A Deep Dive into Chronos Finance

Dive into Chronos Finance, Impossible Finance's latest partners on Arbitrum! Chronos is a community-led liquidity layer and AMM taking making waves in the Arbitrum network.

Hey Penguins!

Just recently, we announced our liquidity partnership with Chronos Finance. This post aims to provide further context about our partnership; detailing our quest to improve & expand liquidity, and the goal to nurture our budding network within the Arbitrum ecosystem.

With this in mind, we will explore the following key-drivers that motivated our decision to partner with the newest liquidity layer on Arbitrum:

- Generalized success of Solidly-inspired exchanges

- Chronos as a key competitor in the battle to become Arbitrums leading DEX

- Partnership model with high-alignment

Solidly-inspired DEXes

Solidly is a decentralized exchange protocol first designed by DeFi architect, Andre Cronje, who was looking to bring a new AMM and tokenomics design that would allow traders, protocols, liquidity providers (LPs) and token holders to align themselves towards the construction of a sustainable (and profitable) trading platform.

Solidity took inspiration from Curve which lock up tokens CRV for veCRV a model that made significant steps into solving the inherent challenge of governance token utility in DeFi by:

- Giving users a share of trading fees

- Voting rights

- Incentive boost on LP rewards

Key characteristics of the original Solidly design include:

-

Support for trading both volatile and stable pairs, integrating UniV2 style pools with a new custom AMM curve for stable pairs (resembling Curve design)

-

Fixed and low trading fees

-

ve(3,3) tokenomics design, featuring:

- Control of protocol emissions in charge of token holders that lock their positions and use them for voting (veToken voters)

- Distribution of trading fees for veToken voters

- Gauges that incorporate the possibility of paying and receiving voting incentives

-

Go-to-market strategy based on partnering with leading protocols in Fantom's ecosystem

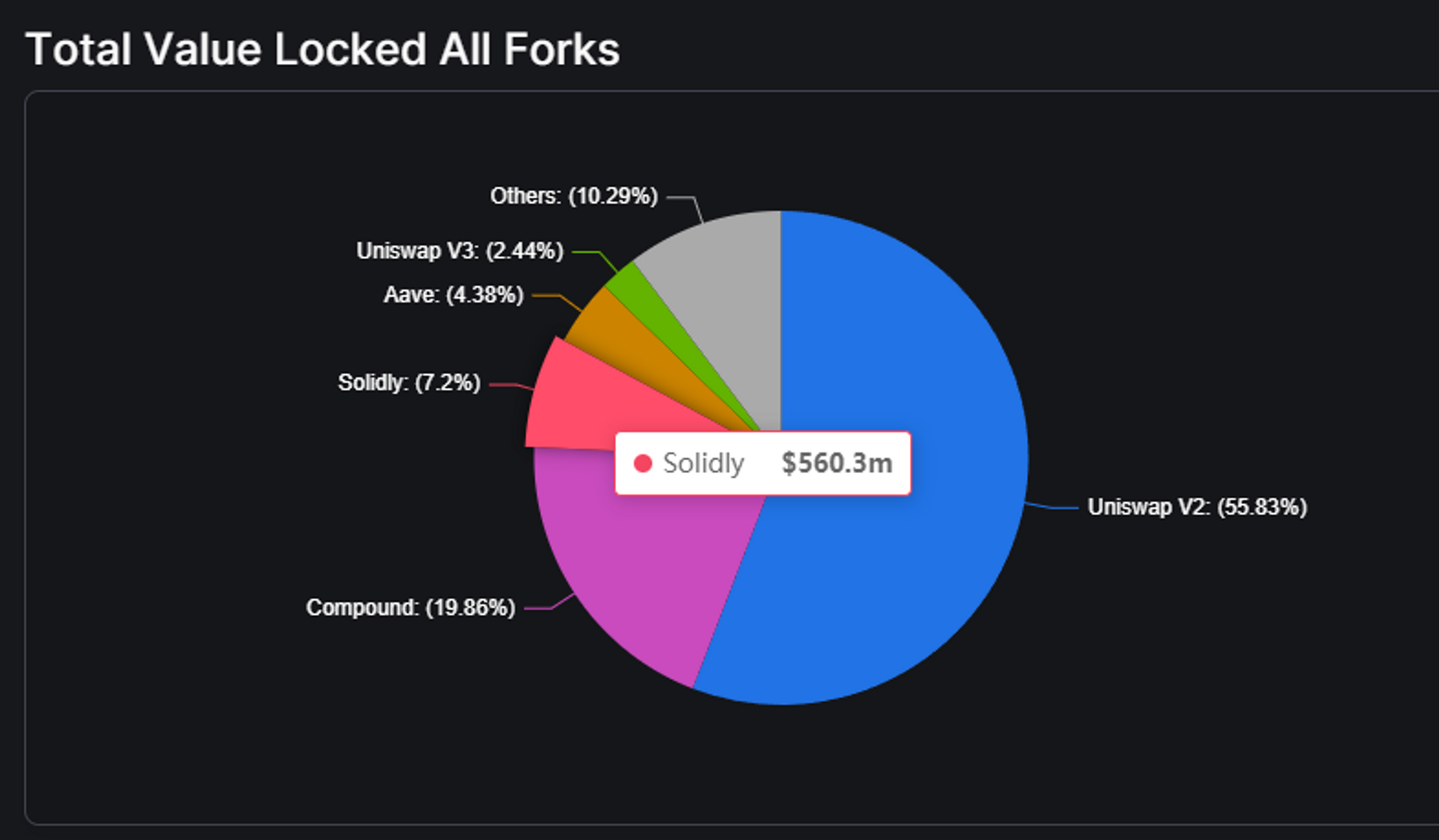

Although certain errors led to the failure of the initial deployment, teams continued to iterate and improve over the original design, leading Solidly to be the Top 3 forked codebase in terms of current TVL with over US$560M of locked capital.

Undoubtedly, Velodrome became the first successful Solidly fork by introducing some key improvements over Solidly's design, stepping up to take the leading DEX position in Optimism with currently more than US$260M TVL.

Additionally, it is also worth highlighting that Thena Finance currently ranked the #3 AMM on BNB chain in terms of TVL has incorporated:

a) NFTs as additional fundraising mechanism

b) Concentrated liquidity positions with automated management (first among Solidly forks).

Finally, it is important to observe that the ve(3,3) tokenomics has a flywheel design that requires coordination to be set in motion and aligned participants to make it sustainable. When the flywheel is functioning in full form it benefits all the key actors in the ecosystem: traders, LPs and veToken voters.

It can be observed that establishing solid relationships with partner protocols is highly valuable, since those partners act as LPs, veToken voters and incentive providers, which ensures a more reliable baseline when compared to more speculative ecosystem players.

Chronos as a Key Player

Chronos is shaping up to become one of the key competitors in the Arbitrum DEX ecosystem through its combination of proven formulas while also bringing to the table innovations to the ve(3,3) model, featuring:

-

Partnerships with key players within Arbitrums ecosystem from Day 1:

- Frax

- Rocket Pool

- Firebird

- Bytemasons

- Inverse Finance

- Liquid Driver

- GMD Protocol

- Impermax Finance

- Sphere Finance

- YieldFarmingIndex

- Granary Finance

- Tarot Finance

- Deus

- Muon

- Libera

- Impossible Finance

-

Successful use of NFT collection as means to raise funds and provide continuous support:

- Over US$3M raised

- NFT minters receiving CHR and veCHR airdrop

- NFT holders receiving 10% of revenue generated by the platform

-

Adjustment over emissions and rebase mechanisms for the ve(3,3), including:

- Reduction of rebases for veToken holders

- Bonus locked positions for early long-term lockers.

-

Novel integration of maturity-adjusted liquidity positions to incentivize sticky liquidity

- Liquidity-providers to ramp-up their staking power over time to reward long-term participants

- Liquidity positions are now tradable NFTs, so users can exit their positions while the liquidity remains at Chronos.

It is worth highlighting that while other efforts have been implemented to attract and retain liquidity, those are mainly based on offering extra-rewards for locking liquidity positions. The problem with this approach is that locked positions are inherently less-valuable than liquid positions, and as a consequence, this creates friction to attract liquidity in first place.

In turn, Chronos alternative brings a new approach that eliminates onboarding friction, as maturing LPs will trade at a premium when compared to liquid ones. In this case the friction is added at the removal of the liquidity positions, as that action will imply in a destruction of value (due to its reduced staking capacity) for the liquidity provider.

For curious minds, it will be definitely interesting to observe the dynamics of this new secondary market over maturing LP positions.

Partnership Model

The partnership model used is intended to align ecosystem participants and put the flywheel in motion. The collaboration from the selected launch partners will allow Chronos to bootstrap initial liquidity (key requirement for any DEX), to set up sustained incentives for veCHR voters, and to gain exposure to partners communities with highly active participants.

In turn, partners holding veCHR initial allocations will be able to control CHR emissions to help drive liquidity for their own pools in a sustainable way, while simultaneously being incentivized to contribute for the long-term success of Chronos.

As Chronos launch partners, the Impossible community will also benefit directly from this partnership by receiving an airdrop in the form of veCHR tokens. Please dont forget to check if you are eligible! The campaign is currently ongoing here.

At Impossible Finance we believe that this partnership will be an important step towards consolidating ourselves as a key player in Arbitrums ecosystem, expand our liquidity management strategies, and be part of the success story of a new protocol with great potential.

About Impossible Finance

Impossible Finance is the go-to crypto investment platform that empowers you with high-quality, fair and accessible crypto opportunities. We simplify DeFi so you can enjoy fairer investing, cheaper trading and better yields through our accelerator, launchpad, and swap platform.