Raft reports a TVL of 35 million USD, having achieved an all-time high of 64 million USD, as per data from DeFiLlama.com.

Market Capitalization: The R stablecoin demonstrates a nearly 22 million USD in market capitalization.

Liquidity: Raft's deepest liquidity pool is hosted on Balancer, boasting 8 million USD.

Pegged Value: R is currently sitting slightly below peg, at 0.99 USD.

Yield Opportunities: The platform offers the highest available yield of 10% through the R Savings Rate.

Minimum Collateral Ratio: The minimum collateral ratio(Min CR) is set at 120%.

Interest Rates: Interest rates are fixed and range between 3% and 3.5%.

Redemptions: Redemptions are available in DAI/CHAI.

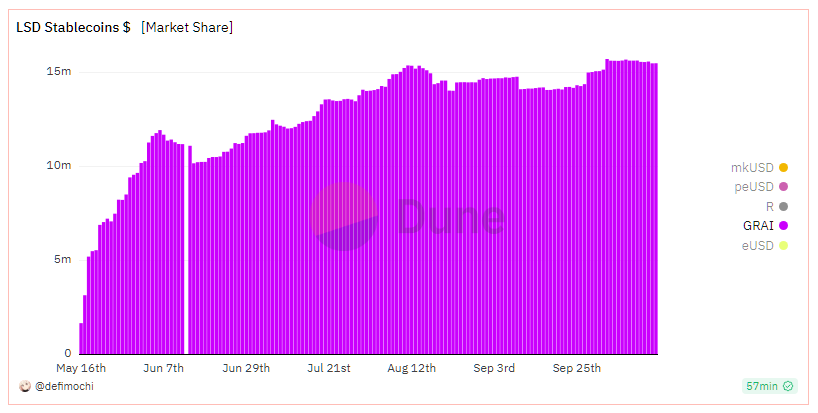

5. Gravita | GRAI

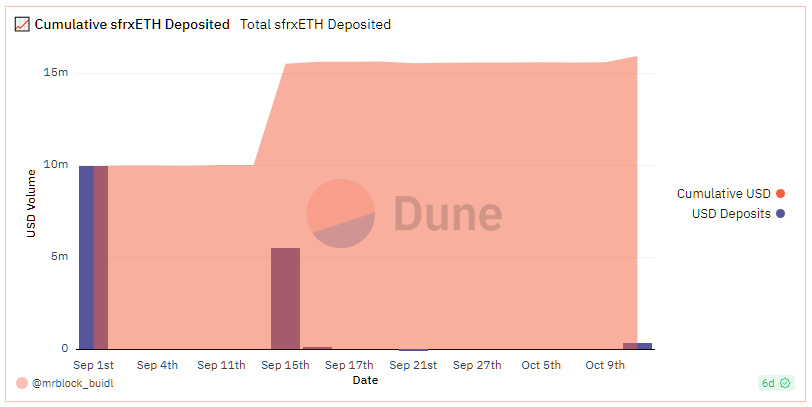

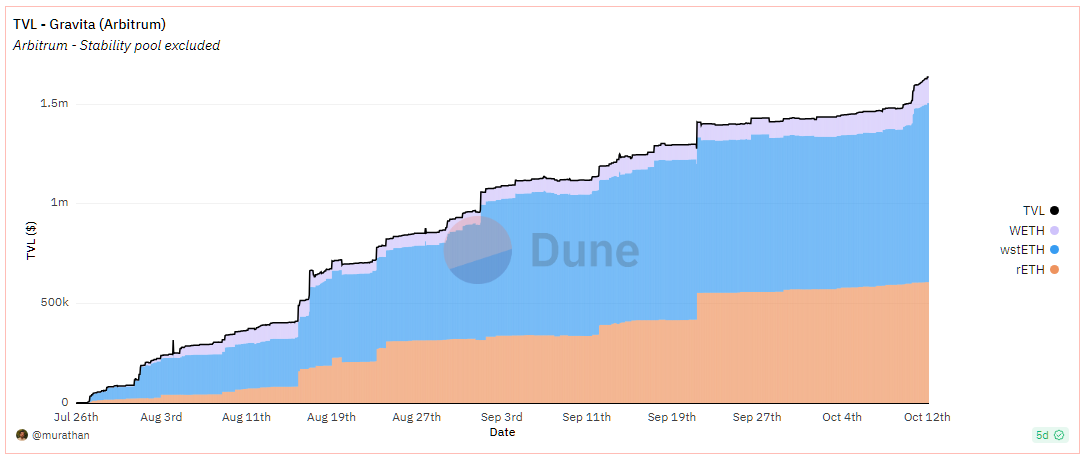

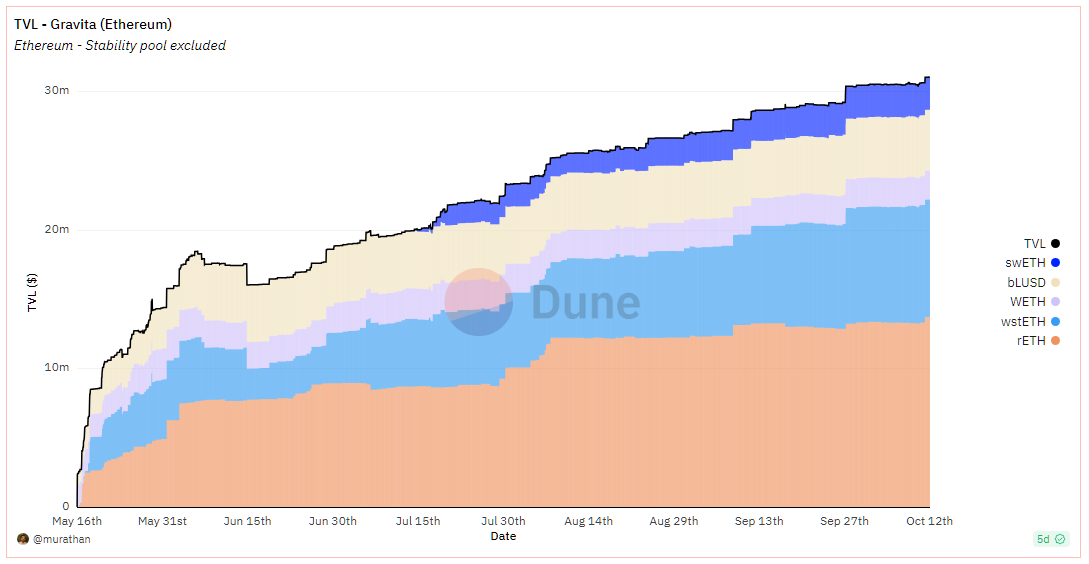

Gravita, the issuer of the GRAI stablecoin, stands out as the closest fork of Liquity, sharing a foundational aspiration to evolve into an immutable and governance-minimized protocol. Now live on several networks, including Ethereum mainnet, Arbitrum, zkSync, Optimism base, and Polygon zkEVM, Gravita accepts a diverse set of collaterals, such as WETH, rETH, wstETH, bLUSD, swETH, and sfrxETH.

TVL: Exhibiting a constant upward trajectory, Gravita recently reached an all-time high with a TVL of 34 million USD. The major contributors to this value are rETH with 13.4 million USD, and wstETH with 7.7 million USD.

Market Capitalization: The GRAI stablecoin has achieved a market capitalization of 15 million USD.

Liquidity: Uniswap hosts 8 million USD in liquidity for Gravita.

Pegged Value: Currently, GRAI is sitting at 0.98 USD.

Redemption and Rates: Gravita implements a 3% fee for redemptions, and the lack of dynamic rates sustains it under its peg.

Yield Opportunities: It provides the highest available yield of 8.38% through GRAI+FRAXBP on Convex.

Interest Rates: Gravita features a 0% interest rate.

Minimum Collateral Requirement: The minimum collateral requirement (Min CR) is defined at 110%, setting a hard ceiling for the peg at 1.1 USD.

Redemptions: Available, entailing a 3% redemption fee, establishing a hard floor for the peg at 0.97 USD.

Honorable Mentions:

- DAI through MakerDAO

- Frax through FraxFinance

- GHO through Aave

- crvUSD through Curve.fi

Note: Ensure to validate the data and references, considering the dynamism and rapid evolution within the DeFi space.

About Impossible Finance

Impossible is an on-chain native, research advisory firm with a DeFi launchpad and accelerator. We help projects kickstart, fundraise, scale and launch their tokens while enabling users to learn, discover and invest in high quality crypto opportunities.