XMAQUINA's Vision for Collective Robotics Ownership

Executive Summary

XMAQUINA is a decentralized ecosystem (structured as a DAO) that gives investors and community members early exposure to the booming field of humanoid robotics and “Physical AI.” XMAQUINA operates as a “Robotics Bank” or investment DAO that pools capital to co-own and co-govern real-world machine assets (robots, autonomous systems) and to take stakes in high-growth robotics startups. By holding the DEUS token, members gain governance rights over a multi-asset treasury and a launchpad for new machine-focused ventures, effectively democratizing access to an industry typically dominated by large corporations and VCs. The project’s mission is to ensure that as robots and automation reshape the global economy, the value created accrues to the many rather than the few allowing everyday people to invest in and benefit from the rise of autonomous machines[7}.

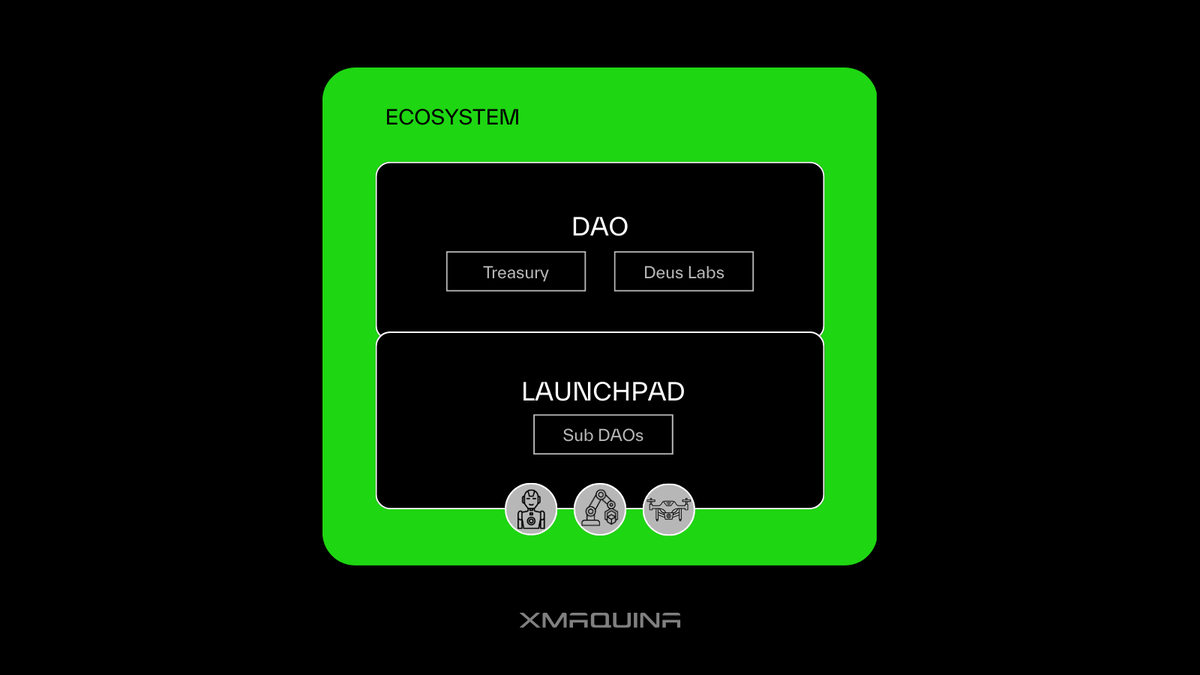

XMAQUINA’s strategy centers on two interlinked pillars:

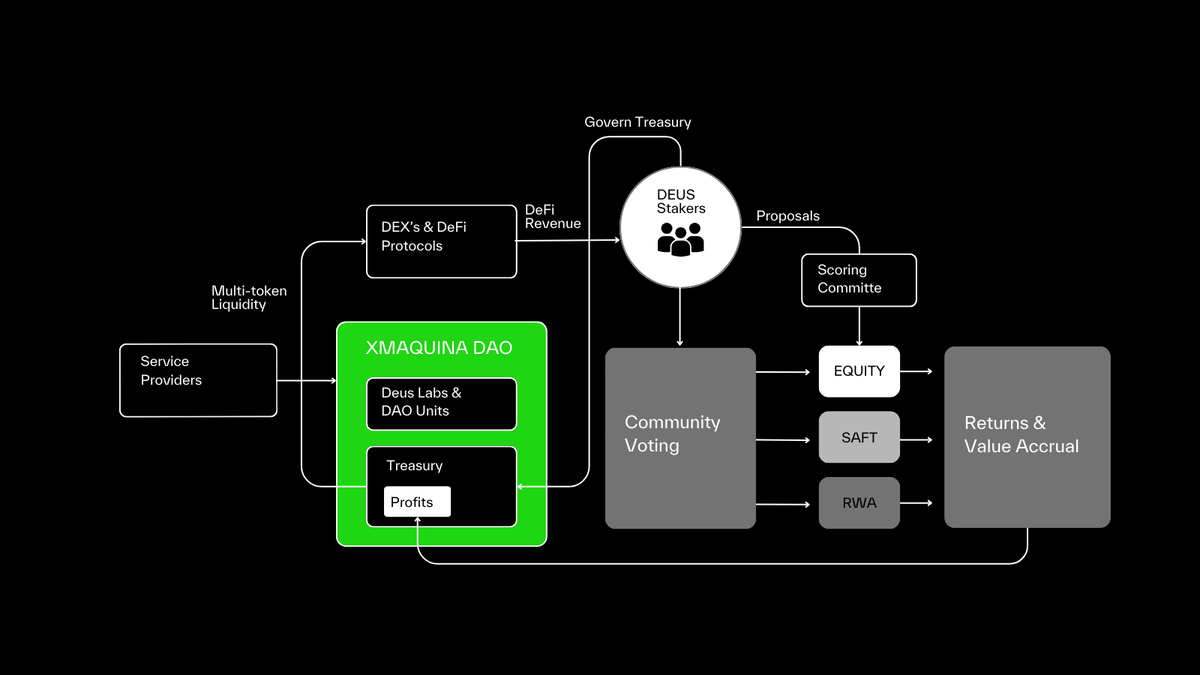

- The XMAQUINA DAO, which manages a diversified portfolio of robotics and AI assets and makes investment decisions via community governance.

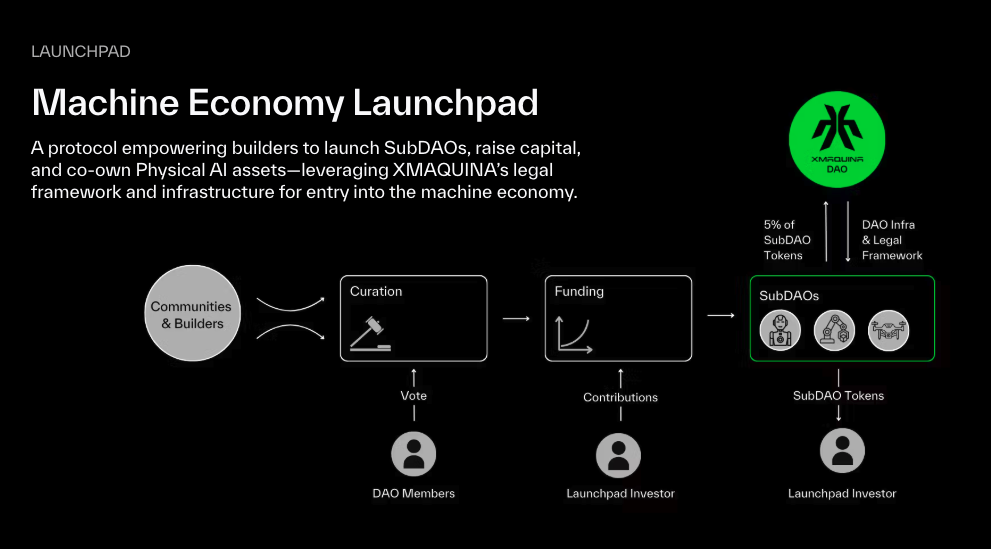

- The Machine Economy Launchpad, a platform for incubating and tokenizing specific robotics projects as sub-DAOs[9].

Revenue generated whether from equity exits, operating profits of robots (e.g. tokenized robot “cafes”), or fees from launching sub-DAOs flows back to the DAO treasury. DEUS holders can then vote to use these proceeds for token buybacks, staking rewards, or further investments, aligning the token’s value with the growth of the robotics portfolio. With a full-stack approach (spanning on-chain governance infrastructure, real-world asset tokenization, and open-source robotics R&D), XMAQUINA aims to build a self-sustaining “machine economy” ecosystem that drives both financial returns and technological progress in the Physical AI space.

The project carves out a distinct niche. Unlike most AI-focused crypto projects that concentrate on software, data, or algorithms, XMaquina's primary focus is on investment in manufacturers of physical hardware and the tokenization of tangible, revenue-generating assets.

The Inevitable Machine Economy

The 21st century is being defined by two parallel automation revolutions. The first, driven by Digital AI (e.g., large language models, data analysis algorithms), is increasingly automating white-collar, knowledge-based jobs. The second, driven by Physical AI (e.g., humanoid robots, autonomous vehicles), is poised to automate blue-collar, manual labor jobs. This dual-front advancement presents a fundamental challenge to the existing socioeconomic structure. As both cognitive and physical labor are progressively replaced by machines, a critical question arises: how will labor acquire capital when its primary means of doing so, selling its time and skills is no longer in demand?

Introduction

XMAQUINA is a Web3 ecosystem focused on humanoid robotics and Physical AI, designed to give a global community exposure to cutting-edge automation technologies that are poised to reshape the economy[13]. XMAQUINA functions as a DAO that invests in and co-owns a range of assets at the forefront of robotics, from equity in private robot companies to fleets of revenue-generating machines and related intellectual property[3]. By leveraging blockchain, the project enables collective governance and ownership of these assets. The core mission is to “make Physical AI accessible to all” by shifting power to the people through decentralized ownership and decision-making[17].

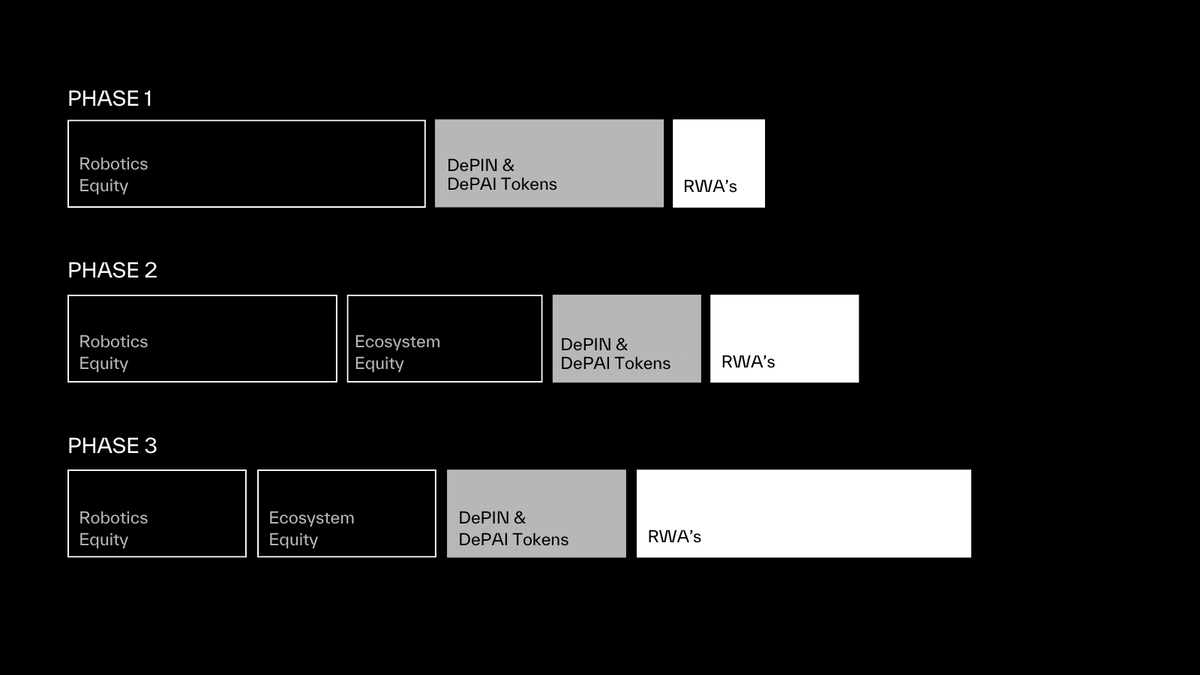

At its highest level, XMAQUINA’s model is akin to a “Robotics VC fund + launchpad run by a community.” The XMAQUINA DAO pools contributions (raised through token sales) into a treasury that allocates capital into four high-growth verticals within robotics and AI:

- Robotics Company Equity: Private shares in top robotics startups (humanoid robot manufacturers, etc.) that were traditionally hard for the public to access.

- DePAI & DePIN Projects: Early-stage Web3 protocols and networks related to decentralized physical infrastructure or AI (e.g. data networks, IoT platforms that support robotics).

- Machine RWAs (Real-World Assets): Physical autonomous machines deployed in real operations that generate income (e.g. robotic kiosks, drones, service robots).

- Robotics Supply Chain: Strategic exposure to critical enablers of the robotics industry such as actuator manufacturers, sensor developers, AI chips, and infrastructure providers that support and scale the broader robotics ecosystem.

XMAQUINA thus gives members a stake in a diversified portfolio covering the entire humanoid robotics tech stack from chips and batteries (“humanoid brain” and power systems) to AI software, sensors, and end-use robots. The DAO not only invests but also incubates projects: via its launchpad, independent sub-DAOs can be spun up for specific robotics ventures, each with its own token, while leveraging XMAQUINA’s legal/governance framework and community support. In return, the main DAO treasury gets fees and token allocations from each sub-project, creating a virtuous cycle where ecosystem growth directly benefits DEUS holders

Team and Expertise

Mauricio Zolliker – Co-founder & CEO

Mauricio Zolliker is the CEO and Co-founder of XMAQUINA. He leads the company’s mission to democratize the machine economy by making it possible for individuals to invest in and benefit from automation. Mauricio holds a Master’s degree in Business Administration and has a strong background in technology and business development.

Before starting XMAQUINA, he was Head of Growth and Business Development at peaq, a blockchain focused on DePIN and Machine RWA applications. During his time there, he helped scale the ecosystem and contributed to its evolution into what is now known as the Web3-based Economy of Things.

At XMAQUINA, Mauricio brings a vision of using blockchain technology to unlock new investment models. His goal is to help people gain access to real-world robotics and automation through the company’s on-chain protocol.

Jessica Alvarez – CMO

Jessica Alvarez serves as the Chief Marketing Officer at XMAQUINA. She brings over ten years of experience in marketing and communications, with a focus on content strategy, SEO, brand storytelling, and social media campaigns.

She holds a degree in Strategic Communications and combines strong creative instincts with a sharp business mindset. Jessica is the driving force behind XMAQUINA’s brand strategy, designing and running marketing initiatives that have helped the company stand out in the fast-growing DePIN and Real-World Asset sectors.

Her work has shaped a consistent and compelling voice for the brand, making XMAQUINA a recognizable name in the machine economy space.

Team Structure

XMAQUINA is driven by a lean team of 7 full-time members and 2 part-time contributors. The full-time core includes the Co-Founders and department leads

XMAQUINA has attracted seasoned advisors to strengthen its strategy. Notably, Michael Ganser (former Senior VP at Cisco) advises on scaling and enterprise partnerships, and Simon Dedic (co-founder of Moonrock Capital) provides guidance on blockchain venture growth and DAO governance. These advisors, along with others, hold a combined ~1% of the DEUS token supply (allocated for advisory roles) and bring decades of industry experience in technology, networking, and crypto investment to the project.

Project Strategy and Technology

XMAQUINA has developed a suite of custom technologies and infrastructure to realize its vision of a decentralized machine economy. The focus is on enabling secure on-chain governance, seamless tokenized asset launches, and cross-chain interoperability for the ecosystem. Key components of XMAQUINA’s platform include:

- Genesis Auction Dashboard: XMAQUINA built a multi-token auction platform (the “Genesis Pad”) to conduct its initial token distribution in a fair, transparent manner. This on-chain dashboard allows community members to participate in token auctions that seed the DAO treasury, effectively replacing the typical closed-door private fundraising with an open, permissionless model[31]. The Genesis Auction platform has been used in multiple “waves” to bootstrap the community and treasury. Contributors deposit accepted crypto assets (USDC, ETH, or even DePIN-aligned tokens) and receive non-transferable receipt tokens that represent their future DEUS allocation and carry immediate governance rights[31].

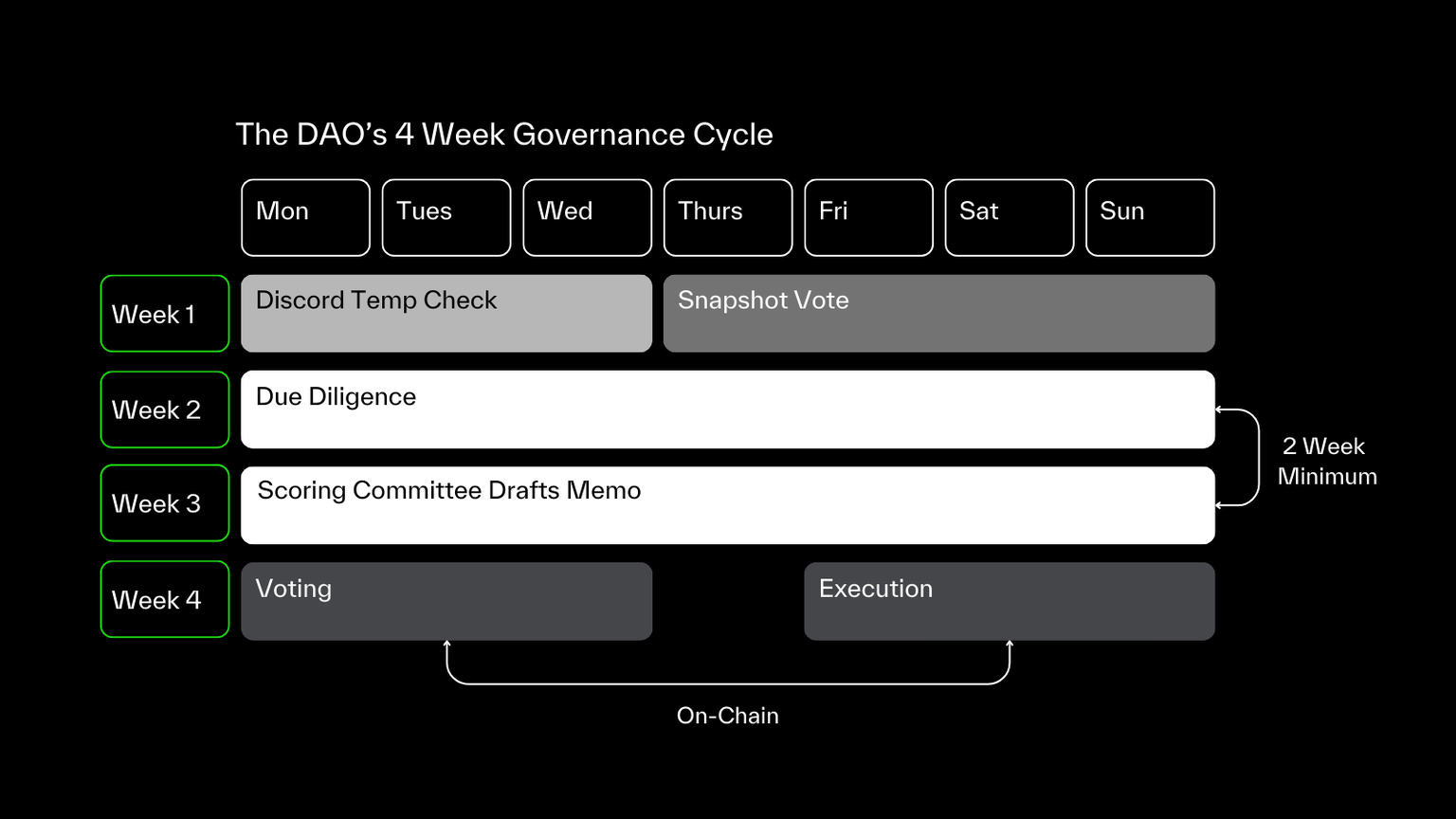

- Aragon OSx DAO Framework: For on-chain governance and treasury management, XMAQUINA employs Aragon OSx, a modern, modular smart contract suite for DAOs. Aragon OSx allows XMAQUINA to manage proposals, voting, and treasury execution in a fully on-chain, secure manner[32]. This framework enables modular governance logic where XMAQUINA can upgrade or customize pieces (like adding new voting modules) without disrupting core contracts[34]. For example, XMAQUINA has integrated an optimistic dual-governance plugin and a veToken governance module on Aragon to enhance participation[35]. The optimistic governance allows faster execution of proposals that have overwhelming support, and the vote-escrowed token (veDEUS) model lets users lock tokens (into “xDEUS”) to gain greater voting power and rewards, addressing voter apathy.

- Custom Tokenization & SubDAO Launchpad: XMAQUINA is developing a protocol to easily spin up sub-DAOs representing specific robotics ventures or assets. This Machine Economy Launchpad is essentially a factory for new DAOs that plug into XMAQUINA’s ecosystem Through it, a team or entrepreneur can tokenize a machine asset or a private company stake as a new sub-DAO (with its own token and governance), while leveraging XMAQUINA’s legal wrappers, technical framework, and community. The launchpad streamlines the complex parts (legal compliance, smart contract deployment, governance setup), lowering barriers for bringing real-world machine assets on-chain[36]. Each subDAO launched contributes a 5% token allocation to XMAQUINA’s treasury and pays protocol fees[26], providing revenue to DEUS holders. This launchpad is slated for release by late 2025 [37][38]. It will enable everything from tokenized robot fleets (e.g. fractional ownership of self-driving cars or robotic warehouses) to syndicated investments in startup equity, all governed under the XMAQUINA umbrella.

- DEUS Development Lab: Complementing its investment activities, XMaquina operates the DEUS Development Lab. This is the DAO's in-house innovation and R&D arm, with a mandate to fund and support the development of open-source robotics, ethical AI, and other decentralized technologies. This initiative allows the DAO to be a co-creator of technology, not just a passive investor. Projects incubated within the lab could eventually be spun out as independent ventures through the Machine Economy Launchpad, providing another avenue for value creation within the ecosystem.

User Segments and Acquisition Strategy

XMAQUINA’s product is multi-faceted, and it targets several distinct user segments, each with tailored acquisition and engagement strategies:

- Retail Crypto Participants: These are individual investors and community members who believe in the project’s vision and want exposure to robotics growth. They interact by acquiring DEUS tokens (primarily via the Genesis Auctions and eventually on exchanges). For this group, XMAQUINA’s strategy is to build a strong community presence through active social channels (Twitter, Discord), educational content (blog posts like “DePAI Digest”), and transparent updates on treasury investments. Incentives like governance rewards and staking yields are offered to retain their engagement. The DAO governance itself is a draw: retail holders can vote on proposals that decide real investments, giving them ownership and influence.

- Builders and Developers: XMAQUINA has an initiative called Deus Labs, which is the R&D and incubation arm of the DAO. This segment includes Web3 developers, robotics engineers, and entrepreneurs who want to build projects within the machine economy. XMAQUINA aims to attract these builders by offering grants, bounties, and even salaried roles or token rewards for contributing to the ecosystem. For example, an open-source robotics developer might get funding from the DAO to work on a project that benefits the community (like a standardized robot NFT token model, or improvements to the DAO’s smart contracts). XMAQUINA’s launchpad also appeals to founders of robotics startups or machine network projects: they can join the MachineDAO incubator to get support in tokenizing their venture, access to the community of DEUS holders, and funding through the subDAO mechanism. The acquisition strategy here involves outreach to universities, hackathons, and partnerships with programs like Gitcoin or other Web3 accelerators. By positioning XMAQUINA as the go-to platform for machine economy startups (similar to how other launchpads incubate DeFi projects), it can attract high-quality builders.

- Launchpad Users / Investors (SubDAO Participants): This category includes both B2B and B2C users who are interested in investing in the specific spin-off projects that XMAQUINA will host. For example, when a new subDAO is launched to tokenize a fleet of autonomous drones or to take an equity stake in a particular robotics startup, there will be investors (possibly including institutional or accredited investors, as well as sophisticated retail) who want to buy into that specific opportunity. XMAQUINA’s strategy to acquire these users is to leverage its platform reputation and deal flow quality. By curating top-tier opportunities, XMAQUINA can attract investors looking for exposure to robotics without having to source deals themselves.

Competitive Landscape and Differentiation

XMAQUINA operates in a unique intersection of sectors. Robotics, real-world assets, and DeFi, and currently faces few direct competitors doing exactly what it does. According to the team, “there aren’t many projects creating a decentralized framework for co-owning and governing real-world automation and robotics infrastructure”. Most related efforts in the blockchain space focus either on purely digital AI or on decentralized infrastructure, but not on investing in physical robots through a DAO. This relative lack of direct competition is an advantage, but it’s worth examining adjacent projects and how XMAQUINA distinguishes itself:

- Traditional Robotics Investments vs. XMAQUINA: In the traditional realm, investing in robotics companies or revenue-sharing in machine assets is limited to venture capital funds, private equity, or crowdsourcing platforms. XMAQUINA’s competitive edge here is that it democratizes this access via a tokenized, on-chain approach. The typical VC model is exclusive only institutions or accredited investors can back robotics startups pre-IPO, and only corporations can deploy capital-intensive robots. XMAQUINA changes that by acting as a “Robotics Index DAO”, where anyone can buy into a basket of robotics exposure through DEUS. Moreover, whereas a crowdfunding platform might let people invest in one robot or startup with no liquidity, XMAQUINA’s token provides liquidity and governance voice over a whole portfolio. This structural innovation (DAO + token) is a key differentiator, essentially offering a product that didn’t previously exist.

- Crypto AI Projects (SingularityNET, Fetch.ai, etc.): Projects like SingularityNET (AGIX) or Fetch.ai (FET) operate in the broad AI/blockchain arena, but their focus is very different. SingularityNET is a marketplace for AI algorithms (mostly software AI services), and Fetch.ai is building tools for autonomous software agents and IoT data sharing. Neither directly targets physical robotics ownership or investments. They don’t pool community funds to buy equity or machines; instead, they concentrate on software and networks. As a result, XMAQUINA doesn’t compete with them for the same use-case, in fact, one could see XMAQUINA as complementary (for instance, XMAQUINA could invest in a Fetch-powered autonomous vehicle network if it aligns with the machine economy thesis). That said, in terms of market positioning, those projects attract the AI-interested crypto investors, so XMAQUINA will draw some comparisons. XMAQUINA’s advantage here is its tangible focus: owning real robots and shares in companies gives a clearer line-of-sight to real-world revenue and value, versus the more abstract utility of AI tokens.

Notably, XMAQUINA recently passed a proposal to allocate capital to Figure AI, with 99.7% of votes in favor. This complements the Apptronik investment by adding another high-profile humanoid robotics company to the DAO’s portfolio. The dual exposure enhances the DAO’s campaign around embodied AI and strengthens its position as the go-to decentralized vehicle for diversified robotics investment.

There are also proposals incoming to allocate into additional robotics blue chips, including Figure AI, Neura Robotics, and Agility Robotics, further expanding the DAO’s exposure to leaders in the humanoid and embodied AI space.

- Decentralized Physical Infrastructure (DePIN) Projects: There is a broader trend of DePIN projects (e.g., Helium for wireless hotspots, DIMO for car data, Hivemapper for mapping, peaq itself for vehicle charging, etc.) which involve communities owning bits of physical networks. XMAQUINA is aligned philosophically (community-owned physical infrastructure) but is more investment-focused than these. For example, Helium didn’t give token holders a governance share of a treasury; instead, it rewarded them for deploying hardware. XMAQUINA actually invests capital into hardware deployments (like the robo-café pilot) or companies. One could argue that XMAQUINA is to robots what something like VitaDAO is to biotech i.e. a DAO pooling funds to invest in a domain. At present, no other DAO has a dedicated focus on humanoid robots and automation. A few might be partially overlapping: for instance, BitDAO (via proposals) or other large DAOs could theoretically invest in RWAs, but they haven’t carved out this niche. There was an initiative called “SophiaDAO” associated with Hanson Robotics’ Sophia robot and SingularityNET, aimed at community involvement in a robot’s AI development, but it didn’t materialize into an investment platform like XMAQUINA (and was more about AI governance for a single robot). Thus, XMAQUINA enjoys first-mover advantage in creating a MachineDAO concept.

- Other Launchpads/Incubators: In terms of launching sub-projects, XMAQUINA’s machine economy launchpad could be compared to crypto launchpads like IF Launchpad, DAO Maker, Polkastarter, etc., but those typically launch fungible tokens for DeFi/Gaming projects. XMAQUINA’s is specialized for machine asset tokenization, which stands largely alone right now. One somewhat relevant project is Alethea AI’s CharacterGPT (for AI characters) or Robonomics (on Polkadot, focusing on IoT/robot control via blockchain), but again, those are protocol-focused, not DAO investment funds. Robonomics DAO does deal with robots (connecting ROS robots to blockchain), but it’s not structured as an investment vehicle pooling community capital to own robots as it’s more of a developer protocol. If anything, XMAQUINA could collaborate with such protocols (using Robonomics tech to manage robot telemetry on-chain, for instance).

The demand for XMAQUINA’s product ultimately hinges on the macro trend: robotics and AI are exploding industries and yet there’s a public fear of being left out of the value creation. XMAQUINA is betting that many will choose to invest in co-owning the robots rather than simply being displaced by them. Early success indicators like oversubscribed auctions give confidence that this demand is real and growing.

Revenue Model and Sustainability

XMAQUINA is building multiple revenue streams to sustain its operations and generate value for stakeholders. Unlike a traditional company that might sell a product or service for revenue, XMAQUINA’s revenues largely come from its investments and platform activities, more analogous to a fund or ecosystem that earns through successful deployments of capital and network usage.

Key revenue streams include:

- Investment Returns (Exits and Appreciation): The DAO’s treasury investments in robotics startups are expected to yield returns in the form of equity exits or appreciation. For example, if XMAQUINA invests in a private company that later goes public or is acquired, the DAO could realize a profit (distribution or capital gain). Such profits could be significant given the high valuations in the sector (e.g., Figure AI raising at ~$39B valuation[60]). These returns are a direct revenue to the DAO treasury. Additionally, if any of the token holdings the DAO acquires (say, from investing in a DePIN network token) increase in value, the DAO can sell them for profit. This is akin to a venture fund’s returns. By design, these returns are meant to flow back to DEUS token holders via the DAO. Governance can vote to use profits for token buybacks (reducing supply, thus benefiting holders) or distribute as staking rewards[11]. Thus, investment returns accrue to the token side (not to a separate equity entity), aligning community incentives, the more successful the investments, the more value can be funneled into the token economy.

- Machine Operations and Yield: When the DAO owns physical machines (robotic assets deployed in the field), those produce operating revenue. A prime example is the tokenized robo-café pilot on peaq: the automated café will generate income from selling coffee, and those revenues are shared with token holders of that machine pool[61]. Similarly, if XMAQUINA co-owns a fleet of robots (drones, autonomous vehicles, etc.), any rental fees or service fees they earn are partially tokenized and flow to the DAO. The revenue model here is essentially yield from real-world assets (like a dividend). XMAQUINA might collect these revenues in stablecoins or other tokens and then channel them into the treasury. It also provides sustainability as the DAO could, in the future, fund its ongoing operations from profitable machine revenue, reducing reliance on token issuance.

- Launchpad Fees and Token Allocations: The Machine Economy Launchpad itself will generate revenue for XMAQUINA. Each project that launches via the platform is expected to contribute a fee or allocation to XMAQUINA. As noted, a standard mechanism is a 5% token allocation from each subDAO to XMAQUINA’s treasury. For instance, if a startup launches a subDAO and issues 100M tokens, 5M would go to XMAQUINA. These could be very valuable if the project succeeds (essentially like equity warrants). Additionally, XMAQUINA could charge a small fee in USDC/ETH for using the launchpad service. Over time, as more projects launch, XMAQUINA accumulates a portfolio of tokens and assets from them, which is an accretive revenue stream. This revenue is clearly tied to the DAO/token, since it directly increases treasury assets. There is no separate corporate entity selling this service for profit; it’s a DAO protocol fee benefiting the ecosystem.

- Treasury DeFi Yield and Other Income: In the interim, before funds are deployed or when holding assets, the DAO can generate revenue through DeFi strategies. For example, stablecoins in the treasury might be put into yield farms or lent on reputable protocols to earn interest. The GitBook mentions the DAO may deploy tokens in DeFi to generate additional value[64]. While not a primary revenue source, this can offset some costs. Similarly, XMAQUINA could earn staking yields if it holds assets like peaq tokens (given peaq is a PoS chain and XMAQUINA has some PEAQ from partnerships)[65]. These kinds of revenues again feed the treasury.

- Incubation/Consulting/Services (Potential): Although not explicitly in the current plan, XMAQUINA’s team could provide consulting or development services to robotics projects (via Deus Labs) which could generate fees. For example, helping a robotics startup with tokenomics or technical integration could be a service. If any such fees are earned, they would likely go to the Foundation or the DAO treasury. This is speculative, but it’s worth noting as a possibility for diversification.

Equity vs Token Revenue: XMAQUINA’s structure blurs the line between equity and token, since the DAO’s activities mostly feed token value. There is a Foundation (non-profit) which holds 7.5% of tokens and perhaps IP, but it’s not structured to take separate profits. The core team/company doesn’t have a traditional product sale revenue; instead, their “equity value” is in the tokens they hold (team allocation 12.5%). Therefore, virtually all revenue streams are directed to the token economy in some fashion. For instance, when a subDAO allocation is received, it goes into the DAO (token holders collectively own it). If the DAO decided to, say, sell a portion and use proceeds for operations, that’s a governance choice but even operations funds benefit token success by delivering roadmap goals.

Reflexive Value from Performance: Successful investments and profitable machine deployments generate returns for the DAO. As decided by governance, these returns can be used for token buybacks or distributed as yield to stakers. Both actions directly increase the financial attractiveness of holding and locking DEUS, which can lead to a higher token price. A higher token price increases the DAO's profile and its ability to raise further capital, creating a positive feedback loop.

One might ask if any revenue goes directly to equity (i.e., the company rather than token holders). The only scenario would be if the XMAQUINA Foundation or a corporate entity charged a fee (like a management fee) for running the DAO. As of now, there is no indication of such fees; the team is compensated from the allocated tokens and funds in treasury as budgeted by the DAO. So, unlike a VC fund that takes a 2% management fee yearly (which would be equity income and can go up to 10% in 5 years), XMAQUINA’s approach is to reward through token holdings and community-approved spending.

Projections

XMAQUINA’s long-term ambition is to become something like the MicroStrategy of Robotics. Instead of holding Bitcoin, the DAO is building a diversified portfolio of robotics equity, machine assets, and Web3 infrastructure. The idea is to give people liquid, on-chain exposure to the future of automation, wrapped inside a single token: DEUS.

This approach positions XMAQUINA as a kind of robotics index fund that anyone can access, with the added benefits of real-world revenue and decentralized governance.

Short Term (2025)

In the near term, XMAQUINA is focused on deploying capital rather than generating revenue. Most of the treasury activity in 2025 will involve acquiring equity in robotics companies, funding early machine deployments, and launching experimental subDAOs.

While the robo-café pilot may generate a few thousand dollars a month once live, these earnings are mainly symbolic at this stage. Treasury growth in 2025 will primarily come from token sale proceeds and a few small yield-generating activities. This phase is all about positioning the portfolio and laying the groundwork for future returns.

Medium Term (2026 to 2027)

By 2026 or 2027, XMAQUINA could begin to see real results from its early investments. For example:

- If a portfolio company like Apptronik or 1X Technologies goes public or offers secondary liquidity, the DAO’s stake could double or triple in value. Selling a portion of that position could bring in a few million dollars.

- If a subDAO launched in 2025 achieves significant growth, even a 5 percent allocation could end up being worth a substantial amount.

- The DAO aims to hold positions in around 10 strong projects. If even two or three of those perform exceptionally well, the returns could fund future investments or support token buybacks.

This is where the “robotics index” model starts to deliver. A few big wins can sustain the broader ecosystem and reduce dependence on new capital inflows.

Long Term (2028 and Beyond)

Over time, XMAQUINA could evolve into a steady-state model where it generates recurring income and treasury growth through real-world operations and protocol activity. Some examples include:

- Launchpad fees from new subDAOs. If five projects launch per year and each contributes a few hundred thousand dollars in token value, that could add up to over $1 million annually.

- Machine operations. If the DAO eventually owns 100 robots, and each nets $1,000 per year, that alone could add another $100,000 in annual revenue.

- Asset management. The DAO may rotate between long-term equity, liquid DePIN tokens, and yield strategies to keep the treasury productive.

This model is designed to be self-sustaining. It can grow and operate without needing constant injections of outside capital.

Sustainability

One of XMAQUINA’s core principles is avoiding reliance on inflationary token emissions. The DEUS token does not have any permanent mint function or built-in tax. Any incentives or liquidity mining rewards come from a finite allocation and are carefully designed.

That means DEUS gains value through real-world activity, not inflation. Treasury growth, machine income, launchpad fees, and token burns or staking rewards all help support the ecosystem in ways that are healthier and more sustainable.

Just like MicroStrategy gave people public market access to Bitcoin, XMAQUINA could become the leading way to gain diversified exposure to the robotics revolution. Only this time, it's powered by a DAO and backed by real-world machines.

Tokenomics and Token Utility

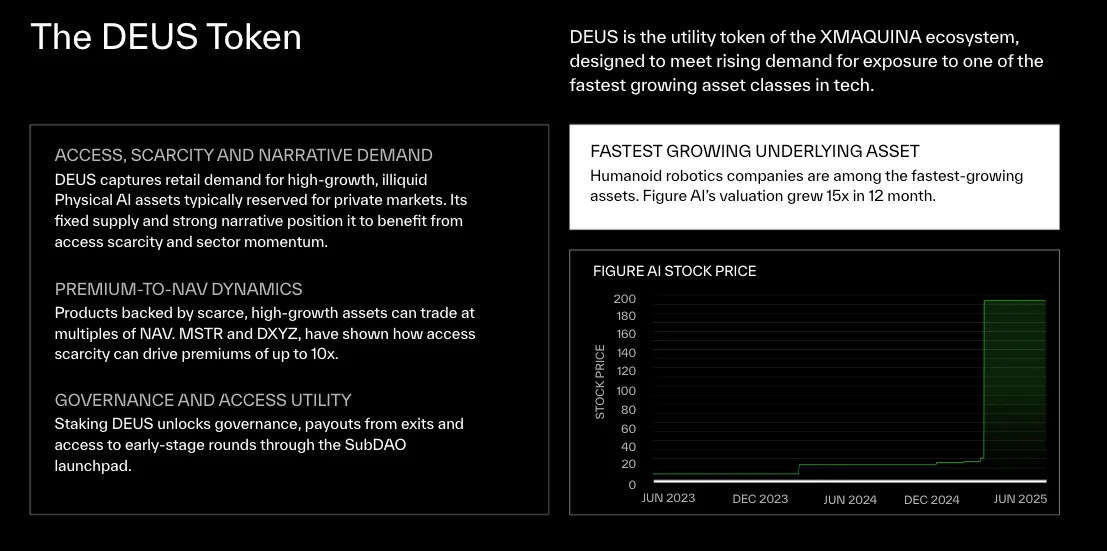

The DEUS token is the lifeblood of the XMAQUINA ecosystem, with carefully designed tokenomics to align incentives for growth and long-term governance.

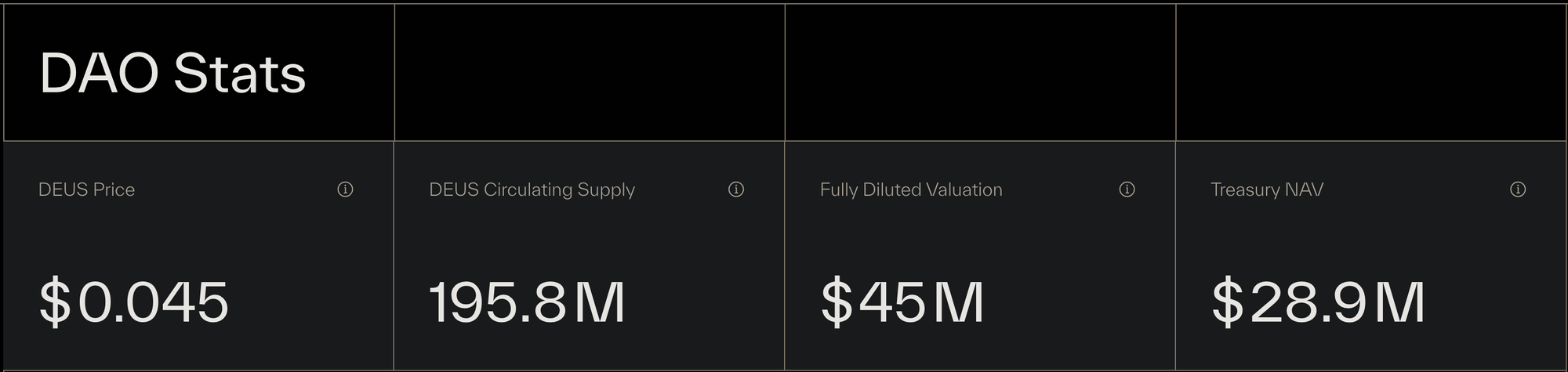

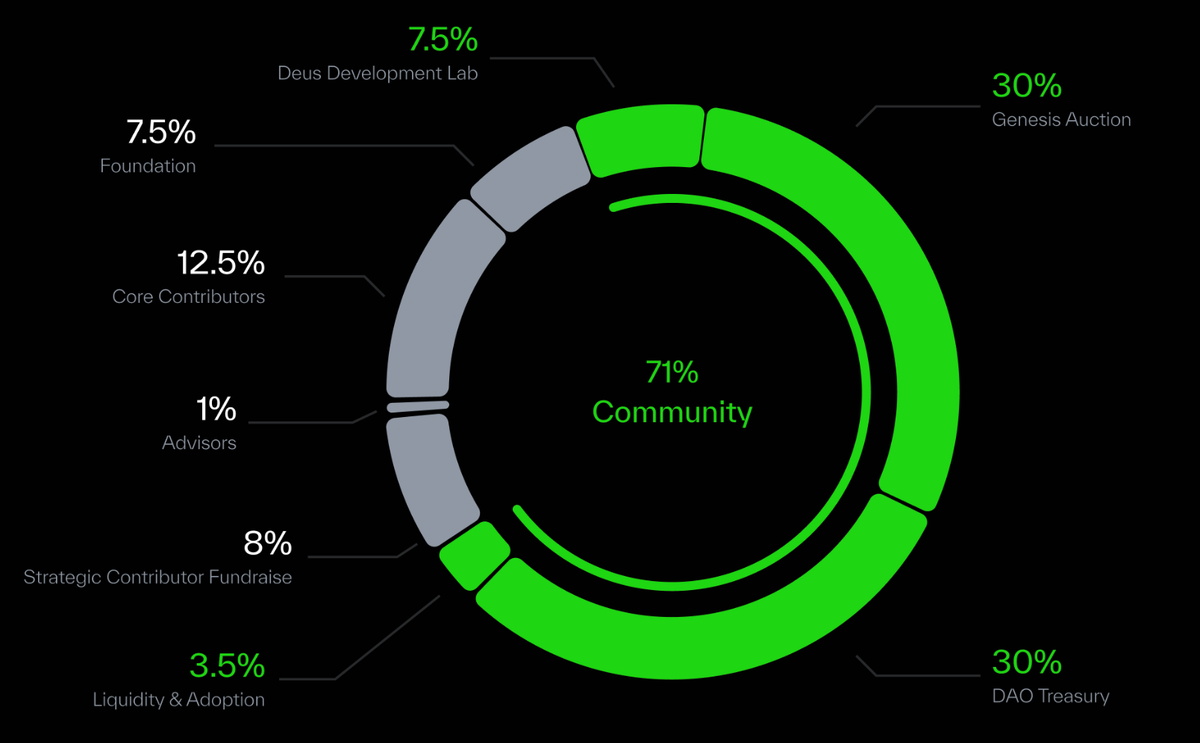

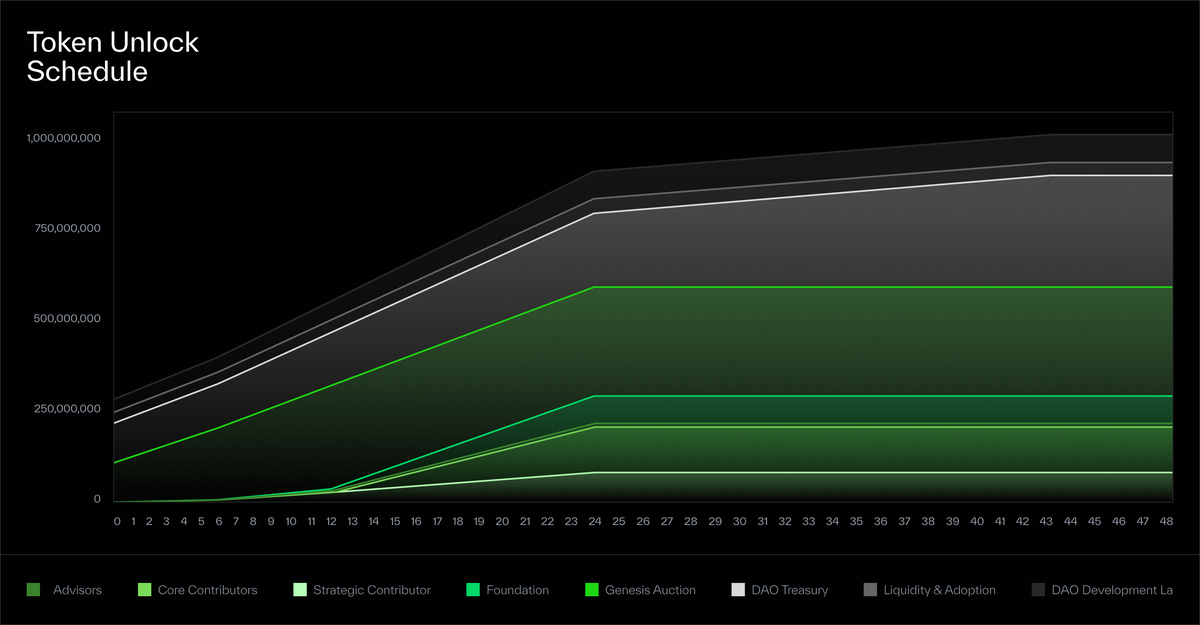

DEUS has a fixed total supply of 1,000,000,000 tokens (1 billion)[66][67]. The distribution is structured to balance between community, operational treasury, contributors, and future growth. The allocation breakdown is as follows[68]:

- 30% – Genesis Auction (Public Sale): 300 million tokens are allocated to the community through the Genesis Auctions (multiple waves). This ensures a wide distribution to early supporters and establishes the community-owned nature of the DAO. (These tokens are subject to vesting: e.g., in Wave 2, 33% unlock at TGE and 67% vest over 12 months[69], to align incentives and prevent immediate sell-off).

- 30% – DAO Treasury: 300 million tokens are set aside for the DAO Treasury. These tokens act as a reserve and could be used for strategic investments, partnerships, or be left uncirculated to represent the NAV backing of the ecosystem. Essentially, this chunk stays under DAO control and can be slowly released via governance to fund initiatives or to provide liquidity when needed.

- 8% – Strategic Contributor Fundraise (Pre-Seed investors): 80 million tokens were allocated to early backers and strategic partners who provided initial capital or value prior to the public sale. This includes crypto VCs and angel investors (e.g., Advanced Blockchain, Moonrock Capital, MH Ventures, etc., who supported XMAQUINA early[57]).

- 12.5% – Core Contributors (Team): 125 million tokens are reserved for the founding team and core contributors. This allocation vests over time (usually multi-year) as a form of equity for the team, incentivizing them to increase token value.

- 1% – Advisors: 10 million tokens for advisors (like Michael Ganser, Simon Dedic, etc.). This is also vested and rewards those providing guidance and network connections.

- 7.5% – Foundation: 75 million tokens allocated to the XMAQUINA Foundation. These could be used for ongoing expenses, grants, or held as a reserve. Essentially, this is an allocation to ensure the project’s continuity and ability to fund non-investment needs (like R&D, community initiatives) outside of the operational treasury.

- 7.5% – Deus Development Lab: 75 million tokens earmarked for Deus Labs, the R&D unit of XMAQUINA. This fund will go towards fostering open-source robotics projects, funding bounties, research partnerships (with universities or developers), and possibly incubating new tech that the DAO can spin out. By having this allocation, XMAQUINA commits significant resources to innovation in the Physical AI space, which can later feed back value to the DAO (in the form of IP or spin-off tokens).

- 3.5% – Liquidity & Adoption: 35 million tokens dedicated to providing liquidity and promoting adoption of DEUS. This portion will be used to seed liquidity pools on DEXs, market making on exchanges, and possibly user incentives (like an airdrop or liquidity mining program) to jumpstart a healthy market for DEUS. Having liquidity is crucial at TGE, so these tokens will ensure trading markets are deep enough and stable. They might be paired with treasury funds to create DEUS/USDC pairs, etc. This allocation essentially serves as the “marketing and growth fund” for the token.

This token distribution was designed to ensure the majority is under community/DAO control (public + treasury), while enough is set aside to reward contributors and fuel future development. It’s worth noting that at TGE, not all these tokens enter circulation as many categories (team, advisors, foundation, etc.) are vested. The initial circulating supply will largely be the portion from the Genesis Auction that unlocks (e.g., 30% of supply, but with only one-third of those liquid at TGE plus maybe any small portion of strategic that unlock at TGE.

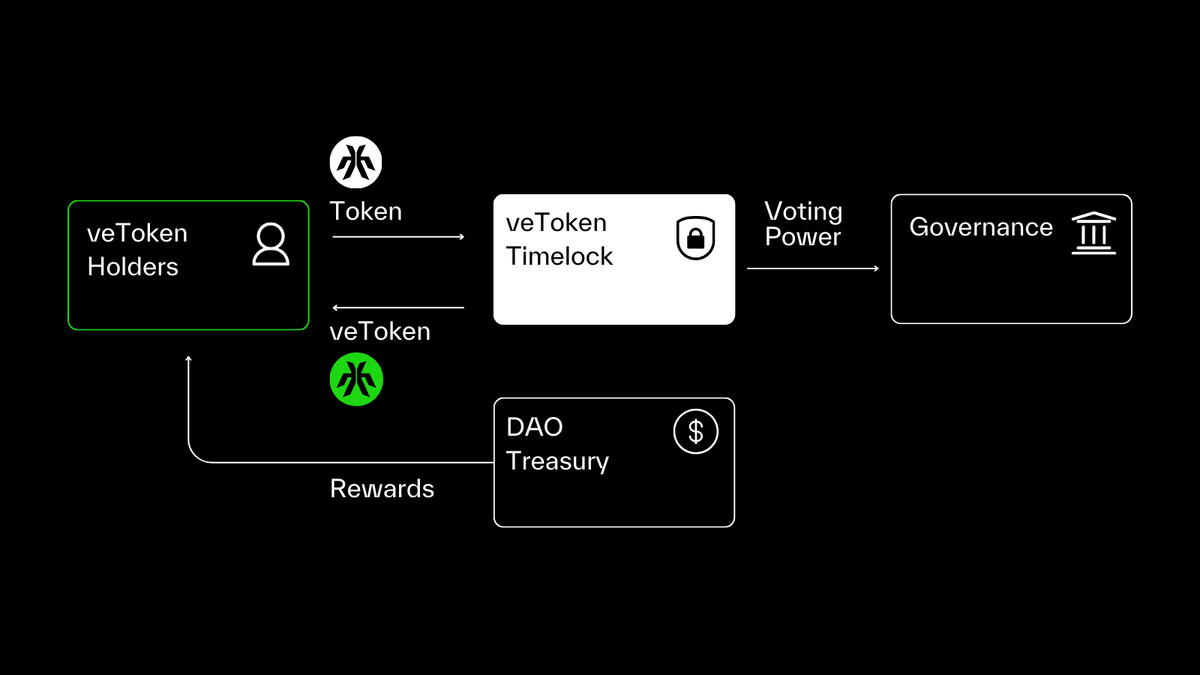

Utility of the DEUS Token: DEUS is fundamentally a governance and coordination token that powers the entire XMAQUINA ecosystem[70]. Its utilities include:

- Governance Rights: Holding DEUS gives members voting power in the DAO’s governance. This means token holders can vote on proposals that determine the DAO’s strategy from which investments to make, to how to allocate treasury funds, to parameter changes in the protocol[71]. DEUS can be staked (or locked as xDEUS) to enhance voting weight, ensuring long-term holders have a stronger voice. The governance is consequential as seen by the community deciding on a $100K+ investment into Apptronik via token votes.

- Treasury Value Accrual (Indirect Ownership): DEUS holders essentially have claim to the DAO’s treasury assets (indirectly, through governance). By owning DEUS, you gain exposure to a basket of previously inaccessible opportunities. One way to view DEUS is as a tokenized index of the machine economy, managed by the community. If the DAO’s investments do well, the value can be channeled back to benefit DEUS. Specifically, DEUS holders can vote on how value generated is distributed[63]: the community can choose to, say, use profits to buy back and burn DEUS (reducing supply and boosting price) or to pay out rewards to those who stake DEUS (like dividends), or to reinvest and grow the treasury (increasing backing per token)[63].

- veToken Staking (xDEUS): XMAQUINA will implement a vote-escrow model (inspired by Curve’s veCRV, etc.) where holders can lock their DEUS for a certain duration to receive xDEUS (or “veDEUS”)[73]. xDEUS will be a non-transferable governance token that confers enhanced voting power and often eligibility for extra rewards. By locking, users signal long-term commitment and get a greater say in governance as well as a share of any distributions. This mechanism also creates sybil resistance (harder for a quick flipper to influence votes) and aligns incentives (since those who might vote for short-term gains are disincentivized by locking). The veToken model is set to launch by Q4 2025[73], and it will encourage holders to become stewards of the ecosystem. Potentially, xDEUS holders could earn a portion of protocol fees or investment returns as periodic rewards, as many ve-token systems do. The lockup times can vary (e.g., 1 month to 2+ years) and voting power scales with time locked.

- Multi-Chain Utility & Payments: As a future omnichain token, DEUS might be used within subDAOs or machine networks as a form of universal payment. For example, the peaq blog mentioned that down the road, XMAQUINA’s native token could be used as the rewards payment method for machine pools[56]. That implies DEUS might be the currency that robot revenue is paid out in (converted to and distributed as DEUS). If so, that creates a steady buy-pressure and demand for DEUS as the ecosystem’s currency. Additionally, subDAOs might require holding some DEUS to align with the main DAO or to get access to deals. While not explicitly confirmed, DEUS could play a role similar to launchpad tokens (like how holding BNB on Binance launchpad gives access) perhaps holding DEUS gives one guaranteed allocation in subDAO sales or discounts on fees. This drives utility beyond governance, making people want DEUS to participate in opportunities.

- Token Supply Governance: Interestingly, DEUS holders even have meta-governance over tokenomics. The DAO could vote to implement supply changes or token burns using treasury funds. For example, if the market deems the supply too high, the DAO could initiate buybacks (which effectively burn tokens by removing them), this is written as one of the utilities: deciding how to manage supply for long-term value alignment. In extreme case, they could even decide to mint more tokens for a new acquisition (though that’s unlikely without broad consensus, since it’d dilute holders).

- Incentivization and Access: DEUS will be used to incentivize various contributors, active DAO members (like those who join working groups, or vote frequently) can earn DEUS rewards. Also, developers in Deus Labs might get grants in DEUS. This fosters a vibrant community where doing work for the DAO pays in a stake of the ecosystem.

Mint/Burn Mechanisms: DEUS has a fixed max supply, so no routine minting beyond the initial distribution. There is a possibility of burning, if the DAO decides to allocate profits to token burns, they would simply buy tokens on the open market and send them to a burn address, thus reducing supply and increasing each remaining token’s share of the treasury. This is not automatic but governed. With revenue flows expected in the future, such burns could become a major value accrual mechanism.

Incentives and Discounts: During the token sale itself, XMAQUINA offered bonus incentives for early and large contributors (e.g., a 10% bonus for Genesis OGs contributing in Wave 2, and up to 25% bonus tiers for whale contributions). These are essentially one-time distribution incentives to bootstrap participation. Post-launch, incentives will shift to encouraging holding and participating: likely liquidity mining (some of the 3.5% Liquidity allocation might reward those who add to liquidity pools), and as mentioned, governance rewards for active participants. It wouldn’t be surprising if XMAQUINA also implements referral rewards or community task bounties paid in DEUS to fuel marketing, though those would be minor relative to core incentives.

Roadmap and Development Plan

XMAQUINA Project Roadmap

**2024**: Foundation & Community Bootstrapping

Late Q3 : Genesis Auction Dashboard (Completed)

Early Q4 : DAO Architecture & Governance (Completed)

**2025**: Governance, Investment & Market Launch

Early Q1 : Community DAO Tooling (Completed)

Q1-Q2 : Genesis Auction Waves & Distribution (Ongoing)

Q2 : DAO Governance Launch (Completed)

: First Capital Deployments (Completed)

: DAO Portal Launch (Completed)

Q3 : Deus Labs Launch (Pending)

: 5th DAO Allocation (Pending)

Q4 : Token Generation Event (TGE) (Pending)

: veDEUS Staking Launch (Pending)

: DEUS Multichain Expansion (Pending)

: 10th DAO Allocation (Pending)

**2026**: Ecosystem & Platform Expansion

Q1 : UBO Pilot Program (Planned)

: UAE Legal Sandbox for RWAs (Planned)

: Machine Economy Launchpad Go-Live (Planned)

: First SubDAOs Deployed (Planned)

XMAQUINA has a well-defined product roadmap spanning from late 2024 through 2026, with development milestones mapped out by quarter. The roadmap not only guides technical and operational progress but also aligns with the growth of the DEUS token’s utility and the ecosystem’s expansion. Below is a quarter-by-quarter overview of key developments, along with how each stage contributes to the project’s momentum and token utility:

- Late Q3 2024 – Genesis Auction Dashboard (Completed): Milestone: Deployment of the on-chain Genesis Auction platform[81]. This leveled the playing field for fundraising by allowing the public to participate in seeding the DAO, breaking away from the typical VC-only model.

- Contribution to token utility: This was the first introduction of the DEUS token to the community. It bootstrapped the initial token holder base and DAO treasury in a fair manner, setting the stage for decentralized ownership. By completing this early, XMAQUINA ensured it had the funds and community to kick off governance in the next phases.

- Early Q4 2024 – DAO Architecture & Governance Processes (Completed): Milestone: Establishing the foundational DAO architecture[82] and essentially deploying the core smart contracts (likely on peaq using Aragon OSx) and formalizing how proposals and voting work.

- Contribution: This laid the groundwork for on-chain governance. By having the architecture ready, the project could immediately start community engagement after token distribution. It ensures the DAO could securely manage its treasury and that token utility (governance rights) was not just theoretical but had a functional platform to be exercised on.

- Early Q1 2025 – Community DAO Tooling (Completed): Milestone: Deployment of community governance tools like Snapshot (off-chain voting), Discourse forums, and Discord integrations.

- Contribution: By Q1 2025, token holders had access to user-friendly tools to propose ideas and gauge sentiment without on-chain gas costs. This increased participation and lowered barriers to governance, directly enhancing the utility of DEUS.

- Q1–Q2 2025 – Genesis Auctions (Waves) and Token Distribution (Ongoing): Milestone: Conducting multiple Genesis Auction waves to distribute ownership of DEUS and raise funds. Waves 1 and 1.5 occurred in H1 2025 (with $1M+ raised, 1k+ participants), and further waves were planned through Q2 2025 to reach the target distribution.

- Contribution: These auctions expanded the community and decentralized the token supply significantly. Each wave also incrementally increased the implied valuation, reflecting growing demand (e.g., Wave 1 FDV ~$37M, Wave 2 FDV $45M). This approach prevented single entities from accumulating too much supply at once, enhancing sybil resistance. By Q2 2025, XMAQUINA had achieved a large base of token holders who are the backbone of governance and evangelism. The treasury also got the capital it needed to start investments, linking token distribution to real economic activity.

- Q2 2025 – DAO Governance Launch (Completed): Milestone: Official start of governance operations, The first proposals were submitted and voted on by the community[85]. This included proposals like treasury allocation to investments.

- Contribution: This was the moment DEUS became fully functional as a governance token. Token holders exercising votes on real decisions (like investing in Apptronik) validated the DAO model. It also set precedents for how proposals are run and how the community coordinates. Successful governance votes also build confidence, attracting more participants and potentially more token demand.

- Q2 2025 – First Capital Deployments (Completed): Milestone: Launch of funding proposals and execution of the first investments from the DAO treasury[86]. In Q2, the 1st DAO allocation to a private company (Apptronik) was executed, with subsequent allocations lined up.

- Contribution: This is crucial because it transitions the project from concept to reality. DEUS token holders now have partial ownership (through the DAO) of a real-world asset. This gave DEUS an intrinsic link to tangible value, which can support its valuation. It also shows the model of co-owning robots is working, a success story to attract media and more users. Furthermore, each investment creates news and partnership opportunities.

- Q2 2025 – DAO Portal Launch (Underway/Completed): Milestone: Launch of the comprehensive DAO management hub/portal in mid-2025[88].

- Contribution: The portal consolidates governance, staking (if live), and treasury info in one interface. Having this by mid-year improved transparency and engagement, even non-technical token holders can actively follow and influence the project.

- Early Q3 2025 – Deus Labs Launch (Pending): Milestone: Kick-off of Deus Labs with its first R&D project and possibly the first DAO-incubated company[89].

- Contribution: Starting Deus Labs means the DAO is not just investing, but also building. This could involve funding an internal robotics project or an open-source initiative. The impact on token utility: if Deus Labs creates valuable IP or even a spin-off token, DEUS holders benefit by association or direct allocation. Also, it signals that part of the token’s value comes from an innovation pipeline, not just passive investments. Early Q3 launch ensures that by late 2025, there might be prototypes or pilot projects which in turn generate excitement and potentially future revenue (e.g., licensing fees or simply increasing the ecosystem’s value).

- Q3 2025 – Increased Investment Activity (Pending): Milestone: Execution of 5th DAO allocation by Q3 2025[90]. Essentially, the goal is to have five investments done by then (including Apptronik as first).

- Contribution: Reaching 5 investments diversifies the portfolio, making DEUS akin to holding shares in 5 different high-tech ventures. This spreads risk and shows momentum. Each additional allocation likely comes with press releases or community discussions (driving narrative and possibly token demand). For the DEUS token, having multiple underlying assets means its intrinsic value (in terms of treasury per token) is growing. Also, by this stage, token holders have voted multiple times, reinforcing governance habits.

- Q4 2025 – Token Generation Event (Pending): Milestone: DEUS TGE (Token Launch) on DEXs and CEXs[91]. This is when the token becomes freely tradeable and gets listed. It’s planned for Q4 2025.

- Contribution: This is arguably the most significant event for market presence. A successful TGE will provide liquidity and price discovery for DEUS. It will allow a broader range of participants (who didn’t join auctions) to enter the ecosystem. For token utility, it means DEUS transitions to full economic utility beyond governance, it now has market value and can be used as collateral perhaps, or traded, etc.

- Q4 2025 – veToken Staking Launch (Pending): Milestone: Deployment of the veDEUS staking contract for xDEUS[73]. Contribution: This adds a new dimension to token utility at a crucial time (post-TGE). It encourages holders to lock up tokens, reducing circulating supply and empowering engaged governance. It also likely inaugurates a reward mechanism perhaps a portion of fees or an inflation. This will drive long-term alignment; as more people lock for veDEUS, the DAO becomes more stable and less prone to speculative swings. For growth, it means by end of 2025, XMAQUINA has in place all the mechanisms of a mature DeFi project (governance token, staking, etc.), which can attract DeFi participants who look for yield and governance influence.

- Q4 2025 – DEUS Multichain Expansion (Pending): Milestone: Bridging DEUS to Base, Solana, Ethereum and other major chains[92].

- Contribution: Being multichain by end of 2025 opens DEUS to a wider investor base and usage scenarios. For instance, listing on Solana’s DEXes or having Ethereum mainnet liquidity means more volume and potentially higher valuation due to access. Also, multichain presence is practically required for any major token nowadays, so hitting this milestone keeps XMAQUINA competitive and accessible. It also ties into governance: XMAQUINA is likely to use LayerZero to allow governance to occur from multiple chains in one unified way (Aragon’s forthcoming features allow cross-chain gov with LayerZero[93]). So token utility (voting, transacting) becomes chain-agnostic, which is crucial for an interoperable future.

- Q4 2025 – 10th DAO Allocation (Pending): Milestone: Execution of the 10th investment by end of 2025[47].

- Contribution: Getting to ten investments means the DAO portfolio is substantial. It also means the DAO presumably has by then spent or committed a large portion of treasury. For token holders, this milestone means DEUS is backed by a broad basket of assets. Possibly several equity stakes, some machine revenue deals, perhaps a few tokens. At that point, one could attempt to calculate a NAV per token. If that NAV is approaching or exceeding market price, it creates a fundamental price floor. This can be a strong narrative to attract more value investors into DEUS. Moreover, having many investments increases chances that one hits big, which speculatively can drive up token price in anticipation. Thus, it sets DEUS up for a 2026 where the story is about managing and growing that portfolio.

- Q1 2026 – UBO Pilot Program with peaq (Planned): Milestone: A Universal Basic Ownership (UBO) proof-of-concept deployment with peaq[94][95]. UBO is presumably an initiative to give people ownership stakes in machine economy revenue (perhaps like micro-dividends to many users).

- Contribution: If this pilot launches, it showcases the societal impact angle of XMAQUINA. It likely involves using XMAQUINA’s model to distribute some robot’s income to a community as a “basic income” style test. For token growth, this can be a PR win and position XMAQUINA at the forefront of equitable AI deployment – potentially drawing interest from public sectors or NGOs. It doesn’t immediately change token mechanics, but success could influence policy or partnerships that enlarge the ecosystem.

- Q1 2026 – UAE Legal Sandbox for Machine RWAs (Planned): Milestone: Participation in a regulatory sandbox in the UAE to experiment with Machine Real-World Assets under compliant conditions[95].

- Contribution: This suggests XMAQUINA aims to work with forward-looking regulators to legitimize and refine the legal framework for tokenized robots. The outcome might be official approvals or simply learnings that make the model legally safer. For DEUS holders, this reduces regulatory risk (one of the biggest threats to any RWA tokenization project) and could allow XMAQUINA to scale in jurisdictions that require licensed compliance. It indirectly boosts token utility by ensuring the DAO can operate and expand without legal roadblocks.

- Q1 2026 – Machine Economy Launchpad Go-Live (Planned): Milestone: Launch of the Machine Economy Launchpad platform for communities to create subDAOs and tokenize assets[38] (essentially full deployment of the subDAO factory).

- Contribution: This is a major expansion phase. When the launchpad goes live, XMAQUINA transitions from doing everything in one DAO to becoming a platform-of-DAOs. It will allow external teams to start using the ecosystem. For DEUS, this means a new spike in utility: DEUS could be required or used in these launches. Even if not required, every project launched funnels value to the DAO (5% tokens, fees) which benefits DEUS holders intrinsically[26].

- Q1 2026 – First SubDAOs Deployed (Planned): Milestone: Deployment of the first cohort of SubDAOs under XMAQUINA[96]. Possibly 1-3 pilot subDAOs are launched (maybe one for a robo-facility, one for a specific startup investment SPV, etc.).

- Contribution: This is where the machine economy concept is fully realized with multiple decentralized ventures operating, co-owned by various participants, all federated by the XMAQUINA DAO. The success of these will reflect back on DEUS: for example, if a subDAO’s token skyrockets, XMAQUINA’s treasury holding of 5% of it skyrockets too, theoretically increasing DEUS’s backing or future profit when sold. It also means more governance work (the DAO has to oversee subDAO performance, maybe vote on issues like whether to dissolve a failing subDAO, etc.), which further cements the need for engaged DEUS voters (increasing demand for governance power). Essentially, by Q1 2026, DEUS’s utility is not just to govern one DAO but to govern a whole ecosystem of machine-related DAOs. This web of activity can drive network effects; the more projects and assets under management, the more valuable the coordination token (DEUS) becomes.

Fundraising History and Future Plans

XMAQUINA’s fundraising has involved a combination of private strategic rounds and public token auctions, reflecting a transition from traditional early-stage funding to a community-driven model. Below is a breakdown of past and current fundraising rounds, along with details on token supply distribution and future capital plans:

Pre-Seed Round (Strategic Contributors):

- Date of Completion: Late 2024 (approximately Q4 2024). This was around the time of XMAQUINA’s founding and initial development phase, prior to launching the public Genesis Auction.

- Total Raised Amount: The exact figure is not publicly disclosed, but it’s on the order of mid-to-high six figures (USD).

- Valuation: The pre-seed was done at a relatively modest valuation to onboard strategic partners. It corresponded to the “Strategic Contributor Fundraise – 8% of supply” allocation[100]. If we estimate the average token price in pre-seed, it might have been around $0.02–$0.03 (given later public was $0.04+). That would imply a fully diluted valuation (FDV) of roughly $20–30 million at pre-seed. For instance, if $800k was raised for 8% of tokens, valuation was $10M; however, likely more was raised or at a higher price. Advanced Blockchain’s investment suggests an FDV in the mid-20M (they traded 30k PEAQ for 270k DEUS; if that equated to say $15k for 270k DEUS, price was $0.055, but PEAQ’s value is tricky). Given the first public wave was around $37M FDV[101], the strategic round was likely a bit lower, say $20M–$25M FDV.

- Vesting Schedule: Pre-seed tokens are subject to lock-up to align with long-term goals. While exact terms haven’t been published, it’s common to see something like 0% at TGE, then linear vesting with a cliff over 12+ months for strategic investors.

Current Round – Seed/Public (Genesis Auction Rounds):

- Target Raise: The current fundraising is being conducted via the Genesis Auction (Seed) rounds. Each wave has had a cap. For Wave 2 (June 24, 2025), the target raise is $1,000,000 USD (1 million USDC accepted)[2]. Earlier, Wave 1 and 1.5 collectively aimed for roughly $1M as well (and achieved ~$1M total). The overall target across all Genesis waves is to distribute 30% of supply for roughly $3-4M total raise (depending on final average price). But each wave is around $1M to not flood the market at once. So Wave 2 specifically: $1M cap.

- Valuation: Wave 2 is being conducted at an implied valuation of $45M FDV[2]. The auction swap rate is 1 USDC = 22.22 DEUS[103], which equates to ~$0.045 per DEUS token. Extrapolating that to 1 billion tokens gives the ~$45 million fully diluted valuation. For context, Wave 1.0 opened at around $0.037 per DEUS (which was ~$37M FDV)[101] and sold out, and Wave 1.5 likely cleared around $0.04 (midpoint), pushing FDV near $40M.

- Vesting Schedule: Participants in the Genesis Auction rounds do have vesting on their tokens to prevent immediate full circulation at TGE. The standard terms: 33% of purchased tokens unlock at TGE, and the remaining 67% vest linearly over 12 months[69].

- Deadline/Timing: Wave 2 launched on June 24, 2025 and ran for a set period (or until the cap was hit). Wave 2 concluded recently and was fully subscribed.

Upcoming Sale at Impossible Launchpad

- Token Price: $0.045

- Vesting Terms: 33% unlocked at TGE, 67% linear vest over 12 months

- Fundraising Chain: Funds collected on Arbitrum

- Distribution Chain: Tokens distributed on Base

- Subscription Start: 12 August 2025

- AMA Livestream: 13 August 2025

- Subscription End: 15 August 2025

Partnerships and Collaborations

XMAQUINA has formed several key partnerships and collaborative relationships to bolster its ecosystem in terms of technology, real-world integration, and outreach. These partnerships span blockchain networks, robotics companies, and other projects in the Web3 and AI space. Here are the most significant collaborations and how they add value to XMAQUINA:

- peaq (Blockchain Network Partner): XMAQUINA is built on the peaq network (a Polkadot parachain focused on the Economy of Things), and peaq is arguably XMAQUINA’s most critical technical partner. The collaboration includes XMAQUINA being the first DAO launched on peaq. Peaq provides the EVM-compatible Layer-1 infrastructure that hosts XMAQUINA’s on-chain components such as the DAO’s treasury contracts, identity management for machines (via peaq ID), and the Machine Pool smart contracts[56]. Peaq is tailored for DePIN (physical infrastructure networks) and XMAQUINA serves as a flagship use-case, showcasing how peaq’s tools can tokenize and manage machines. In return, XMAQUINA benefits from peaq’s optimized performance and modules (like low-cost transactions and built-in DID for machines).

- ELOOP Network (DePIN partner): ELOOP is a tokenization platform on peaq, known for its work in car-sharing tokenization in Europe. XMAQUINA partnered with ELOOP to create the world’s first tokenized Robo-Café demonstration[55]. In this three-way collaboration (XMAQUINA + ELOOP + peaq), ELOOP’s tech was used to fractionalize the revenue rights of a physical robot café on-chain, allowing peaq community members to provide liquidity and earn from each cup of coffee sold. This demo proved that the concept of Machine Pools (where people earn from robots’ work) is feasible. The partnership with ELOOP is likely to extend to more real-world pilots, possibly using ELOOP’s experience to tokenize other physical assets like EV charging stations or rental robots. For XMAQUINA, partnering with ELOOP gave them a ready-made tokenization engine and allowed a quick real-world validation of their model. For ELOOP, XMAQUINA brought a new use case (robots instead of cars) and expanded ELOOP’s reach to the Web3 community.

- Robotics Companies (Investment Partners): While not “partnerships” in the traditional sense, XMAQUINA’s investments often come with a collaborative angle. The prime example is Apptronik, after the DAO invested in Apptronik (purchasing shares)[45], Apptronik can be considered a partner. The relationship is mutually beneficial: XMAQUINA will promote Apptronik within its community and possibly contribute ideas or pilot deployments, while Apptronik gives XMAQUINA an insider view and perhaps preferential access to future funding rounds or product integrations. XMAQUINA likely aims to form similar ties with other robotics startups it invests in, such as any company from their shortlist (1X Technologies, Figure AI, etc.). If XMAQUINA invests, say, in Figure AI or 1X eventually, those could become strategic partners where XMAQUINA might help them create a subDAO for their community or share research via Deus Labs. Additionally, XMAQUINA might forge partnerships for joint ventures – e.g., if the DAO wanted to deploy a fleet of robots, it might partner with a robotics manufacturer to get units at better rates or to co-develop certain features.

- Advanced Blockchain AG and Investors: Advanced Blockchain AG (AB) is not only an investor, but they have listed XMAQUINA in their portfolio and actively support it. AB’s research arm wrote about XMAQUINA and they provide advisory.

- Universities and Research Institutions: XMAQUINA’s Deus Labs intends to partner with academic institutions to further R&D. While specific universities are not named, it’s plausible they may partner with robotics departments at leading universities. These are likely in development for 2026, and the “partnership” would look like grants or collaboration agreements. Thus XMAQUINA can stay on top of technological breakthroughs and even secure IP or early access to innovation, feeding Deus Labs projects and giving the DAO potential first rights to invest in spin-offs.

- IX Swap: This crucial partnership addresses the critical challenge of liquidity for Machine RWAs. IX Swap is a platform that aims to provide a licensed and compliant Decentralized Exchange (DEX) for trading real-world assets. By partnering with IXS, XMAQUINA gains a potential pathway for its tokenized robotics assets to be traded on a secondary market, a feature that is essential for attracting institutional capital and providing liquidity to its investors.

- Chirp Network: This partnership solves the connectivity problem for physical machines. Chirp is a DePIN project building a decentralized wireless network for IoT devices. By integrating with Chirp, XMAQUINA’s autonomous robots can utilize a decentralized communication layer, reinforcing the project's core ethos and ensuring that its machines are not reliant on centralized telecom providers.

Risks and Risk Management

Like any ambitious project operating in both the crypto and robotics domains, XMAQUINA faces a variety of risks. The team has identified these and taken steps to mitigate them, ensuring the company and protocol’s resilience. Here we outline the major risk categories and how XMAQUINA manages them:

- Regulatory and Legal Risk: XMAQUINA’s model of collective investment in real-world assets could be scrutinized under securities or investment laws. There’s risk that regulators might view the DAO’s activities (pooling funds to invest in companies or revenue-sharing from machines) as requiring registration or falling foul of financial regulations. To manage this:

- XMAQUINA has engaged in proactive legal structuring. They formed a DAO legal wrapper, possibly a Marshall Islands DAO LLC via Aurum’s DAOBox, which provides a compliant entity for the DAO while preserving decentralized governance. This structure ensures that the DAO can enter contracts (like equity purchase agreements) legally, and that liability is contained within the DAO LLC (protecting individual token holders).

- They enforce jurisdictional compliance in fundraising: U.S. persons were excluded from the token sale, avoiding immediate SEC issues. They likely took similar precautions with other restricted countries. KYC/geo-blocking was probably implemented for the auction.

- The participation in regulatory sandboxes (like the UAE sandbox in 2026)[95] is another mitigation strategy as by working with regulators in a controlled environment, they aim to shape and comply with regulations rather than be caught off-guard. This forward-looking approach reduces risk of clampdowns and increases legitimacy.

- Investment and Market Risk: XMAQUINA’s success hinges on making good investments in robotics companies and assets. Risks here include:

- The robotics startups might fail or not deliver returns (startups are high-risk; especially hardware startups can burn cash). If XMAQUINA picks wrong or there’s an industry downturn, the DAO treasury could suffer losses.

- The wider crypto market volatility can affect DEUS token price irrespective of project performance (market crashes can hurt token value and thus the treasury’s buying power or community sentiment).

- Mitigation:

- Diversification: As noted, they plan to invest across different verticals and multiple companies (10 by end of 2025)[47], which spreads risk. The portfolio includes not just equity but also potentially revenue-generating machines and tokens (a mix of asset types, reducing correlation).

- Due Diligence & Council: They established a Northstar Council (likely composed of experts and community-elected members) to rigorously vet investments[46]. This reduces the chance of hasty or poor investment decisions. Also, requiring proposals to pass community vote means many eyes evaluate each deal.

- Small Ticket Sizes Initially: They likely start with moderate investment sizes (e.g., the Apptronik stake amount is probably sized such that even if it went to zero, the DAO is not bankrupt). They raised ~$2M in auctions and perhaps another ~$1M in pre-seed, and the first deal (Apptronik) was on the order of tens of thousands of dollars. So they are not betting the farm on one deal.

- Active Portfolio Management: They can decide to exit investments if beneficial (if a token investment moons, they could sell some to secure profits; if a startup is underperforming, they might avoid follow-on and pivot to others).

- The token itself being governance means if the community senses market risk (like needing to conserve funds in a bear market), they could vote to pause new investments or convert holdings to stablecoins to ride out downturns. This flexibility via governance is a form of risk control by consensus.

- Technical and Smart Contract Risk: As a crypto project, XMAQUINA deals with smart contracts (for token, auctions, DAO governance) that could have bugs or vulnerabilities. A hack or bug could lead to loss of funds or governance hijacking.

- Mitigation:

- They have a security & audits process[131]. Likely they got the Genesis auction contracts and token contracts audited (maybe by firms recommended via Base or by partners like Runtime Verification contacts from Vincent’s network).

- Using Aragon OSx gives some security reassurance as it’s a well-tested framework[33]. They’re not writing their DAO from scratch but using a modular system that isolates plugins and has undergone audits. Aragon integration also provides an emergency security mechanism (like pause or delay in proposals execution if something is off).

- Governance and Organizational Risk: Decentralized governance can be slow or can be gamed by whales if not managed. There’s risk of low participation (leading to governance capture by a small group), or conversely, too much division preventing decisions. There’s also a social risk of conflicts in the community or team could derail progress.

- Mitigation:

- veToken model: Implementing xDEUS (vote locking) incentivizes long-term participation and disincentivizes frivolous voting[133]. It also ensures those with most influence are economically aligned (they locked tokens).

- Optimistic governance they use can allow day-to-day decisions to pass quickly if not contentious, speeding operations while still being reversible if someone objects.

- Delegation and Councils: They might allow token holders to delegate votes to trusted community members (ensuring informed voting). The Northstar Council is a form of delegated committee focusing on investments, which streamlines proposals.

- The treasury multi-sig keys are held by the founding team or council (likely 4-of-7 or similar scheme). These keys control funds in the Gnosis safe that holds the treasury and unallocated tokens. They are in the team’s custody because fully on-chain governance controlling funds in real-time was likely not set until governance matured (by Q2 2025 governance can instruct spending, but execution might still be via multi-sig for now or via Aragon agent contract controlled by multi-sig).

- The smart contract admin keys (for upgradability or emergency pause in Aragon, etc.) are also likely held by the core team multi-sig. This is a security measure to fix any bug promptly. However, this is recognized as a centralization risk.

- Operational and Execution Risk: Building both complex blockchain software and dealing with real-world robotics deals is challenging. There’s risk of not delivering on time or within budget. Also risk of losing key team members.

- Mitigation:

- They seem to stick to roadmap (already delivered early components on time in Q4 2024/Q1 2025)[82]. Strong project management and the experienced CPO helps keep execution on track.

- By being a DAO, some operational load is shared with community (like community mods, ambassadors who emerge).

- Market Adoption and Demand Risk: There’s a risk that the concept doesn’t catch on as expected, maybe not enough people want to hold the token or use the launchpad, or robotics hype might fade if, say, a technology setback happens (like if humanoid robots progress slower than anticipated).

- Mitigation:

- XMAQUINA is driving a lot of educational content to build a narrative (so people understand why this is important). This narrative work helps sustain interest beyond hype cycles.

- They also pivot the focus as needed: if one vertical is slow, they can emphasize another (for example, if general humanoids are slow, maybe their investments in logistics robots yield better near-term results).

Conclusion and Strategic Outlook

XMaquina presents a bold and timely vision, positioning itself as a decentralized investment protocol for the impending machine economy. It is not merely another crypto project but a socio-technical experiment aiming to redefine the relationship between labor, capital, and technology in an automated world. The project's thesis to enable collective ownership of the means of production in the 21st century is powerful and has attracted a strong team, credible backers, and an engaged early community.

Looking forward, the strategic outlook for XMAQUINA will be defined by its ability to execute on its ambitious roadmap and mitigate its substantial risks.

Key Catalysts for Success:

- A successful and liquid Token Generation Event (TGE) and an effective multichain expansion to major ecosystems.

- A significant increase in the valuation of humanoid robotics companies held in the DAO’s treasury. This sector is experiencing rapid growth, and appreciation in these assets could substantially strengthen the balance sheet and drive token value without requiring asset sales.

- The release of comprehensive technical documentation for the Machine Economy Launchpad, providing clarity and enabling full due diligence.

- The announcement of a high-profile, high-quality investment in a leading robotics company, validating the DAO's ability to source and execute deals.

- The deployment of the first fleet of Machine RWAs that generate tangible, verifiable revenue for the DAO treasury.

Key Factors to Monitor:

- Progress against the public roadmap, especially the timeline for the TGE and multichain deployment.

- The transparency and execution of the transition away from the "Dual Governance" model to a more fully decentralized framework.

- Any global regulatory developments concerning DAOs and the classification of tokenized real-world assets.

- The quality and adoption of the first projects to launch on the SubDAO platform, as this will be a leading indicator of its success.

About XMAQUINA

XMAQUINA stands out by blending blockchain with real-world robotics. It focuses on two pillars: a DAO for managing investments in assets like humanoid robots and a launchpad for tokenising new ventures. This setup lets everyday participants co-own and govern the tech shaping tomorrow's economy.

With partnerships like peaq for blockchain infrastructure and investments in leaders like Apptronik, XMAQUINA is already making waves. Its roadmap includes expanding to multi-chain support and launching sub-DAOs by 2026, all aimed at ethical AI growth.

Whether you're drawn to the tech or the community-driven model, XMAQUINA offers a fresh way to engage with physical AI. Stay involved and watch this ecosystem evolve.

About Impossible Finance

Impossible Finance is the go-to crypto investment platform that empowers you with high-quality, fair and accessible crypto opportunities. We simplify DeFi so you can enjoy fairer investing, cheaper trading and better yields through our accelerator, launchpad, and swap platform.