Mastering Trading Bots: a dive into the world of HFT

Humans need rest. Bots don’t.

Let’s unpack the engine behind 24/7 crypto trading, from CEX solutions to Solana-native on-chain terminals.

Whether you're a developer, a trader, or just curious about how trading bots actually work, this piece is for you because it breaks down:

→ The full tech stack

→ How bots plug into Solana

→ The most powerful tools in the plying field today

Let’s unlock the bot brain 🧵👇

What is a Trading Bot and how it works

A crypto trading bot is an automated software application that interacts with blockchain protocols and Cexs/Dexs to execute trades or strategies (arbitrage, MM, sniping, etc) based on predefined execution logic or real-time signals. These bots operate 24/7 and are especially popular in fast-moving market niches, like Meme plays, low cap crypto trading and high-lev scalping strategies, where timing and latency are critical.

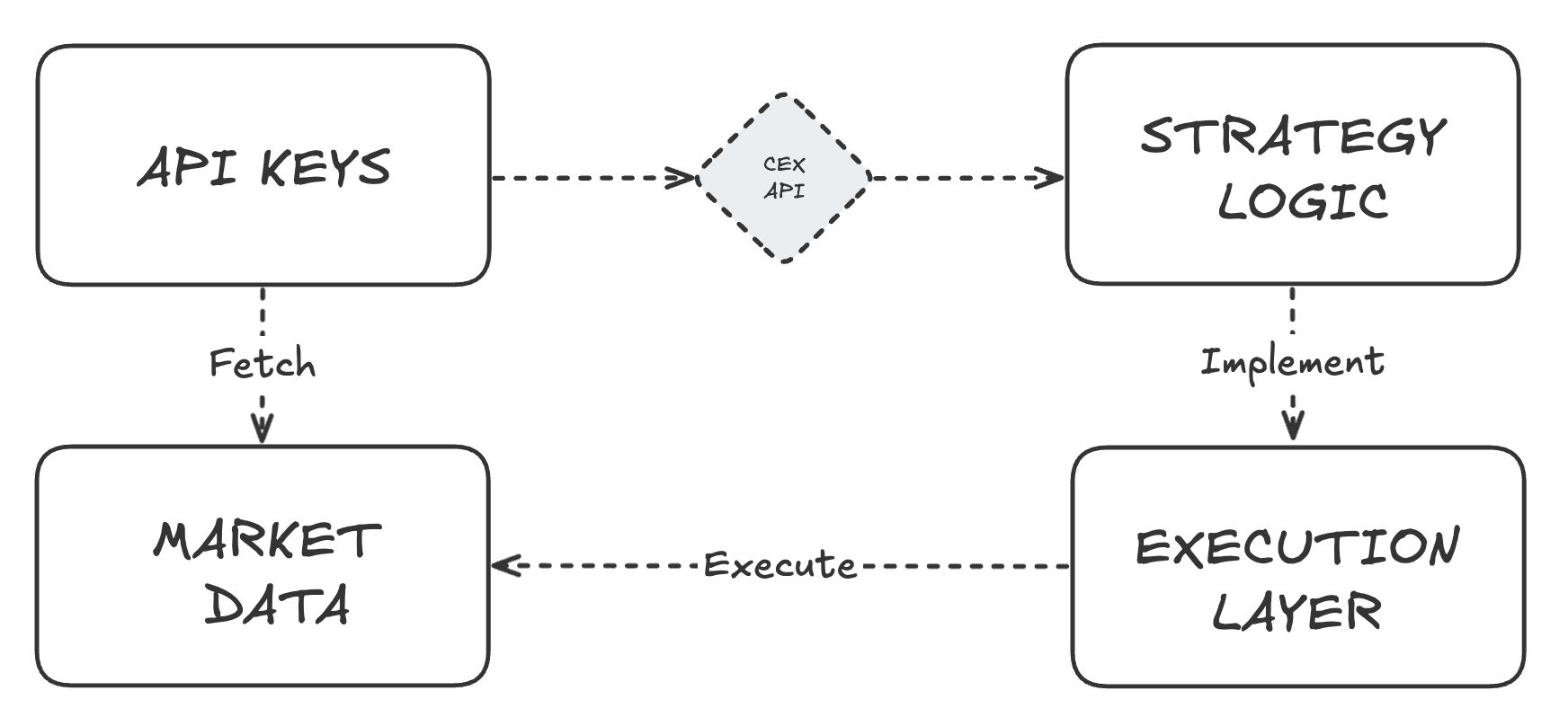

Regardless of whether it's integrated into Telegram, web interface, or CLI, it consists at a high level of a well-defined modular infra that handles:

- Market Data Ingestion. Real time data fetching, management and indexing from CEX/DEX APIs, Websocket, custom indexers or on chain logs, for DeFI;

- Strategy Execution. The strategy layer which implements the trading strategy logic, like MMs, Arbitrage, Sniping and so on; it receives input from the market data adapter and outputs trade signals;

- Order Execution and Management. The Order Manager (or Exchange Adapter) is the Execution Layer, which interfaces with the exchange/broker APIs (REST/Websocket), manages the different order types and latency optimizations for the on-chain side (nonce/account state, Validator peering and targeting, RPC routing, gas fees logic, mempool scanning, etc).

- Data Storage (State Layer). The component responsible for tracking and managing all relevant information that defines the bot's current state. Technically speaking, it is a dynamic in-memory or persistent storage module that holds: Open positions; current PF holdings; pending orders; historical performance (P&L, win rate, etc.); strategy-specific variables (e.g. last crossover point for a EMA strategy); market context (e.g. last fetched price, indicators, volatility state).

- Infrastructure and Security Backbone. The infrastructure layer is responsible for hosting, scaling, and securing the trading system, ensuring consistent availability, performance, and resilience across multiple network and market conditions. It typically includes (Deplyment Models, i.e.): virtual private servers (VPS), containerized environments using Docker or Kubernetes, or serverless functions for stateless, event-driven tasks.

If instead we wanted to build a trading bot for example on Solana, a couple of things would change from a traditional CEX bot:

- There’s no need for external exchange APIs, because bots directly listen to on-chain programs via “blockSubscribe” or “logSubscribe” through Solana RPC Endpoints.

- we will need an Interface Definition Language, a JSON representation of a Solana program's interface (much like an ABI, Application Binary Interface, in EVM environments), allowing tools and clients like bots and dApps (to encode/decode bot/on chain program instructions, i.e.) to automatically generate code to interact with the network, avoiding the need to manually serialize/deserialize instructions and accounts. Anchor is currently the de facto standard in Solana’s ecosystem for program introspection, client generation, and contract interaction, but we can even develop our own IDL.

To operate effectively on Solana, a crypto trading bot must build and submit transactions programmatically, meaning it automates all the steps a user would manually perform when trading. This typically involves:

- Creating Associated Token Accounts (ATAs). Before holding or trading a token, the bot must create the proper on-chain account to receive that token (especially for newly minted memes).

- Fetching Bonding Curve Data. For tokens launched via platforms like pump.fun, prices are determined by bonding curves. The bot retrieves and decodes bonding curve state data to estimate price, slippage, and liquidity.

- Tracking Token Migration to AMMs. Once a token "graduates" from its bonding curve (i.e. meets certain capital thresholds), liquidity is migrated to Raydium AMMs. The bot should listen for this event and adapt trading logic accordingly (switching from bonding curve pricing to AMM-based).

- Using Anchor IDL to Encode/Decode Instructions: Solana smart contracts (programs) built with the Anchor framework expose their interfaces via an IDL. The bot uses this to correctly construct and decode on-chain instructions for trading actions.

- Managing SOL Fees and Slippage Settings. Every transaction costs a small amount of SOL. The bot must manage fee budgets, estimate compute units, and apply appropriate slippage settings to ensure successful execution.

- Listening to the Chain in Real-Time. Via WebSockets (e.g. “blockSubscribe”), the bot subscribes to events such as new token mints, bonding curve updates, or liquidity pool changes.

A Current Overview of the Most Famous Trading Bots/Terminals

Now that we have provided detailed context on terminal/trading app category, it's time to focus on the main players on the playing field.

While this is a fairly recent phenomenon, the square has become quite quickly crowded with many candidates with quality products: let's analyze them one by one briefly to understand what their USPs, potential moats, and business models are.

First off, we can break these projects down into three main types based on how and where users plug in:

- Bots running through a Web UI. which (as the name suggests) are accessed and used directly from the Web browser, just like any other website. Dominating this niche: Photon, BullX and especially Axiom.

- Telegram Bots

- Cross-Platform Bots you can use across multiple devices

Let 's now turn the spotlight on major projects based on volumes generated and market share.

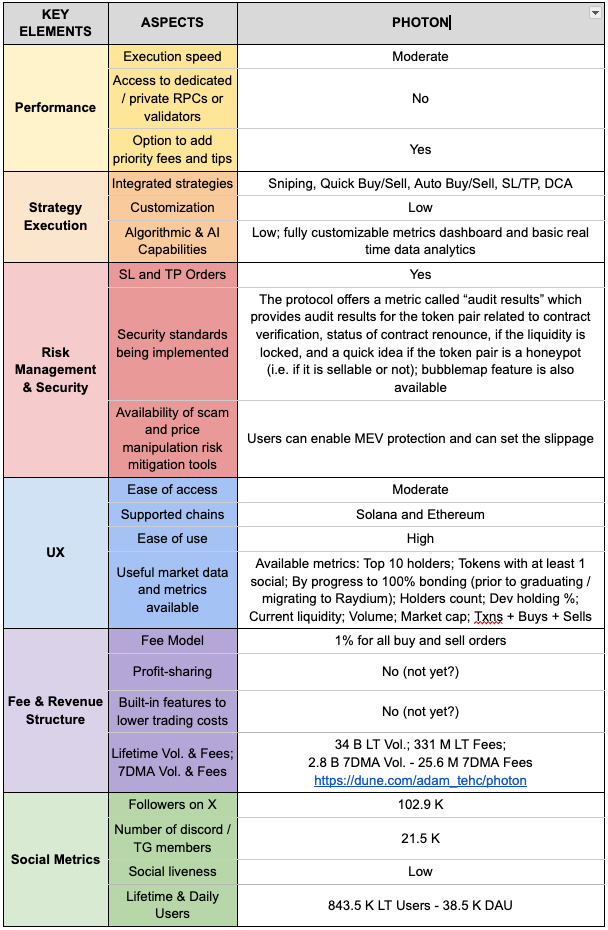

Photon

Web-based Trading Bot optimized for token discovery and execution speed with good volume market share and a wide range of features:

- Sub-second execution (built for sniping tokens fast)

- **Advanced filters. (**Top 10 holders; Tokens with at least 1 social; By progress to 100% bonding (prior to graduating/migrating to Raydium); Holders count; Dev holding %; Current liquidity; Volume; Market cap; Txns + Buys + Sells)

- **Wallet integration (**Phantom + MetaMask support)

- Web UI: Intuitive dashboard (mobile + desktop)

- Multiple order type support (limit, quick buy and DCA)

- Multi-wallet trading (buy/sell any token with multiple wallets at the same time)

- Live market insights (trending page, scam filters and so on)

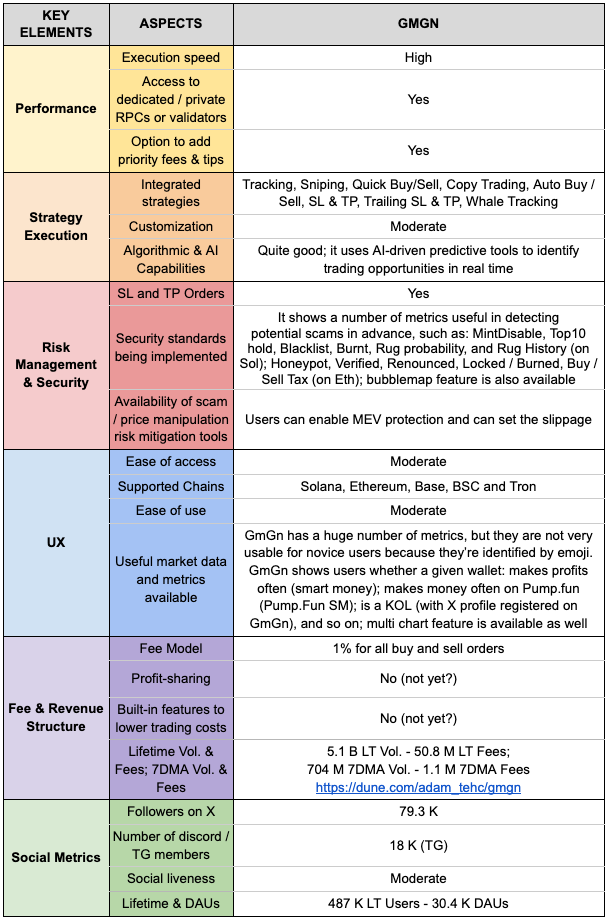

GMGN. ai

Multi-chain trading terminal designed for deep and wide-ranging research. Key features:

- supports so many different strategies (sniping, copy trading, wallet & X tracking, notification alerts, etc.)

- is available on multiple interfaces (TG + Web UI)

- is running on Ethereum, Base, Solana, Tron and BSC

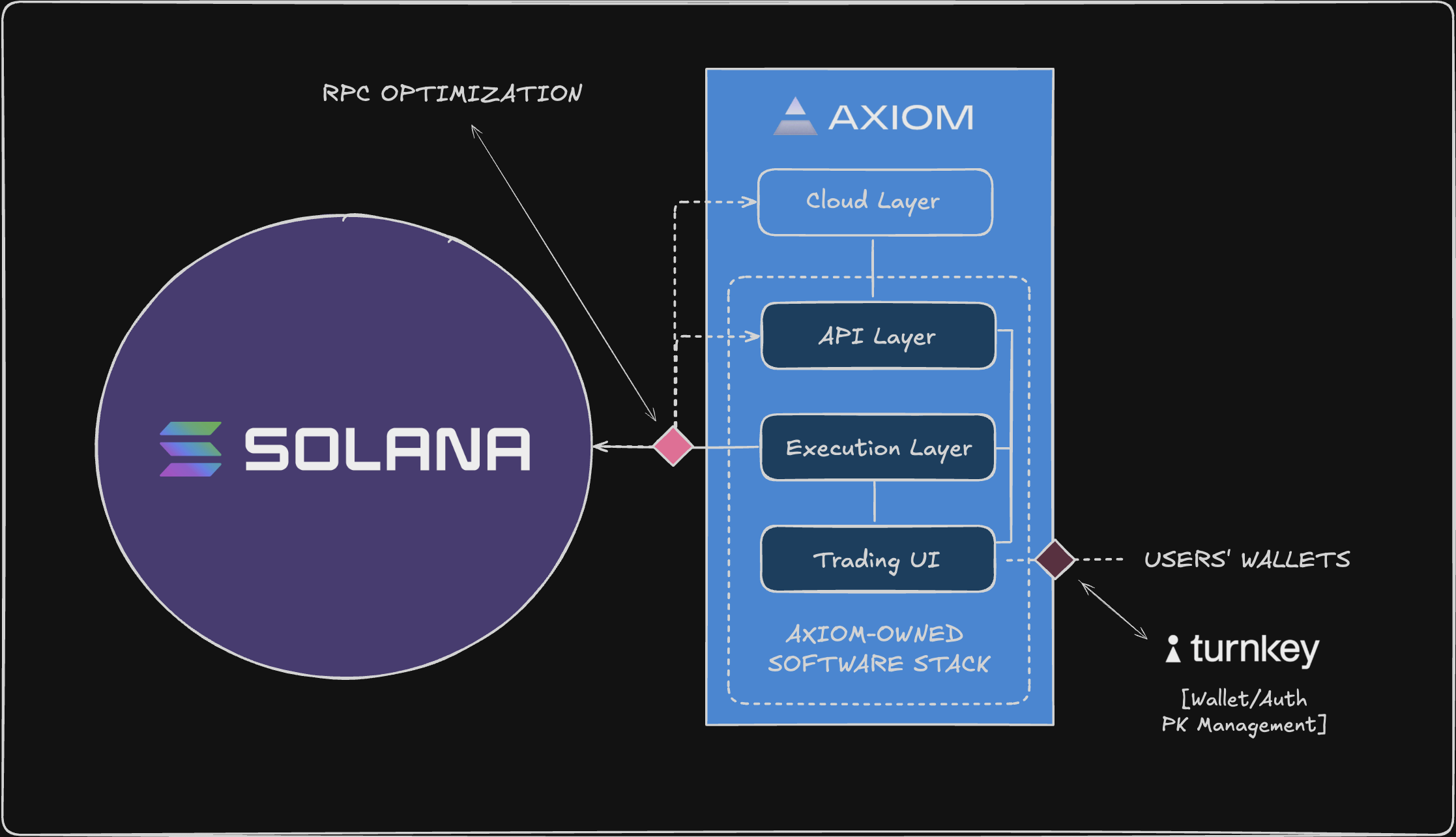

Axiom

Web-based trading bot with a software and hardware stack fully optimized to achieve the lowest possible latency. If you want to get an idea of the infrastructure design, take a look below.

Key features:

- Out of the box infra - multiple services directly embedded in app, from meme trading, which is the core business, to perp trading on Hyperliquid via passive yield solutions (on Stables thanks to Margin Fi, soon on SOL via Jito.

- Smooth UI.

- The fastest to land on chain - The Turbo Mode is an internally developed routing engine that directs transaction traffic to top validators via the TPU. Core features: Custom RPC Routing; Validator Targeting; Nonce Account Utilization; Automatic Priority and Bribe Fees.

- Advanced Filters and tracking solutions (Discover, Pulse and Trackers sections indeed allow users to: easily locate tokens with higher traction (custom filters available) eliminating potential scams and soft rugs, consult in app the main meme launchpads (Pump.fun and Raydium post migration) with quick buy option as well as monitor Wallets/X Profiles - posts in real time).

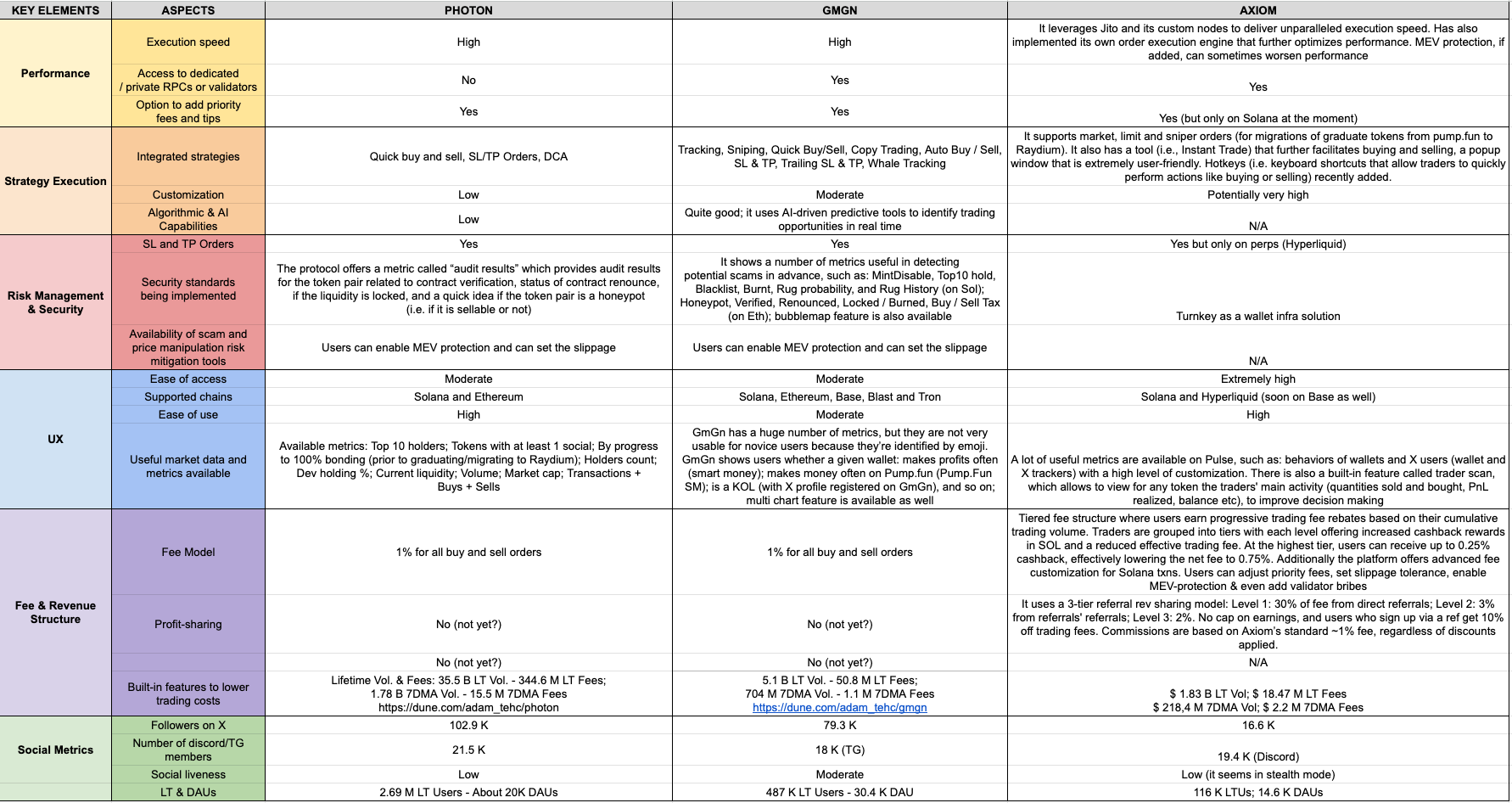

Below you will find a comparative table for easy metric analysis.

Conclusion

Whether you’re a builder, a scalper, or just trying to catch the next meme coin pump, let me tell you that trading bots are eating the market.

The edge lies in their automation, precision, and “around the clock” presence. And if you’re not exploring these tools, odds are you’re the exit liquidity for someone who is.