Credible Accounts - Rewriting CA Rules in

Web3 today is like a chaotic street market: every buyer brings their own cash pile, every stall has its own rules, and no one's really sure if the deal will go through or not. There’s no universal system to exchange assets, no shared logistics layer to track what’s where. It’s all duct-taped together.

Enter: Credible Accounts, a new framework powered by @OneBalance_io turning this mess into large scale retail distribution. Its goal? To rewrite the whole UX playbook in DeFi as we know it today and bring intuitive, low-latency, risk-managed and chain-abstracted execution to the masses.

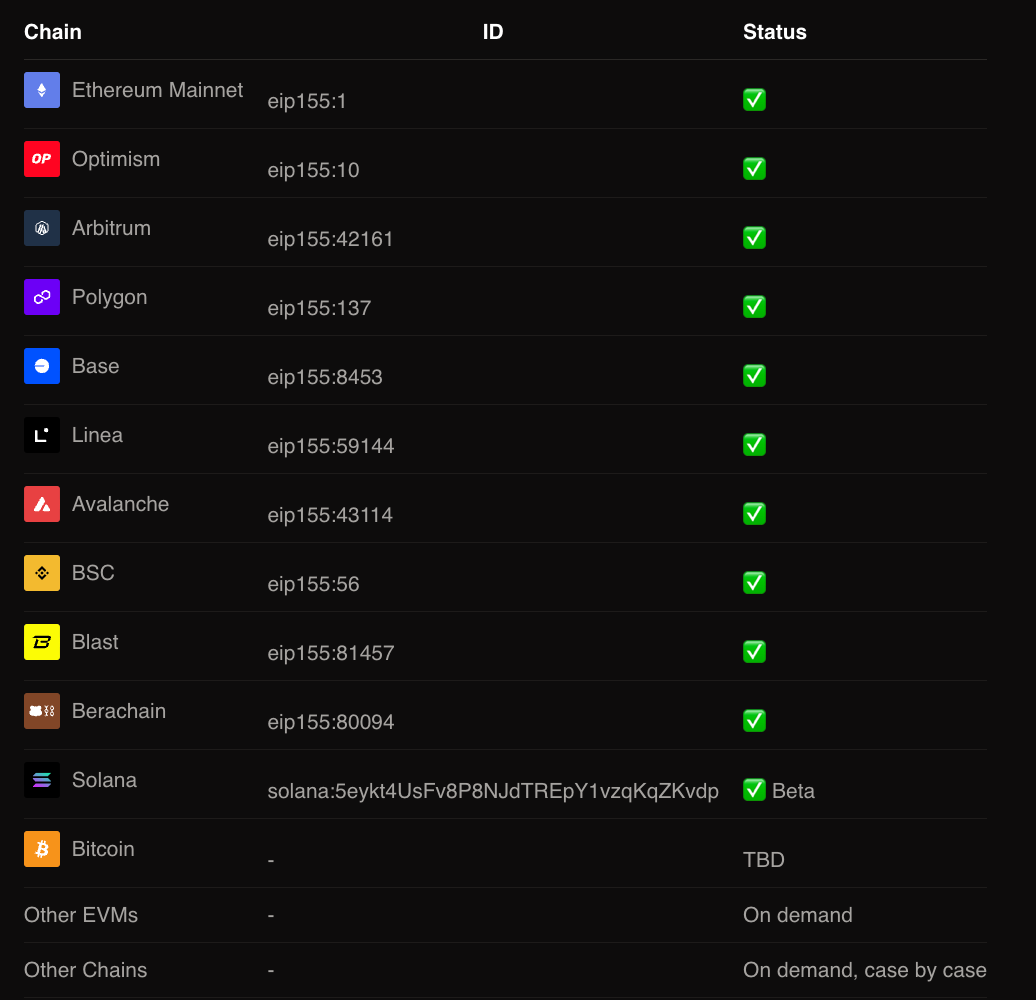

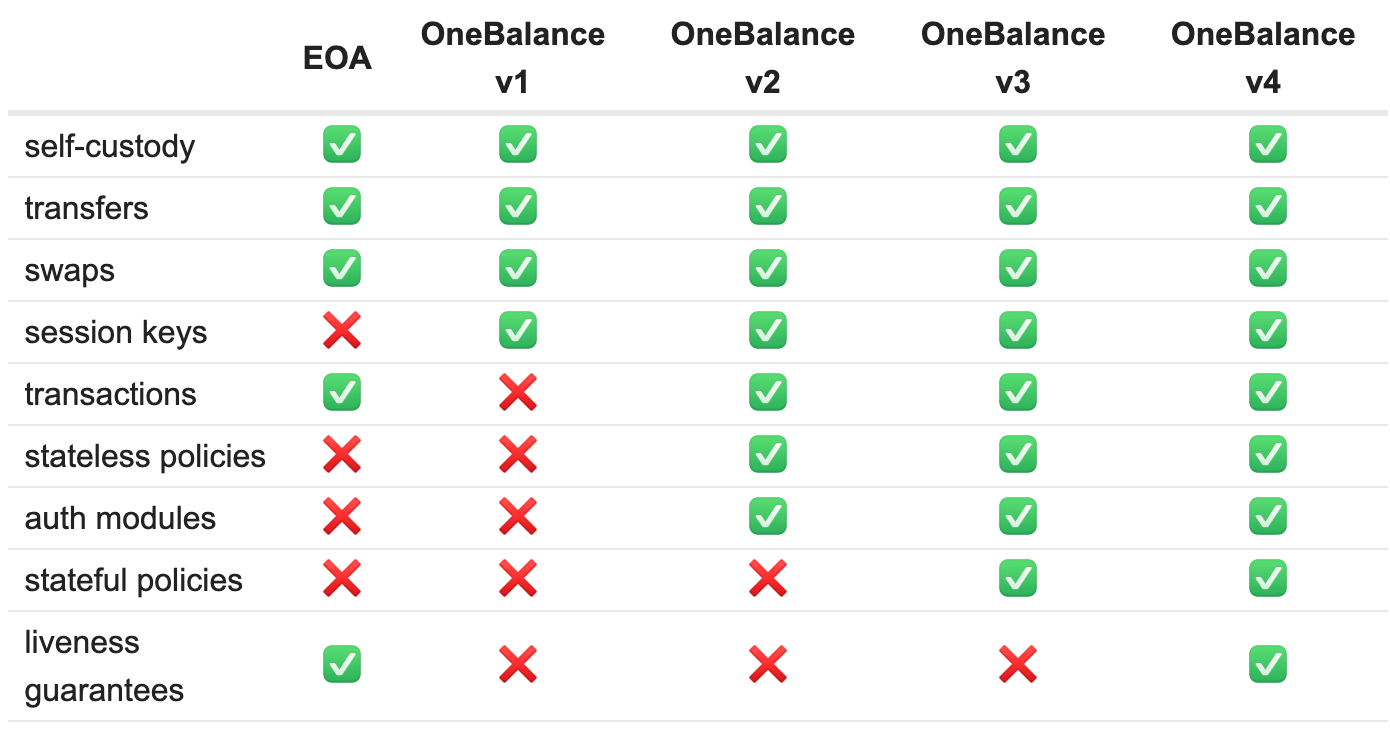

For years, crypto has been stuck in a chain-first mindset: first ETH, then Solana, L2s, other main infra competitors, etc. But the future it’s not chain-bound, but rather account-centric. Why? Because users don't want to juggle wallets, gas tokens, or manually route cross-chain ops. They just want stuff that work, seamlessly, instantly, and without worrying about what chain it's on. That’s why the conversation is shifting from which chain to which account model to rely on. Because only by rethinking accounts themselves can we move past the current fragmentation.

Chain abstraction tried to simplify the overall mess, simplifying order flow and smoothing the overall cross-chain UX. But let’s be real: CA still struggles with execution speed, and different VMs don’t play well together. That’s where Credible Accounts change the game: a new primitive built for a truly chain-agnostic experience.

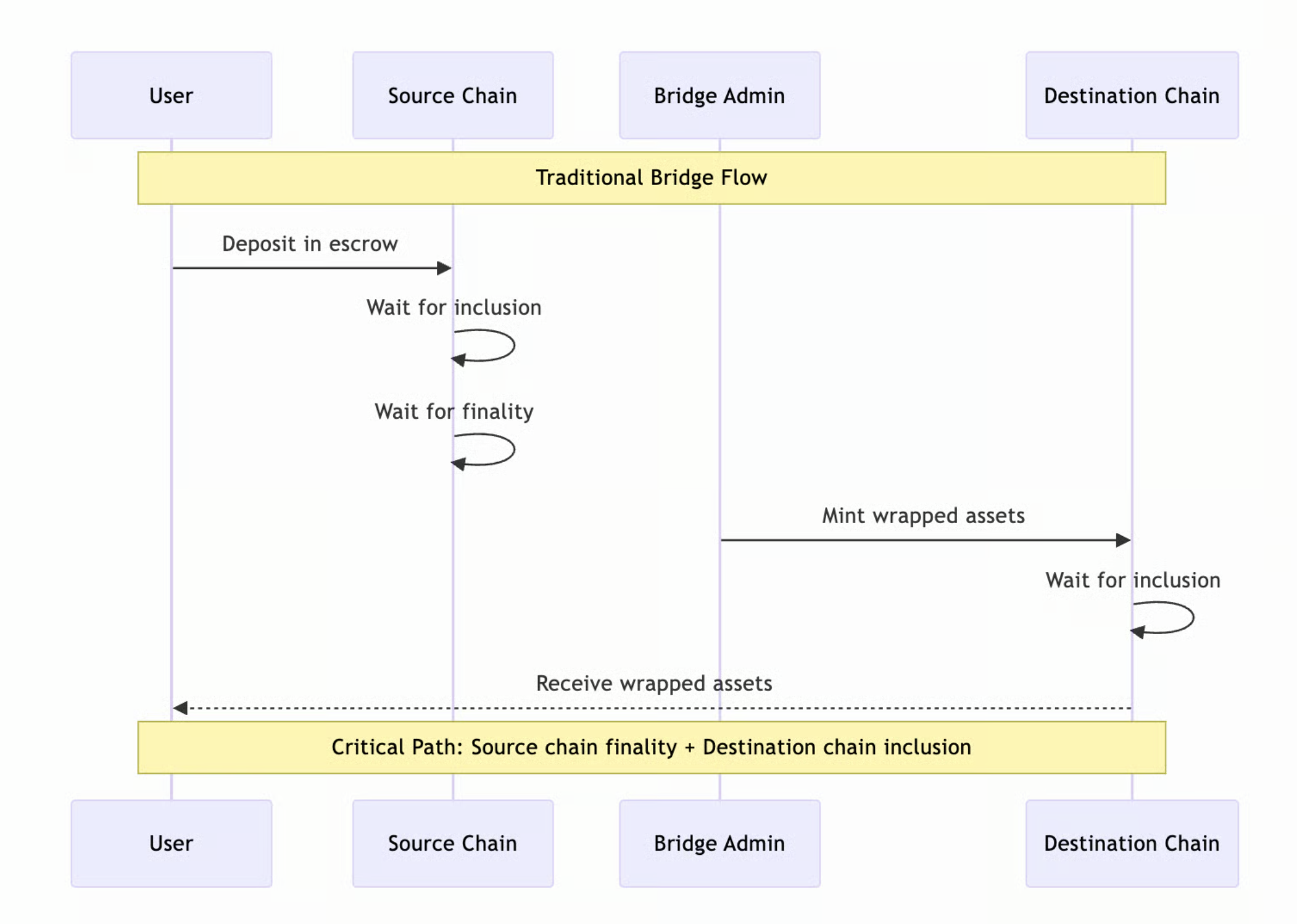

Traditional bridges (like those built on classical or intent models) must wait for finality on the source chain before completing the transaction on the destination chain. That’s slow, expensive, and limited by blockchain confirmation speeds.

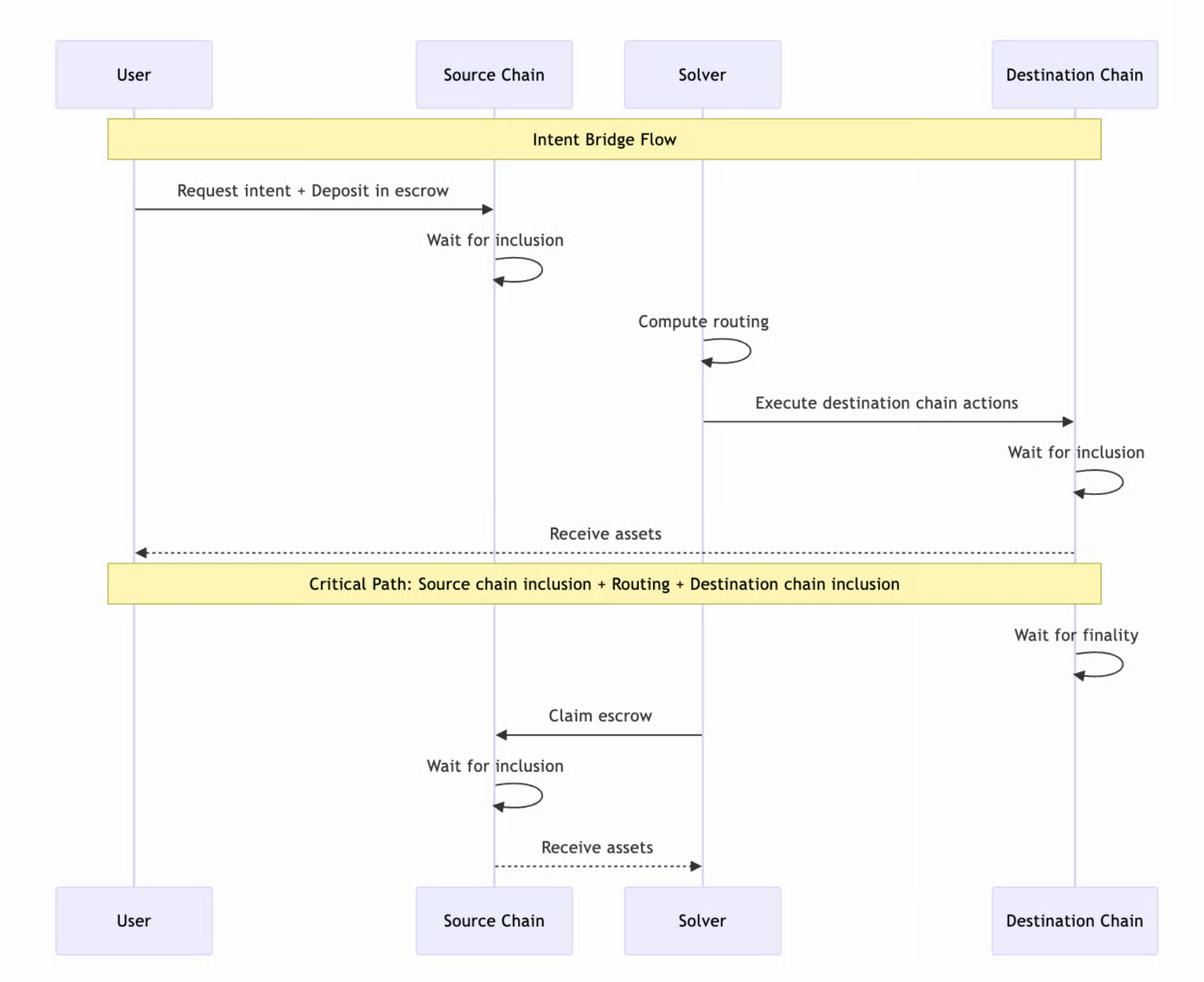

Even intent-based bridges that improve speed do so by letting solvers take on the finality risk, which opens the door to failures, slippage, or MEV exploits. They still can’t eliminate the need for source inclusion.

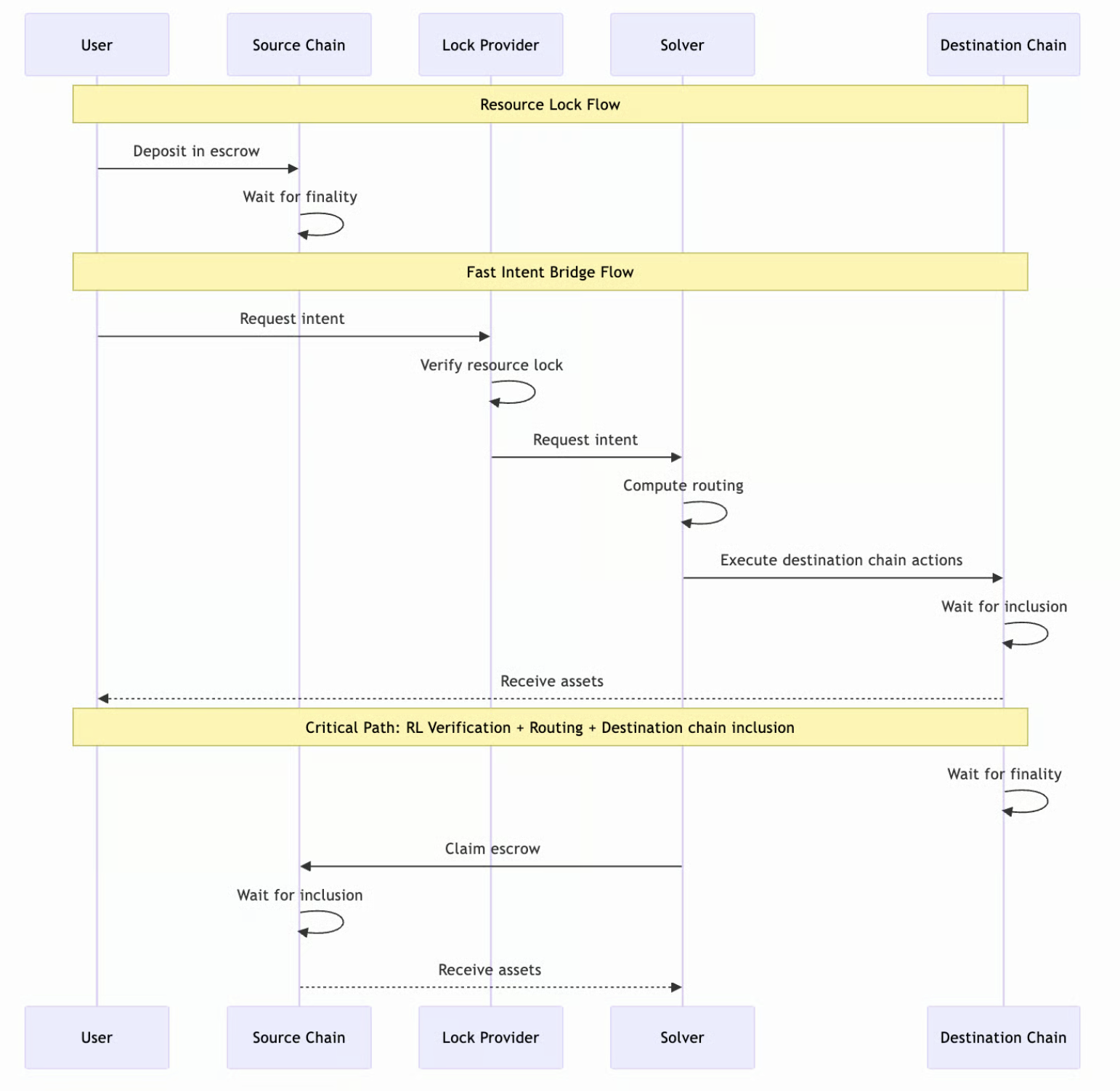

OneBalance changes the model entirely by co-signing and guaranteeing the transaction with a verified resource lock. This makes the source chain state irrelevant in real-time: as long as the lock is in place, execution can proceed safely. Using more technical language, we could say that the OB Stack guarantees through resource locks the asynchronous execution of multi-chain intents by unbundling execution from settlement.

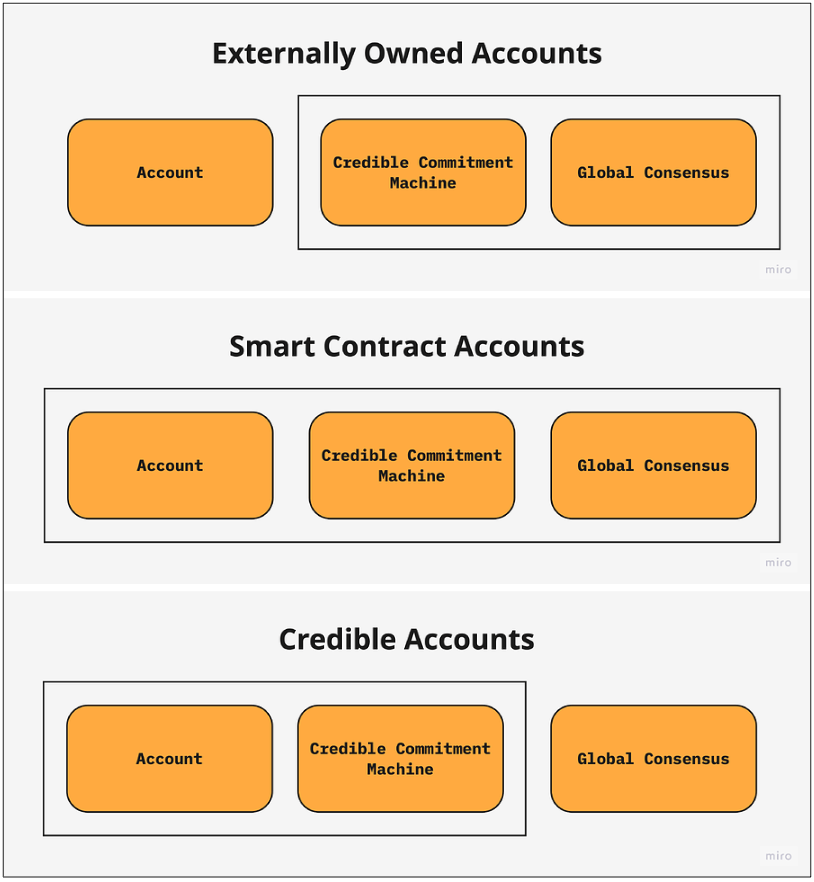

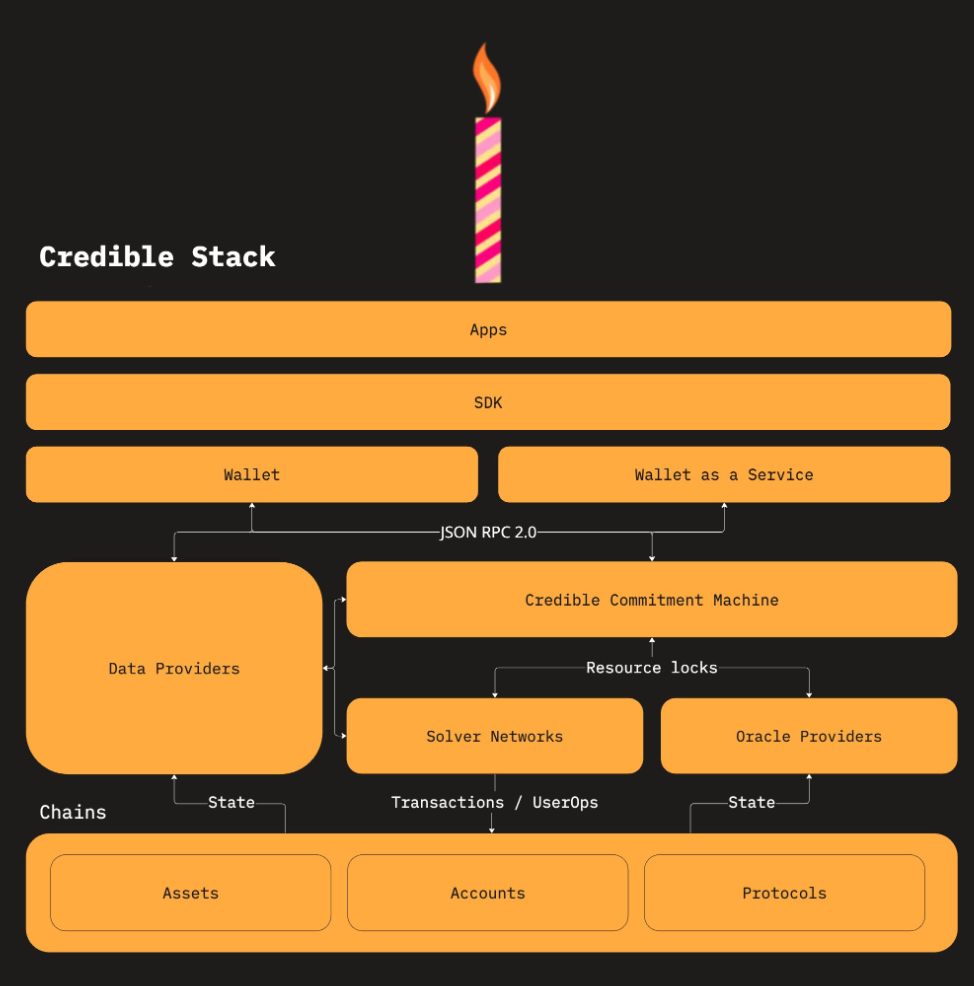

Think of a Credible Account as a supercharged smart, cross-chain wallet that:

- Lives on a secure environment (the “Credible Commitment Machine”, CCM)

- Can make strong, unbreakable promises about what it will and won’t do (credible commitments)

- Works across any blockchain ecosystems

Technically speaking, it’s a sort of individual rollup which wraps the user's state on each chain, mirrors it to a trusted virtual environment (CCM, i.e. the secure system enforcing your intent like a binding promise), and from the latter triggers state change/transition requests from anywhere to anywhere, without waiting for the source chain's finality.

You may be wondering what Resource Locks are. We are talking about a cryptographic mechanism developed by OneBalance allowing cross-chain txns to be executed asynchronously: meaning the txn can be completed on the target chain before final settlement happens on the source chain. It acts as a kind of temporary deposit / lock in a SC, so that funds can't be double-used while the OneBalance backend sorts out the multichain settlement in the background. This unlocks a near-instant UX for the user, while still ensuring everything is secure and immutable. It is at this point that the Resource Lock (RL) Service comes into play, another key component of OneBalance's backend infra that performs 4 main functions:

- Verifies → Checks the user’s balances and whether they’re locked or eligible;

- Co-signs → Adds cryptographic approval to user txns, ensuring that no one can double-spend those funds during the settlement lag;

- Guarantees → Provides security attestations to solvers, who can execute the target txn instantly even if the source is still pending;

- Tracks Positions → Monitors all unsettled positions to stay within system-defined risk limits.

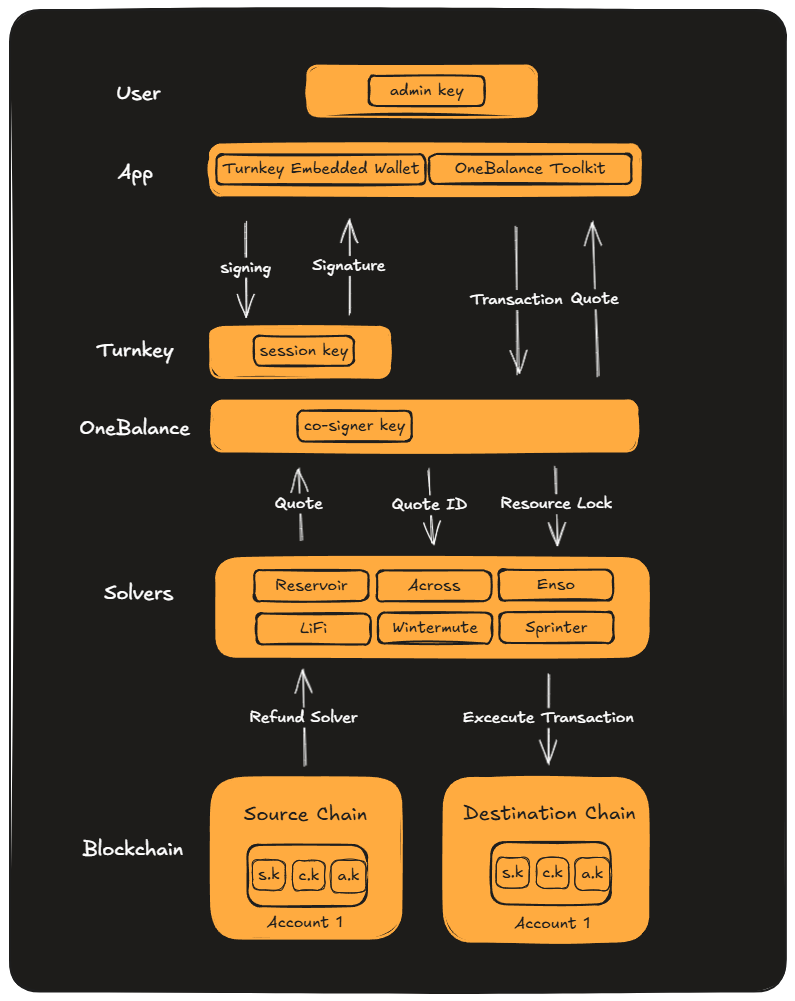

It can be useful to go through the life cycle of a txn using OneBalance stack:

a) Intent submission → The user submits a multi chain intent and funds are temporarily locked; OneBackend evaluates funds availability on each chain and defines the path to be adopted (whether Fast or Standard Path).

b) Quote phase → The solver proposes a quote (price + gas); the user signs the txn and sends it to the OB Backend.

c) Resource Locks → OneBackend forwards the transaction to the RL Service, which:

- Verifies balance and legitimacy;

- Cryptographically co-signs to prevent double-spending;

- Provides security guarantees.

d) Execution → The operation is executed by the solver:

- on target chain immediately (Fast Path)

- after confirmation on source chain (Standard Path)

How do all these technical stuff translate into practice? Credible Accounts basically allow you to:

- Send, swap and bridge tokens from any chain;

- Unify account balances (and even margins of different protocols) within a single interface;

- Skip gas headaches

- use better security and permissions (like passkeys and session keys)

- Pay for anything with any token you own

- Unlock complex use cases like trustless cross-chain trading/lending

…..at the speed of the target chain (even if the txn starts from Ethereum)

If you want to try this new infra, let me give you a quick alpha: @vooi_io has integrated it into the new Light version (and the points campaign has just started: it seems like a good shot to kill 2 birds with one stone).