Testing 13 Web3 Growth Platforms: How to Cold Start a Project with Zero Cost to 10k Users

Originally Written by: awesomesunny.eth Translated by ChatGPT + Impossible Finance Team Original Link: https://www.techflowpost.com/article/detail_10956.html

TL;DR

Background

As someone responsible for growth in a Web3 project, a common question I hear is how to cold start a project, simply put, how to go to market (GTM), let more people know about the project, and take it to the market.

Compared with Web2, there is currently no systematic GTM methodology for Web3; we’re still in a stage of relative blind growth. The ways of managing community user expectations through Token and NFT also differ from the growth hacking methods of Web2, which has rendered many Web2 market play methods ineffective, and even incompatible, with Web3.

However, the logic and process of the two are similar, both need to attract customers, activate, retain and recommend. Among them, customer acquisition in Web3 has many common play methods, such as AMA, Giveaway, Collab, etc.

Therefore, based on these common scenarios, making good use of native Web3 growth platforms can greatly improve the efficiency of early customer acquisition and reduce acquisition costs. Good community operations can also retain loyal seed users relatively accurately. It's a word: Absolute!

AARRR model

With the increase of various Web3 projects (in a bear market, it feels like there are more project parties than users), the Web3 Growth track has emerged with many products, gradually refining into vertical fields. From user acquisition, community management, information reminders, reward distribution, data analysis and so on, there are many DApps that can be used [see below for details].

Source: Twitter@Safaryclub

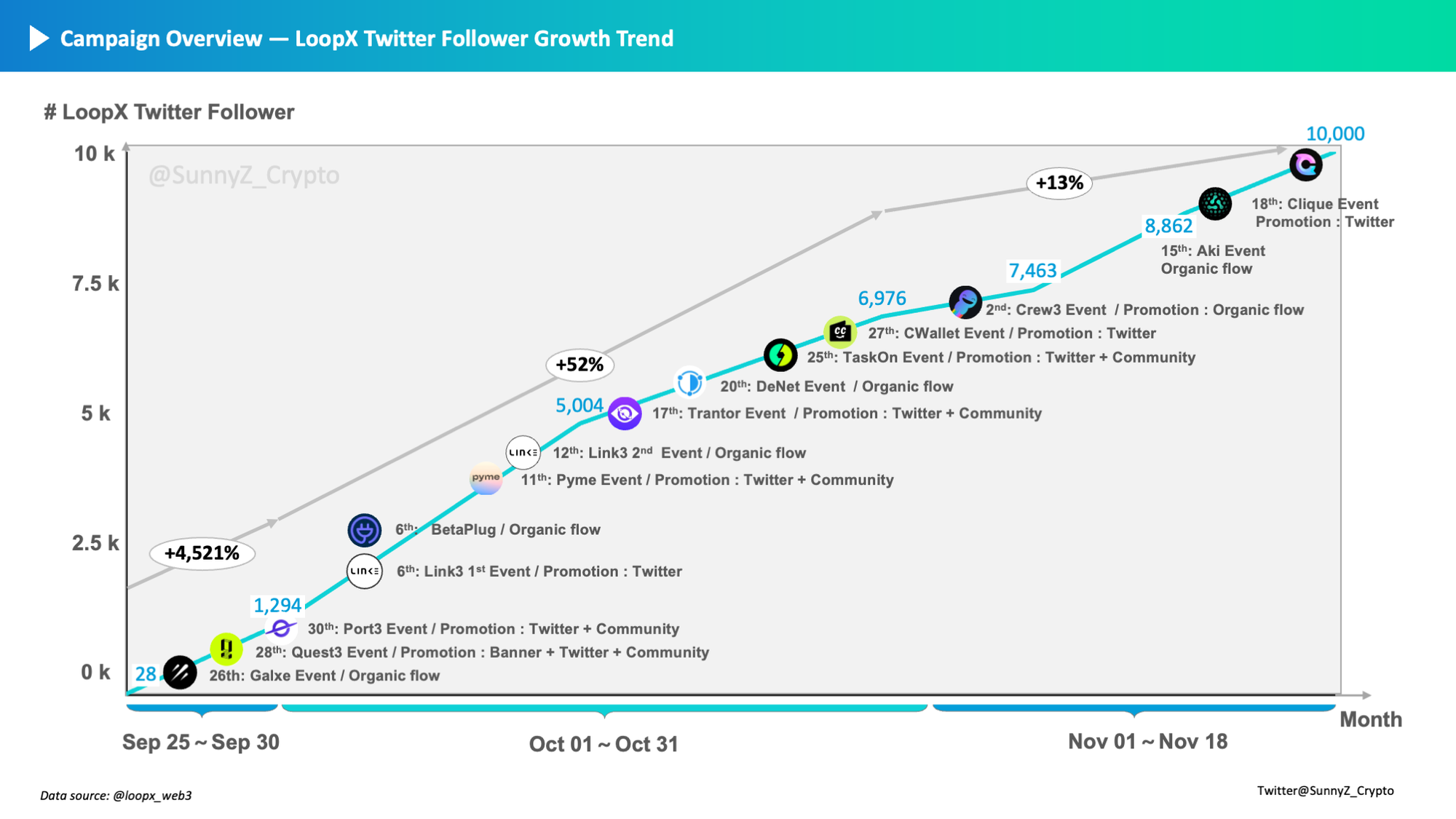

The most relevant to project cold start is user acquisition. Recently, my LoopX project is experiencing this cold start process, so I have reviewed how I used native Web3 growth methods to increase the project from 0 to 10k fans. I also hope to provide some inspiration and help for other project parties doing marketing.

Growth Path

In the past month and a half, I used 13 platforms in depth in the order shown in the figure below, launched multiple activities and recorded the data of Twitter fan growth. The overall trend is a steady rise in stages. The growth was rapid in September and October when there were many activities. In November, due to my laid-back nature, there were basically no tasks, so the growth rate slowed down a bit with collaborations and giveaways as the main focus.

In the actual operation process, if you are not sure how to arrange the order of cooperation on each platform, you can refer directly to the following figure.

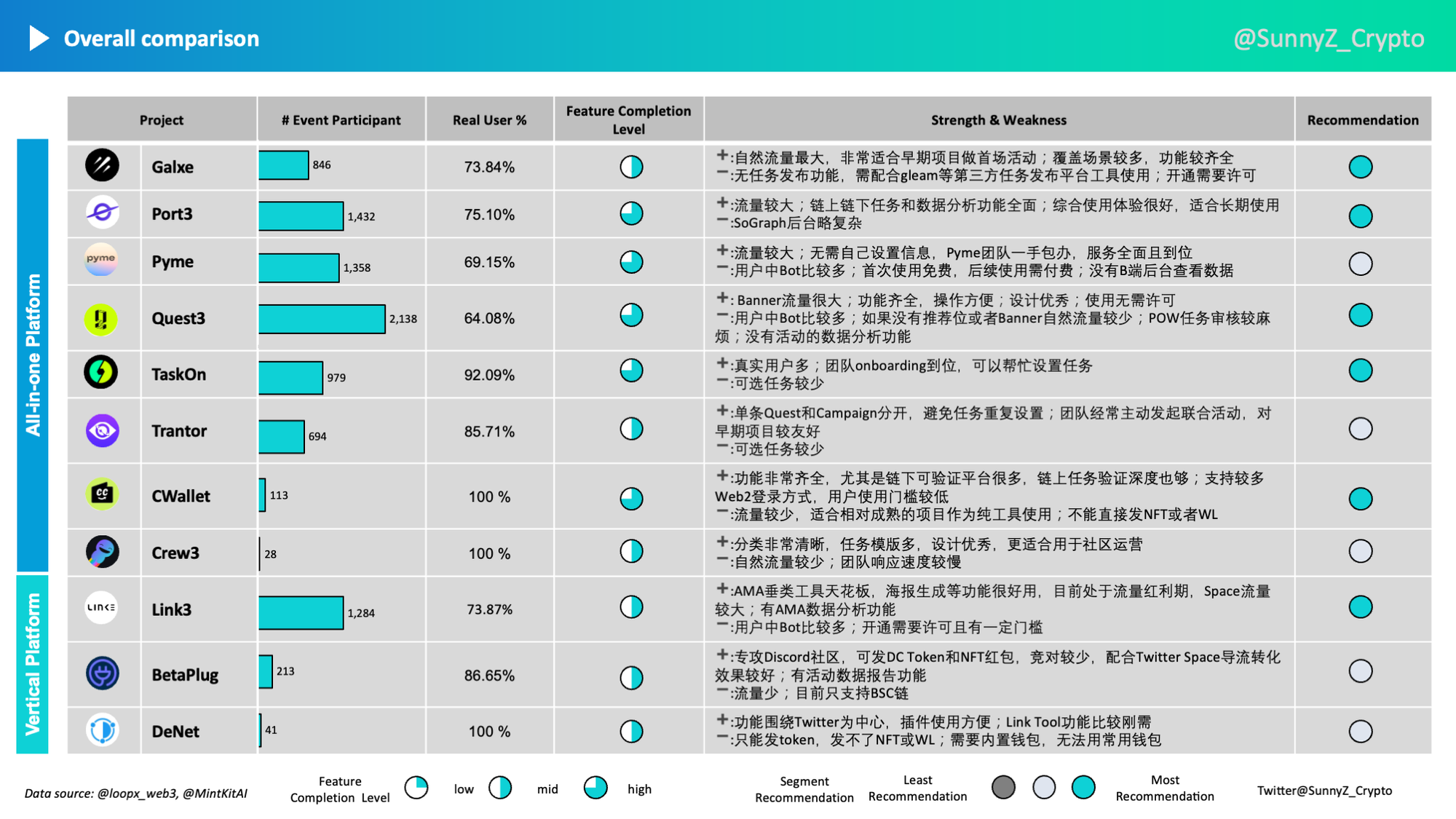

Although these 13 projects have different directions, their features have high similarity, especially the All-in-one platforms. The gap is not large, and it is clearly seen that each is following a trend, mainly competing on product iterations and business development speed. It is indeed a fiercely competitive space.

In order to better use each platform, understand their strengths and weaknesses, and optimize the details of the activities, I analyzed the data of these 13 platforms according to the actual operation results (the activities of Aki and Clique have not ended yet, the data will be updated after they end). Among all the factors, I focused on comparing the two major modules of functionality and traffic, which correspond to the two core pain points of solving needs and providing value (driving traffic). The following is the introduction and comparison information of each platform:

(Disclaimer: Not an advertisement or soft article for any platform, nor related to any interest)

Web3 Growth Tools Practical Summary

Introduction of Platforms

There is a wealth of information and articles about these projects. Here is a brief introduction with a compilation of links for your own review.

In addition to the above platforms, Layer3, Dappback, and other projects are also good, but they charge for activities, so they are not included in this review. After all, I use free tools to prioritize guerrilla marketing.

Looking at the logic of platform growth, Web3 at this stage should not charge to better expand the B-end market. The cost of user migration is low, the interchangeability between products is strong, and whoever offers a cheap, big bowl and is easy to use will be preferred. This can also be considered healthy industry competition.

Test Logic

Before presenting the data, let's clarify the logic. The method mainly involves controlling variables + multiple tests to ensure data comparability and relative accuracy.

- Task setup: Task setup is similar across platforms, all involving social media follow and filling out a product feedback Google form (of course, some platforms don't support form filling and only have social media tasks). The form content is consistent across platforms but the links differ.

- Screening method: Real users are manually filtered out according to the responses in the Google form backend and then rewards are issued.

- Data analysis: Data is analyzed based on user wallet addresses at mintkit.ai. Users are classified into Bot (robot), General (ordinary user), Diamond Hand, Blue Chip, and Whale (big fish) categories based on NFT holdings and types, wallet balance, wallet association degree, etc.

- Multiple tests: If conditions permit, different features of the same platform will be tested more than once, such as Galxe, Link3, Quest3, DeNet, and others.

- Detailed scenarios: For example, for AMA, the same Space is used to test multiple platform data, GA likewise.

(Note 1: All data in this article comes from real growth data of @loopx_web3 project. Single test data may contain certain errors. Actual operation shall prevail)

(Note 2: For easy identification, this article uses some abbreviations for platforms and common terms: TW for Twitter, DC for Discord, TG for Telegram, TS for TwitterScan, WL for Whitelist, GA for giveaway, Txn for Transaction)

Traffic Comparison

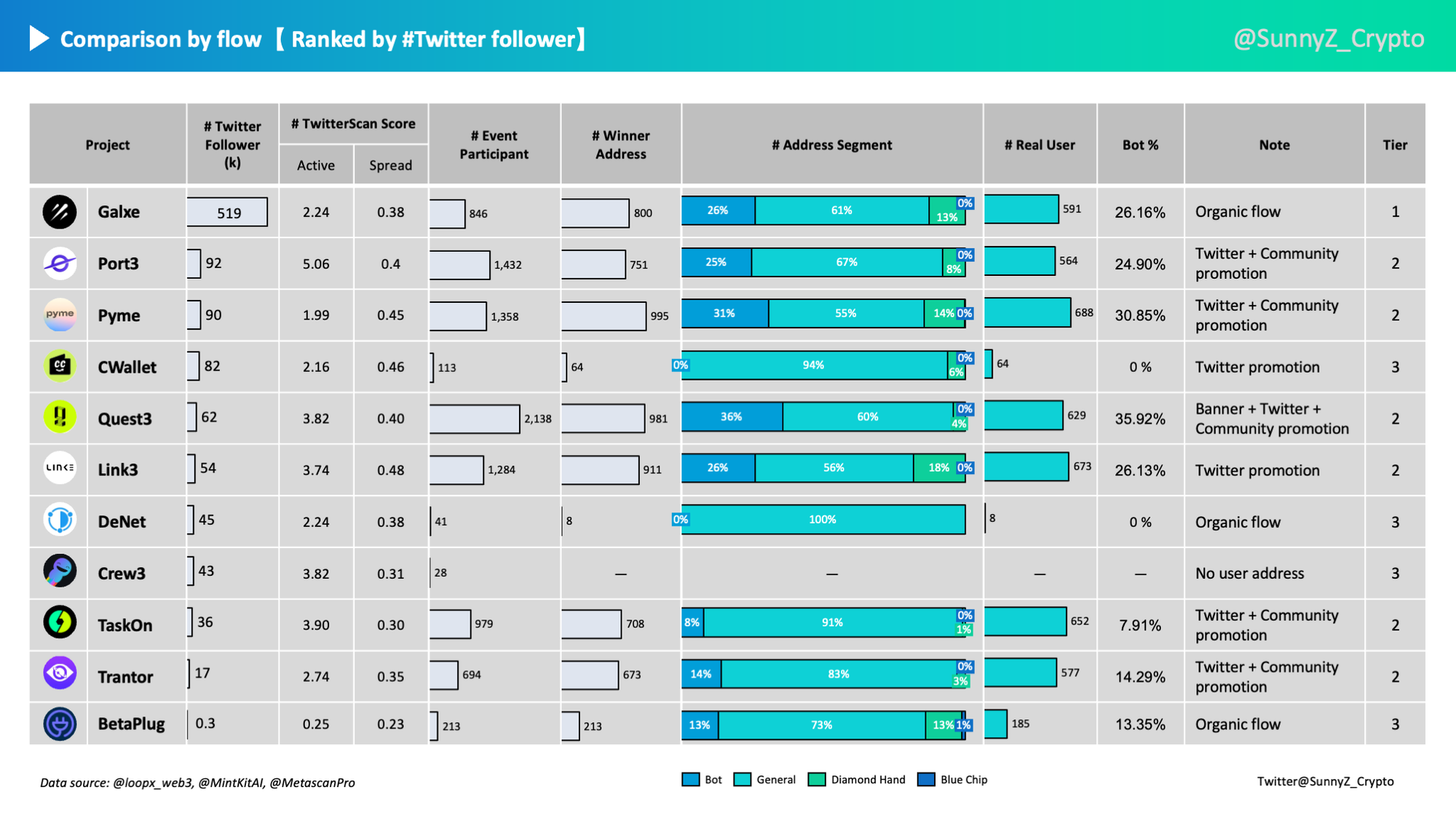

- The traffic of each platform varies significantly, roughly divided into three echelons. Galxe is in its own category, as Galxe's natural traffic can match the second tier platforms, namely Port3, Pyme, Quest3, Link3, TaskOn, and Trantor, among which Quest3 Banner has a clear traffic advantage.

- In terms of TS's activity and spread indicators, Port3, Quest3, Link3, Crew3, TaskOn have very active TW operations, so the corresponding event spread is also wide (speaking of which, why are so many projects called xx3👀?). Galxe has been issuing coins for a long time and seems a bit complacent. Given its thick old bottom, even if the activity level is not high, the spread is not too affected.

- Platforms with high traffic also have more Bots, almost all platforms have 15~30% Bots, among which Quest3 is 36%, almost half are Bots, it seems that DID projects still have a long way to go. Among these platforms, Port3 and Clique support the issuing of rewards after filtering by various data conditions. It's worth mentioning that Clique's data monitoring is most in place, which can largely avoid a large number of Bots holding rewards.

- What surprised me was Trantor, which doesn't have many TW followers, but has many activity participants and decent user data performance. In subsequent communication, I found that Trantor often initiates joint marketing activities of multiple projects, which is of great help in enhancing the stickiness of B-end users.

- Crew3 was affected by domain name issues, so this data is not very referential. Web3 projects are still fragile, and problems with domain names and accounts can be quite damaging to project development.

User Overlap Comparison

- There is a high degree of overlap between all platforms and Galxe users, which on one hand indicates that "wool party" members don't have a clear platform preference and cross-platform wool gathering is the norm. On the other hand, it also shows that Galxe has a large user base and a clear first-mover advantage in the market.

- There is a high degree of overlap between Port3, Link3, and Galxe users. This may be because the previous version of Port3 did not support direct reward distribution and required cooperation with Galxe, so these users come from Galxe. Galxe is also the earliest platform to launch the AMA badge function among all, and Link3 mainly targets the AMA vertical market, so it's normal for these two to have a high overlap of user sources.

- Pyme and Trantor also have a high overlap of users. Pyme has a distinct advantage in the Indian and Southeast Asian markets. Trantor, incubated by StarryNift, indirectly shows that users converted from GamFi are mainly distributed in these markets.

- Among all platforms, TaskOn's data is quite unique, whether it's the number of bots or the degree of overlap. TaskOn has a deep collaboration with OntoWallet, and many of its users come from the DeFi track, indicating that DeFi users and NFT Badge collectors are likely not the same group.

Function Comparison

It's impossible for project teams to exhaustively compare all functions horizontally, so this comparison mainly focuses on the needs and frequently used functions of project teams, and divides them into on-chain tasks, off-chain tasks, reward distribution, data analysis, and scenario coverage. Here, gray indicates the function is present, green indicates this function is superior to other platforms.

Vertical platforms and All-in-one platforms do not compare functions on the same dimension, so they have been broken down by platform type. It would be more reasonable to view them separately.

- The functional differences between platforms are not large, and the overall situation is mainly off-chain verification, supplemented by on-chain verification and coverage of multiple scenarios. This validates the aforementioned DApp function volume and the strong interchangeability of each;

- Data analysis function is very important, but not many projects have this function, only Port3, Link3, BetaPlug, and Clique. After all, data analysis needs to be integrated with data monitoring. For platforms, this is not a cost-effective function, especially retention data. If it really needs to be displayed, the requirements are quite high. This also indirectly shows that Web3 growth has not yet reached the data-driven stage;

- Function completeness and traffic do not necessarily have a direct correlation. This is related to the marketing strategy of each project, and whether or not to implement To B to achieve To C differs. For example, pure tool platforms like CWallet, Genki, and of course Gleam, are only growing To B and not To C. Simply put, they will not directly lead to backflow to their own platform. This also determines that these platforms do not have launchpad attributes, making them unsuitable for early-stage projects to use for cold starts;

- The specific differences in product form mainly come from the different long-term missions of each platform. For example, Galxe wants to develop an on-chain voucher system, so it only does a detailed segmentation in badge issuance. The early process can be completed in conjunction with Gleam, which gives Galxe strong scalability, but it's rather mundane in task publishing. For example, Crew3 wants to be Web3 Discord, so it has many community activity templates, like daily check-ins, content creation, invitation tasks, etc., which are more focused than other platforms;

- All-in-one platform functions are comprehensive, but the depth of verification in segmented scenarios is insufficient and the functions are not perfect, so products in many segmented fields have been derived based on GA, AMA and other high-frequency scenarios. Simply put, the market for online earning is vast, and there are many opportunities, so just get to work.

Here are screenshots of the background of each project team. Everyone can directly feel the differences and details of each function ⬇️

Combining the function and traffic indicators, the approximate distribution of the above-mentioned projects is as follows:

(Please note, there may be some inaccuracies in the data of a single evaluation, actual operations should be taken as accurate)

We can see that there is no clear market leader in this field, and new products are constantly emerging, which is a very good market signal. Each DApp can find its own position and there is a huge space for development.

Other Factors Comparison

In addition to the two indicators, in the process of using products and liaising with teams, the following projects are doing well in aspects such as design, development, BD (not in order). Among them, the design of Quest3, the iteration of Link3, and the BD of Clique are top-notch 🆙

- BD responsive: Clique, Port3, DeNet, Pyme, TaskOn, CWallet

- Excellent product design: Quest3, Link3, Crew3, Aki Network

- Fast function iteration: Link3, Quest3, Beta Plug, Clique

Many times, the difference in BD response determines the speed of project cooperation. These soft indicators often truly determine the future direction of a project, especially for DApp class products, because product requirements are common, and the breadth and depth of information obtained by front-line market personnel, as well as the speed of feedback to the product, directly affect the development and iteration of the product. Therefore, when choosing to use a product long-term, it would be wise to look at the project's TW activity and iteration speed.

Usage Suggestions

- In the absence of deep cooperation with other platforms, it is recommended to use Galxe for the first event. It has natural traffic and a large user base, which can quickly acquire early users;

- Try to reach co-PR and community promotion cooperation with the project party. If you can get the Banner or other recommended positions, be sure to strive for it. The Banner of Quest3 is quite good, and the Banner of Galxe can be used when the growth has reached a certain stage, and the product has a major version launch;

- Don't just stick to one platform for wool gathering, use them in a distributed way. After using a single platform multiple times, there will be no new users, which is no different from holding activities only in your own community. In the long run, 2-3 All-in-one platforms are appropriate, and for vertical platforms, it's advisable to break down by scenario, with 1-2 per scenario being suitable;

- More mature project teams can conduct more activation and retention activities. At present, not many project parties have these activity methods that I've seen. Port3, Trantor, Crew3, and BetaPlug are okay, but others haven't been discovered yet. If there are fun platforms, recommendations are welcome~

Collaboration Contact

After confirmation with the project teams, the following contact information can be used for direct communication and cooperation. If you have any questions, it is recommended to directly connect with the respective team.

Original Content by:

A Web3 BUIDLer, welcome to exchange ideas

- Twitter / Telegram:@SunnyZ_Crypto

- Link3 ⬇️

Finally, a big thank you to Grace from TwitterScan and Messy from Minkit for their help, and to the project teams for patiently answering my many questions during the communication process. I sincerely hope that your projects will continue to improve and WAGMI!