Impossible Finance x Powerloom Partnership

Company Overview

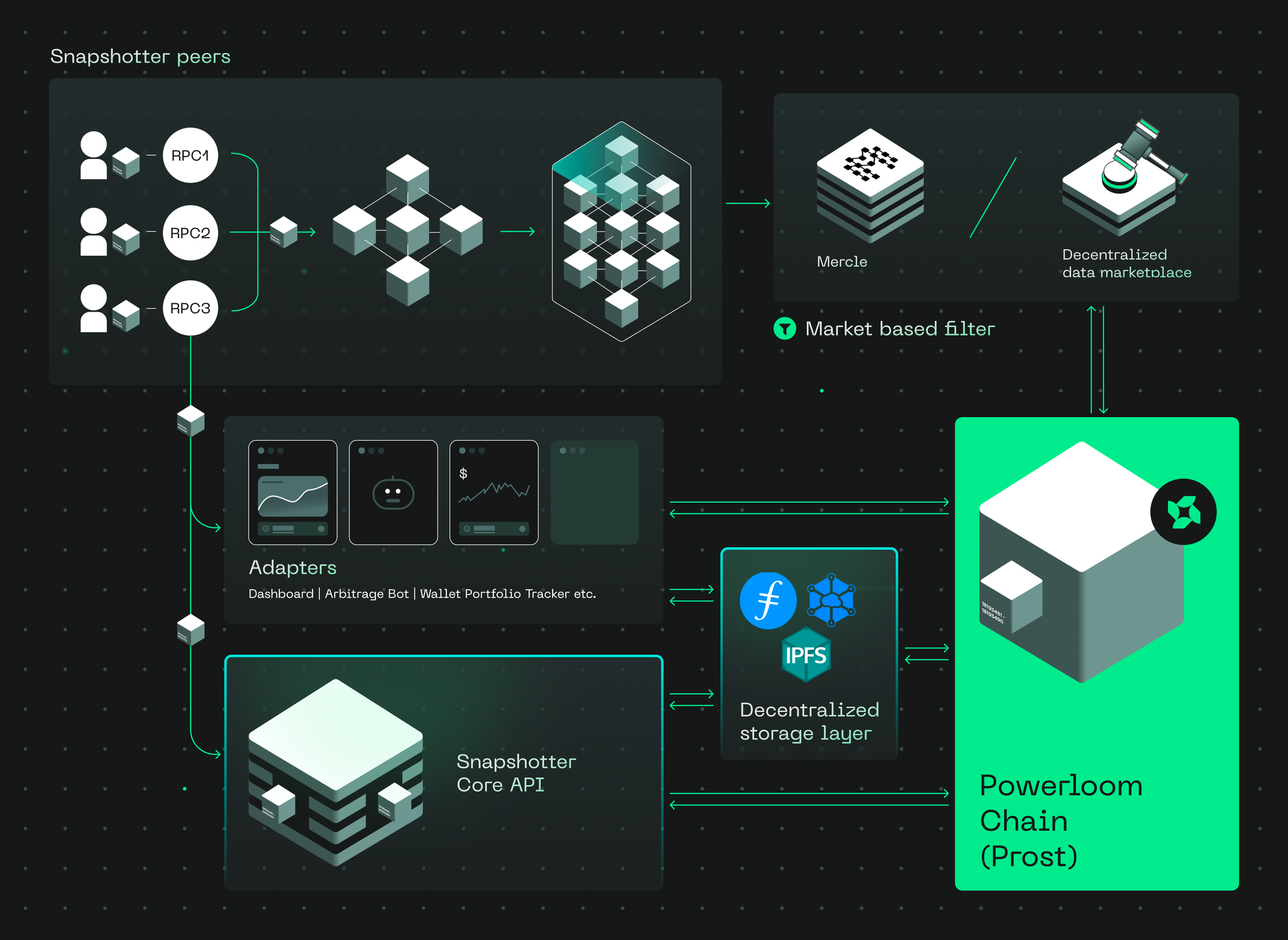

Powerloom protocol is a decentralized data indexing product focused on completely decentralizing data sources for dApps and protocols. Unlike its peers in the market (Graph, Covalent), Powerloom focuses on enabling a network of participating peers to pass through data on state transmissions and event emissions across smart contracts. The primary value proposition for consumers of Powerloom is the distributed approach to sourcing, parsing, and passing on data. It leaves considerably less of an attack vector for third-party party data-sources to interfere with the accuracy of the information provided.

Vision & Mission

The Powerloom Protocol is a decentralized data protocol primarily designed to meet the growing data requirements of smart contract-based applications, including DeFi, games, and other user-centric platforms. It incentivizes participating peers to achieve consensus on state transitions and event emission observations across multiple smart contracts.

By utilizing data compositions on smaller, consensus-reached data units, Powerloom stands as a peer-validated and accurate information source, empowering rich data applications such as dashboards, bots, aggregators, and insights trackers.

💡 Powerloom in a nutshell:

Powerloom is analogous to a decentralized library catalog for blockchain data.

The "snapshotters" are like librarians who continually observe shelves of books (smart contracts), cataloging additions or removals of books, changes in existing books, and notes added by readers in book margins (events).

Highlights

- Decentralised Data: Powerloom allows developers to build applications on top of decentralized, consensus-backed data, enhancing reliability and transparency.

- Real-Time Data: The snapshotter network provides real-time data updates as transactions occur on the blockchain, enabling applications that require live data.

- Time-series Queries: Datasets are available across precise time periods captured in epochs, which can be further filtered and composed to serve specific use cases. This is useful for analytics and tracking trends.

- Flexible Data Models: Developers can contribute to data markets by building their own use cases and contributing to the "data markets" to track what's most valuable for their specific use case, beyond basic transactions.

- Modular and Extensible: Powerloom has a modular architecture that makes it easy for developers to add support for new data sources, transform data, and build on top of existing data pipelines.

Protocol Dynamics

Powerloom offers an infrastructure that can power the data requirements of emergent applications in Web3. It does this function better than its peers through two core tenets. Firstly, through bootstrapping a network of nodes and snapshots that are responsible for sourcing and passing on the data. Secondly, through offering simple-to-use APIs and dashboards that visualize the consensus around the accuracy of blockchain data. A live implementation of the model for sourcing Uniswap’s data can be seen here.

Looking through the lens above, Powerloom is simultaneously a protocol and a service provider targeting developers looking for accurate data feeds. The protocol differentiates itself from more traditional, centralized peers by optimizing the breadth and depth of data points available. Powerloom’s tokens are used by various participants on the network to determine the nature of feeds available on the protocol.

Powerloom currently differs from its peers like Graph and Covalent in many ways. Currently, Covalent focuses on the breadth of chains supported with limited focus on the API endpoints provided for individual chains. This works because their focus is on optimizing the number of chains supported. Conversely, Graph focuses on optimizing the number of subgraphs in the product whilst being restrictive on the supported networks.

Powerloom’s focus is on being in the middle. We will initially launch focusing on EVM-supported chains but rely on the community to expand the API endpoints to keep up with developers' demands. Early on, developers would be incentivized in tokens (instead of having to pay a fee) as a mechanism to onboard them.

Tokenomics

Different stakeholders use Tokens on the network in a mix of functions. The table below helps summarise individual roles, the incentives they receive, and the role tokens play

Token Usage By Participants

Role | Role Description | Required for | Incentivized by |

|---|---|---|---|

Snapshotter | Captures event emissions and stores them to be parsed. | TBD tokens needed to join the network as a snapshotter. | Tokens rewarded in proportion to performance on the network |

Validator | A pre-defined maximum number of validators will be activated on the network. They will be responsible for the security of the network. | Tokens needed to join the network as a validator. Token requirement will be considerably higher than what snapshotters will be required to hold.

250k tokens that are owned, or 500k tokens that are delegated will be needed by validators. | Tokens rewarded on a block by block basis. Initially tokens will come from the protocol’s allocated treasury. Eventually, they could claim a portion of the fee generated via curators. |

Curator | Primarily developers that will be looking for new API endpoints. They will be using the data provided by the network in their apps. | Curators will not be required to have a minimum number of tokens early on in the network | Curators will be rewarded tokens on a case by case basis from the DAO. The token allocation will be contingent on the volume of API calls and nature of applications developed by curators |

Signaller | Analysts that provide insight on emergent data needs for the network. They will be able to raise requests before an industry trend becomes dominant.

E:g : Analysts would have likely spotted the Ordinals trend considerably earlier than a developer building an Ordinals marketplace would have. | Signallers do not have a minimum token requirement to post a request | Signallers will be rewarded tokens on a case by case basis with an emphasis on the quality of their inputs towards the network. |

Traction

Powerloom has been developing since 2021 when it raised a seed round. In 2023, they kick-started community initiatives beyond the developers they have worked with. As a result, they ran several initiatives.

Incentivized Testnet

The network launched the Incentivized Testnet for community members as an initiative to foster community engagement and protocol development. This allows the community members to test and interact with the Powerloom Protocol, contributing to its refinement and helping with onchain data across DeFi transactions. The community's active participation in this testnet aids in the organic growth of the ecosystem, ensuring it's robust and community-driven.

Updates and Announcements

The Powerloom team leverages social platforms like X (fka Twitter), Telegram, Discord, LinkedIn, and our official blog for regular project updates. This includes significant partnership announcements, like the one with Polygon and its integration with zkEVM and others. Discord and Telegram are specifically used to engage with the community. Powerloom has also set up a dedicated FAQ channel on our Discord server, providing a space for community members to access essential information and get answers to pressing questions. For those not active on social platforms, Powerloom has built an active community via email, sending out newsletters that provide recaps of community calls, major updates, and other essential announcements.

Community Calls & Technical Updates

The Powerloom team has conducted 6 community calls. The team engages in these calls to share important updates with the community, bring more transparency to the inner workings of the protocol, and These engagements foster community trust, gather feedback, and clarify Powerloom's direction, goals, and milestones. They play a crucial role in ensuring the community's needs and concerns are addressed.

Technical Community Calls: Through these calls, our core developers have openly showcased our technological advancements, and protocol improvements positioning ourselves as a leader in the space. They also serve as a platform for feedback, ensuring continuous alignment with market needs.

Community Metrics

- Discord: 20,000 members

- X: 21,700 followers

- X impressions: ~ 250k/ month

- Telegram Channel: 5,000 members

- Active Email list: ~24,000 subscribers

Team

Fundraise

The numbers below are indicative and subject to change as they work with stakeholders over the course of bringing the network to fruition. Their plan is to conduct the node mint within Q1 2024 with a tentative plan for the TGE in Q2 2024.

Core Metrics

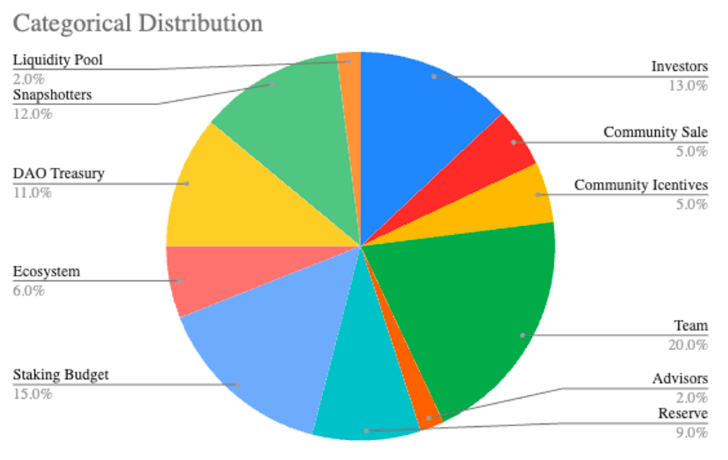

Total Token Supply (TTS): 1B

Fully Diluted Valuation (FDV) at the last round: 30M

The Delaware C Corp entity has raised a total of US$3,245,000 through SAFE(s).

- Pre-seed rounds of $1,142,857 in Q4 2020 by Protocol Labs and Consensys + $50,000 through a SPV in Q4 2020

- Seed round of $3,115,000 with a token warrant at 30M FDV in Q2 2021 led by Blockchain Capital

- A total of 13% of tokens have been allocated

Investors

Other investors

Fenbushi Filecoin Eco Fund, CMS Holdings, Protocol Labs, Divergence, Privcode Capital (MXC), Youbi Capital, Double Peak Group, Altonomy, Inclusion Capital, Longhash, KNS Group and TheLAO.

DeFi founders/angel investors:

Stani (Aave), Ash (ex-Accomplice), JD and Sandeep (Polygon), Danny (Ceramic), Alan and Caleb (Radar/Core Scientific), Sid (DefiDollar), Regan (ex-Coinlist), Aniket (Biconomy), Ajit (Aave), Richard (ex-DRW), Keyur (Polygon) and Nirbhik (TheDappList) who also participated.

The protocol will be governed by Powerloom Foundation, an entity setup in Cayman along with a BVI subsidiary to issue tokens and potential sales.

Vesting Terms

Category | Vesting Terms |

|---|---|

Investors | 12 month cliff, followed by 12 month linear vest |

Community Sale | 10% upfront, 90 day cliff, 90% linear vest over 9 months |

Community Incentives | 20% upfront, 90 day cliff, 80% linear vest over 9 months |

Team | 12 month cliff, followed by 36 month vest |

Advisors | 12 month cliff, followed by 24 month vest |

Reserve | 12 month cliff, followed by 24 month vest |

Staking Budget | 48 month linear vest |

Ecosystem | 3 month cliff, followed bt 45 month linear vest |

DAO | 24 month cliff, followed by 24 month linear vest |

Snapshotters | 48 month linear vest |

Liquidity Pool | 100% upfront |

Distribution

A total of 12% of the network is allocated to be vested to snapshotter rewards over the next four years. Their are currently conducting a node mint with the intent of bootstrapping the initial subset of snapshotters from the community.

Snapshotter Node Mint

In a strong partnership with Polygon, Powerloom is planning the first ever infrastructure NFT mint. The total number of node slots being sold will be limited to 10000 and the goal is to sell out. Individual snapshotters will receive a soul-bound NFT on Polygon POS for participating in our network. The tiers for the node mint will follow a clearing price model. They plan on limiting 10 slots per address. Similar to phase1 of the testnet, they will be announcing a incentivized testnet for these holders which will eventually continue as mainnet rewards. They can join as soon as they mint their slot. However, they must pass KYC and be from unrestricted jurisdictions to claim rewards. Before they open up the mint to public, they are planning a 48 hour pre-mint to whitelisted wallets from:

Powerloom Community: 4000 slots

- 1 slot for each Testnet OG

- 1 slot for each Phase2 participant with at least one onchain task completed

- 1 slot for each KYC verified member

- 10 slots for snapshotters that successfully passed phase1 (max 10 even if they qualify for above)

Partners: 1000 slots to select partners and ecosystem participants

Pre-mint Winners: 5000 slots allocated through a selection process for qualified pre-mint addresses.

Powerloom plans to set up a pre-mint website with Sybil detection to qualify addresses before the mint.

Timeline:

- The announcement will be made on January 24th 2024 - pre-mint goes live immediately

- Pre-mint (whitelist) will start the first week of February on or before 7th February.

- If any slots remain, they open to the public after 48 hours.

Node Mint Tiers

Users that purchase nodes will be given ranked access on Discord and early access to a suite of Powerloom’s offerings in the near future.

Bridges to reach the Polygon ecosystem:

Impossible Finance will receive a unique IF promo code to share with the community to get a 5% discount on each mint.

Pre-mint Criteria

- Minimum 0.1 WETH on Polygon or 0.1 ETH on Ethereum Mainnet on Jan 1st, 2024

- Connect to Powerloom Discord

- Follow Powerloom’s Twitter

- Once they complete all the steps above, you automatically enter the raffle.

Reward Structures

Owners of the SBT would receive tokens for the testnet period prior to TGE. Powerloom Network has allocated 800 tokens for each slot holder for a period of 100 days. A total of 8 million tokens are anticipated to be distributed through this model.

💡 NOTE:

If you have minted more than 10 slots, rewards will be slashed by 10% for the number of slots in excess of 10.

For example, if you have 15 slots, rewards will be slashed by 10% for (15 - 10) = 5 slots that are in excess.

Reward Unlock Schedule for Testnet Participation:

- Initial Unlock at TGE (Token Generation Event): 40% of the maximum rewards will be available at TGE, equating to 320 tokens.

- Linear Unlock Over 60 Days: The remaining 60% of rewards, totaling 480 tokens, will be unlocked linearly over 60 days, amounting to 8 tokens per day. This gradual release ensures ongoing engagement and contribution to the ecosystem.

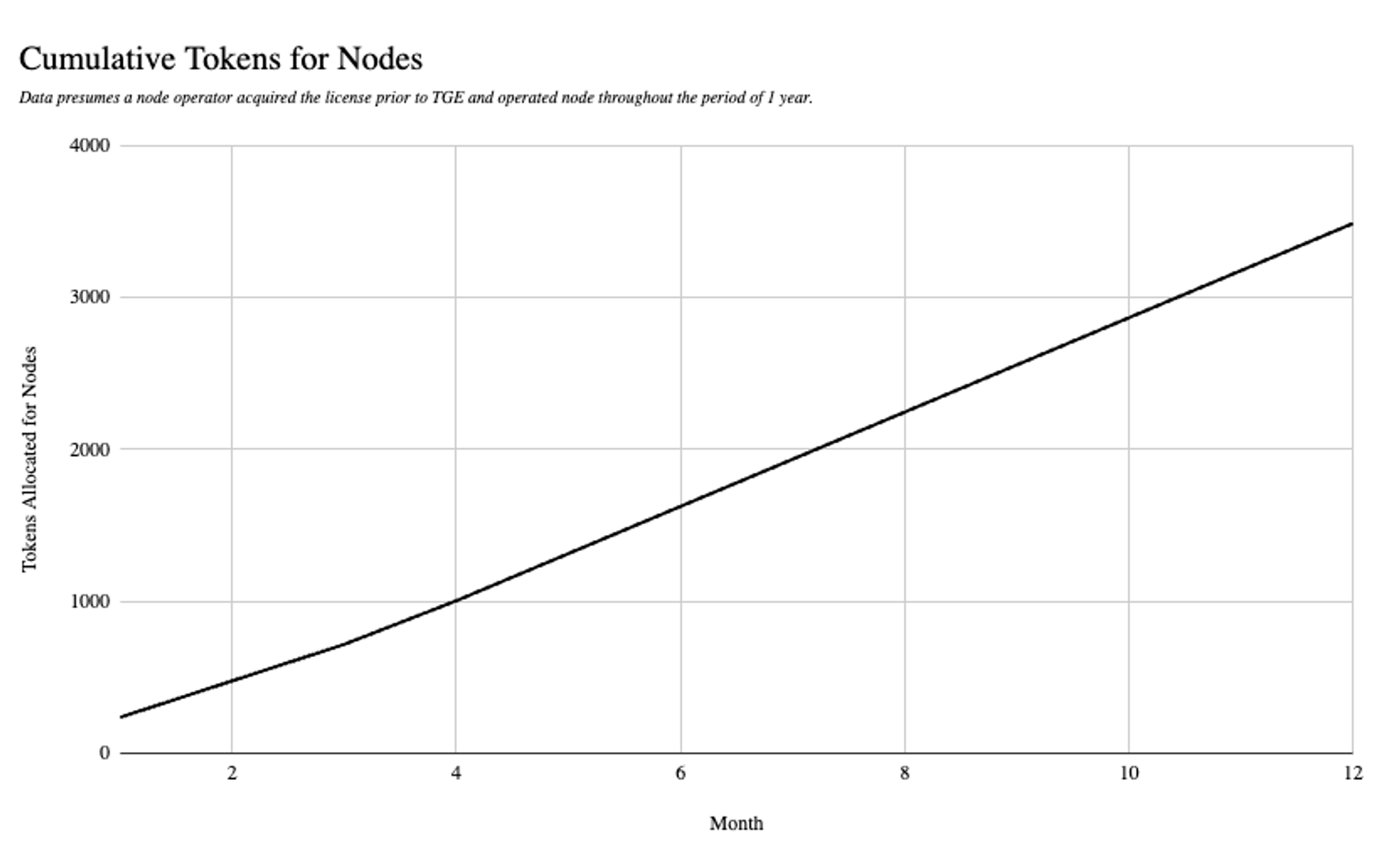

After the TGE, the rewards issued will slightly increase. Slot holders will continue to receive tokens each day for performing the role of snapshotters. Powerloom network anticipates to increase the rewards slightly to 10.33 tokens per day for each slot held.

Over the course of a year, the individual can expect to receive ~3550 tokens for performing the role of a snapshotter. These tokens are to be a subsidy for performing the role of a snapshotter.

The chart below lays out the cumulative tokens an individual slot holder can hypothetically receive over the course of a year. There is a slight curve around month 3 to account for the uptick in number of tokens received per day. As mentioned, node rewards in the future are subject to stricter requirements. Users minting a slot in the future may not receive the same reward structures compared to an individual minting slots today.

Pitch Decks

Other Resources

- Main Website

- Docs

- Linktree [Includes all socials]

- CoinList Incentivized Testnet Page

- Blog

- Protocol Overview

- Powerloom Seed Round Announcement [October 2021]

- Open-sourced repos

- Single step deploys

Disclaimer

Composed and presented by Impossible Finance Research Team

About Impossible Finance

Impossible is an on-chain native, research advisory firm with a DeFi launchpad and accelerator. We help projects kickstart, fundraise, scale and launch their tokens while enabling users to learn, discover and invest in high quality crypto opportunities.

Website | Twitter | Discord | Telegram | Blog

Terms & Conditions

- Notes: DISCLAIMERS, TERMS, and RISKS

- Risk Warning: Trading and/or generally investing in any cryptocurrency involve significant risks and can result in the complete loss of your capital. You should not invest more than you can afford to lose and you should ensure that you fully understand the risks involved. Before investing, please consider your level of experience, objectives, and risk tolerance, and seek independent financial and legal advice if necessary. It is your responsibility to ascertain whether you are permitted to use the services of Impossible Finance based on the legal and regulatory requirements of your country of residence and/or applicable jurisdiction(s).

- The information provided on this memo does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such. Impossible Finance does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.