Monthly Market Pills (Aug 25)

Landing now on X the latest drop in our Monthly Market Pills series.

We cut through the noise of August (from shaky macro signals to crypto’s rotation of flows) and spotlight what really matters for the road ahead.

Macro. Crypto. Future scenarios. All boiled down, no fluff.

Let's get started.

Intro

Risk markets spent August moving on macro rails: a softer dollar, a cooling US labor market, long-term bond interest rates still very high, and commodities (especially precious metals like Gold, Silver and Palladium) catching a strong bid. Policy noise (new/expanded US tariffs) kept a re-inflation risk on the tape even as headline inflation drifted lower. US equities chopped near highs awaiting FED pivot on rates while the VIX is still pinned under 20: a classic sign of market complacency.

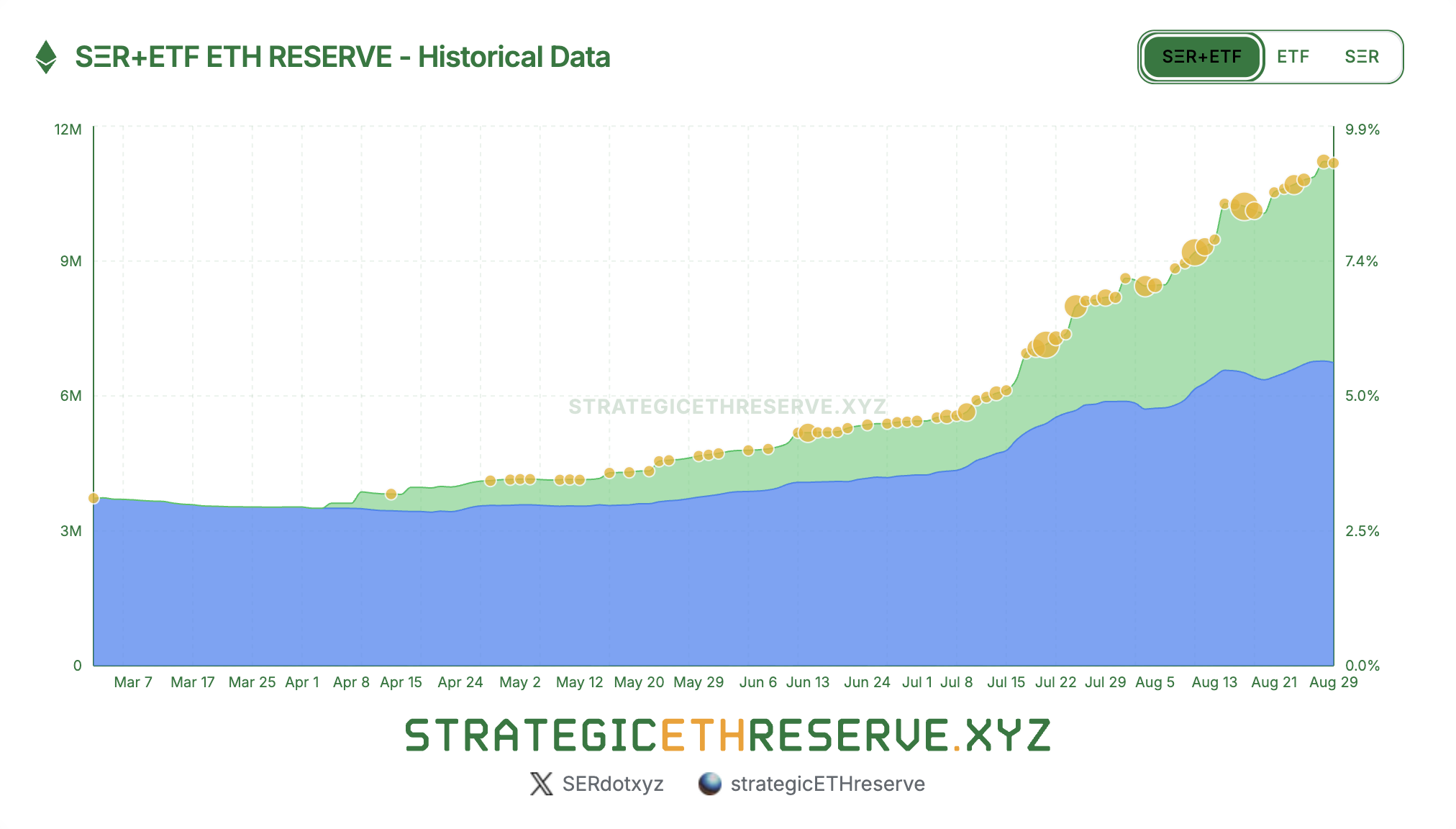

Crypto tracked that cross-current: ETH held the leader role with ETFs doing most of the heavy lifting on net demand, while BTC underperformed on relative flows and sticky supply dynamics (and the ETH/BTC chart reflected that rotation). Liquidity was thinner in alts into month-end, with dispersion driven by real catalysts (mostly infras and buybacks) over narratives alone.

September is historically one of the lowest-performing months, and there will be no shortage of major macro events:

- 03/09/2025 - ISM Manufacturing PMI.

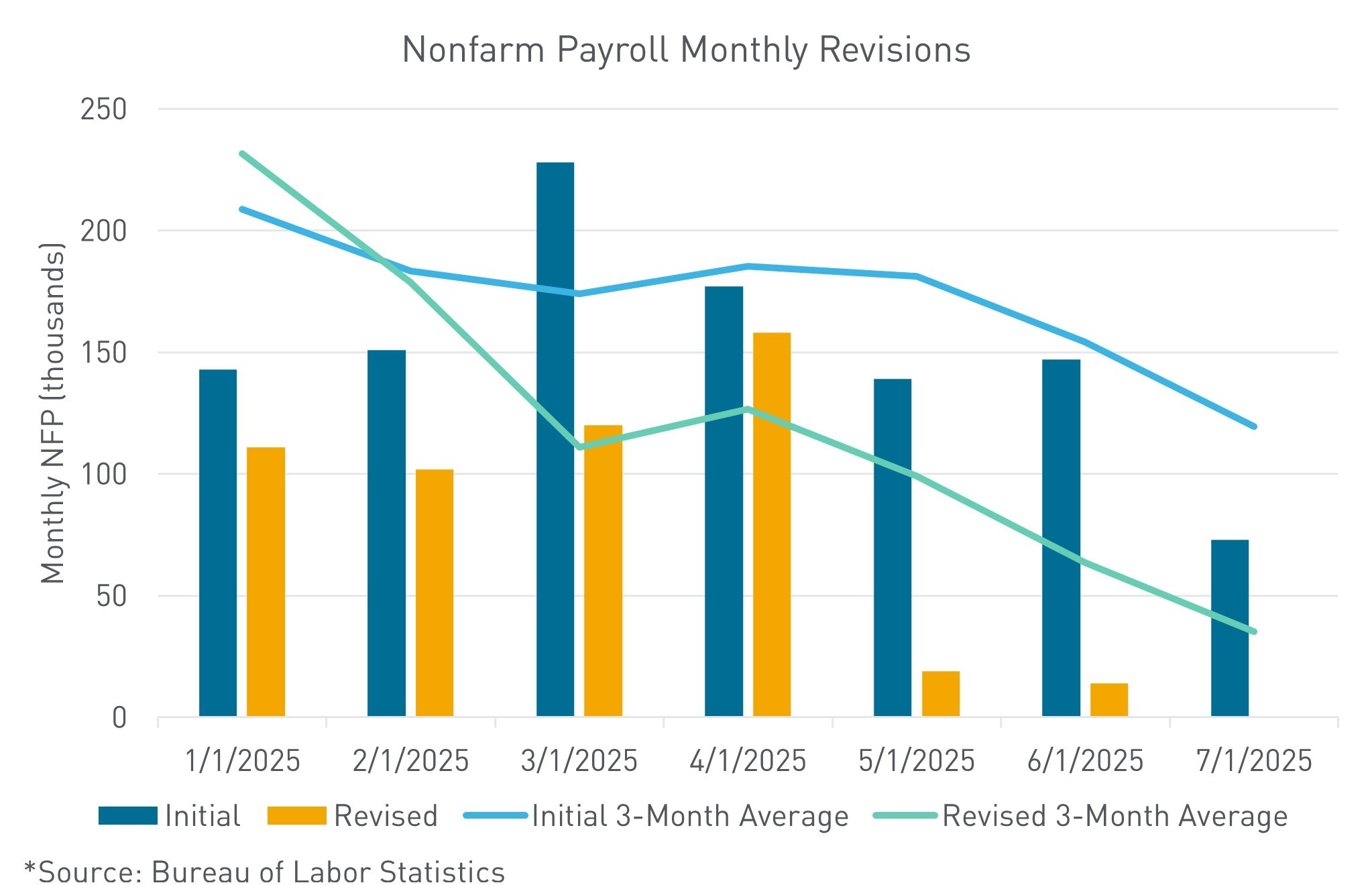

- 06/09/2025 - Nonfarm Payrolls (NFP) & Unemployment Rate. Always a market mover, especially after Powell’s Jackson Hole warning on labor market fragility.

- 09/09/2025 - Preliminary Benchmark Revision to Establishment Survey Data, a benchmark revision adjusts historical data to incorporate more complete and accurate employment counts.

- 11/09/2025 - CPI (Consumer Price Index). It will likely be the most important inflation print of the year. Core CPI especially critical given tariff-driven pressures.

- 12/09/2025 - PPI (Producer Price Index).

- 17/09/2025 - FOMC Meeting & Rate Decision. It could be a potential pivot signal.

- 26/09/2025 - PCE Inflation → the data Powell watches most closely.

Buckle up ladies and gentlemen.

Macro overview

The current macro picture feels less like a steady roadmap and more like a messy patchwork: fragmented, chaotic, and full of contradictions.

In the U.S., the Fed is boxed in: inflation risks are creeping back while the labor market is flashing signs of real weakness. Long-dated Treasury yields remain stubbornly high, with the 20Y and 30Y dancing near 5%. That alone would be concerning, but the bigger issue is global. While Powell holds rates in restrictive territory, central banks abroad are going the other way, cutting aggressively and exposing the cracks in a deeply uneven monetary landscape.

Meanwhile, Washington isn’t exactly calming nerves. The government is still deficit-funding its policy agenda while keeping an increasingly aggressive stance on the global stage. The latest flashpoint? Escalating tensions with India, one of the world’s fastest-growing economies, now tilting closer to China’s orbit.

And then there’s the dollar. Once the ultimate safe haven, it continues to leak strength against major currencies, eroding confidence further. Investors are also losing patience with the labor data saga: a market that’s clearly cooling is being masked by constantly revised, inconsistent figures, undermining trust in an administration already struggling to maintain credibility.

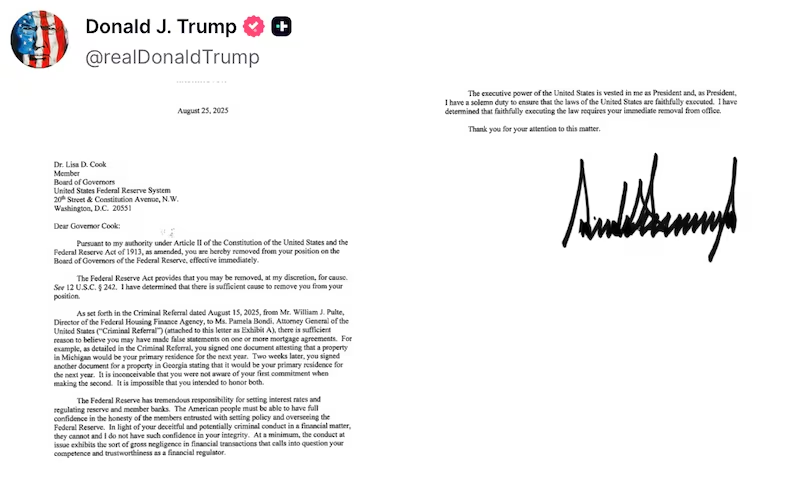

And that's not to mention the political US drama, which reached new highs in August. President Donald Trump shocked markets by moving to remove Fed Governor Lisa Cook, an unprecedented attack on the institution’s independence. Trump already has 2 confirmed appointees (Waller and Bowman), with Stephen Miran awaiting Senate approval. If Powell steps down when his term ends in May 2026, Trump could soon control 5 of 7 Board seats. Critics warn this risks turning the Fed into a political rubber stamp, undermining decades of credibility and potentially destabilizing the dollar even further.

And yet… against all this chaos, Wall Street keeps partying. The S&P and Nasdaq keep grinding to fresh highs, almost oblivious to weak jobs data, sticky inflation, and political fireworks at the Fed. Markets are acting like nothing’s wrong, but how long can the music play?

BTC: The Calm Before the Storm?

Bitcoin came out swinging in August, smashing into new mid-month highs before cooling off. The pullback looks more like a breather than a breakdown: the bullish structure is still intact, even with seasonal headwinds and equity market jitters weighing on PA. Meanwhile, BTC dominance keeps sliding as Ethereum steals the spotlight. ETF inflows and on-chain activity tell the story loud and clear: the market is rotating into ETH (mainly, not only).

If Bitcoin can hold its bullish structure through September, a run back to new highs by year-end will be the base case scenario.

ETH: Is it Finally Time to Shine?

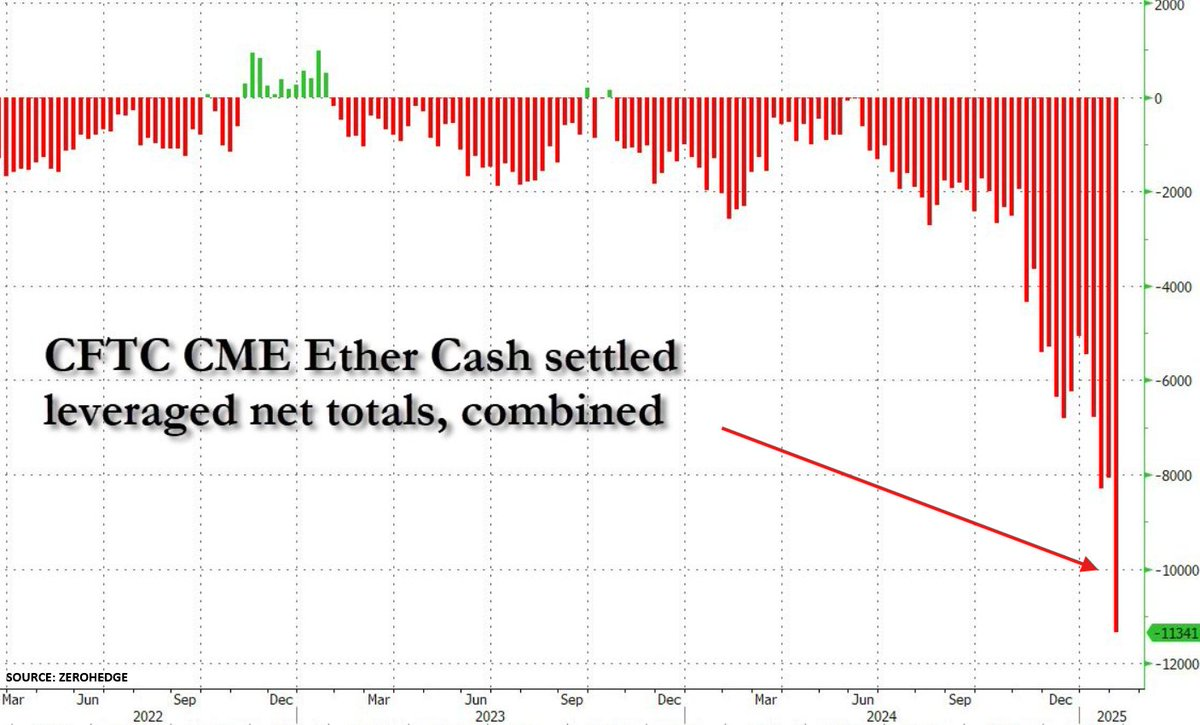

ETH has been on fire the past two months: the ETH/BTC chart says it all. Fresh highs, a clean pullback, and still no cracks in the bullish structure. If we see a breakout with strong volume above $5K, it could unleash a violent squeeze on the massive pile of CME shorts, catapulting ETH into the $6K–$7K zone faster than most expect.

Meanwhile, institutional accumulation goes on, which is exerting a form of synthetic supply reduction and may even soon lead to a supply shock.

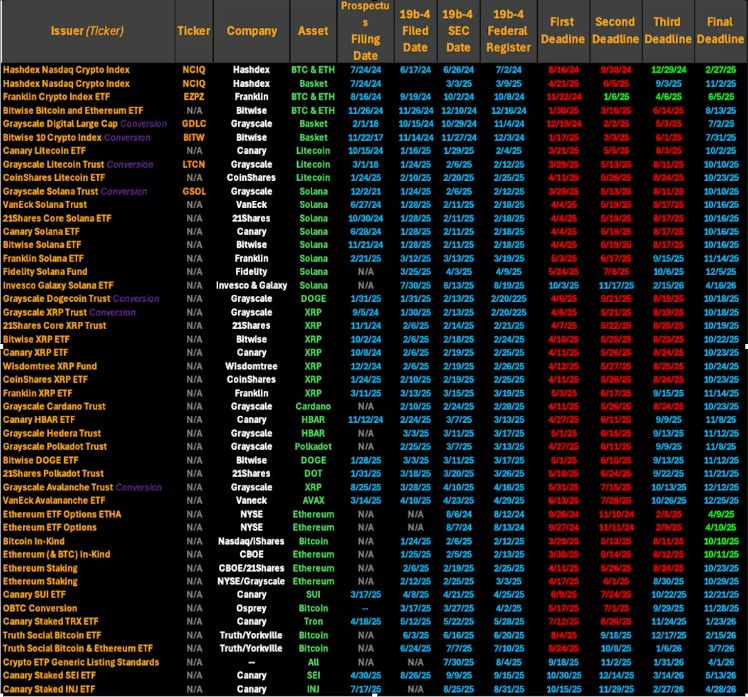

SOL: Heading toward Internet Capital Markets, backed by incoming ETFs

Solana is quietly setting the stage for what could be one of its most important chapters yet. On the institutional front, ETF approval chatter is heating up, adding a serious tailwind to the narrative. At the same time, protocol-level upgrades like ACE, MCL, and Ampelglow are expected to significantly boost scalability, efficiency, and developer experience, adapting the existing infrastructure to the needs of modern markets.

Meanwhile, the consumer app wave is real. From payments and gaming to DePIN and DeFi, Solana is no longer just a chain for builders but increasingly a place where end-users are showing up in force. That combo (i.e. institutional adoption + core protocol innovation + consumer traction) gives SOL one of the clearest multi-dimensional growth stories in the space right now.

Of course, all eyes remain on whether the network can maintain stability and throughput under heavier loads, but for now, Solana’s momentum feels undeniable.

Keep an eye on SOL.

Altcoins Are Cooking…And Timing Couldn’t Be Better

BTC dominance is finally cracking, and short volumes are piling up aggressively: just like we saw in 2021 (then everybody knows what happened).

ETH is leading the charge, pulling major alts in its wake. Projects with real PMF, strong fundamentals, and buyback-driven tokenomics are the ones to watch because they’re built for this kind of market.

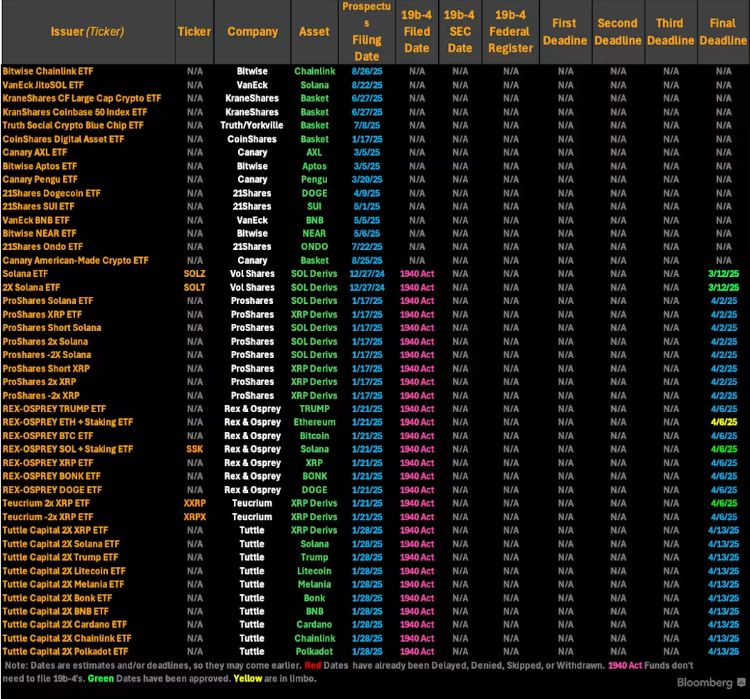

The kicker? Most of the altcoin ETFs are set to land in the coming months — lining up perfectly with this momentum.

📝 Add these to your watchlist:

- Chainlink —> The most institutionalized crypto asset ever has now introduced buybacks;

- CEX Tokens (BNB, BGB, OKB, etc) —> Strong buybacks + high probability ETFs + mainstream narrative;

- Solana —> Major ETFs coming + key infrastructure updates to close the gap with TradFi CEXs (CME; Nasdaq and so on);

- Jito —> THE SOL beta play (+ BAM + incoming buyback mechanisms);

- Hyperliquid —> a money printer that exerts constant, built-in buy pressure on its token, block by block, regardless of market mood;

- XRP —> strong institutional demand + major ETFs on the way