Zyfi Research Report

Context

Managing gas expenditure can be a significant challenge for users, particularly when they are about to execute a complex transaction only to find they have insufficient gas tokens. New users often find the concept of holding native gas tokens on different blockchains confusing, and struggle with acquiring them, leading to wasted time and scattered funds across multiple wallets.

Gas Abstraction is a necessary vision that the web3 space needs to fulfill in order to remove these complexities from the UX of all users if all DApps want to scale to a significant level of real-world adoption.

Smart Wallets offer a solution by facilitating user interaction with the UserOp Mempool, a specialized transaction pool designed for smart contract wallets (as outlined in EIP-4337). The UserOp Mempool allows users to execute transactions with paymasters, enabling gasless transactions.

Despite these advantages, Smart Wallets have some drawbacks:

- They require gas to deploy, imposing additional costs on users or applications.

- They are often app-specific and lack interoperability with other dApps.

- Most users are accustomed to using EOAs.

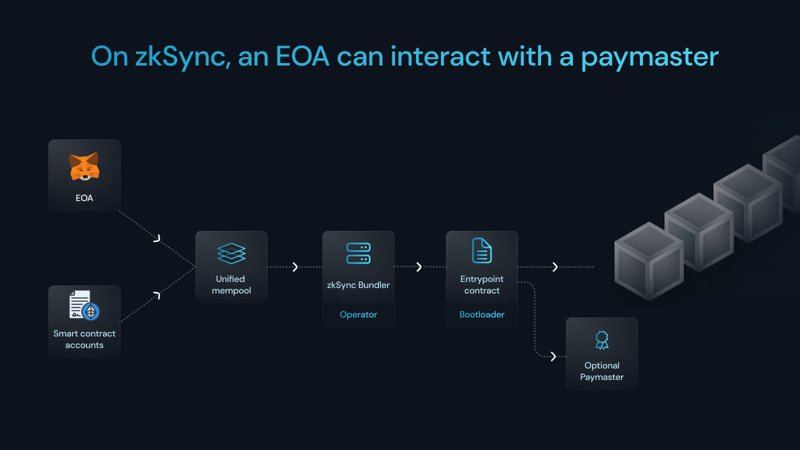

However, a key limitation is that Externally Owned Accounts (EOAs, i.e. the most common type of user wallets) cannot interact with paymasters due to technical constraints, as most EVM chains do not have native Account Abstraction (AA) at the core protocol level.

Native Account Abstraction (AA) allows EOAs to function like Smart Contract Wallets, enabling users to:

- Batch multiple transactions under a single signature (e.g., approval and swap).

- Pay gas fees using any ERC-20 tokens, and not just ETH.

- Have their transactions sponsored by third parties, such as dApps.

Now, it is important to mention how the ZKsync Team, undisputed leaders in terms of spearheading technological infrastructural innovation in web3, is the first to implement native AA, allowing all EOAs to fully benefit from Gas Abstraction on their ecosystem.

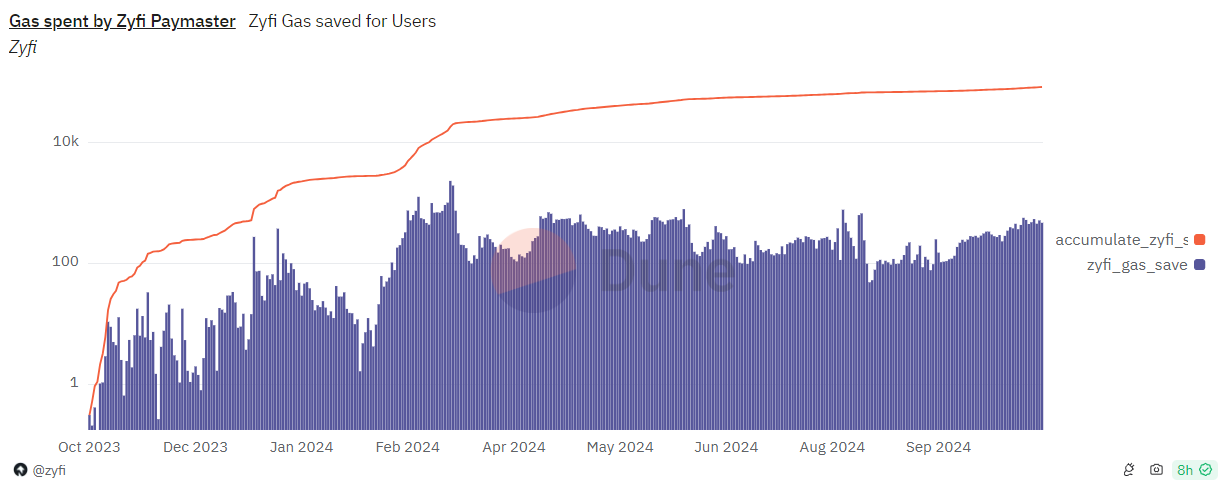

In this context, Zyfi emerges as the first paymaster-as-a-service provider on the ZKsync Era chain, sponsoring gas fees for users and enabling gas payments in any tokens.

Powered by MatterLabs, Zyfi provides a Gas Abstraction layer thought its paymaster that supports both EOAs and Smart Wallets.

ZKsync has also launched the Elastic Chain concept and Zyfi quickly decided to deploy their paymaster contracts on various Elastic Chains, becoming the official paymaster on ZKchains like Cronos zkEVM, Abstract, and Nodle.

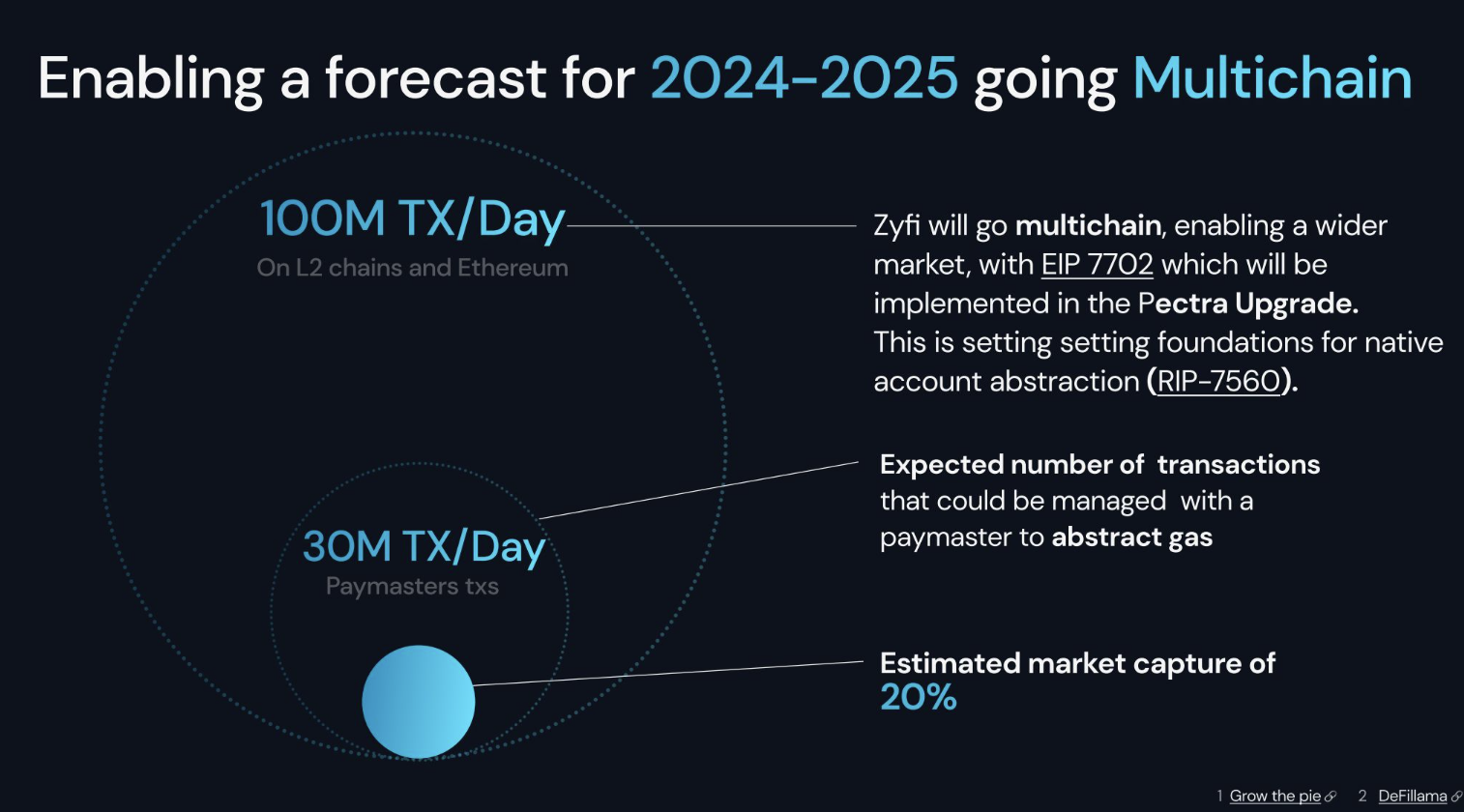

Zyfi is also poised to expand cross-chain once native AA will be implemented on the Ethereum mainnet (through EIPs such as EIP-7702), potentially in early 2025, allowing omnichain gas sponsorship and paymaster interactions with all EOAs.

Project Overview

Zyfi is building the best on-chain user experiences leveraging Paymasters and Intents for every Dapp on ZkSync ecosystem and, in the near future, on every chain adopting native AA.

Zyfi focuses on flexibility and ease of integration through their API.

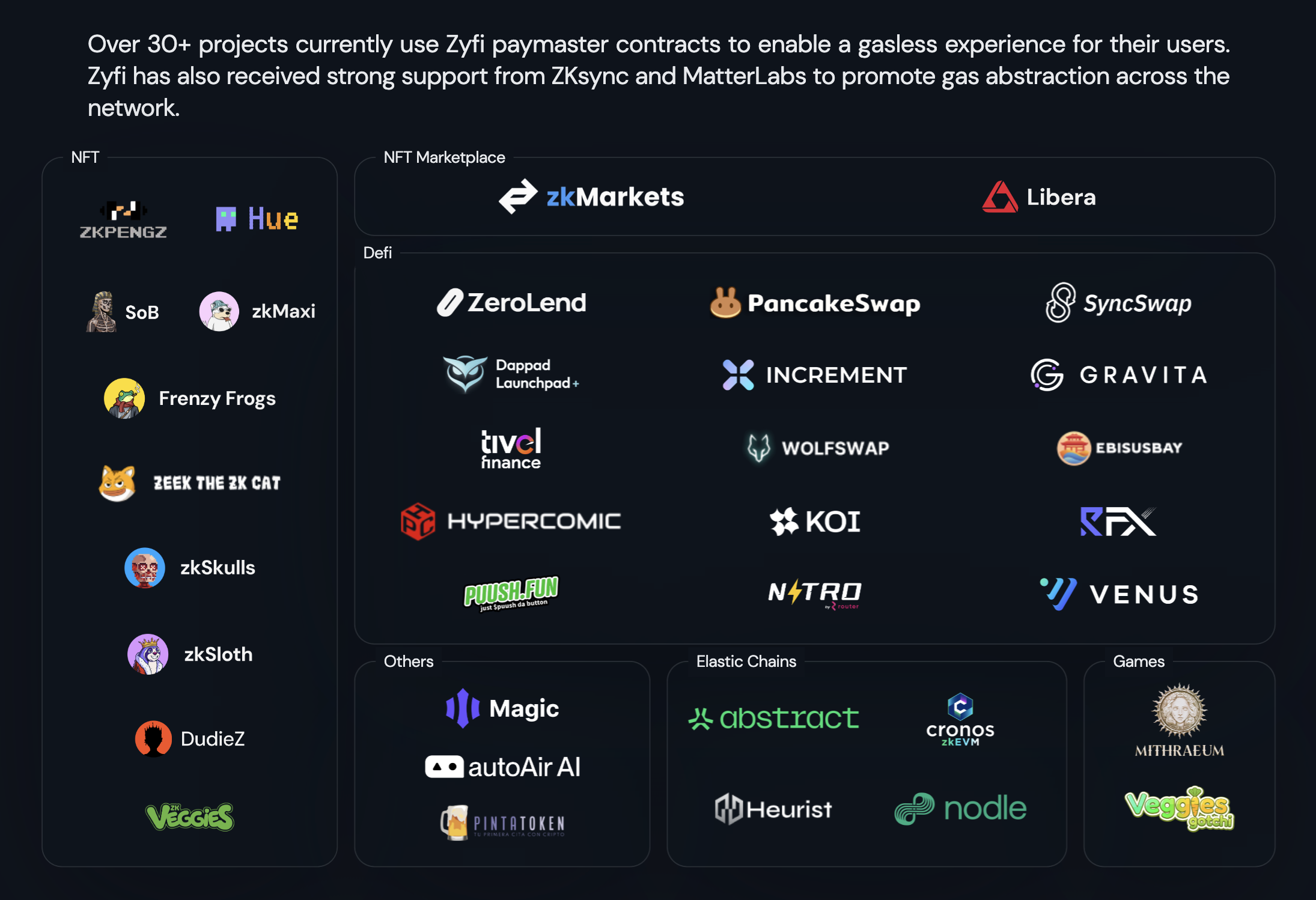

The Zyfi paymaster is already finding product market fit, on a B2B standpoint, because already integrated into 40+ Dapps including: Venus, Pancakeswap, SyncSwap, Koi Finance, Zerolend, HyperComic, Gravita, and many more.

DApps can either propose to their users to pay with any ERC-20 traded on ZKsync (currently more than 80), or decide to sponsor part or all of the transaction gas cost with their own custom logic.

Traction

Paymaster’s Integrations and NFT Partners:

Pancakeswap, SyncSwap, Koi Finance, Venus, RFX, Increment finance, Mithraeum, Zerolend, Router Nitro, Nodle, Heurist, Wolfswap, Ebisus Bay, Tivel Finance, Veggies Gotchi, Puush Fun, zkMarket, Cronos zkEVM, Abstract, HyperComic, Gravita, Libera, Hue NFT, AutoAirAI, Zeek, zkVeggies, zkPengz, DudieZ, zkSkull, zkSloth, Frenzy Frog, SoB, zkMaxi.

Usage Overview:

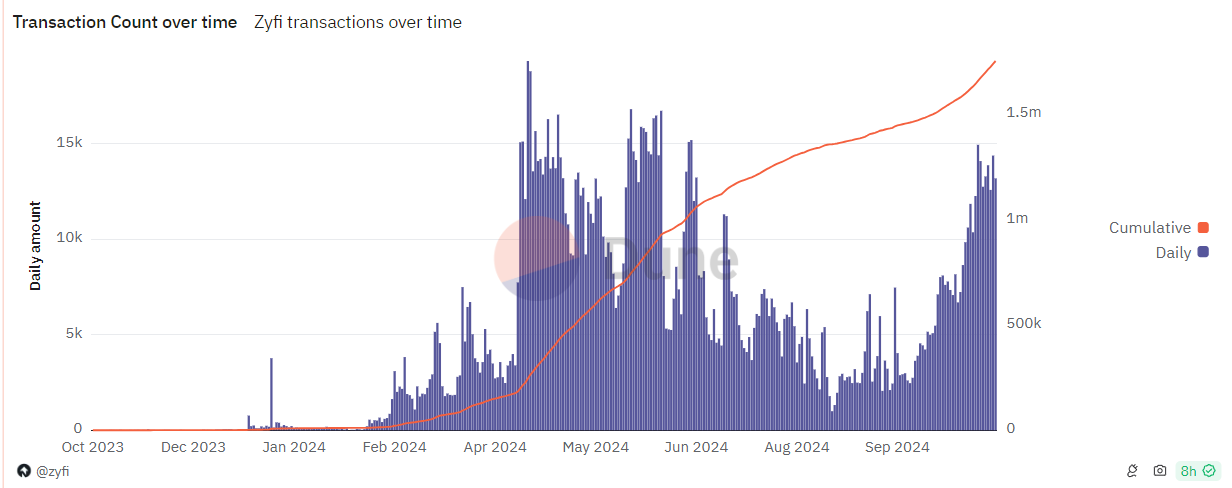

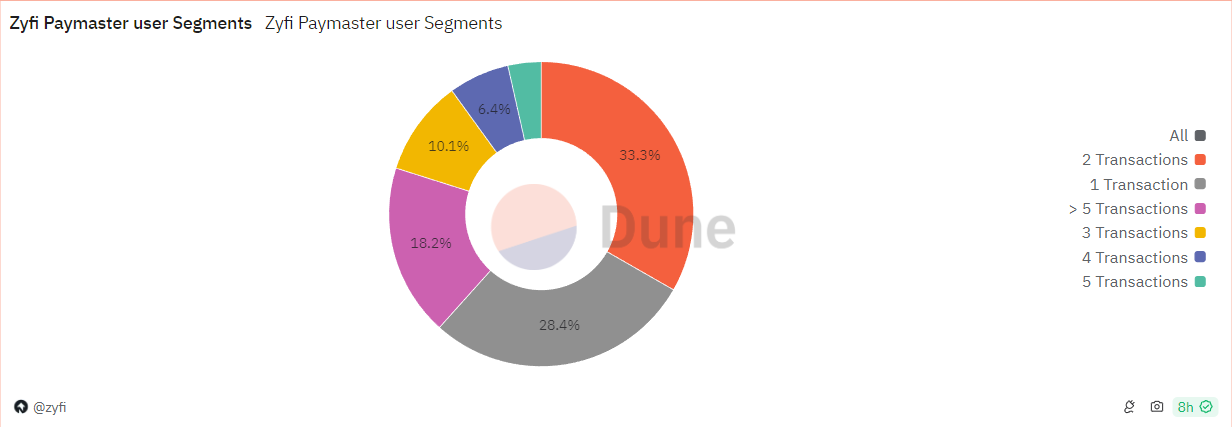

Total Amount of Transactions: 1.7M+

Total Paymaster Users: 220k+

Additional Notes:

- Received 2 Grants from ZKsync.

- Gas Grants: Currently there is a $50K USD pool of incentives/ gas subsidies live, ranging from $500 to $5,000 offered by ZyFi to projects that integrate their paymaster on a FCFS basis over the coming weeks.

- Quests Dashboard: 10% of the ZyFi’s total token supply will be allocated as rewards to their community. The Zyfi Quests Dashboard, thought to distribute points to the biggest spenders on Zyfi’s paymaster, will be among the premier platforms closely monitored for these rewards.

Project Breakdown

Zyfi’s Paymaster(s)

ZKsync is the first EVM-compatible layer 2 that supports account abstraction at the core protocol level. This enables EOAs to send transactions gaslessly on zkSync through any wallet (Metamask, TrustWallet, Rabby, etc.).

Leveraging this, ZyFi has built three main products to enable Gas Abstraction on ZKsync:

- Seamless, flexible, and audited erc20_paymaster and erc20_sponsored paymaster with APIs to enable users to pay with any token as gas and to benefit from sponsorship logic provided by DApps.

- A Permissionless Multi-signer Paymaster allowing multiple parties to collectively sponsor gas fees in using their own API or the Zyfi API. (Public Good)

- An Intent function in the sponsored paymaster allowing third parties, like NFT collections, to sponsor gas on any integration partner’s front-end.

The Zyfi API:

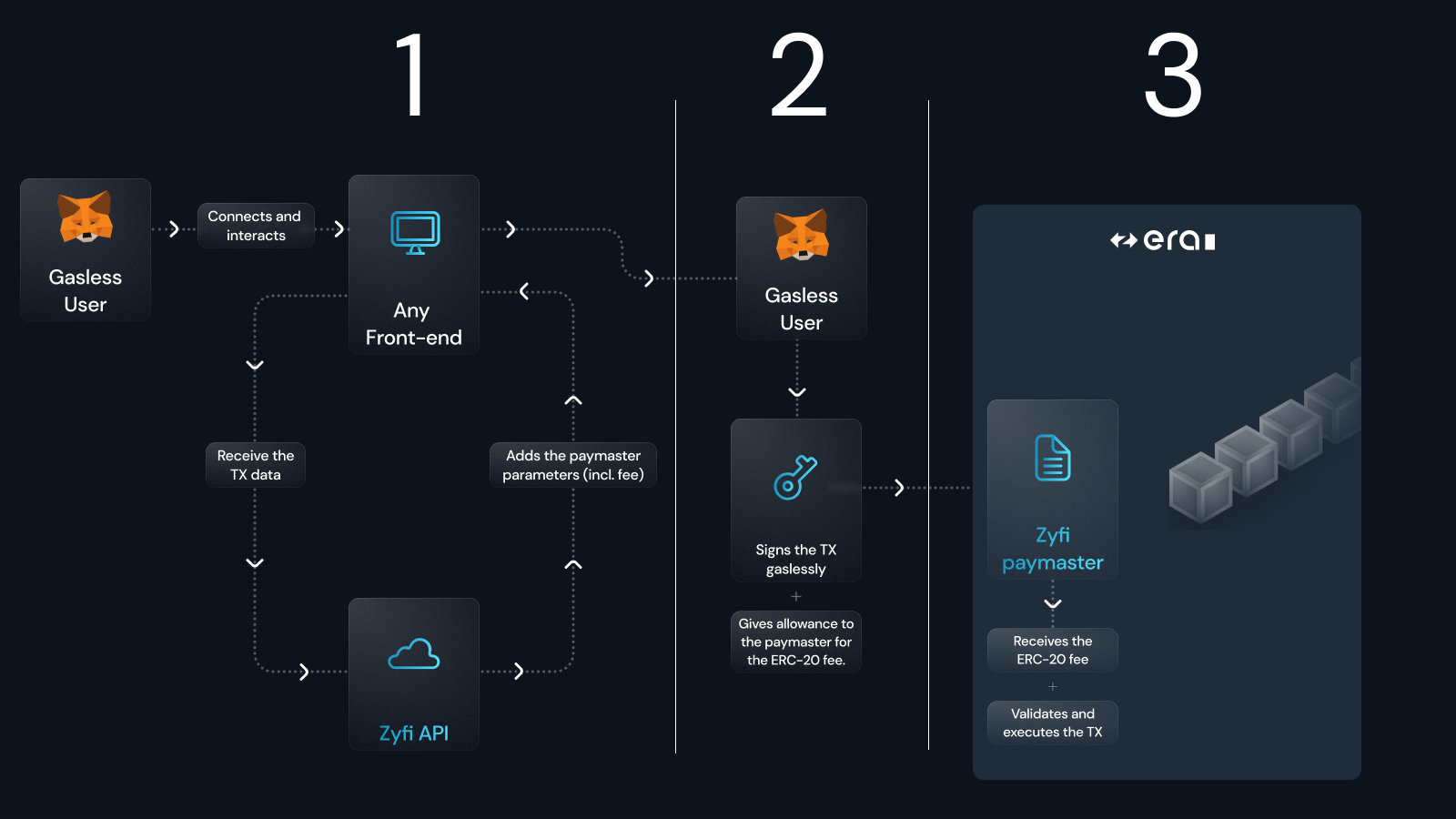

The Zyfi Application Programming Interface (API) enables seamless integration between Zyfi’s paymaster and the frontends of connected dApps. It collects user transaction data and permissions to execute transactions. The process works as follows:

- The paymaster API interacts directly with any front end. It receives the transaction data and adds the paymaster parameters including the fee token on the ERC-20 that will be used to pay for the gas costs.

- User signing transaction data. The user then signs a gasless transaction and gives the allowance to the paymaster for the ERC-20 fee.

- Paymaster execution. The Zyfi Paymaster then receives the ERC-20 fee to validate and execute the transaction while paying the ETH gas fees for the end user

1. Retrieving Transaction Data from the Frontend

Zyfi's API seamlessly integrates with the front-end of any platform, whether it be a DEX, NFT marketplace, DeFi protocol, or gaming dApp. Upon connection, the API retrieves the necessary transaction data requested by the user. It then calculates the gas fee based on the ZKsync network and fetches the current off-chain price of the selected ERC-20 token for gas payment. The API completes the transaction data by incorporating the ERC-20 token fee, preparing it for acceptance by the paymaster, and returns the finalized data to the front-end for user approval.

2. User Signing the Reconstructed Transaction

Once the transaction data is updated, the front-end presents it to the user for review. The user signs the off-chain transaction, which includes the updated details, granting the paymaster permission to utilize the ERC-20 token for gas fees. This signed transaction gives Zyfi's paymaster the necessary allowance to proceed, provided the user holds sufficient ERC-20 tokens to cover the gas costs.

3. Execution of the Transaction

Upon receiving the signed transaction data, Zyfi’s paymaster processes the transaction by verifying the ERC-20 token fee. Once validated, Zyfi executes the transaction on the user’s behalf by covering the required gas fees, ensuring a smooth and efficient transaction completion.

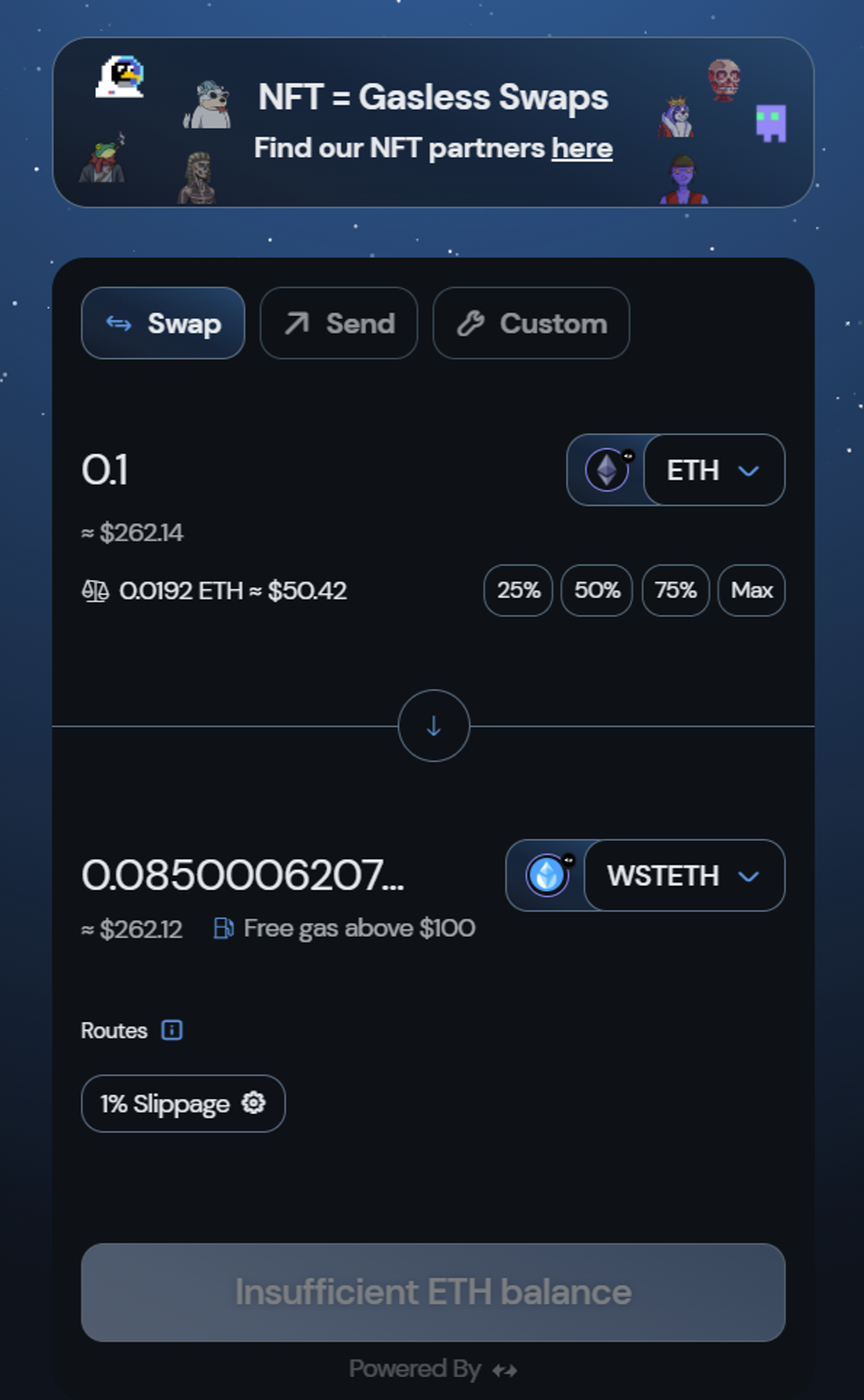

Zyfi’s Gasless Swap

ZyFi has also built a Gasles Frontend , that allows users to swap tokens on ZKsync benefitting from significant gas savings.

Features

The main feature of Zyfi is to provide gasless experiences on any type of wallet available today (EOA/Smart wallet) on all ZK Chains, including ZkSync Era, Cronos zkEVM, Abstract Chain, and more to come. Our partners and we, with our own front-end, can offer gasless swaps and various sponsorship logics.

- Enjoy a simple and basic gasless swap.

- SyncSwap example

- PancakeSwap example 1, example 2

- Enjoy gasless LP activities (Deposit into a Pool, Withdraw, Collect Rewards).

- Koi Finance example

- Enjoy gasless swaps or transactions linked to specific sponsorship logics (e.g., hold an NFT, buy a certain threshold of a specific token, based on your trading volume).

- NFT example

- Zyfi front-end threshold (All swaps above $100 are gasless):

The second main feature is an innovative intent-adjacent function for Dapp partners to offer free transactions or any type of on-chain actions using a CheckNFT:True function in the API call.

- An intent-adjacent function CheckNFT:True enables cross-sponsorship with other platforms.

- zkMarket activated it to offer gasless swaps to zkSloth holders

The last but not least feature of Zyfi’s product is to allow users to pay with more than 80+ tokens as gas on all ZK Chains, including ZkSync Era, Cronos zkEVM, Abstract Chain, and more to come.

- Let users of a Dapp pay with more than 80 tokens as gas.

- Zyfi front-end

- Zyfi paymasters deployed and integrated by more and more apps on all ZK chains:

- Partnership with Ebisus Bay on Cronos zkEVM

- Partnership with Wolfswap on Cronos zkEVM

- Deployment of Zyfi’s paymaster contract on Abstract testnet

Product Use Cases

These are some of the example use cases that the ZyFi paymaster unlocks:

Address Whitelisting

- Purpose: To streamline transactions by allowing only pre-approved addresses to initiate transactions that the paymaster will sponsor.

- Implementation: The list of addresses is maintained on the frontend (client-side). The system can be designed to only sponsor gas for transactions initiated from these whitelisted addresses.

- Benefit: Eliminates the need for on-chain transactions for address verification, reducing costs and enhancing efficiency.

Contract-Based Sponsorship

- Purpose: To sponsor transactions related to specific contract interactions, such as token approvals or interactions with newly introduced products.

- Implementation: The sponsorship is applied to all approval transactions of a particular token or any interaction with specific contract functionalities, managed from the frontend.

- Benefit: No on-chain transactions are needed to implement changes; updates are made in the signing logic, which simplifies the process and reduces transaction costs.

Exclusive Events

- Purpose: To offer gas sponsorship during special events organized by the DApp, like anniversaries, token launches, or real-life gatherings.

- Implementation: Custom business logic can be created on the Dapp side to handle such events, and a call to Zyfi API or (in case of permissionless paymaster managed by Dapp) signer will only sign for those transactions.

- Benefit: Enhances user engagement by reducing the cost barrier during special promotions or events, encouraging participation without worrying about gas fees.

NFT Sponsorship

- Purpose: To reward NFT holders by allowing them to perform transactions without paying gas fees.

- Implementation: Holders of a particular NFT collection can transact gaslessly, facilitated by the Zyfi API or permissionless paymaster.

- Benefit: Encourages ownership and active participation within the NFT community by reducing the cost of transactions, which can be particularly appealing in permissionless and public good contexts.

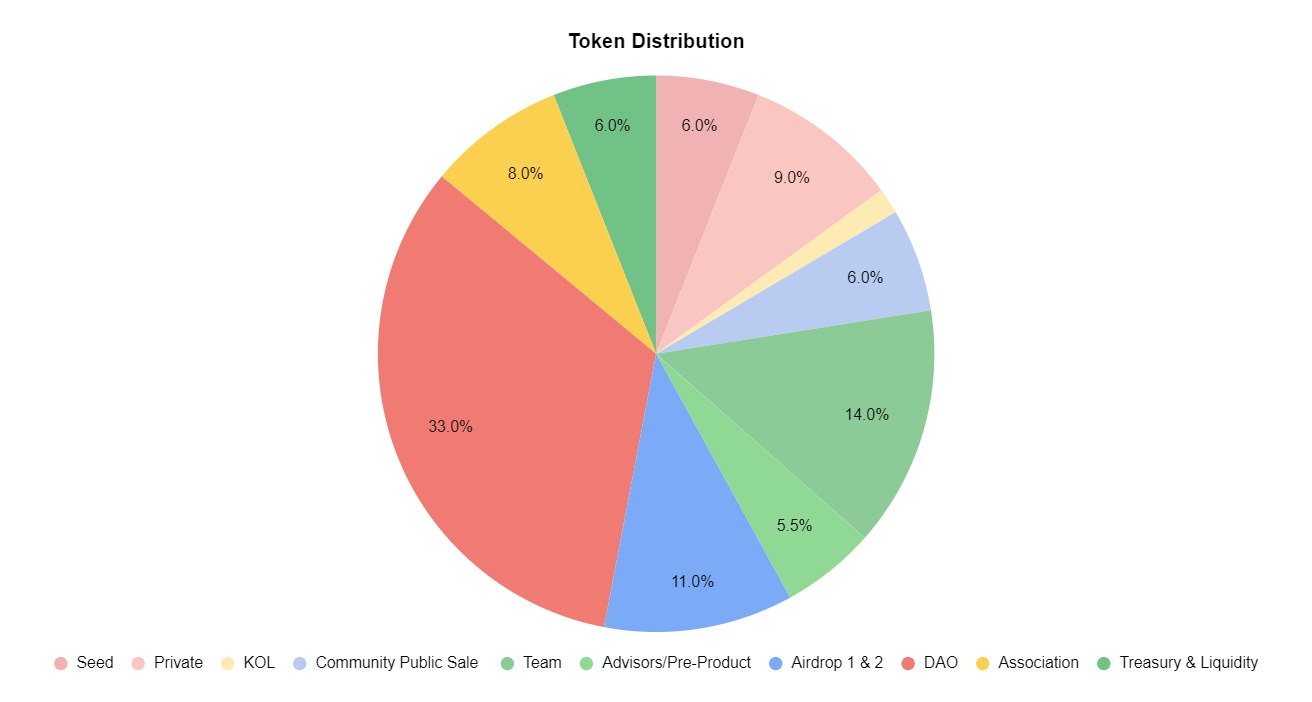

Tokenomics & Revenue

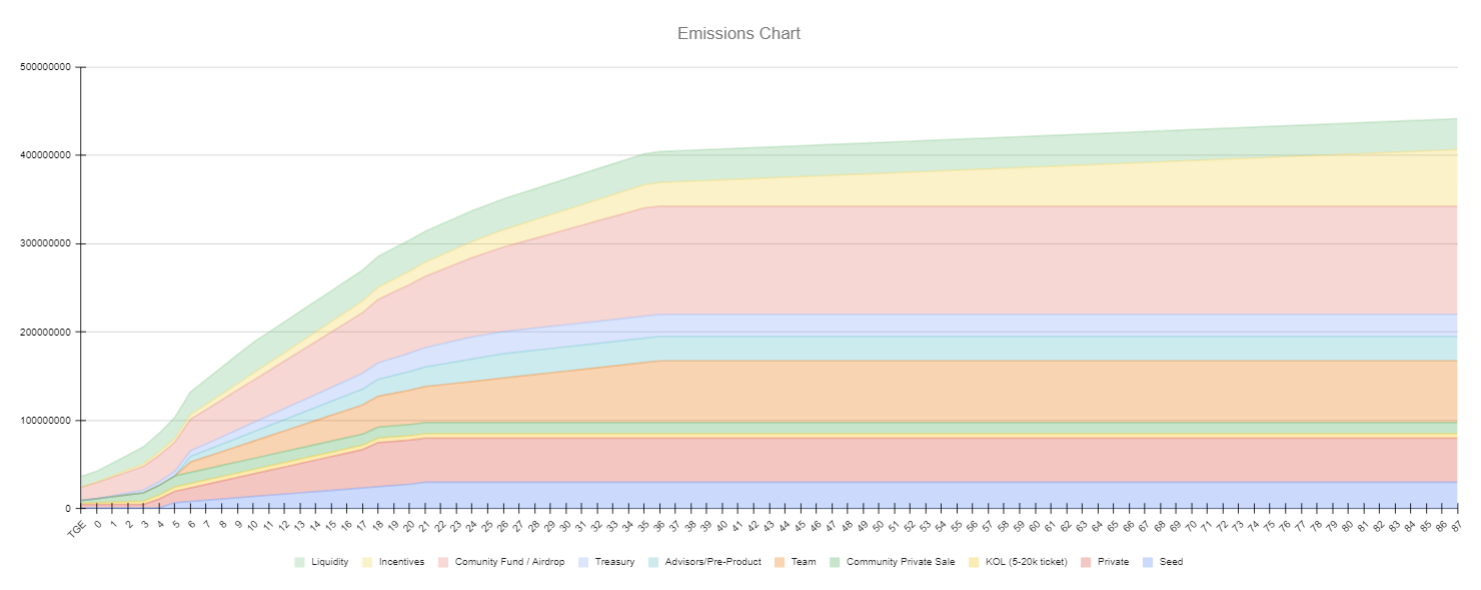

Tokenomics:

Token Utility:

The Project will be divided into two main components: ZFI and stZFI assets.

ZFI, Utility Token: ZFI tokens can be used to pay for gas fees on the Zyfi platform and Zyfi’s integration partners. Holders who choose to pay gas fees with ZFI benefit from a direct 20% discount on the total gas cost, making transactions more cost-effective. It's also the only way to access stZFI.

- $ZYF

- Liquid Token

- Discounts on Gas

stZFI, Governance Token: Holding and staking ZFI tokens allows users to actively participate in Zyfi governance, with 33% of the total supply under their control, influencing key decisions such as fee activation, reward allocation and grant distribution. Stakers will also earn an APY in Zyfi staking points based on their staked amount

- $stZYF

- Staking

- Voting power on fee mechanism

- APY in staking points

Revenue Model:

- Monthly subscription fee to the API. (e.g. 100$ for every 10k txs)

- The zyfi.org Frontend collecting a 0,15% swap fee.

- The DAO is going to be able to independently vote over turning the “fee switch” on for $stZFI, unlocking up to 50% revenue sharing.

- The ZyFi paymaster itself is not charging any fee currently, but up to 100% markup to the gas fees could be charged, according to DAO governance decision.

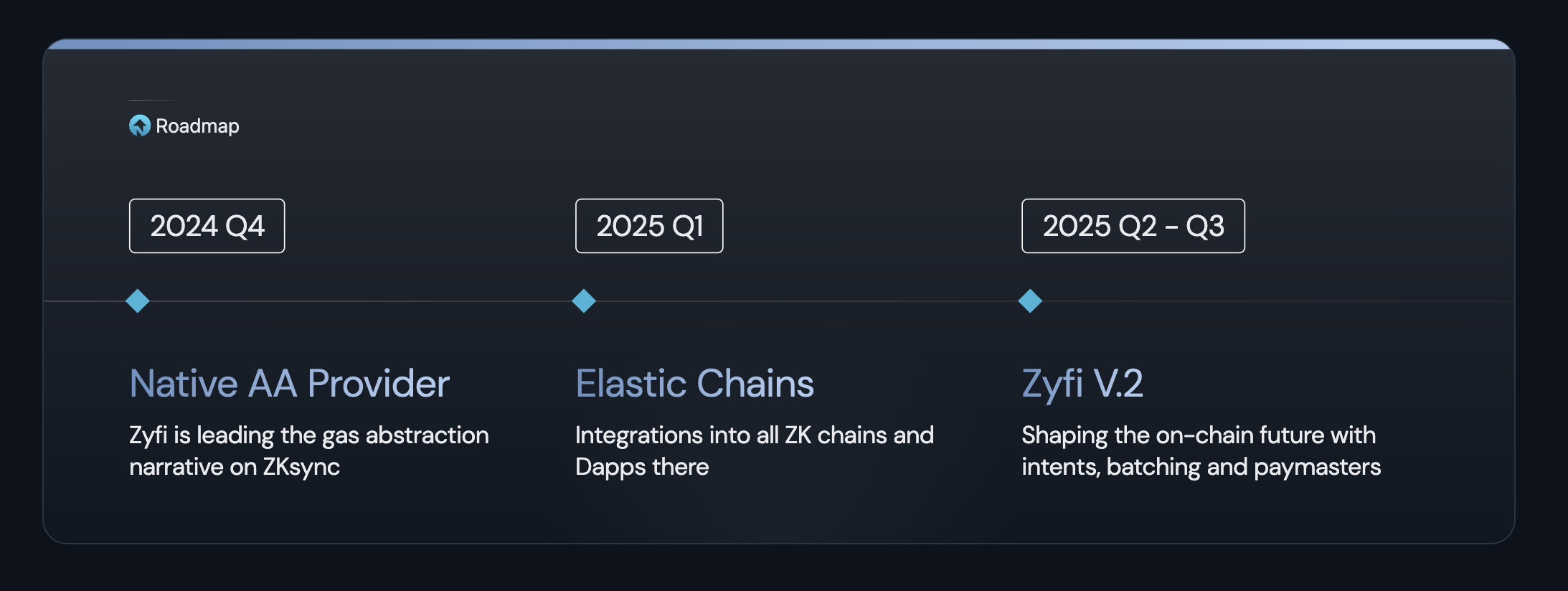

Roadmap

Over the past year, Zyfi has been leading the gas abstraction narrative on ZKsync, collaborating with over 30 DApps and facilitating more than 1.7 million transactions.

In parallel, ZKsync has introduced Elastic Chains, a scalable ZK chain network designed for interoperability and a seamless user experience. Building on this foundation, Zyfi has already partnered with Cronos zkEVM, Abstract, Heurist, and Nodle to ensure the best possible on-chain experiences.

By pioneering gas abstraction and paymaster solutions, Zyfi has gained valuable insights into shaping the future with ZKsync and the broader ZK ecosystem. Zyfi is actively implementing new features like Intents and transaction batching to still deliver the best on-chain experience across more and more DApps and ZK chains.

Competitive Landscape

Although nascent and native to ZKsync, Zyfi is already scoring with 1.7M txs.

Here you can find a comparison of how it scores against industry leaders such as Biconomy, Alchemy and Pimlico.

These are the Fully Diluted Valuations, for comparison:

- Biconomy: 208M+

- Alchemy: N/N (no token available)

- Pimlico: N/N (no token available)

Below you can also find a table summarizing the total market penetration for all of Zyfi’s Paymasters’ addresses, together with the ranking comparing them to other competitors on the chain.

The Cumulative Rank for Zyfi is n°3

Source (Updated: 10/22/24)

Core Team

Investment Thesis

Current wallets and Externally Owned Accounts (EOAs), are still a massive barrier to entry for new users looking to enter the web3 space, and as such infrastructure in the form of Account and Gas Abstraction is crucial for driving adoption and allowing the next wave of users to be onboarded into various ecosystems.

ZyFi’s paymasters allow projects to subsidize gas for their community, and/or users to pay with various ERC-20 tokens (Currently more than 80), enabling gas fees to be paid with a variety of different assets, rather than all the various native gas tokens.

Because of these convenient features, ZyFi has positioned itself to be a leading player within the gas abstraction sector, with ZyFi’s tech stack and paymaster finding strong PMF and helping push over 1,700,000 transactions for more than 220,000 users on zkSync. As more Elastic chains and ecosystems continue to get integrated, the importance of having gas abstraction and other solutions for users continues to get increasingly more important.

In addition to that, once native Account Abstraction goes live on various chains, including the Eth Mainnet, Zyfi’s business will easily be targeting an even wider surface area, and capturing value accordingly.

Risk Evaluation

ZyFi’s main risk as a Paymaster-as-a-service would be in relation to smart contract risks and the security of funds. However, ZyFi has ensured that smart contract risks are being mitigated as much as possible by engaging 2 different audits, with the results and implementations of the audits being shown below.

ZyFi's smart contracts are designed to be immutable, significantly enhancing their appeal for several critical reasons:

- Audits conducted on these smart contracts remain perpetually valid, as the contracts are unchangeable and cannot be upgraded

- Users are relieved from the need to monitor for contract alterations that could potentially lead to fund losses or other nefarious consequences

- Such design choice eliminates any possibility for malicious actors to alter the code, or for external pressures (or attacks) to compel a developer to implement unfavourable updates, safeguarding against both cyber and physical threats

• Cantina Audits 1

• Cantina Audits 2

Zyfi's Links

Features of ZyFi

PancakeSwap integrates Zyfi for gas-free DeFi trading

Paymaster on ZKsync: a simple “Add-on” or a priority “UX

Introducing — A “one-for-all” permission-less multi-signer paymaster

Zyfi paymaster tutorial is now approved by the @zksync community page

ZK-Powered Chains: Huerist, Nodle, Space x Time, ZyFi

Experience a FREE on-chain world during Zyfi's DeFi stage

New Integration: @Zyfi_org X @syncswap

Enjoy gasless transactions now with @PancakeSwap on @zksync

New integration: @Zyfi_org X @koi_finance

Gas-Free Swaps above $100 are back!

Cross partnership @zkmarkets X @zkSlothNFT X @Zyfi_org

How to enjoy a paymaster transaction

New Integration: @Zyfi_org X @EbisusBay

New Integration: @Zyfi_org X @wolfswapdotapp

About ZyFi

ZyFi is the leading Gas Abstraction layer on ZkSync leveraging Intents and Native Account Abstraction for every wallets (EOAs and smart wallets included) to allow users to pay gas fees with any token and Dapps to sponsor transactions for their users based on custom logic.

Website | Docs | Twitter | Youtube | Discord

About Impossible Finance

Impossible Finance is the go-to crypto investment platform that empowers you with high-quality, fair and accessible crypto opportunities. We simplify DeFi so you can enjoy fairer investing, cheaper trading and better yields through our accelerator, launchpad, and swap platform.

Website | Twitter | Discord | Telegram | Blog

Disclaimers

Composed and presented by Impossible Finance Research Team based on information provided by ZyFi team.

- Notes: DISCLAIMERS, TERMS, and RISKS

- Risk Warning: Trading and/or generally investing in any cryptocurrency involve significant risks and can result in the complete loss of your capital. You should not invest more than you can afford to lose and you should ensure that you fully understand the risks involved. Before investing, please consider your level of experience, objectives, and risk tolerance, and seek independent financial and legal advice if necessary. It is your responsibility to ascertain whether you are permitted to use the services of Impossible Finance based on the legal and regulatory requirements of your country of residence and/or applicable jurisdiction(s).

- The information provided on this memo does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such. Impossible Finance does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

- The details provided in this document are summarized from materials provided in due diligence from ZyFi team to Impossible Finance