Impossible Cloud Network Research Report

Context

The global cloud services market is anticipated to grow substantially by 2034, with projections estimating it will ~5x in size, reaching a total addressable market of $2.7 trillion, making it one of the fastest growing trillion-dollar markets in the world.

This growth is driven by the rise of transformative technologies such as generative AI, edge computing, 5G, VR/AR applications, and real-time analytics, causing an explosion of stored data volume, altogether with an increase in business and enterprise adoption across all industries.

Despite the vast potential, the cloud market is predominantly controlled by a few large corporations, such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform.

This is leading to a number of concerns:

- This Oligopolistic regime is leaving customers and developers facing high costs, vendor lock in, data privacy and security risks

- The heavy focus on the US for the geolocation of the datacenters is posing security concerns due to the US cloud act, allowing US government organizations to look into all the data stored within US cloud companies

- High market entry barriers for new cloud companies, such as the amounts of capital required to compete effectively and at scale with the dominant players, averaging CapEx at $20-$50 billion annually to fund new hardware, infrastructure, and data centers.

- Dominance by a few large players stifles innovation.

- Scalability issues to handle the growing demand for distributed and localized computing power required by emerging technologies like AI and edge computing.

AWS, for instance, is already restricting power-hungry instances that make use of GPUs in certain locations like Dublin due to power limitations.

In cities, like Frankfurt, data center operators reported that limited power availability poses significant planning risks.

A decentralized cloud ecosystem, built and owned by many, could effectively address the challenges mentioned above.

Decentralized solutions (e.g., IPFS) are better equipped to address energy consumption, power limitations, and data locality challenges by moving processing closer to where the data is stored.

Cloud DePINs (such as ICN, Akash, Filecoin, Aethir, and Dfinity) feature distributed hardware ownership and geographically dispersed infrastructure that can reduce peak power demand on the local power grid and reduce the cost of ownership, hence addressing scalability issues.

DePINs also offer a practical solution for the substantial hardware investments needed to compete with incumbents, and, at the same time, incentivize innovation.

Despite these facts, and while having built supply-side capacity, most web3-based Cloud DePINs are still searching for product-market fit and are lacking real-world demand (Depin.ninja reports an aggregated $12.3M in ARR for the whole industry).

Within this context, Impossible Cloud presents itself as the first cloud DePIN network, both enterprise-grade and ready to challenge the likes of AWS, GCP, and Microsoft Azure. Thanks to the adoption of the web3’s standards of decentralization, ICN will be able to scale it’s supply of hardware resources without having to compete on capital expenditure (CapEx), while at the same time, is immediately ready to meet web2 levels of adoption and demand.

Impossible Cloud has, in fact, an already existent web2 business with accelerating enterprise traction, that has already surpassed a total fiat deal volume of $2,5Million in early 2024, now targeting a 7-digit ARR at the end of 2024, with a MoM growth of revenues in double-digit percent.

The founders are experienced serial-entrepreneurs who generated over a billion dollars in total combined revenue followed by a successful IPO.

The Impossible Cloud ensures the highest security standards for its B2B clients by offering robust identity and access management (IAM), single sign-on (SSO), and default SSL HTTPS end-to-end encryption. Additionally, the platform provides both server-side encryption and the option to support client-side encryption DePIN-powered, ensuring data protection throughout the entire workflow.

Furthermore, with the adoption of a decentralized approach and blockchain technology, the network is able to tackle key challenges faced by traditional centralized cloud providers and mitigate the risks of downtime associated with central cloud failures, improve overall performance, and significantly reduce costs, with potential savings of up to 80%.

Project Overview

Impossible Cloud aims to revolutionize the cloud services industry by building an enterprise-grade alternative to centralized solutions, through the development of a suite of decentralized, DePIN powered, cloud services.

Having already achieved product-market fit, and accelerating traction, with cloud storage, Impossible Cloud is currently expanding both supply and demand, while developing additional cloud services to be able to provide the most comprehensive, flexible, secure, and cost-effective solution to all of their customers.

Traction

Revenue & Growth

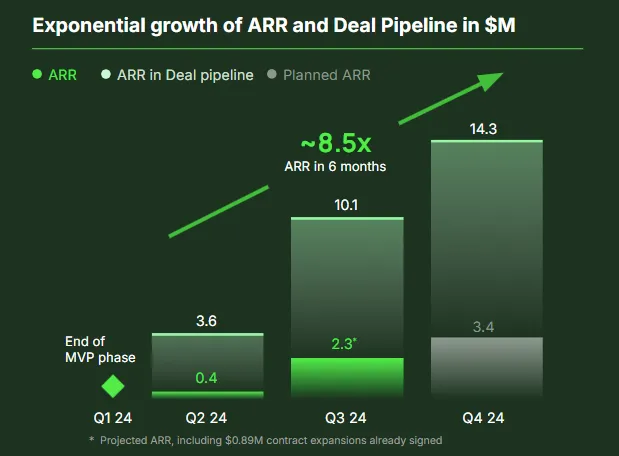

The Impossible Cloud team has reported an ARR of $3 Million by the end of Q3/ 2024 (having only started to sell in late 2023)

When compared with the $12.3M ARR reported by Depin.ninja, it appears that ICN’s ARR already amounts to 18% of that total, which is significant, considering the whole DePIN industry is comprised of >2000 projects valued at ~$90B.

On top of this, Impossible Cloud reports an ARR Deal Pipeline of ~$14M by Q4 ’24, MoM growth of revenues is double-digit percent and $32.7M ARR planned for Q4 ’25 as they plan to go multi-service.

This vertical growth for Impossible Cloud is enabled by:

Demand-side

- Distributors:

- The distribution partners reach more than 35.000 resellers that each have large networks of own enterprise customers.

- Example distribution partners in their European home market are: Tarox, MSP Nordics, Interworks Cloud, Cloud Factory Group, Aconitas, ADN, DSD Europe

- Product Integrations:

- Distribution is helped by Impossible Cloud being integrated in countless web2 business software applications, such as: Veeam, Acronis, HYCU, StarWind Software, Storware, Comet Backup, Veritas, MSP360, Tiger Surveillance, Iconik, Nakivo, Nasuni, Duplicati, Nutanix, …

- Reached >1000 paying enterprise-customers in only 3Qs

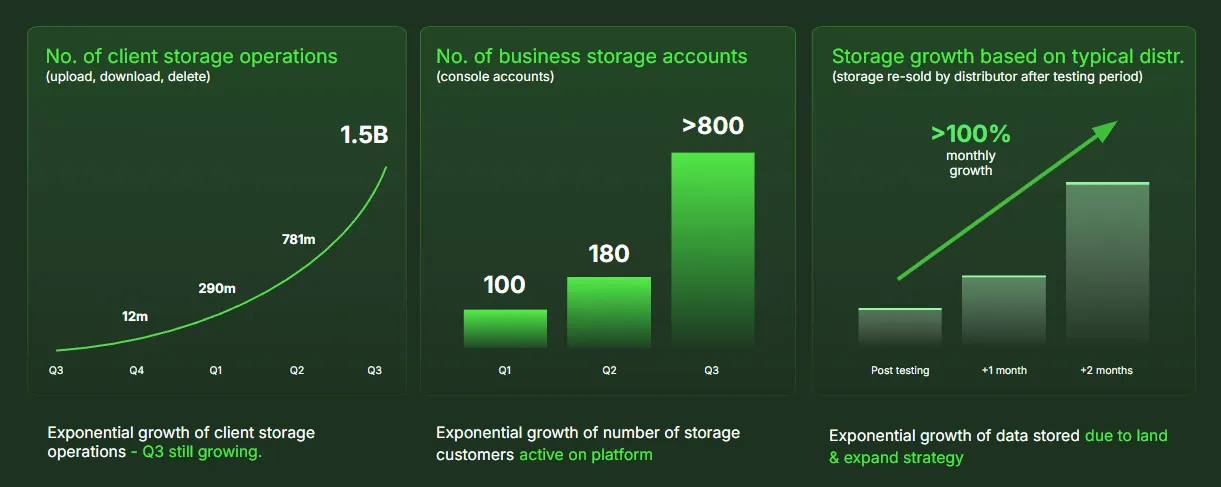

- Above 100M files uploaded daily; 1.5B client storage ops.

- Have built a great list of positive client reviews and store data from a vast variety of businesses, from SMBs to airports, from AI companies to Bundesliga soccer clubs.

1.5m aggregated B2B customers reached by the web2 players integrated

Supply-side

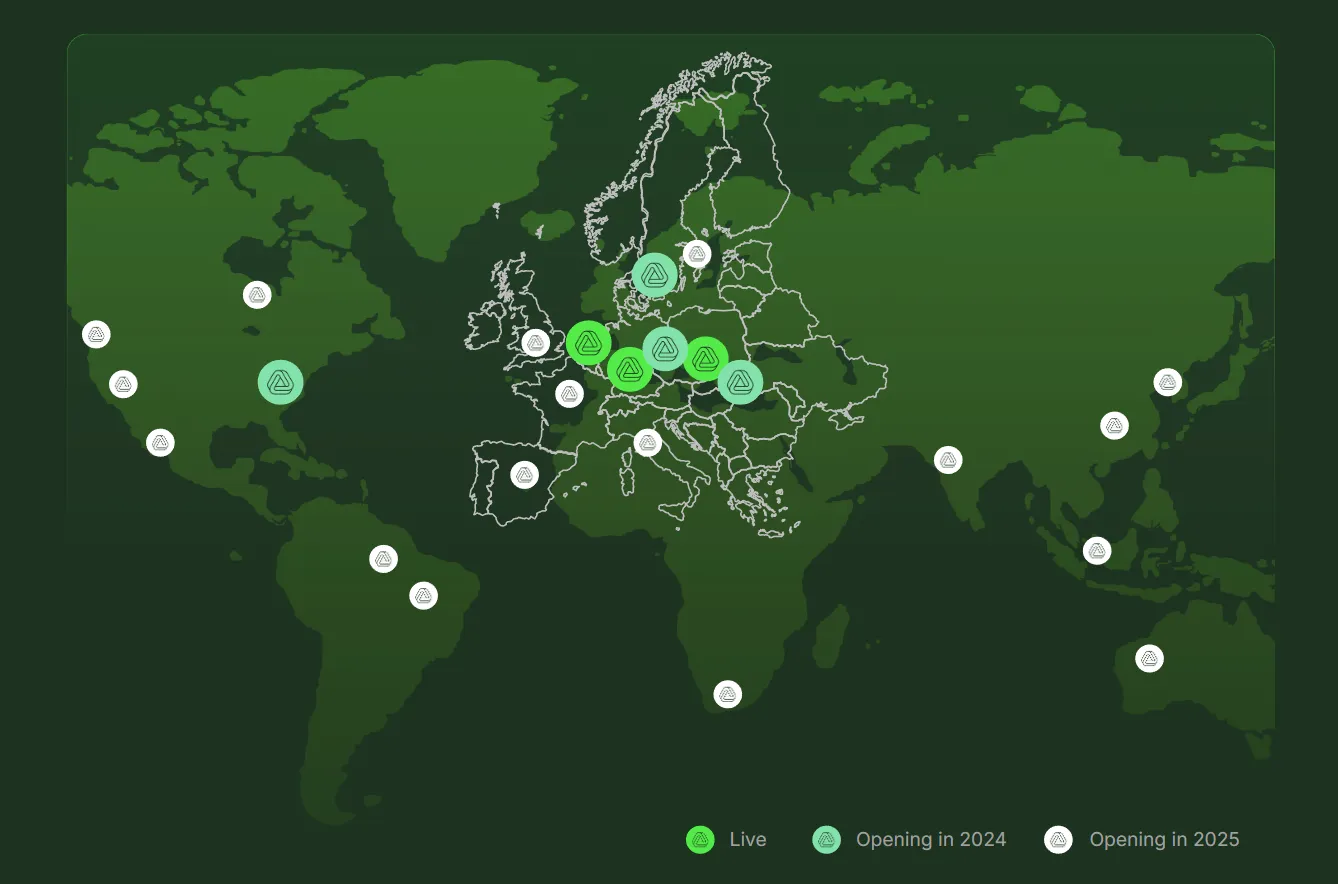

On the supply-side, ICN has already partnered with top-tier global data centers and service providers

- Multiple locations in Germany, Netherlands, Poland, Denmark, USA and signed LOIs to expand to 20+ locations in 2025

- Supermicro, a provider of IT solutions and bare metal servers

- Aethir, adding GPU computing capabilities to the network, also benefiting from market access tooling resulting in more demand for their service

- Witness Chain, “The EigenLayer AVS for DePIN coordination”, to integrate and collectively enhance network trust and reputation

- Compliant under all major jurisdictions (EU’s GDPR, U.S.’s DCA)

- Will be able to match demand with local supply, respecting the “data-locality” principle to increase performance speed, but also allowing EU customers to avoid/ minimize the likelihood of being matched with e.g. US datacenters. This is meaningful because under U.S.’s DCA, US Companies are forced to provide access to the data to Governmental authorities, while GDPR is more protective in terms of clients’ privacy.

- This is a significant USP vs AWS, GCP and Azure, for any business that values data privacy because it-s allowing EU customers to eliminate the risk of having data stored in or accessed from other geographies (e.g., US).

Try out all the different object storage use-cases through a free trial of the Impossible Cloud Console (up to 150GB with no payments)

Technical Insights

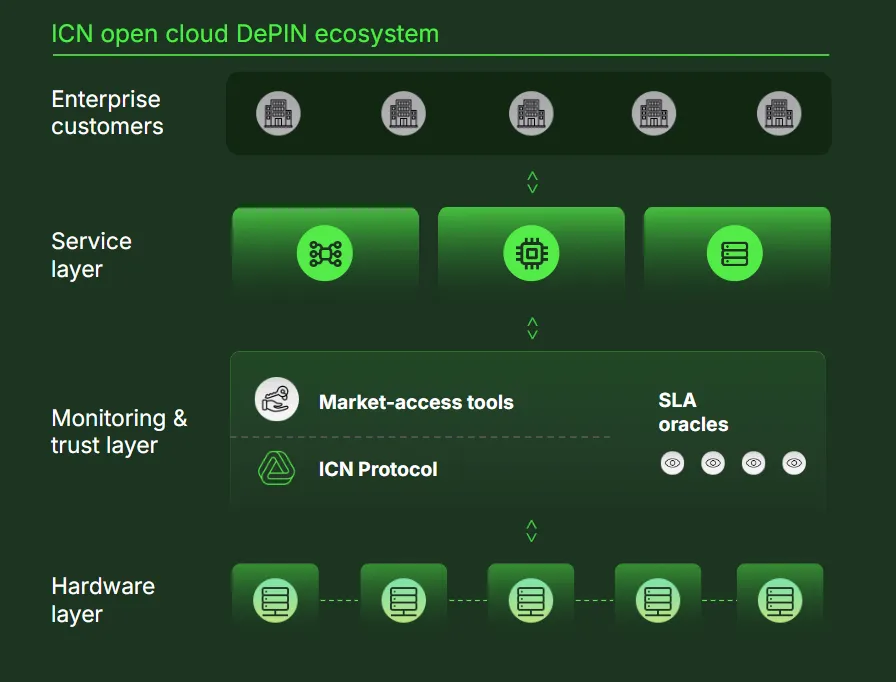

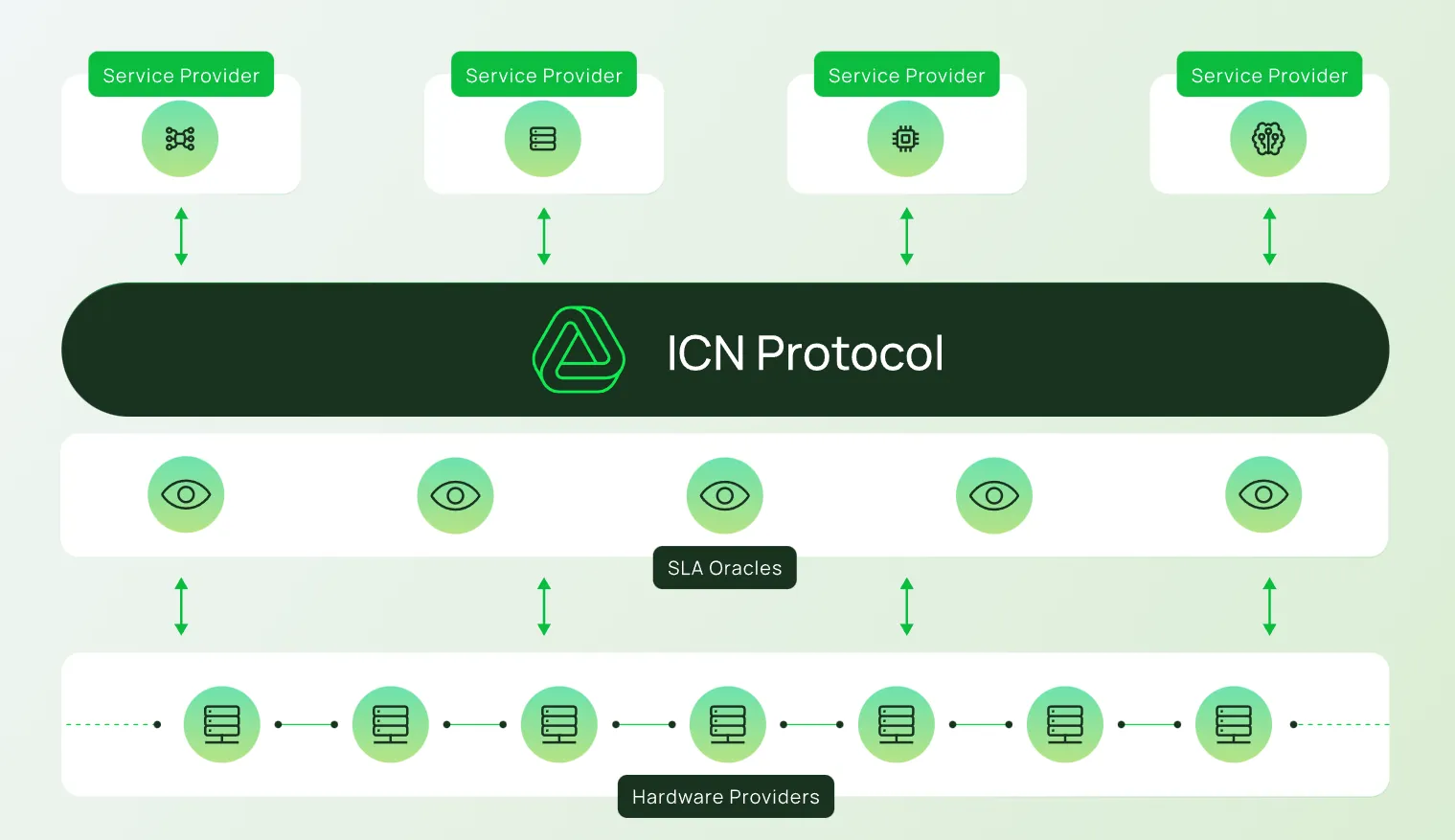

Impossible Cloud Network utilizes a multi-layered architecture, with each layer managed by different participants interconnected through the ICN Protocol.

This system is underpinned by a blockchain-based matching mechanism, designed to equilibrate hardware supply with cloud service demand, while minimizing subsidies and facilitating service providers in achieving product-market fit.

A Multi-Layered Approach

The Impossible Cloud Network (ICN) takes a layered approach, consisting of a hardware layer, a service layer, and a monitoring layer:

- Service Layer: The service layer enables composability, allowing open-source software to combine into larger constructions, similar to Lego bricks. This fosters a global knowledge store that grows at a compounding rate, enhancing innovation and service diversity.

- Monitoring & Trust Layer: The monitoring layer, consisting of SLA Oracle nodes, serves as the layer of trust. By implementing a best-in-class set of verifiable proofs, as they become available, ICN will effectively address the DePIN verification problem. SLA Oracles ensure that hardware performance and compliance are continuously monitored and verified, maintaining the network's integrity and reliability. This layer also encompasses a large inventory of market-access tools which help bridging the gap between the DePIN hardware layer and web2 clients. Most notably this includes a comprehensive partner-portal, a deep IAM stack, billing tools, a marketing-portal and storage console, all fully programmatic available via APIs and UIs.

- Hardware Layer: Thanks to the reduction in CapEx to fuel hardware supply growth, allowed by a clever economic incentives design, this layer is potentially able to scale beyond the combined infrastructure of Amazon, Google, and Microsoft developed over the last 15-20 years.

Correspondingly, ICN comprises three main protocol participants:

- Service Providers (SPs)

- SLA Oracle Nodes (SLA-ONs)

- Hardware Providers (HPs)

Each participant plays a critical role in ensuring the network's scalability, composability, trust, and overall success:

- Service Providers (SPs) use ICN's hardware capacity across different hardware classes to build services, offerings, and products for business customers. In some cases, partnering Cloud DePIN projects could directly act as SPs. The composability aspect is crucial here, as SPs can seamlessly integrate multiple hardware resources and software functionalities to create complex, value-added services. This approach allows SPs to combine Infrastructure as a Service (IaaS) and service offerings with their proprietary software, Independent Software Vendor (ISV) integrations, and additional services like support and consulting. By leveraging the composability of the ICN ecosystem, SPs can innovate rapidly and provide highly customized solutions, while not having to build the stack from the bottom up.

- SLA Oracle Nodes (SLA-ONs) monitor, verify, and report network performance and reliability metrics. They establish a critical layer of trust by using verifiable proofs. SLAONs enforce Service Level Agreements (SLAs) through automated penalties and rewards, ensuring high reliability and performance. This monitoring layer creates a feedback loop that continuously improves network integrity and user trust.

- Hardware Providers (HPs) add hardware capacity to the network. Each HP can operate one or more Hardware Nodes (HNs) across different hardware classes, such as Storage, GPUs, and CPUs, at multiple locations. For example, an HP could operate three HNs in two locations with a combination of hardware classes at each site. Contributions from each HN are calculated separately based on resource provision and utilization over specific periods. This decentralized hardware contribution ensures the highest levels of scalability, leveraging the community's power to surpass traditional cloud infrastructure investments by orders of magnitude.

This system enables SPs that have already found product-market fit to focus on their strengths, specializing in specific services and market development, while expanding hardware resources as needed.

It allows HPs to compete in a fair, non-monopolistic market by specializing in operating and managing reliable hardware that can be offered as a resource to SPs with existing business customers.

Finally, it allows SLA-ONs to take on the role of an external, unbiased network ‘auditor’, ensuring high network performance, contributing to and benefitting from a thriving ecosystem.

The Impossible Cloud Network Protocol (ICNP)

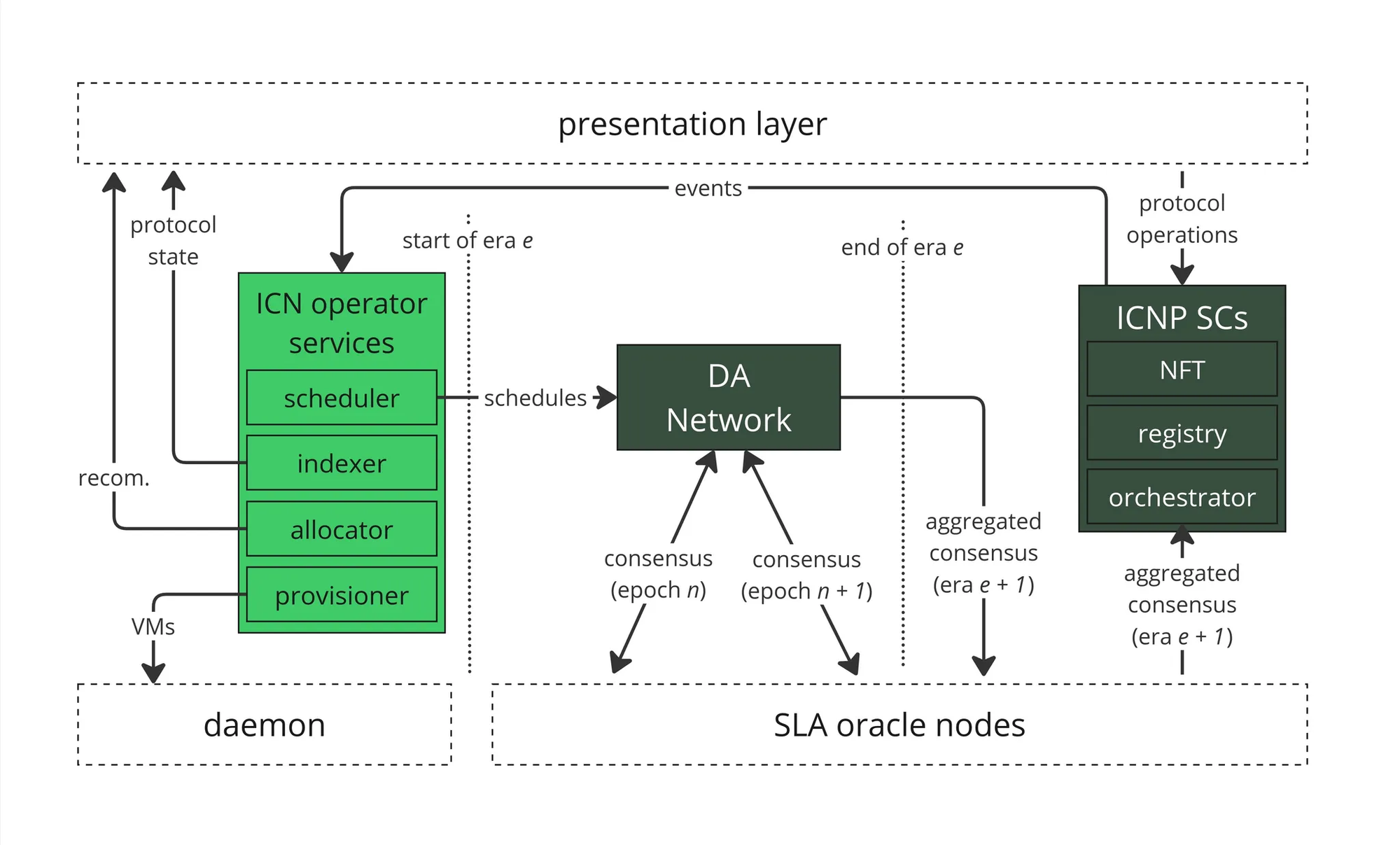

The ICN Protocol consists of three primary components:

- ICN Operator services: managing backend services

- Data Availability (DA) network: responsible for storing off-chain data

- ICNP Smart Contracts (SCs): interacting with the base layer blockchain and submitting DA attestation on-chain.

Tokenomics

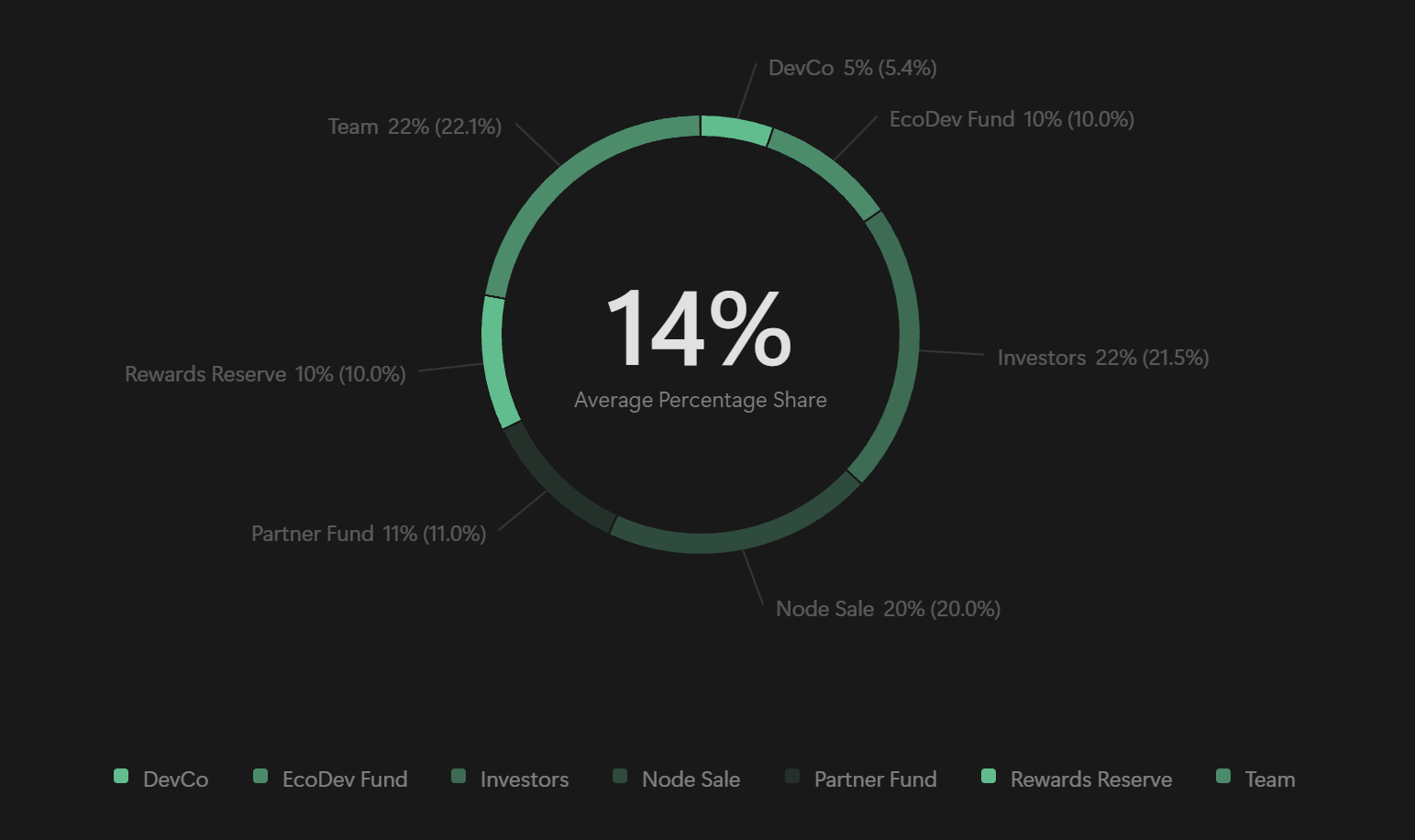

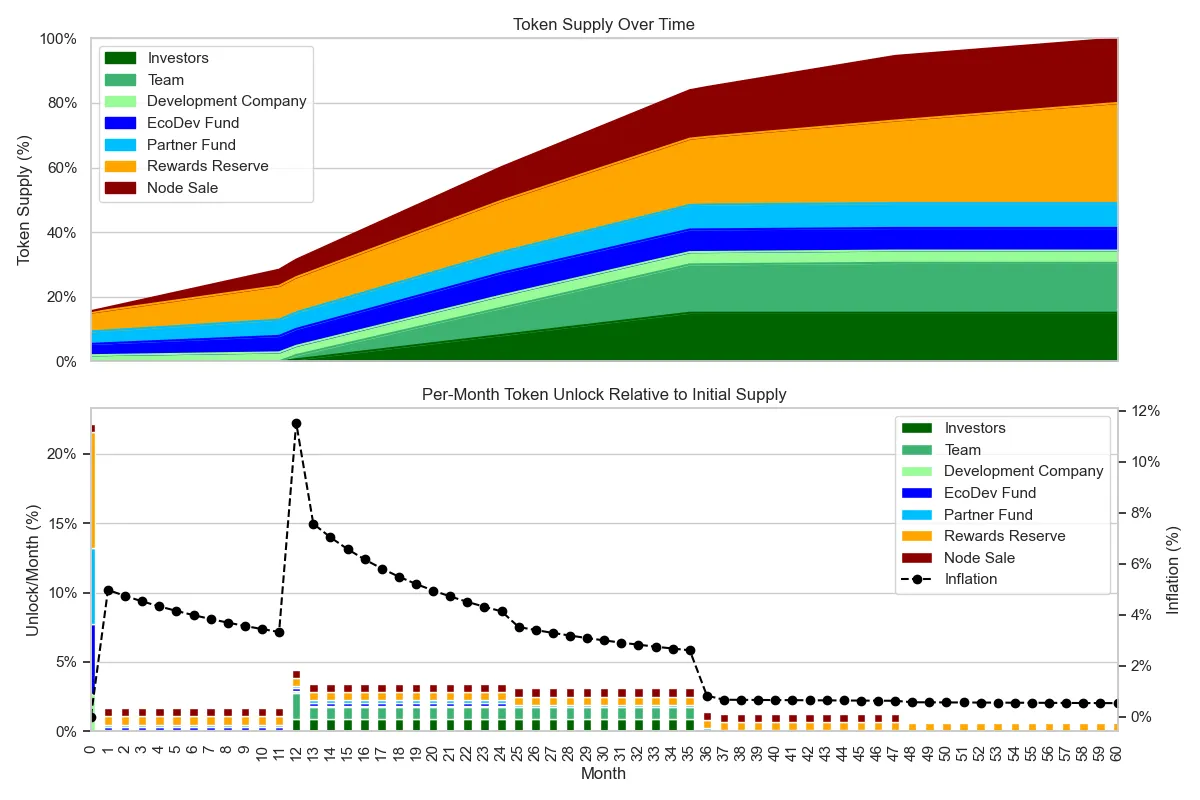

Summary Table: Initial Token Allocation

*A network inflation mechanism is expected to be implemented, ensuring that 20% of all newly minted tokens within the first 4 years will be allocated as network rewards for the contributions made by node holders to the network.

Fundraising

ICN totaled $18M in funding raised over 3 rounds:

- Pre-seed: Founder-only, $3.3M (2021)

- Seed: top tier VCs (1kx, HV Capital, Protocol Labs), $7.7M, $35M Equity Valuation (2022)

- Seed-extension: existing investors plus LBBW VC, $7M, $92M Token Valuation (2023)

Investors: HV Capital, 1kx Capital, TS Ventures GmbH, Tuva Explorations (Protocol labs), LBBW VC

ICNT Token Utility

The $ICNT token aligns incentives throughout all ecosystem actors and grants governance rights to the holders. These are the main token utilities and sinks:

- Ecosystem Partners and Service providers continuously need to buy large quantities of ICNT to access ICN network resources. With growing demand for Cloud Services, more ICNT are required to be bought on the open market by Service providers.

- All participants of the ecosystem have to stake & lock ICNT relative to their network contribution, ensuring long-term commitment to the network.

- Hardware providers (HPs) need to buy and stake ICNT as collateral while operating their hardware and earning (base and utilization) rewards. This staked ICNT is eventually subject to slashing if the HPs misbehave, accordingly to Oracle Nodes’ supervision.

- HPs receive ICNT for the utilization of their hardware and their service (utilization rewards). Incentives per unit increase as utilization increases, ensuring that hardware providers have strong incentive to attract usage and to expand hardware when network resources become scarce.

- Regional incentive mechanisms are utilized to ensure focused network formation in new regions and/or regions with stronger utilization and for hardware types with stronger demand (base rewards).

- Oracle Node operators receive ICNT for their services to the network stability and reliability.

Roadmap

Phase 1: v0.x ICN Platform (Testnet)

Timeline: Starting Q3 2024

- Sequentially release ICN Platform functionality on testnet (including Fracle nodes).

- Tune protocol data schema for performance, scalability, and bug fixes.

- Optimize protocol execution costs; conduct security audits.

- Public testing by partners and community.

Phase 2: v1.0 ICN Platform (Mainnet)

Production Deployment of MVP and ICNT Token

- Capacity onboarding with rewards based on provable capacity and usage metrics.

- Implement access fees and capacity rewards.

- Introduce HP deposit and controlled slashing mechanics for SLA violations.

- SLA Oracle nodes with initial "proof of performance" metrics.

Phase 3: Extension of ICNP Functionality

Expanding Protocol Logic for Economic Vision

- Support for geographical and hardware-type expansion with partners collaborating cross-operatively.

- Decentralize by removing centralized components in the ledger layer.

- Extend functionalities of SLA Oracles with more trustless proofs.

- Increase the trustlessness of the protocol.

- Develop additional components to support new functionality.

Phase 4: Partnering Projects’ Software Integration

- Streamline partnerships and cross-utilization, making integration seamless.

- ICNP will recognize and integrate with partnering projects.

- Automate hardware provisioning and software installation for partners.

- Support specific hardware class requirements for each partner project.

Phase 5: Service Awareness

Enhancing SLA Guarantees

- Develop service-aware functionalities to tie SLA guarantees to service stack, not just hardware.

- Collaboration with partner projects to integrate SLA interface between ICNP and services.

Competitive Landscape

There are three potential areas of competition:

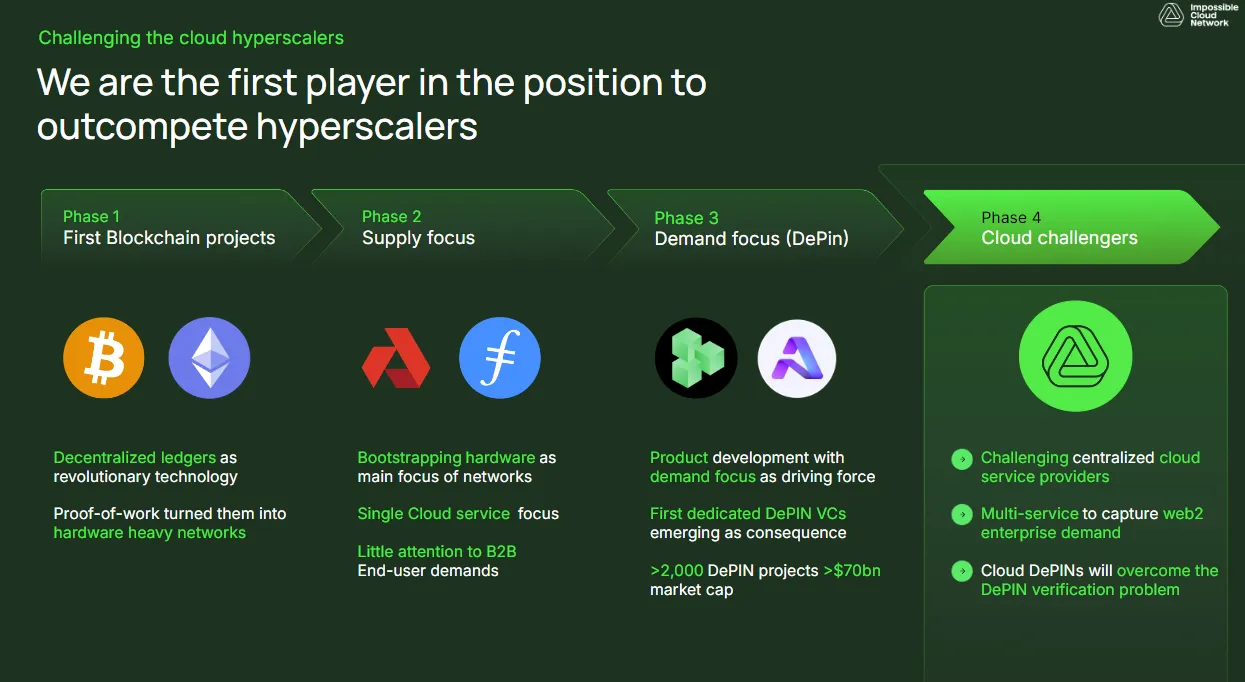

- “Hyperscalers”: i.e. AWS, Azure, and Google Cloud. These players are so large that they function more as market-shaping forces rather than direct competition. For the foreseeable future, these companies set the standards around which others must operate to succeed in the B2B space, particularly in terms of compatibility, performance, trustworthiness, and pricing.By leveraging the web3 USPs and by decentralizing the Hardware Providers’ Network, ICN is potentially going to be able to break through the CapEx bottleneck to scale up to hyperscalers’ level of supply, and compete with them, also thanks to their web2 approach to scaling demand.

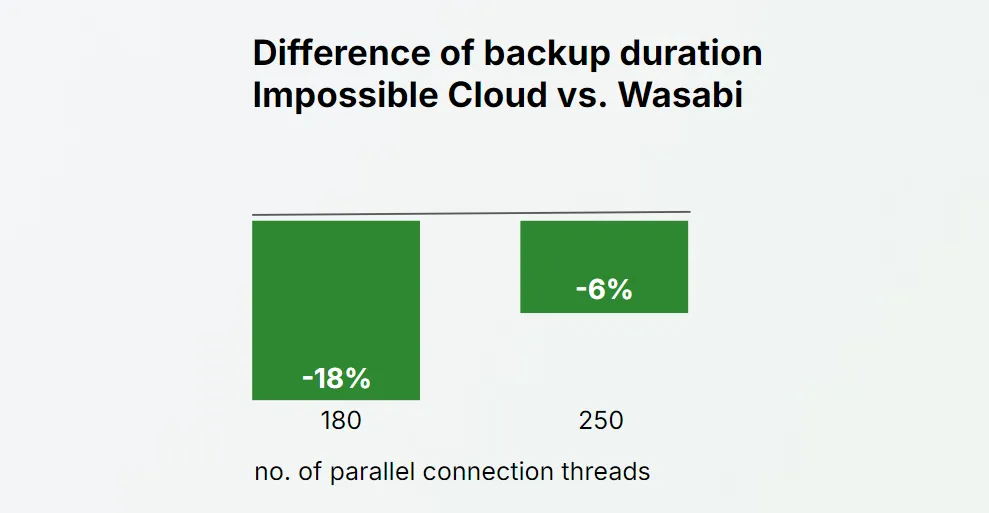

- Web2 challengers: Companies like Wasabi for Object Storage or Cloudflare for CDNs demonstrate that the market is ready for alternatives to AWS, GCP, etc. Their success validates the potential for other competitors to gain traction. ICN’s advantage against these competitors is using blockchain technology to scale their supply side avoiding any CapEx bottleneck.Test results shared by ICN clients also show that ICN is up to 18% faster, compared to the many web2 competitor:

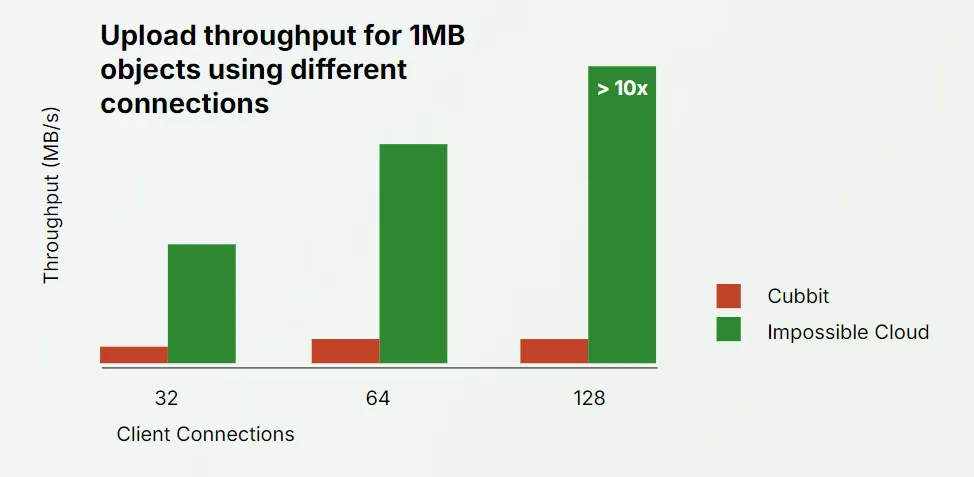

- Web3 competitors: Projects like Filecoin, Akash, Fluence or Render typically focus on specific cloud service use cases but often struggle with product-market fit. These projects may lack either demand or supply, but partnerships with them can provide what they are missing.Most notably, test results for download operations show ICN is up to 10x faster than other decentralized platforms (graph below) competing on storage alone, ICN is already ready to go multi-service and scale its services beyond storage.

Fully-Diluted Valuations (FDVs) of Web3 competitors:

- Filecoin: $8B FDV

- Render: $3.3B FDV

- Aethir: $2.6B FDV

- Arweave: $1.5B FDV

- Akash: $720M FDV

- Fluence: $350M FDV

Team

Successful serial entrepreneurs as founders

ICNs founding team previously founded Goodgame Studios (>$1B combined revenue and >1,400 employees) and did a successful IPO to become NASDAQ listed.

The team consists of ~50 employees, in addition to a few freelancers and interns.

The leadership impresses with top profiles who complete the wide range of skillsets required for this type of project. Overall, the workforce is divided into three main units of about equal size: Cloud Commercial (14), Web3 & Token (15), and Core Engineering (16).

Core Team:

Dr. Kai Wawrzinek (CEO): former CEO & Founder of Goodgame Studios, one of Europe’s biggest online gaming companies with a reverse-IPO valued at €270M. Kai was honored as Entrepreneur of the Year.

Dr. Christian Kaul (COO): holds a PhD in Computational Neuroscience and brings many years of leadership experience with unicorns during their rapid scaling phase, e.g. Groupon, Stillfront Group, and Airbnb.

Laura Schröder (Director Marketing): an experienced marketing executive who developed brand, marketing, & communication strategies for several scaling tech startups, i.e. Personio, and Workday.

Marilena Placenti (Chief People Officer): is experienced at scaling tech-startups, e.g. Wunder Mobility from 120 to 250 FTEs.

Dr. Thomas Demoor (CTO): has >15 years of experience in advanced storage, cloud & database technologies, possibly one of Europe's leading engineering experts in the field of object storage.

Dr. Slobodan Sudaric-Hefner (Director Web3 Economics): lead Tokenomics teams at Celo (L1) And Mento (DeFi). He holds a PhD in Economics.

Oliver Scheffert (CCO): built & led the DACH sales & channel departments for Microsoft Azure before joining Impossible Cloud. Oliver received the Circle of Excellence Platinum Club Outstanding Achiever Award at Microsoft.

Maurizio Binello (VP Web3): a former engineer who turned to web3 and led the building of multiple protocols at top web3 consultancy Horizen Labs. Maurizio was in charge of the APE Coin launch.

Investment Thesis

Impossible Cloud Network is uniquely positioned to become a leading cloud service provider and bring mass adoption to DePIN/web3.

Impossible Cloud Network is well balanced at the intersection of Web2 and Web3, leveraging the scalability and technological potential of decentralized infrastructure while addressing immediate global demand, finding strong, and accelerating product-market fit in Web2 and beyond. By bridging the gap between these two worlds, they bring experienced Web2 builders who are driving the adoption and real-world use cases needed to propel Web3 forward.

ICN has already demonstrated success by developing a fully functional, enterprise-grade object storage service acting as the foundation of its decentralized ecosystem. This storage service is supported by numerous hardware providers and serves a growing customer base, with business clients uploading up to 100 million files daily, allowing Impossible Cloud to achieve what many Web3 projects struggle to realize: product-market fit.

By delivering a reliable and adopted enterprise-grade cloud platform, ICN can establish itself as a leader in the DePIN space, offering a solution that is both usable and scalable

Their B2B distribution strategy is tailored to leverage third-party businesses as intermediaries to drive up Impossible Cloud’s sales and conversion, causing the vertical MoM growth we saw in the slides over the Traction section of the report. Their market access tools and business clients will attract other web3 cloud projects to join the ecosystem.

The founders and the CEO hold a proven track record of being able to scale businesses, generating over a billion dollars in revenue, and conducting a successful IPO for Goodgame Studios in their past.

Starting with storage is also a strategic move, leveraging the principles of data gravity and locality, which are essential for any cloud service ecosystem. Data storage acts as the backbone for a wide array of services, including AI GPU computing and data processing, making it a critical entry point. By anchoring its ecosystem in this foundational service, Impossible Cloud ensures that customers can run high-performance applications close to where their data is stored, enhancing both efficiency and service quality.

As the network of hardware providers expands globally, Impossible Cloud is well-positioned to grow beyond data storage and into other high-demand services like AI GPU computing. This growth marks the next step toward building a fully decentralized cloud infrastructure that meets real-world demand and expands the possibilities of Web3.

Risk Evaluation

While Impossible Cloud is well-positioned for growth, there are several risks associated with the project:

- Technical Risks: The company could potentially face the challenge of meeting sharply rising demand for its services. The ability to scale and develop the core technologies of the ICN fast enough is crucial to its success. Any delays or shortcomings in this area could hinder the company's growth and market positioning.

- Mitigation: ICN will leverage a modular infrastructure, cloud-native solutions, and strategic partnerships to scale efficiently and manage demand spikes. In addition, reward incentives will be in place for HW providers to join/expand in time when demand picks up and a global network of HW providers is already being built, so that all agreements and preparations will be finalized ahead of global expansion in 2025.

- Market Timing: Timing remains a difficult factor to predict. While some projects succeed despite incomplete products due to favorable timing, others with fully developed solutions may falter due to market misalignment. Web3 is constantly maturing, but market volatility and shifts in investor and user sentiment could affect adoption rates.

- Mitigation: ICN will focus on building partnerships (also through Impossible Finance), phased product releases, and flexible and transparent pricing to adapt to shifting market conditions. Also, compared to other Web3 projects, the strong footprint with Web2 enterprise customers will shield ICN from negative sentiment in the Web3 sphere as revenue will not be affected by this.

- Regulatory Risks: Impossible Cloud, like other global cloud infrastructure providers, can face regulatory challenges due to varying data localization laws in different regions. These laws often restrict and regulate the cross-border transfer of certain types of data and require that it be stored and processed within the country of origin. Key examples include the EU (Under GDPR), Russia, India, Canada and China.

- Mitigation: ICN currently operates, and it’s fully compliant under GDPR in the EU(one of the strictest data protection regulations in the world), and will be ready to adopt the regulatory frameworks of different jurisdictions.Additionally, ICN will also be able to serve restricted data and resources from HPs to local SPs respecting the “data gravity” rule for better performance of the network and additional compliance guarantees.

Links

Features of Impossible Cloud

- News and Press Releases:

- Impossible Cloud Network Reveals Strategic Roadmap for Decentralized Cloud Platform (The Defiant)

- Bracing for the Storm: Decentralized Cloud Could Be Europe's Silver Lining

- Impossible Cloud Demoor CTO

- ADN and Impossible Cloud Announce Strategic Partnership to Revolutionize the MSP Market

- Impossible Cloud (BlocksAndFiles article)

- Impossible Cloud Raises $7.6M to Decentralize Cloud Services with Web3 (Venturebeat)

- Cloud Computing Startups to Watch (Technopedia)

- Impossible Cloud Launches Partner Program (AI-Techpark)

- Video Content:

- Podcast:

About Impossible Cloud

Impossible Cloud Network (ICN) has the vision to outcompete AWS. ICN is a game-changer in the DePIN space by decentralizing the cloud while maintaining highest performance and service quality. In contrast to other projects, ICN is already serving thousands B2B enterprise clients and is the first project to bring true mass adoption to web3.

Website | Twitter | Discord | Telegram

About Impossible Finance

Impossible Finance is the go-to crypto investment platform that provides you with high-quality, fair and accessible crypto investment opportunities. We empower web3 startups through our accelerator, launchpad, and venture services.

Website | Twitter | Discord | Telegram | Blog

Disclaimers

Composed and presented by Impossible Finance Research Team based on information provided by the ICN team.

- Notes: DISCLAIMERS, TERMS, and RISKS

- Risk Warning: Trading and/or generally investing in any cryptocurrency involve significant risks and can result in the complete loss of your capital. You should not invest more than you can afford to lose and you should ensure that you fully understand the risks involved. Before investing, please consider your level of experience, objectives, and risk tolerance, and seek independent financial and legal advice if necessary. It is your responsibility to ascertain whether you are permitted to use the services of Impossible Finance based on the legal and regulatory requirements of your country of residence and/or applicable jurisdiction(s).

- The information provided on this memo does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such. Impossible Finance does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

- The details provided in this document are summarized from materials provided in due diligence from the ICN team to Impossible Finance