Token Launch Models and Go-To-Market Strategies: A Plunge into TGE's Complexities

Intro

The evolving complexity of onchain liquidity has made launching a successful token more challenging than ever. With the rise of concentrated liquidity models, the introduction of intent-based trading, the fresh launch of Uni V4, and increasing competition for user attention, projects must adopt innovative Token Generation Event (TGE) formulas and liquidity provisioning strategies to optimize price discovery, reduce market manipulation, and ensure long-term sustainability.

This research will seek to explore the options available to teams looking for the governance token launch solution best suited to their needs and available resources.

Questions to be answered

The launch strategy of a token bears a lot of weight and must be evaluated carefully (selecting the right liquidity venues, managing wisely Protocol Owned Liquidity, and countering threats like MEV operations and toxic order flow) because it can undermine the future of the protocol itself.

Before TGE, each project has to answer the following questions:

1. On the premise that the business and tokenomic model of the project has already been established and the deployment blockchain has already been chosen, which model best fits the project based on available financial resources and networking contacts?

Quote asset acquisition (USDC/ETH/BTC). Any investment rounds, OTC sales, and MMs agreements grant a greater margin of error to projects because they have liquidity from day 1 but much of the community-driven protocols do not share these benefits and are therefore assumed to own only the quote asset, i.e., their governance token. The approaches offered by the crypto world are many, but each brings with it strengths and weaknesses that are worth knowing about:

Pre sale / IDO → fundraising method where a new token is launched on a Dex, allowing investors to buy it directly from a liquidity pool. Unlike ICOs, which involve direct sales by projects, or IEOs, that are facilitated by Cexs, IDOs leverage decentralized AMMs like Uniswap, PancakeSwap, Aerodrome or Balancer.

ICO → another fundraising paradigm used by crypto projects to raise capital by issuing and selling directly their tokens directly to investors. It is similar to an Initial Public Offering (IPO) in TradFi but is typically less regulated and accessible to a global audience.

Liquidity Bootstrapping Pool → A LBP is a dynamic price discovery mechanism used for launching tokens in a fair and efficient way. It leverages Balancer’s smart pool technology to allow projects to gradually decrease the token price over time instead of relying on fixed-price sales (like traditional IDOs). LBPs are widely used in DeFi token launches to prevent whale dominance, bot front-running, and excessive volatility at launch. They are an alternative to traditional liquidity pools where the price is determined by immediate demand.

Directly through a spot dex → It is the solution chosen primarily by projects that cannot leverage a wide network of contacts in the Web3 world or that feel they can better manage the TGE phase on their own. More on that right after.

2. What is the best spot dex model to deploy initial liquidity on?

A close look at each paradigm

Deciding on the most suitable spot dex infrastructure is perhaps the most difficult because it requires a high level of know-how about the different exchange curves to understand the different implications associated with each. Let 's then try to summarize briefly the specific features of each model and check its suitability for TGE.

- Constant Product —> The Constant Product Market Maker (CPMM) model, popularized by Uniswap V2, is one of the most widely used AMM designs for DEXs. It follows the fundamental x * y = k formula, where liquidity is evenly distributed across all price levels, ensuring continuous trading availability regardless of market conditions.

✅ Pros:

- Simple & Easy to Deploy. CPMM pools are straightforward to set up and widely supported by existing DEX platforms (e.g., Uniswap V2, SushiSwap, PancakeSwap).

- Very Wide Bonding Curve. Liquidity remains available across all price levels, ensuring that traders can always buy and sell, even in low-volume conditions.

- Passive Liquidity Provision. LPs can add funds without actively managing their position, making it a suitable option for projects seeking a low-maintenance liquidity solution.

❌ Cons:

- Capital Inefficiency. Liquidity is spread too thinly across the entire price range, meaning only a fraction of deposited assets are used at any given time. This results in higher slippage for traders and less effective liquidity deployment.

- Vulnerable to MEV & Impermanent Loss. Since liquidity is always available, arbitrage bots extract value constantly, offloading the costs of this toxic flow onto LPers (in addition to IL).

- No Price Discovery Mechanisms. The deterministic nature of the bonding curve means that the market does not naturally establish the "fair" token price—price setting is entirely based on supply and demand within the pool. This can lead to inefficiencies at launch if the initial liquidity ratio is not well-calibrated (or if not available at all).

Suitability for TGE:

👍 Best for: Simple, low-maintenance liquidity provisioning, especially for long-tail assets

👎 Not ideal for: High-value TGE launches, as it lacks price discovery mechanisms and cannot optimize capital efficiency. Better alternatives exist for projects looking to bootstrap liquidity dynamically

b) Concentrated Liquidity —> A major evolution from CPMM, the Concentrated Liquidity Model introduced by Uniswap V3 allows LPers to allocate capital within specific price ranges, significantly improving capital efficiency while offering deeper liquidity around active trading prices.

✅ Pros:

- Capital Efficiency. LPs provide liquidity only in a chosen price range, concentrating capital where trades are most likely to occur.

- Lower Slippage for Traders. Since liquidity is tighter within the chosen price bands, large trades can execute with less price impact, leading to better quote prices (and thus a better UX).

- Customizable Liquidity Strategies. LPers can choose to act as passive LPs (wide ranges) or active market makers (tight ranges), making it a flexible solution for different market conditions.

❌ Cons:

- Requires Active Liquidity Management. If the price moves outside of an LP’s selected range, their liquidity becomes inactive and stops earning fees, requiring manual rebalancing.

- More Complex to Set Up. Unlike CPMM, which is fully passive and automated, concentrated liquidity demands a deeper understanding of price movements, making initial deployment more challenging.

- Sensitivity to IL. The liquidity concentration within a price range makes the position much more sensitive to IL.

- Vulnerable to MEV (Without Protection Mechanisms). Uniswap V3 is one of the solutions most exposed to MEV risk because its design introduces new forms of value extraction (such as JIT) and also features very deep liquidity distributed among chains.

Suitability for TGE:

👍 Best for: High-value token launches, where capital efficiency and deep liquidity are critical. Works well for projects launching on Uniswap V3/V4 (or equivalent solutions) and willing to actively manage liquidity ranges.

👎 Not ideal for: Projects that prefer passive liquidity provision, as inactive liquidity can lead to price instability if not actively adjusted.

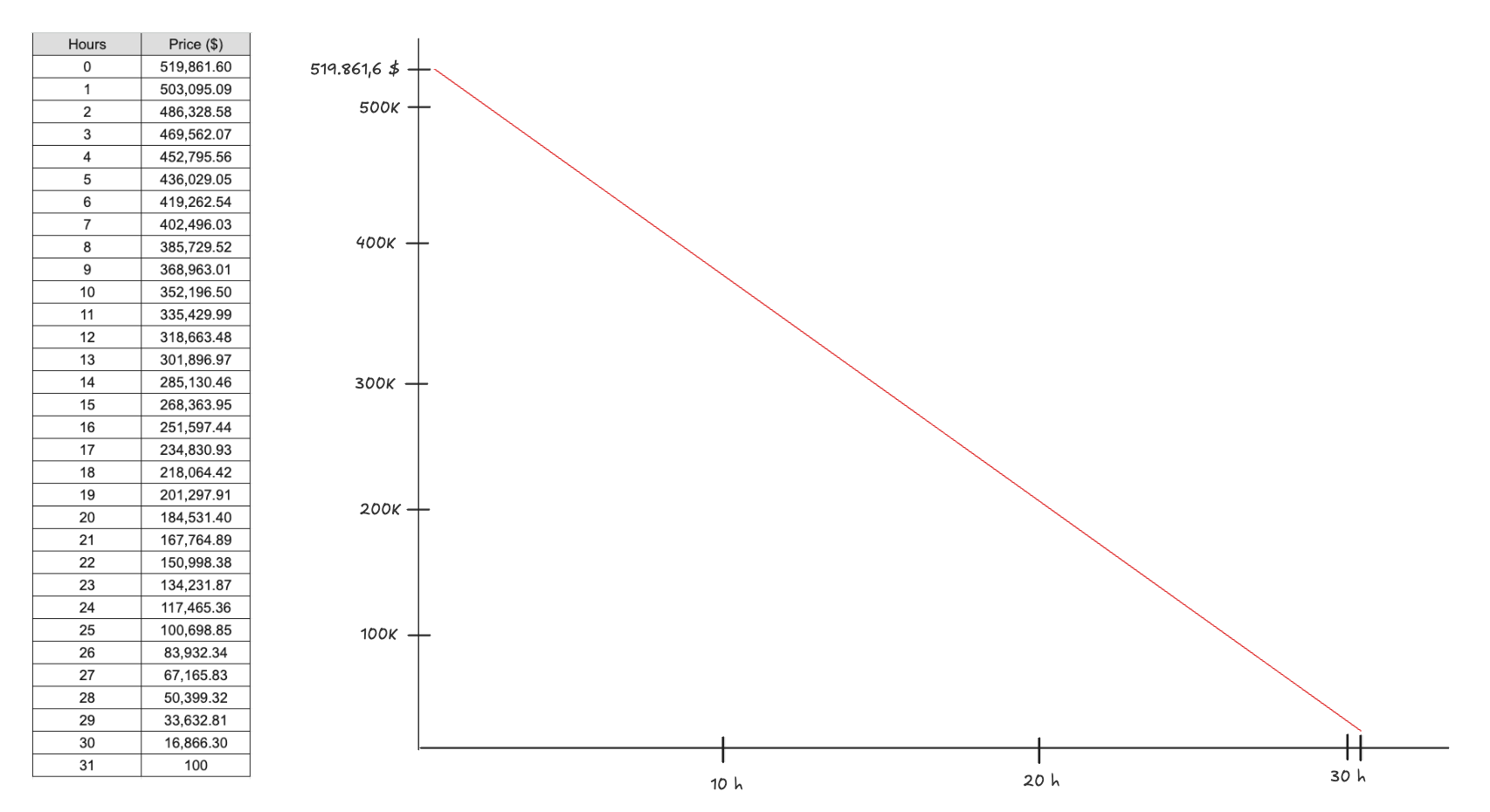

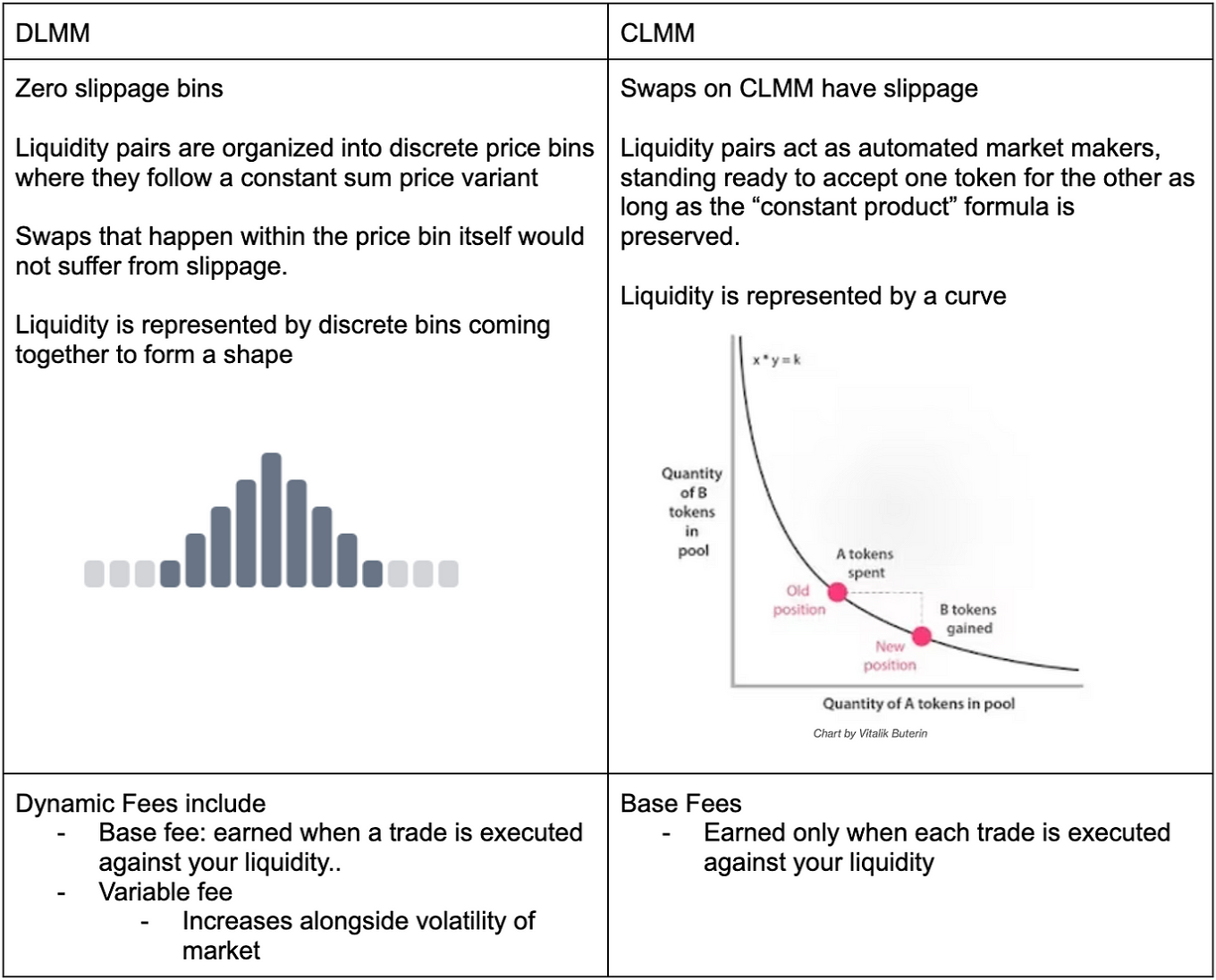

c) Hyperliquid model (AMM + CLOB) —> The operating logic of the TGE on Hyperliquid under HIP-1 (Native Token Standard) involves several key components, including initial liquidity provision, trading mechanisms, listing costs, and Hyperliquidity strategies, that must be well understood in order to best evaluate this launch solution. Listing a token on Hyperliquid involves a Dutch auction mechanism to determine the gas fee for deployment. The process begins with an initial high price, which gradually decreases over a 31-hour auction period until a bid is placed.

The lowest possible cost is 10,000 USDC, but in practice, the final listing price depends on market demand. If the previous auction was successful, the next auction starts at double the last winning bid. As the number of projects listed has risen significantly, the real listing costs are actually much higher and now exceed US $300K, making them comparable to the fees of major centralized exchanges.

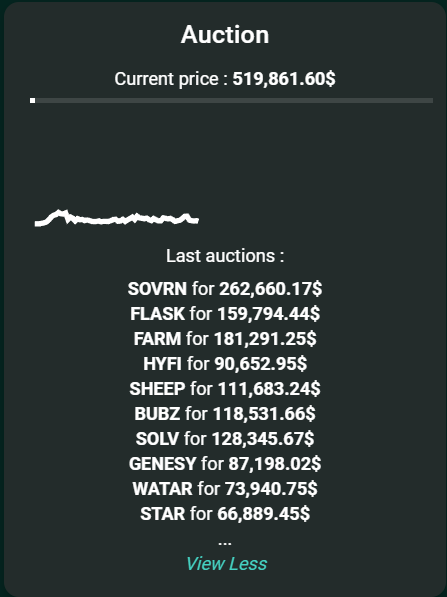

The second aspect to understand well is Hyperliquidity, the Hyperliquid’s innovative liquidity provisioning system designed to ensure deep and efficient markets for newly launched HIP-1 tokens. Unlike traditional MMs or AMM models (AMMs), Hyperliquidity operates inside an on-chain order book while being fully decentralized and automated. It acts as a built-in market maker that continuously adjusts liquidity without requiring manual intervention, ensuring that spreads remain tight and price discovery remains efficient.

When a project launches a new HIP-1 token, Hyperliquidity plays a key role in establishing an initial market. The deployer has the option to set parameters such as the starting price, the number of price levels in the order book, and the size of each order. A particularly important setting is the number of seeded levels, which determines how many buy-side orders are placed at launch. If the deployer funds these levels with USDC, it creates immediate buy support, allowing for more balanced trading conditions. If no USDC is provided, the order book starts with only sell-side liquidity, meaning prices will be entirely dictated by organic demand.

The system functions through a recursive price ladder, where orders are placed at predictable intervals. Prices follow a structured increase of 0.3% per level, creating a stable range of liquidity that adjusts every three seconds. Unlike AMMs, where liquidity provision is passive and based on a fixed formula, Hyperliquidity dynamically shifts orders as trades are executed. When a bid or ask is filled, the system automatically places new orders on the opposite side to maintain market balance. This mechanism prevents extreme volatility while ensuring that liquidity is always available, a critical feature for new token markets.

✅ Pros: it eliminates IL, which has long been a challenge for LPers in DeFi. Since it operates within an order book rather than a liquidity pool, there is no risk of value deterioration due to price fluctuations. Moreover, by actively placing and adjusting limit orders, Hyperliquidity ensures that trading occurs with minimal slippage, unlike AMMs that rely on liquidity curves and can suffer from large price movements when significant trades occur. No requirement to provide upfront liquidity (Hyperliquidity enables gradual liquidity bootstrapping, allowing the market to develop organically while maintaining a structured and predictable trading environment. The automated nature of the system ensures that liquidity remains active at all times without needing human intervention, reducing the reliance on third-party MMs).

❌ Cons: High Listing Costs and Uncertainty in the Dutch Auction (Since the final price fluctuates based on demand, projects cannot predict their exact listing cost in advance, making it difficult to budget effectively. If the auction fails (i.e., no bids are placed), the project has to restart the process, potentially delaying its launch), No Guaranteed Liquidity Without External Funding (Hyperliquid’s order book model does not automatically provide liquidity, unlike AMMs, where liquidity pools ensure that every trade has a counterparty. Instead, the project must seed USDC liquidity if it wants to create an initial buy-side order book. If no USDC is provided, the token launches with only sell-side liquidity, which means that price discovery could be entirely dictated by organic demand, potentially leading to extreme volatility or even a complete lack of trading activity), Trading Fees Are Burned Instead of Accruing to the Project (another downside is that all trading fees collected in non-USDC HIP-1 tokens are burned. Unlike some exchanges that return a portion of trading fees to the protocol or liquidity providers, Hyperliquid does not allow projects to earn revenue from trading activity on their own token).

Suitability for TGE:

👍 Best for: projects priritizing efficient price discovery, fair and decentralized liquidity provision, and a fully on-chain trading environment, or targeting institutional or sophisticated DeFi traders who are comfortable with order book mechanics and can manage liquidity effectively

👎 Not ideal for: smaller projects or teams that are not well-versed in order book trading mechanics

d) ve 3-3 —> The vote-escrow (ve) 3-3 model, pioneered by Solidly and later refined by Velodrome and Aerodrome, is a governance-driven liquidity incentive mechanism that aligns the interests of LPers, token holders, and protocols. Unlike traditional AMMs, which passively distribute fees, ve-model DEXs allow long-term token holders (veHolders) to direct emissions, creating a more sustainable and protocol-owned liquidity structure.

✅ Pros:

- Sustainable Liquidity Incentives. Unlike short-term liquidity mining, which leads to mercenary farming, veToken models reward long-term liquidity commitments, reducing capital flight after incentives end.

- Emission Voting Power. veToken holders decide where liquidity incentives should be directed, meaning projects can directly influence liquidity depth by incentivizing voters.

- Trading Fees Distributed to veToken Holders. Instead of rewarding only LPs, trading fees go to long-term veToken holders, aligning governance participants with the DEX's success.

❌ Cons:

- Requires Initial Token Distribution for Liquidity Alignment → A successful veDEX launch needs a significant initial token airdrop and distribution plan to ensure a strong base of engaged voters.

- Complex Locking Mechanism → Token holders must lock their governance tokens (e.g., $AERO → $veAERO) for up to four years, which may deter short-term participants.

- Inflationary Token Emissions (If Mismanaged) → Since LP rewards come from weekly emissions, long-term sustainability depends on gradual emission reduction or protocol revenue growth.

Suitability for TGE:

👍 Best for:

Aerodrome/Veldrome partner projects or projects that have benefited from their AirDrop

Teams that want to sustain liquidity long-term without relying on mercenary LPs

👎 Not ideal for: Projects that do not want to rely on governance incentives for liquidity provision, or who are unwilling to purchase the underlying protocol governance token (or make a long-term commitment).

e) Decentralized Market Making Services —> Decentralized Market Makers (DMMs) like Arrakis Finance, Gamma Strategies, and Tokemak provide an alternative to traditional MMs by automating liquidity management on AMMs like Uniswap v3, SushiSwap and Pancake. These protocols optimize liquidity provisioning, reduce IL, and enhance capital efficiency for projects launching tokens through DEXs. For projects planning a TGE), these solutions offer a hands-off approach to managing liquidity, reducing the complexity of manual market-making and improving price stability. However, they also come with limitations, including dependence on AMMs, potential capital inefficiencies, and external smart contract risks.

✅ Pros: Hands-off liquidity management, which reduces the need for manual market-making, can help reduce IL thanks to dynamic strategies, better price stability and capital efficiency through using V3 and other liquidity solutions.

❌ Cons: Dependence on AMMs (if Uniswap v3 or similar DEXs lack volume, liquidity may be underutilized), volatility can still be an issue (rebalancing strategies are not perfect, especially for new tokens), Smart contract risks because additional layers of automation increase potential vulnerabilities.

Suitability for TGE:

👍 Best for: projects that plan to incentivize liquidity providers through staking rewards or yield farming programs and for teams with limited market-making expertise that want a set-and-forget liquidity solution for their TGE.

👎 Not ideal for: tokens with extreme price volatility, as liquidity ranges can become inefficient quickly, leading to wasted capital. It is also unsuitable for teams with a low liquidity budgets that require deep, long-term liquidity provisioning, since most DMMs focus on optimizing existing capital rather than attracting new liquidity.

f) V4 —> Uniswap V4 is the latest iteration of the most famous spot dex in the whole DeFi space, introducing a major architectural shift that increases flexibility, reduces gas costs, and allows projects to customize liquidity pools through hooks, smart contracts that modify the behavior of liquidity pools. This upgrade transforms Uniswap from a one-size-fits-all AMM into a fully programmable trading infra, making it significantly more adaptable for token launches, liquidity incentives, and MM strategies.

At the core of V4 is the singleton contract model, which replaces the fragmented pool structure of previous versions with a unified system where all liquidity pools are managed within a single contract. This dramatically reduces gas costs for swaps, LP management, and multi-hop transactions. Additionally, the introduction of native ETH support eliminates the need for WETH wrapping, streamlining the UX and further reducing gas costs.

However, the most game-changing feature in V4 is hooks: customizable logic allowing devs to modify swaps, liquidity provision, and fees. With hooks, projects can introduce dynamic fees, on-chain limit orders, automated rebalancing strategies, impermanent loss protection, MEV-resistant trading, and more. This flexibility makes Uniswap V4 a powerful platform for TGEs and liquidity management.

[One of the first implementations on the topic is Uni LBP, which is trying to brings Balancer-style LBPs to Uniswap v4, offering a more efficient and gas-optimized way to launch new tokens. It works by gradually lowering the price over time, ensuring fair price discovery while making it harder for bots to manipulate the market.

Unlike traditional liquidity pools where both assets are required in a 50/50 ratio, Uni-LBP removes the need for initial capital in the form of a base asset (like ETH or USDC). Instead, projects can bootstrap liquidity using only the token being launched, making it significantly more accessible to new teams.

The mechanism behind Uni-LBP is simple but powerful. As time goes on, the contract adjusts the liquidity position based on the elapsed bootstrapping period. Liquidity is added progressively, and sell pressure increases gradually, ensuring the price finds equilibrium without sudden dumps. The key formula that governs price decay ensures that liquidity is optimally provided based on market demand.

What makes Uni-LBP truly powerful is its deep integration with Uni v4’s concentrated liquidity model. This allows it to achieve high capital efficiency, meaning that more liquidity is available within a tighter price range, reducing slippage and improving execution for traders. Additionally, single-sided liquidity provision also means that users can effectively place limit orders, allowing them to participate in the market without needing to actively trade.

How it works —> Before any swap occurs, the Uni-LBP contract updates its liquidity position based on the current epoch, ensuring that liquidity is added progressively while price decay happens smoothly. The contract continuously monitors whether the price remains **within the liquidity range (**if it does, more liquidity is sold into the pool, naturally driving the price downward). If the price moves outside the range, additional liquidity is provided, ensuring a balanced price discovery process.

The best part? The contract will be highly customizable, meaning that projects will be able to tweak the price decay function to fit their specific needs, whether they want linear decay, exponential decay, or custom price curves].

✅ Pros: Highly customizable liquidity management (in terms of execution logic), lower gas costs & better capital Efficiency, dynamic fees suitable for volatile markets, on-chain limit orders & TWAMM integration, enhanced MEV protection & security, native ETH support.

❌ Cons: Increased complexity in liquidity management, higher security risks due to custom hooks, requires governance & community education (because the learning curve is steep).

Suitability for TGE:

👍 Best for: teams with strong SC developers who can leverage hooks securely, innovative projects that need advanced liquidity management (e.g., dynamic fees, TWAMM, customized staking incentives, etc)

👎 Not ideal for: simple token launches that only require basic AMM functionality, where Uni V2 or V3 might be a better fit; small teams without Solidity expertise, as hooks introduce complex security risks; projects that rely heavily on passive retail users, who may struggle with customized liquidity mechanisms.

Meteora Dynamic Meme Pools (permanently locking liquidity) —> Meteora is a liquidity management and decentralized AMM protocol designed to achieve maximum capital efficiency through its DLMMs (Dynamic Liquidity Automated Market Making) and offer the best possible LPing experience. The Meteora’s team also found a novel way to optimize token launches, namely for memecoins. Its Memecoin Pools introduce permanently-locked liquidity with claimable fees, dynamic fee structures, and lending yield integration to provide better capital efficiency for LPers (this means that LPers forever give up its liquidity in exchange for the fees generated by the pool). The platform is deeply integrated with Solana's DeFi ecosystem, has key partnerships with DEXScreener, Birdeye, and Jupiter, and has even developed anti-sniping tools such as the Alpha Vault. Meteora enables memecoin creators to lock liquidity permanently while still earning swap fees and lending yield, which aligns incentives between all stakeholders (projects and holders). Memecoin pools follow a preset fee schedule that gradually decreases over time to discourage bot trading and early dumping.

Default Fee Reduction Timeline (Dynamic Fee)

- 15% – At trading start

- 7% – After 10 min

- 5% – After 2 h

- 2% – After 4 h

- 1% – After 6 h

- 0.5% – After 8 h

- 0.25% – After 24 h

This fee curve protects early price discovery by making bot-driven arbitrage expensive while gradually normalizing trading fees over time. For launchpads, MMs, and special integrations, Meteora allows custom fee schedules by creating dedicated pool config keys. Example: Moonshot by DEX Screener

- 5% – Initial Pool Trading Fee

- 2.5% – After 4 hours

- 1% – After 24 hours

Projects can request a custom fee schedule by contacting the Meteora team. It also introduced M3M3, an embedded stake-to-earn mechanism rewarding users who stake their LP tokens.

✅ Pros: permanent liquidity locking with fee claims, dynamic fee structure optimized for market conditions, dual yield: swap fees + lending interest (Meteora pools automatically lend SOL or USDC from the liquidity pool into external lending protocols, allowing creators to earn additional interest on locked liquidity. This protects LPers from low trading volume periods by providing alternative yield streams), anti-sniping & front-running protection (thanks to Alpha Vault), incentivized liquidity via M3M3 staking (M3M3 introduces a stake-to-earn mechanism, where top LPers earn a share of the fees generated from permanently locked liquidity, basically shifting memecoin dynamics from a race to sell into a race to stake).

❌ Cons: lack of control over fees (only Meteora can modify), permanent liquidity locking Is irreversible (while this is great for trader confidence, it means projects must plan carefully before committing funds to a pool), limited flexibility in pool configurations, protocol fee reduces earnings for LPs (Meteora takes 20% of the dynamic fee as a protocol fee to fund treasury growth and incentivize trading bots. This means LPs and projects only earn 80% of fees, reducing overall profitability).

Suitability for TGE:

👍 Best for: memecoins & high-Volatility token launches; projects requiring anti-sniping protections (Alpha Vaults); long-term aligned projects

👎 Not ideal for: short-term speculative tokens, non-Solana based tokens, projects requiring high customization (no direct backend control over fees means limited flexibility for third party teams)

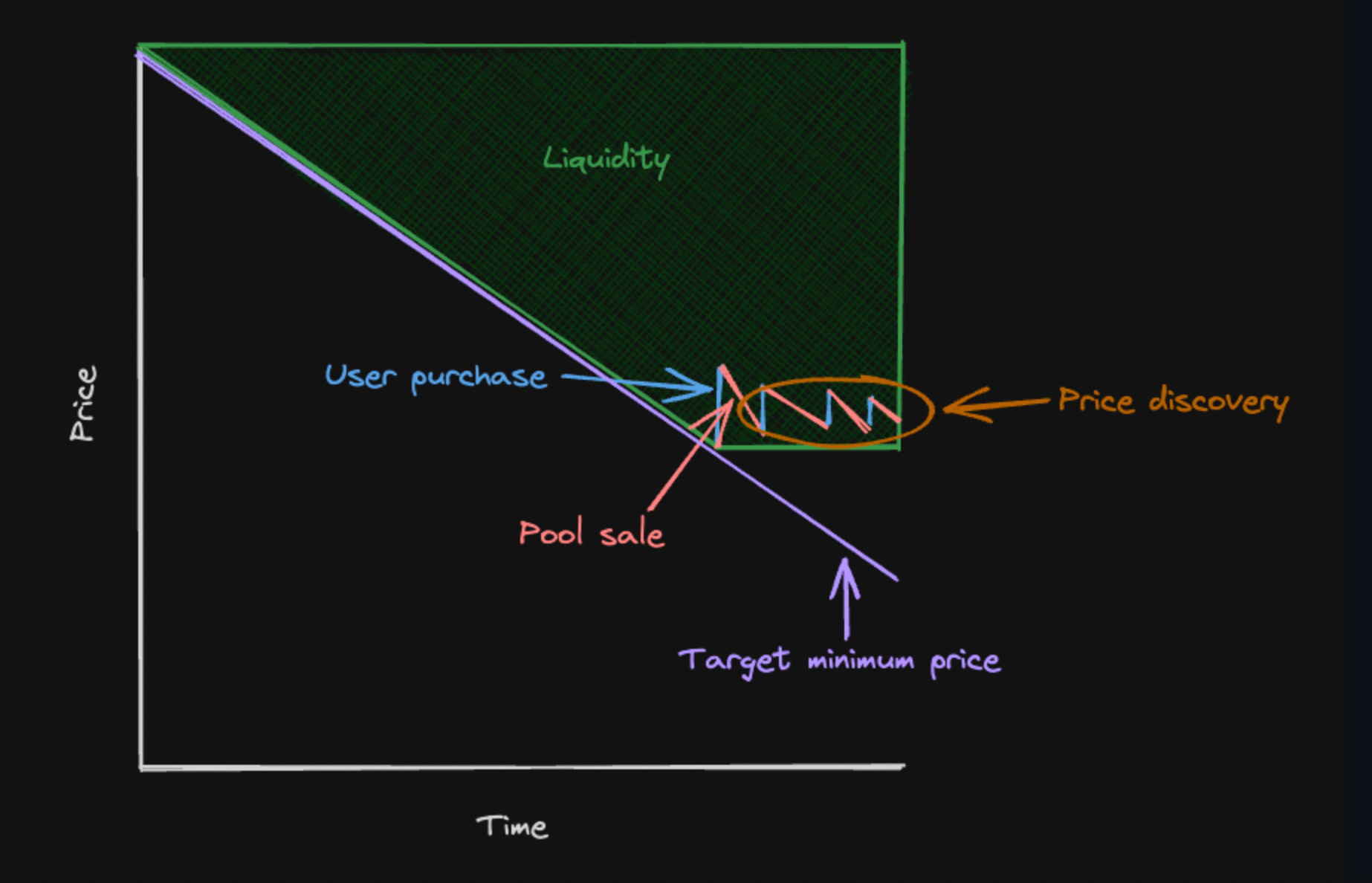

Jupiter’s ILM —> The Intuitive Launchpool Model (ILM) is the Jupiter’s novel approach to token launches leveraging Dynamic Liquidity Market Maker (DLMM) pools to allow projects to control how liquidity is distributed across a range of prices.

[Dynamic Liquidity Market Maker —> DLMM is an advanced iteration of concentrated liquidity market making (with an infrastructural architecture very similar to that of Joe's Liquidity Book), primarily designed to enhance capital efficiency, reduce slippage, and improve liquidity provision strategies on Solana. Unlike traditional AMMs (Automated Market Makers) or CLMMs (Concentrated Liquidity Market Makers), DLMM incorporates discrete zero-slippage price bins (unless the trade involves a bin shift), offering more precise control over liquidity and pricing structures.

DLMM operates through a bin-based liquidity structure, where liquidity is allocated into discrete price bins rather than a continuous bonding curve. Each bin represents a fixed price level at which liquidity is available. This structure allows trades within the same bin to execute with 0 slippage, meaning that traders don’t experience unexpected price movements when swapping tokens.

The main components of DLMM include:

- Zero-slippage price bins. Each bin holds liquidity at a specific price level, enabling precise liquidity concentration.

- Dynamic fee structures. Fees are adjusted based on market volatility, increasing LP profitability.

- Flexible liquidity strategies. LPs can design custom liquidity shapes, concentrating liquidity where they expect price action.

- Single-sided liquidity provision. LPs can provide only one asset (e.g., the base token) without requiring stablecoins like USDC or SOL upfront].

Unlike traditional AMMs like Uniswap, which rely on rigid and deterministic bonding curves, ILM offers a much more flexible way for projects to manage price discovery and liquidity distribution. At its core, ILM enables token issuers to structure their launch with a custom price curve, determining how liquidity is allocated at different price points. This approach is particularly useful for preventing early-stage manipulation, as it allows teams to design a liquidity spread that minimizes the impact of bots while optimizing fundraising potential. Instead of relying on a standard x*y=k curve where liquidity is distributed uniformly, ILM lets teams define price progression and thus liquidity shape, ensuring a more controlled and predictable market entry.

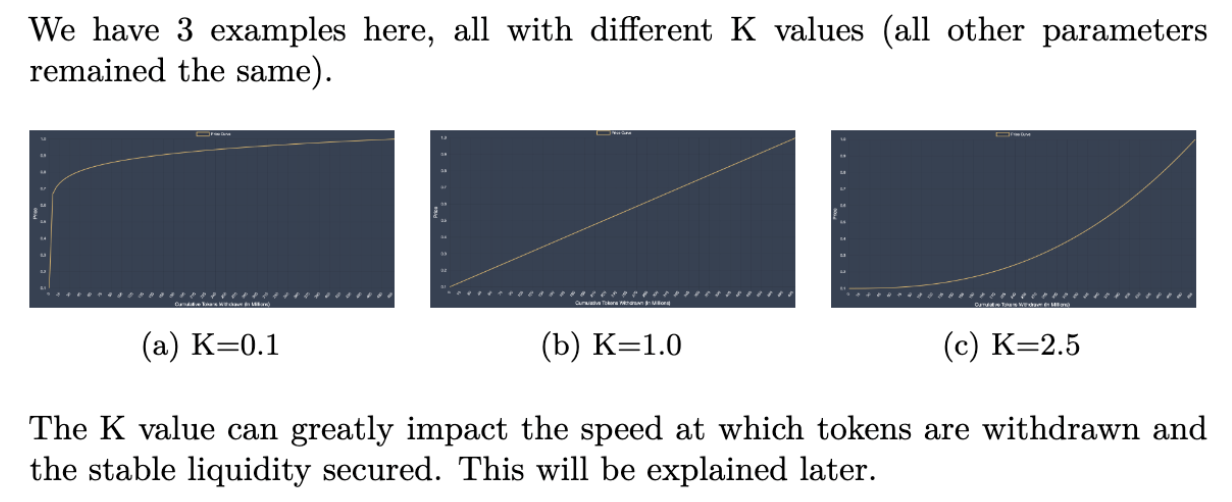

One of the key advantages of this model is its ability to drastically reduce slippage and make liquidity much more efficient compared to traditional AMMs. Because DLMMs allow for concentrated liquidity in specific price ranges, early buyers don’t experience the extreme volatility that often comes with AMM-based launches. This also means projects can accumulate liquidity in a more structured manner, ensuring a stable post-launch trading environment. ILM’s flexibility extends to how it handles price curves. By setting an initial price, a maximum price, and a curvature factor K, projects can determine how fast or slow the price of their token increases as liquidity is withdrawn. A steep curvature discourages bots from acquiring large portions of the supply early on, as prices rise sharply with demand. Conversely, a gentler curve can favor long-term accumulation, allowing retail participants to enter at reasonable price points before a steeper climb.

In practice, ILM operates through single-sided DLMM pools, meaning LPers only need to deposit their project’s token. As users swap stablecoins (like $USDC) for the token, the liquidity shifts dynamically, and the active trading price moves along the defined curve. This approach significantly improves price discovery, as tokens are distributed based on real demand rather than an arbitrary AMM function.

✅ Pros: customizable launch strategy (tailor liquidity allocation to suit project needs, bot mitigation (higher early K values effectively discourage sniping and price manipulation activity), stable liquidity accumulation (means more predictable fundraising potential), lower slippage (more efficient use of liquidity compared to other AMM paradigms), scalable across different kind of projects (can be suitable for memes, governance tokens, or utility tokens as well).

❌ Cons: requires more planning (teams need to carefully define their price curve), more complex setup (compared to a simple Uniswap launch e.g., ILM requires deep understanding of price curve mechanics), potential liquidity concentration risks (poorly designed curves could lead to low liquidity at critical price points).

Suitability for TGE:

👍 Best for: Projects Requiring Controlled Price Discovery (ILM is perfect for projects that want to prevent extreme volatility and price manipulation during their launch. The ability to structure a price curve allows teams to avoid the "pump and dump" patterns common with AMM-based launches), Projects Seeking Long-Term Liquidity Stability (since ILM prevents immediate sell pressure and extreme slippage, it benefits projects focused on gradual adoption rather than speculative hype)

👎 Not ideal for: projects requiring immediate deep liquidity (ILM’s single-sided liquidity model means that liquidity builds as demand increases, rather than being provided upfront in a deep pool. Projects that need immediate deep liquidity for large-scale trading (e.g., institutional adoption, large OTC deals) might find ILM quite limiting); Tokens with broad initial distribution needs (If a project wants to distribute tokens as quickly as possible to a wide audience (e.g., through a fair launch with instant access), ILM’s controlled liquidity allocation might feel restrictive compared to standard AMM models).

(Coinlist) Filling Up From the Bottom model —> The "Filling Up from the Bottom" model is a ground breaking token allocation strategy designed to maximize the number of participants in a fixed-price sale while ensuring a fairer distribution among all buyers. Unlike traditional pro-rata mechanisms, which tend to favor large capital allocators, this approach ensures that allocations are spread out as evenly as possible, benefiting smaller participants without completely excluding larger investors.

The mechanism functions like filling a container with water, ensuring that every participant gets at least the minimum allocation before progressively increasing each allocation up to a user’s requested maximum amount. Essentially, the available tokens are distributed from the smallest demand upwards, ensuring that all participants receive a fair share, with larger buyers only receiving additional allocation once smaller requests have been fully satisfied.

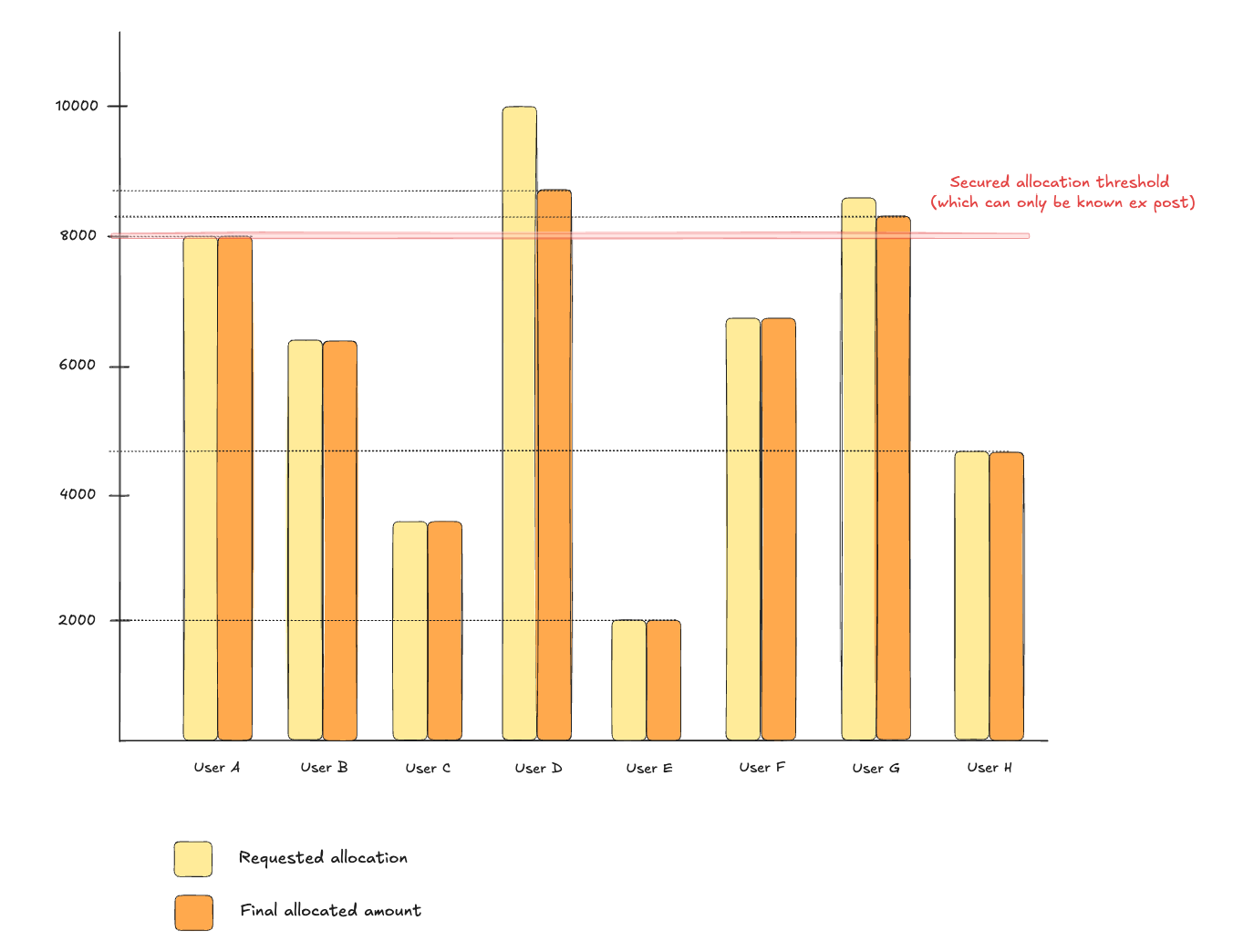

Let’s show the Filling Up From the Bottom model from below with an example, to visualize the working mechanism:

Imagine a token sale with $50,000 worth of tokens available. There are eight participants who submit their maximum purchase requests, just like in any fixed-price sale. The minimum purchase amount is set at $500.

Since we have eight users, the first round ensures that everyone gets a base allocation that is fairly distributed. If the full $50,000 were to be evenly split among eight users, each would initially receive $6,250. However, since Users C and E requested less than $6,250, they receive their full requested amounts first.

Total allocated so far: $5,500, leaving $44,500 left for the remaining participants.

Since Users C and E are fully satisfied, they are removed from further allocation rounds. In other words, the process is the same as shown above, but with fewer participants. Now, we have six users left and $44,500 remaining. The next equal allocation gives $7,416 to each of the remaining users (since $44,500 / 6 = $7,416). However, User H requested only $4,500, so they are fully allocated and removed from the next round.

Total allocated so far: $10,000, leaving $40,000 left for the remaining participants.

Now, we have five users left competing for the final $40,000. The next allocation evenly distributes the remaining $40,000 among the remaining 5 users, which would be $8,000 each. However, User B requested only $6,500, so they are fully satisfied and removed from the next round. And so on. In this way:

- Smaller participants are guaranteed their requested allocation first before the larger requests are fulfilled.

- Large investors do not receive unfair priority (everyone is treated equally up to their requested limit).

- Total distribution remains fair while maximizing participation.

✅ Pros: fairer distribution among participants (since the method prioritizes maximizing participation, it prevents a scenario where a small number of whales dominate the sale), encourages long-term community growth (by ensuring wider distribution, this model fosters a stronger and more engaged community, as opposed to a market controlled by a few dominant players who may dump their holdings quickly), flexible for larger Investors without overpowering the sale (large buyers are still able to express their demand, but they only get additional tokens after smaller requests have been met).

❌ Cons: not suitable for hyper-exclusive private sales (if a project wants to conduct a highly selective sale with a limited number of strategic investors, this model won’t work well since it prioritizes mass distribution over exclusivity); not optimized for maximum fundraising per participant (e.g. if a project wants to allow participants to invest as much as they want, this model caps allocations in a way that might leave some high-net-worth participants unsatisfied).

Suitability for TGE:

👍 Best for: projects that want to maximize the number of individual holders and create a long-term decentralized network of supporters; public sales and community rounds where fairness is prioritized over maximizing fundraising from whales

👎 Not ideal for: Venture-backed projects that rely on large early investors to provide liquidity and long-term funding.

3. Single- or multi-layered approach?

Teams that lack liquidity at TGE should initially adopt a one-size-fits-all approach, i.e., focusing on a single dex without diversifying liquidity sources

But it is important to ensure liquidity on different spot dex solutions as early as possible (once the quote asset has been captured), in order to diversify balance sheet reserve allocation risks, to access different trading models, and to encourage aggregation activity (through dedicated protocols, such as Uni X or Cow).

4. How to Prevent or otherwise reduce MEV risks and sniping activities to protect LPers and traders?

The liquidity pool creation phase hides many pitfalls and hurdles that can undermine the trust users place in the protocol. One of the main risks that every team should try to mitigate is that related to MEV operations, from sandwich attacks to front running through arbitrage, to sniping bots' actions.

In order to prevent these problems, there are different methods available, which can be used together :

- Atomic transactions (and any other Revert-on-failure logics) prevent frontrunning and sandwich attacks by ensuring all liquidity deployment and token pricing happen in a single transaction. In other words, atomic execution ensures that multiple smart contract operations execute as a single, indivisible unit—either everything succeeds or everything fails.

- Private transaction execution (especially the one related to pool creation and pricing) through a dedicated mempool, using the most famous RPC endpoints like FlashBot and MEV Blocker. Submit liquidity addition transactions via Flashbots/Cow means executing them without being visible in the mempool.

- Time-Locked Liquidity or Trading Delay functions prevent instant trading after liquidity deployment, stopping bots from sniping before humans can react.

- Whitelist-Only Trading (community members, team, KOLs, etc) for the first minutes stops bots from buying instantly when liquidity is added.

Conclusion

Teams' choices about which TGE formula to adopt, as we have seen, are likely to influence the success of the protocol itself and therefore must be considered very carefully.

The order of the questions is not random but defines a specific priority level for each aspect addressed, even though they are all important for a smooth TGE execution.

Resources

New Uni V4 Hooks. Link

Hyperliquid docs, HIP 1 and 2. Link

“Why We Need to Fix DeFi: Addressing the CVMM Problem”, published on Mirror by Arrakis. Link

“The Arrakis Pro Guide to Protocol Owned Liquidity: Key Tips for TGE and Beyond”, published on Mirror by Arrakis. Link

Meteora’s Official documentation. Link

“Meteora x Moonshot: A New Meta for Memecoin Launchpads”, published by Meteora on its Medium official page. Link

“Uniswap V4 Hooks Guide (I): RBAC Hook”, published by Umbrella Research on its Medium official page. Link

“Uniswap v4 Hooks Guide (II): Dynamic Fees Hook”, published by Umbrella Research on its Medium official page. Link

“Uniswap v4 Hooks Guide (III): Liquidity Incentives Hook”, published by Umbrella Research on its Medium official page. Link

Uni-LBP’s Official Github page. Link

Intuitive Launchpool Modelling - Website. Link

ILM Whitepaper. Link

About Impossible Finance

Impossible is an on-chain native, research advisory firm with a DeFi launchpad and accelerator. We help projects kickstart, fundraise, scale and launch their tokens while enabling users to learn, discover and invest in high quality crypto opportunities.

Website | X | Discord | Telegram | Blog