Monthly Market Pills (June - July 25)

The month between June and July was really hot for the crypto sector, which set new all-time highs for BTC (123K) and finally gave some positive signs on the altcoins side. The climate of geopolitical uncertainty caused by U.S. tariffs (and retaliatory actions by the affected countries), military escalation between Israel and Iran, general distrust of long-term bond products (especially U.S. bonds), and the health of Japan's financial system (unsustainable even if domestic debt, generally higher volatility ratios on main indexes, rising long-term rates, etc) is starting to erode macro indicators but apparently is not strong enough to undermine the momentum of U.S. indexes, which return to new all-time highs on the heels of a general state of euphoria (aka FOMO).

Yet there are plenty of signs that the US economy is weakening:

Economic Growth Slows (and this is a red flag for H2)

- Consumer spending fell 0.3% MoM in May (real terms), per the PCE report. Durable goods consumption was hit particularly hard as pre-tariff front-running faded.

- Restaurant and travel spending slumped, while services consumption posted its weakest monthly reading since Feb 2023.

- Q1 GDP growth was revised downward, with consumer spending rising just 0.5% SAAR instead of the previously estimated 1.8%.

Labor Market: Strong but Softening Beneath the Surface

- June saw 147K jobs added, matching recent trends, while unemployment dipped to 4.1%.

- However, jobless claims have quietly climbed to 8-month highs, and it's getting harder to find a job.

- Immigration policy changes could further shift labor supply/demand dynamics, but it s hard to say how and when.

Inflation: Muted but Volatile Underneath

- Core PCE rose just 0.1% MoM (from 2.2%)

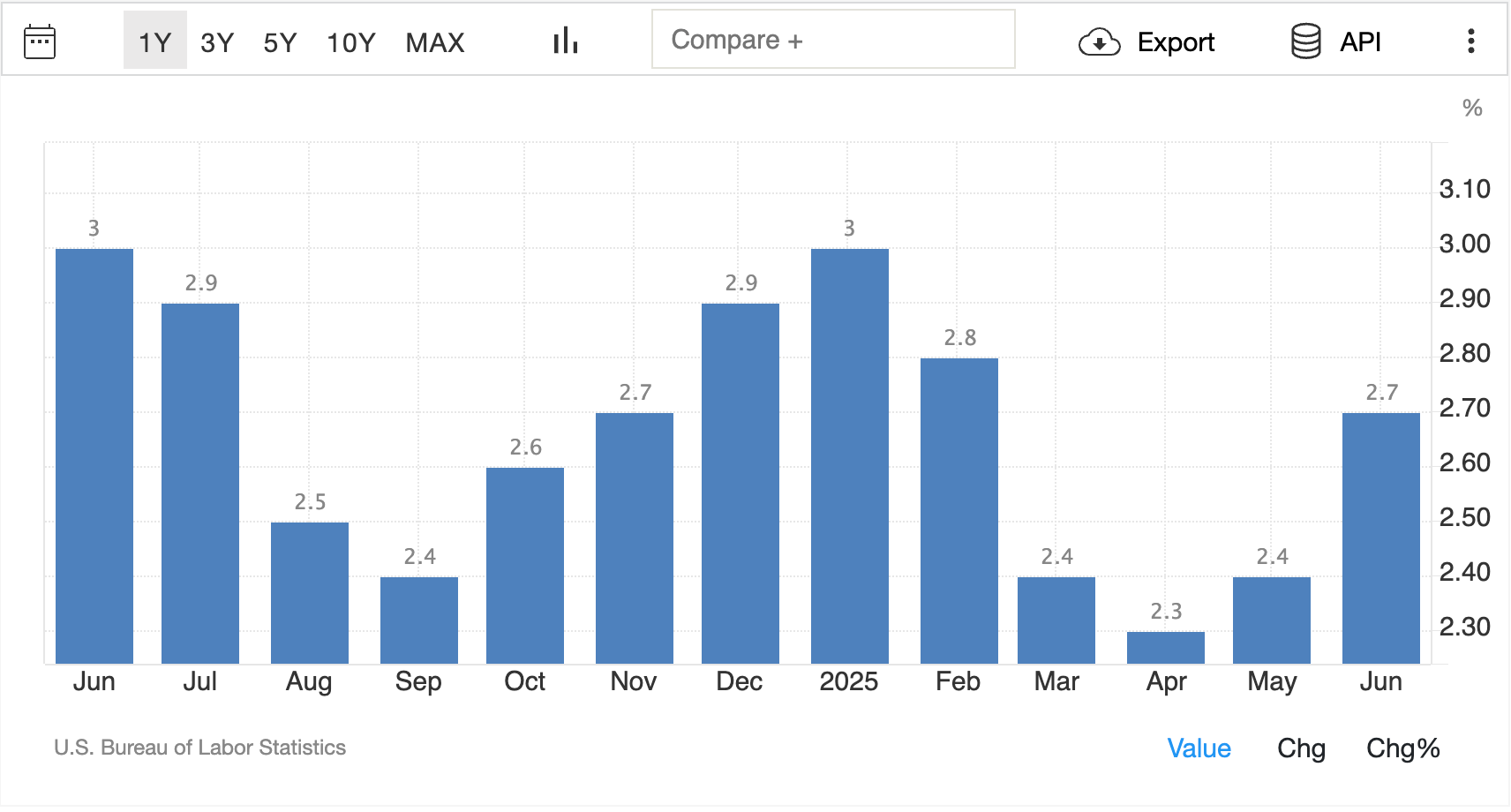

- U.S. annual inflation rose to 2.7%, its highest since February, up from 2.4% in May. Price increases were driven by food, transportation services, and used cars, while energy costs declined less sharply.

Geopolitics & Trade: Tariff Shockwaves Begin to Hit

The U.S. trade war has re-escalated, with ripple effects starting to reach macro indicators:

- Tariffs on copper and pharma, and vs Canada, Southeast Asia, and Brazil are either implemented or imminent (Aug 1 deadline).

- Copper tariffs (50%) triggered a +10% spike in copper prices, with inventories and futures both surging.

- Consumer prices haven't fully reacted yet, as inventory buffering and margin compression delay pass-through effects. But inflationary pressures are likely building beneath the surface.

- The average U.S. tariff rate has surged from <3% in Jan to ~18%, with further increases expected: it s a 90-year high.

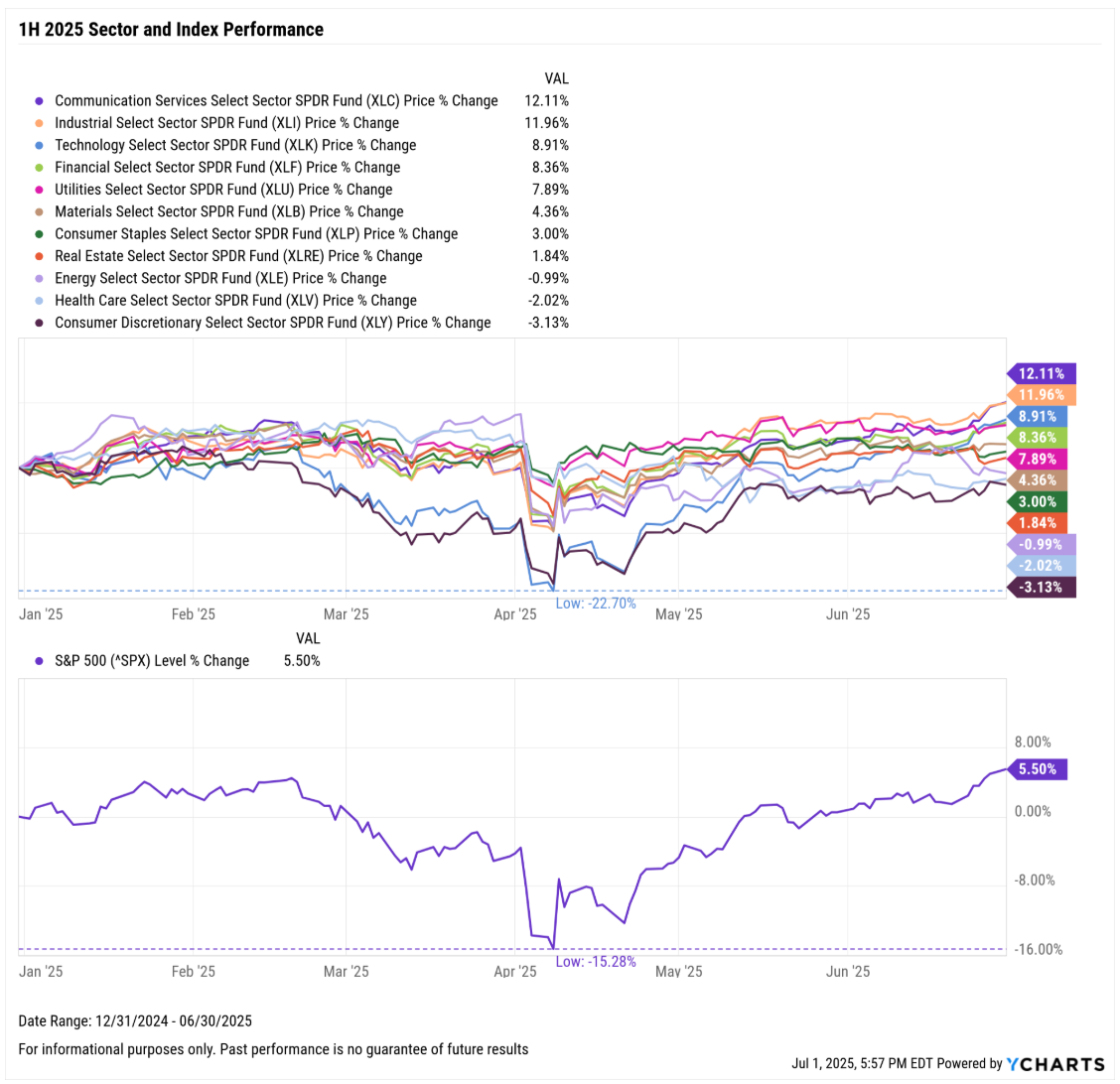

Markets have been surprisingly calm, with the S&P 500 up +5.1% in June, but this may reflect investor belief that Trump’s tariffs are negotiation tools, not final positions (does the TACO trade ring a bell?). Stock valuations are generally very high and seem not to discount the various risk factors on the table.

Global Capital Flows: Foreign Demand for U.S. Assets Still Steady

- The April TIC report showed $138B in outflows from Treasuries and Agency MBS — the biggest monthly decline since 2022, but it follows $345B in inflows from February–March.

- Foreign holdings remain near ATHs.

- China and Japan reduced direct holdings, likely shifting custody to Belgium (Euroclear).

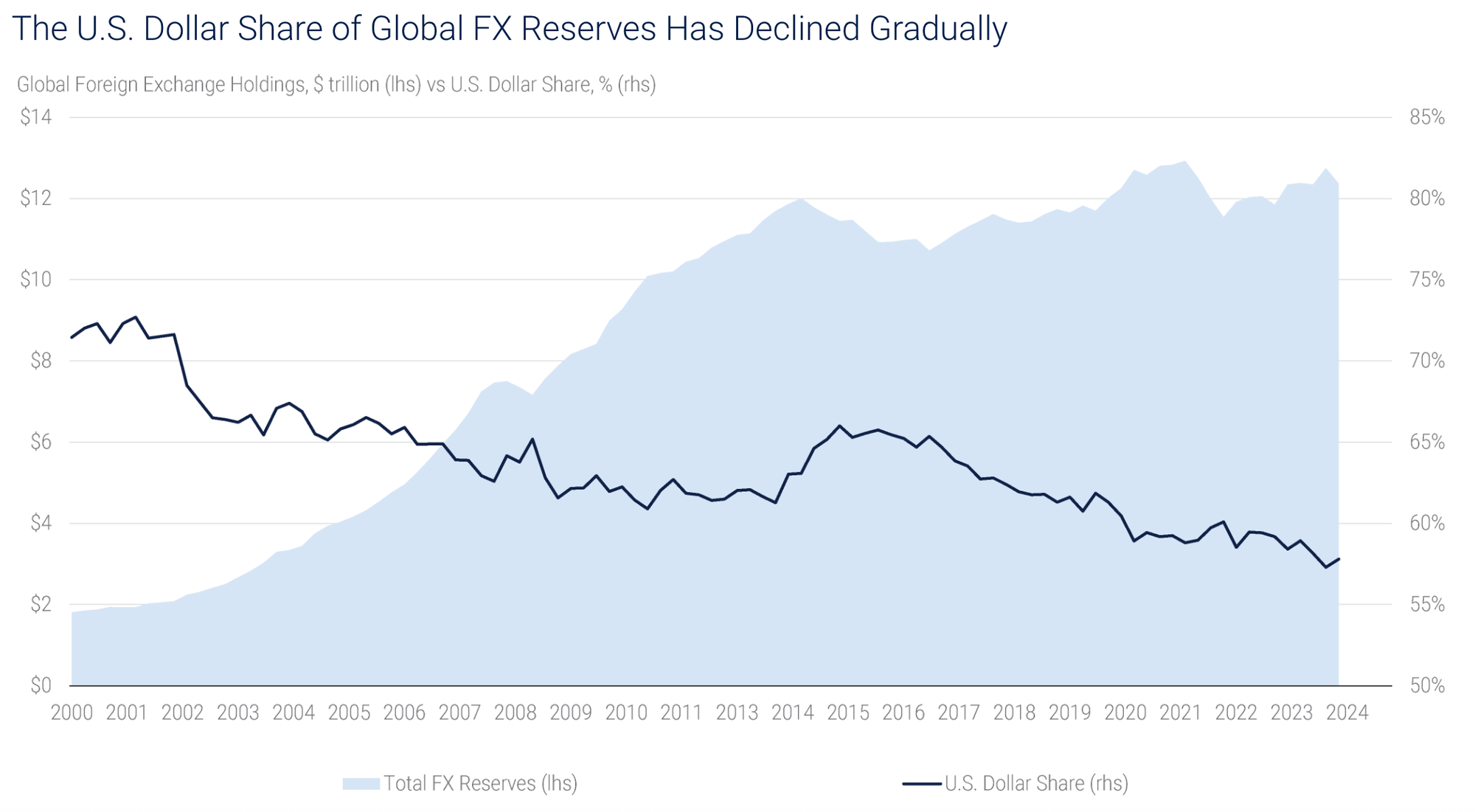

- The U.S. Dollar share of FX reserves continues to drift lower, but reallocation is slow-moving and unlikely to spark abrupt selling.

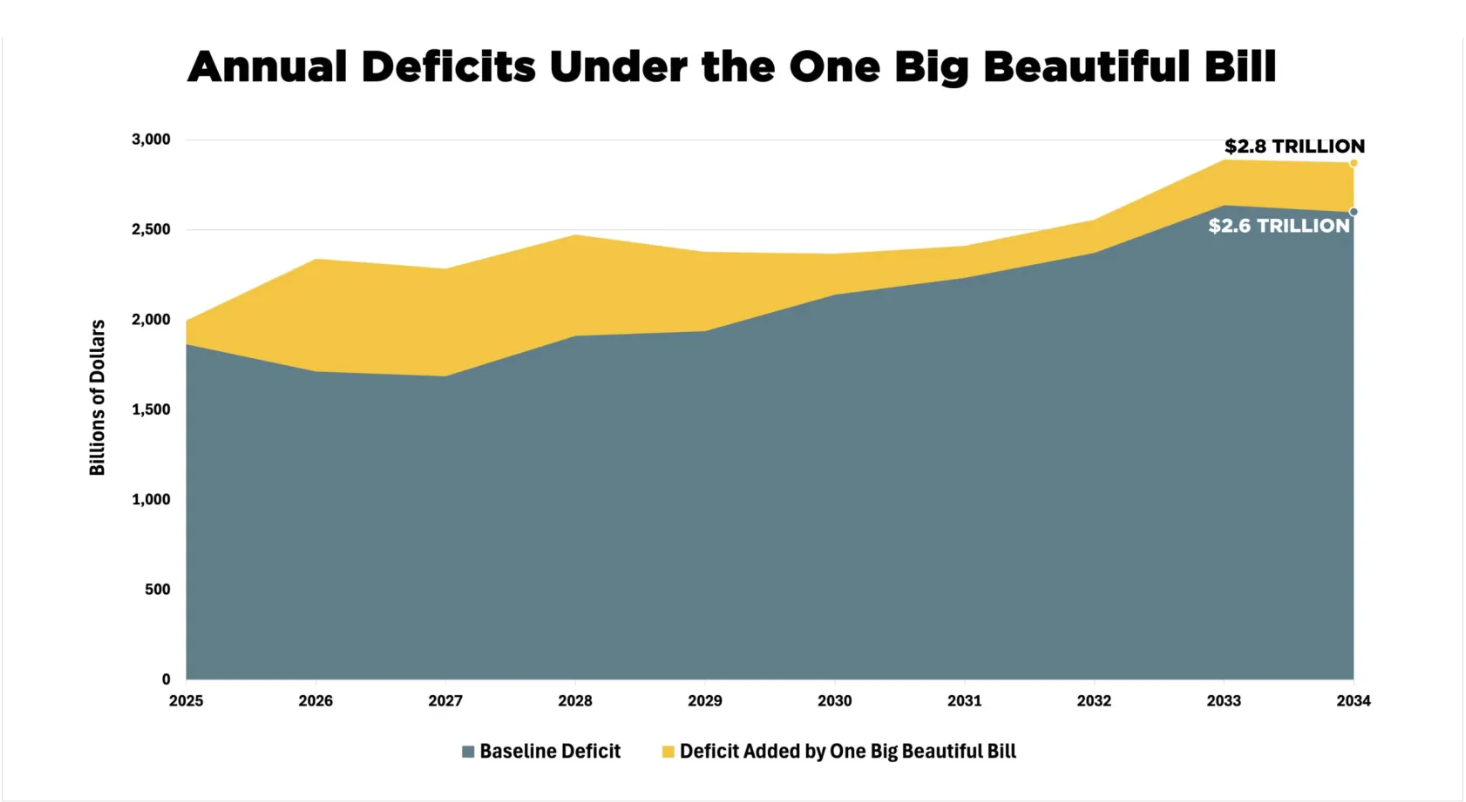

- And the situation is even more worrisome in light of the latest regulatory intervention sought and obtained by Trump, the Big Beautiful Bill, which could increase the budget deficit by $2.8 trillion by 2034 and cause 10.9 million Americans to lose health insurance coverage.

BTC is the north star

BTC has been the absolute star of these last 4 weeks: after a close in June above 106.5K, it opened the following month with a retest of previous highs in the 110-111K area and broke up violently, pushing to 123K and then consolidating in the 117-119K area.

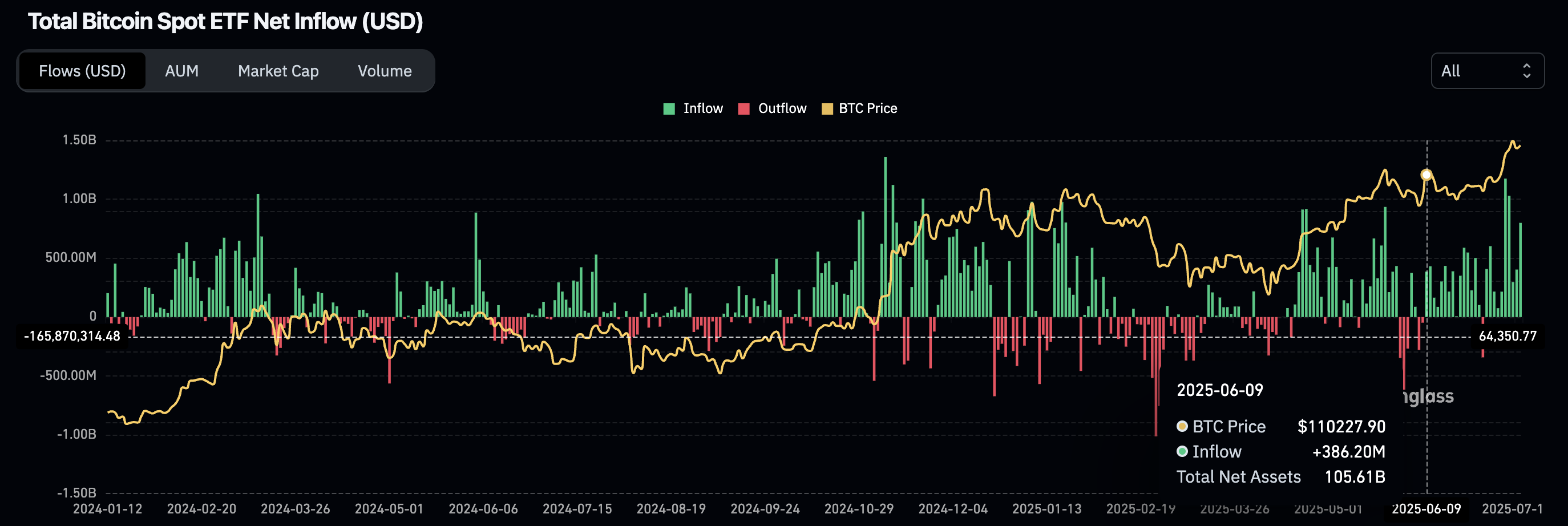

ETFs inflows are also meaningful and further certify the health of this bullish movement.

Some signs of concern, however, come from Open Interest, which is up vertically (nearly 50B of OI has been added in 15 days) and not backed up by spot volumes of the same magnitude.

Ethereum's renaissance

While it is true that in the past 2 months BTC has dominated the scene, it is also true that in recent weeks the spotlight has shifted to ETH: after 3 years of constant (and frustrating) weakness against BTC, the queen of cryptos has finally reversed the trend on the daily and is about to seal the reversal on weekly TF.

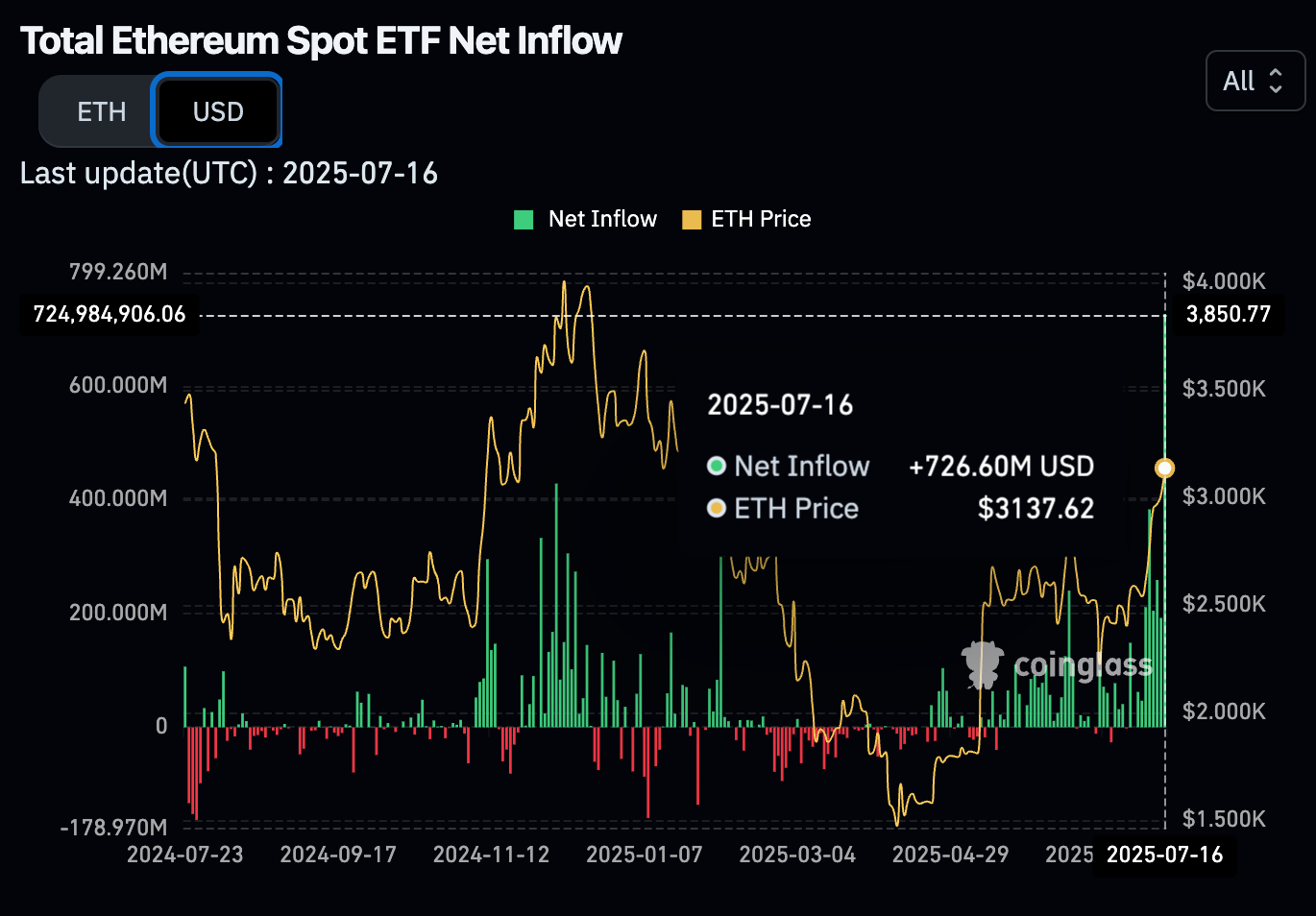

Inflows on ETFs have literally blown up in the last few days, coming close to equaling those on BTC (which, however, has an M Cap of almost 5.5 times higher, 2.3 T vs. 400 B). In July alone, the aggregate figure set a record 1.2 B...and we are only half way through the month.

What certainly contributed most to the growth of interest on ETH were:

- the capital rotation out of bitcoin, which almost always occurs toward the end of bull market cycles

- the Genius Act, which finally laid out a clear regulatory framework for stable coin issuers

- the phenomenon of tokenization, which is gaining global prominence (the growth of RWAs is vertical and a vast proportion of these are on Ethereum or related L2s)

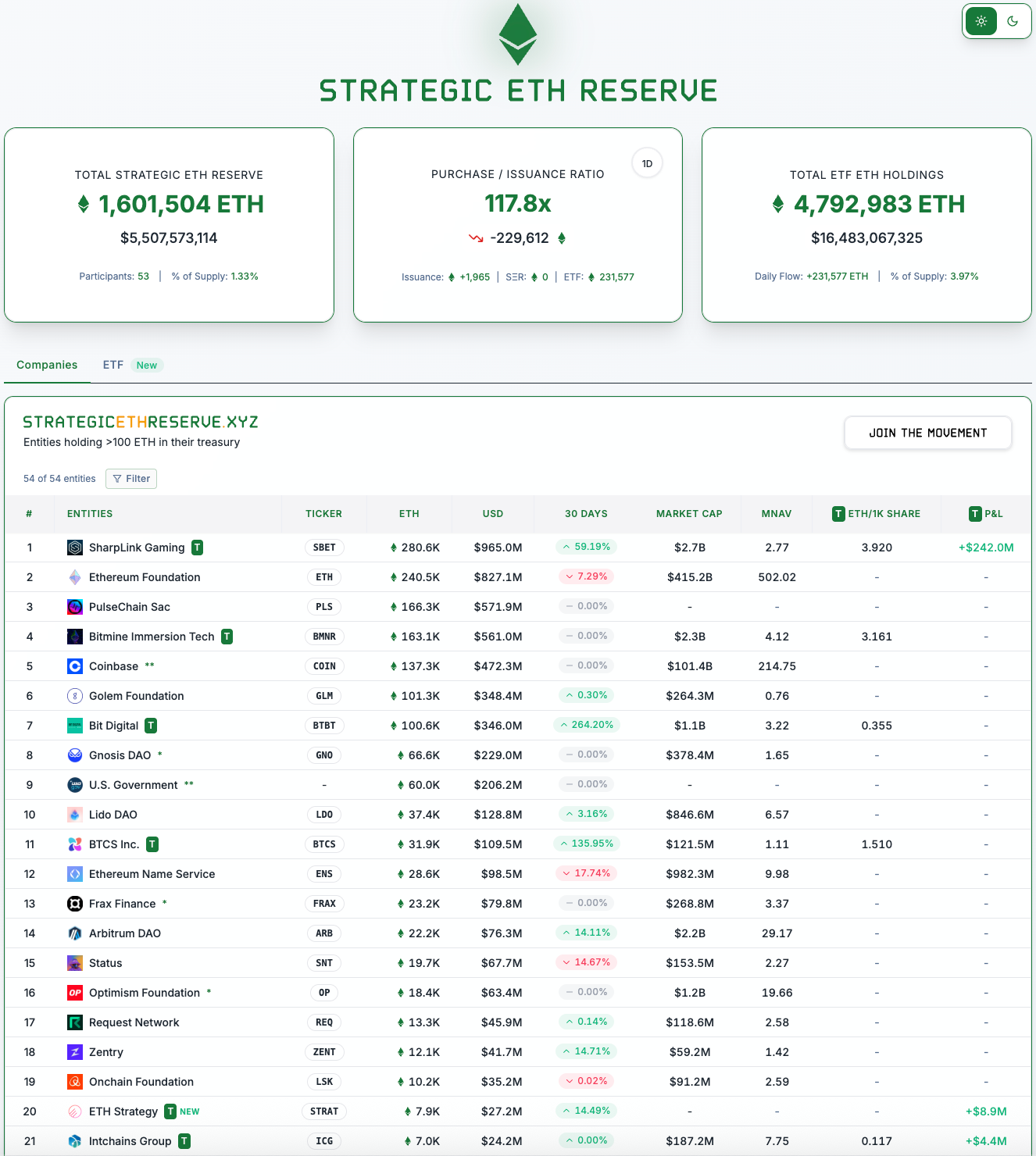

Along with the growth in inflows, the number of companies holding ETHs within their treasuries is also increasing.

Solana: Institutional Primetime Begins

June and early July marked Solana’s breakout moment into the institutional big leagues. Price held steady in the $150–$168 range, even as alts wobbled. But the big story here is that TradFi wants to be in.

On July 2, the REX-Osprey Solana + Staking ETF (SSK) launched, trading $40M on day 1. Days later, Galaxy + Invesco filed for QSOL, targeting direct SOL exposure with staking rewards. It's clear that SOL is now an ETF-grade asset.

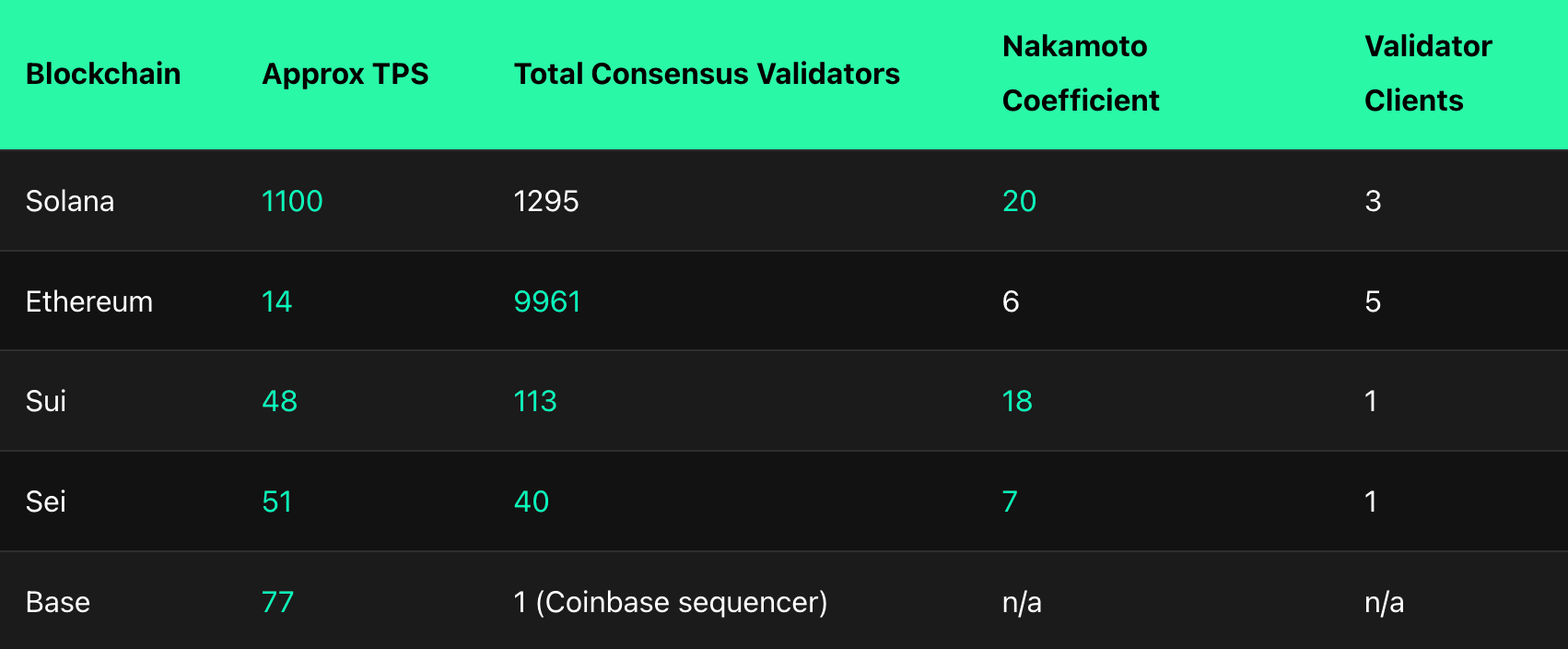

Under the hood, the network is humming. Solana’s had 16 months of 100% uptime, handled 200M+ daily txs in January without breaking a sweat, and now moves faster than ever thanks to scheduler upgrades and CU limits raised to 50M (soon 60M).

Validator economics are in their best shape ever: priority fees now go 100% to validators, MEV tips are flowing via Jito, and the break-even point dropped from 50K SOL to 16K. Validators are making real money, and sticking around. Participation is up too: SIMD-228 saw 74% of stake vote, the biggest governance turnout in blockchain history.

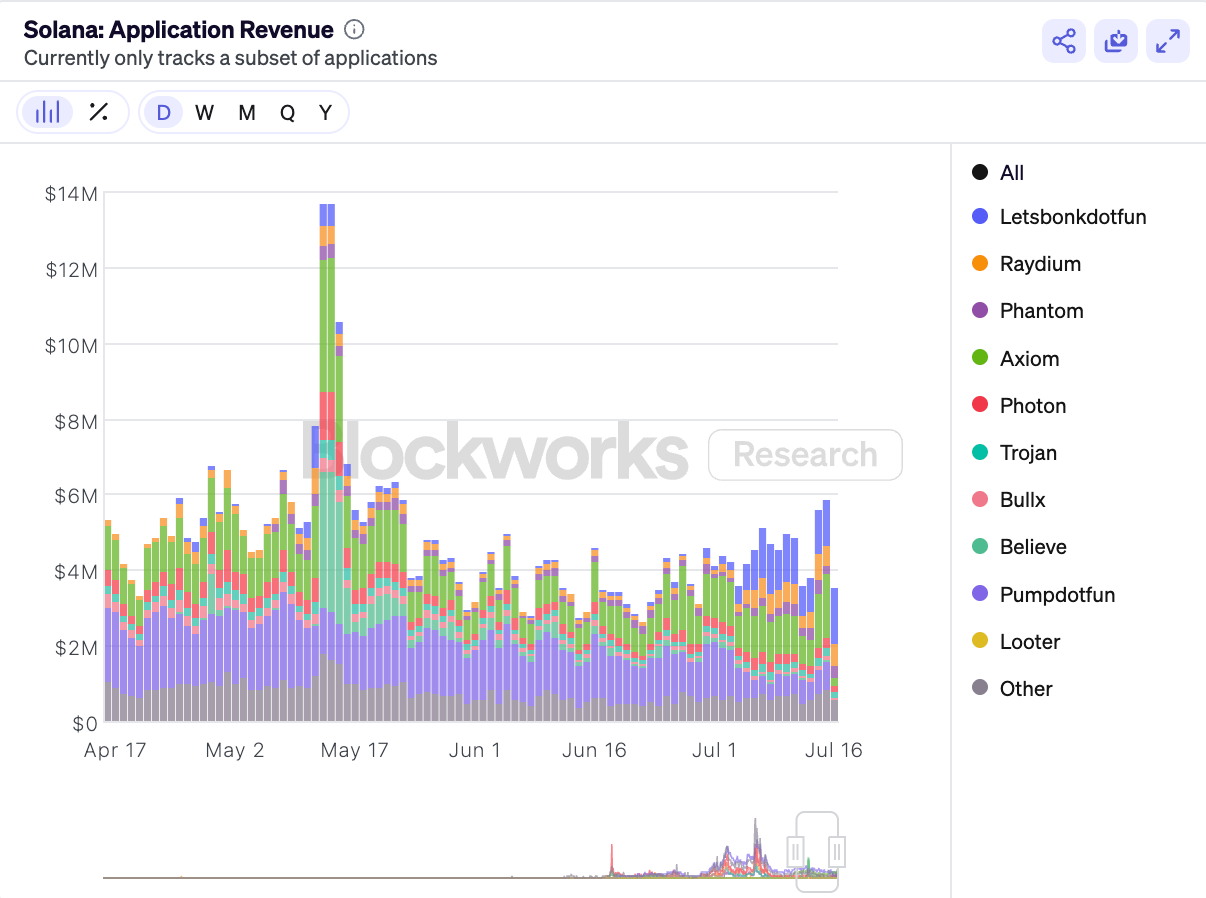

App revenue is booming as well. Solana logged over $1B in app revenue for 2 quarters straight. DeFi, NFTs, memes, and infra are thriving, with Jito, Raydium, Meteora, Pump.fun, and Telegram trading apps like Axiom and Photon leading the charge.

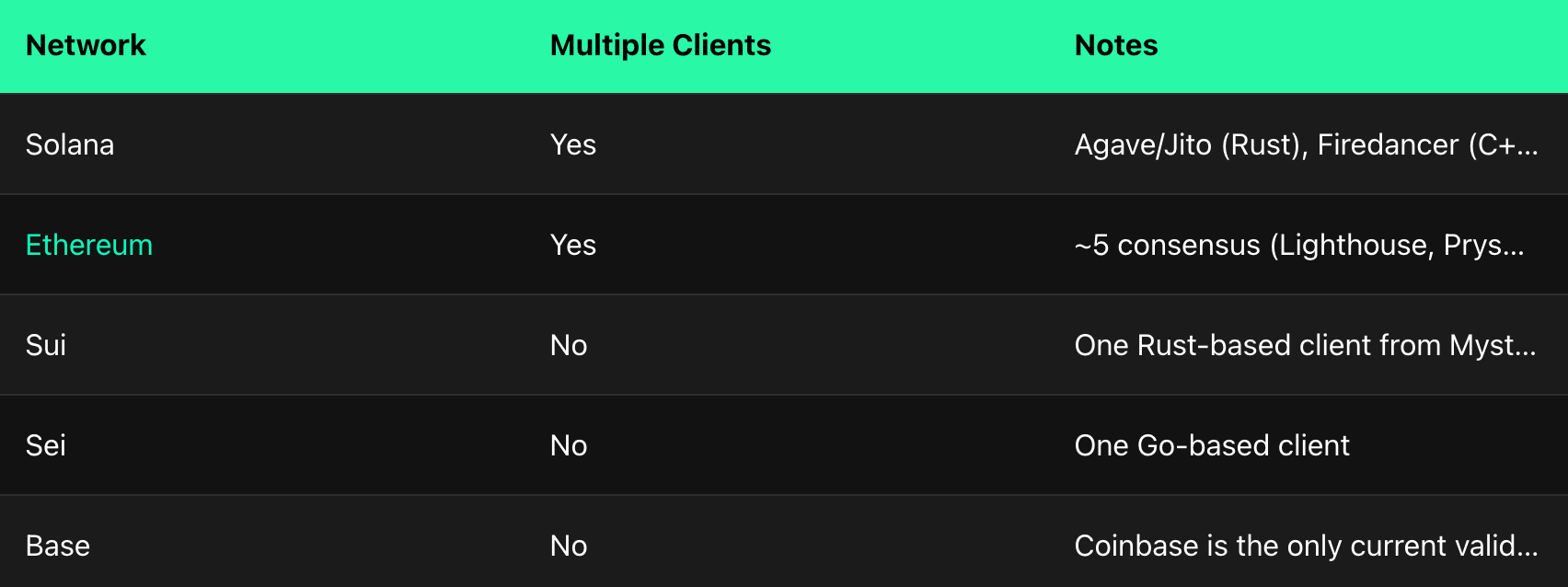

The validator set is strong: 1,295 consensus nodes, a Nakamoto Coefficient of 20, and a second validator client (Firedancer) now live in production. More clients (Mithril, Sig) are on the way, boosting decentralization and fault tolerance.

Meanwhile, Solana’s tooling and identity stack are getting serious. Pinocchio, Solana Blinks, and Attestation Service (SAS) are powering the next wave of compliance-friendly, user-friendly Web3. SAS is already used by Civic, Sumsub, Polyflow, and others to plug KYC and verifiable credentials into apps, without sacrificing privacy.

XRP:

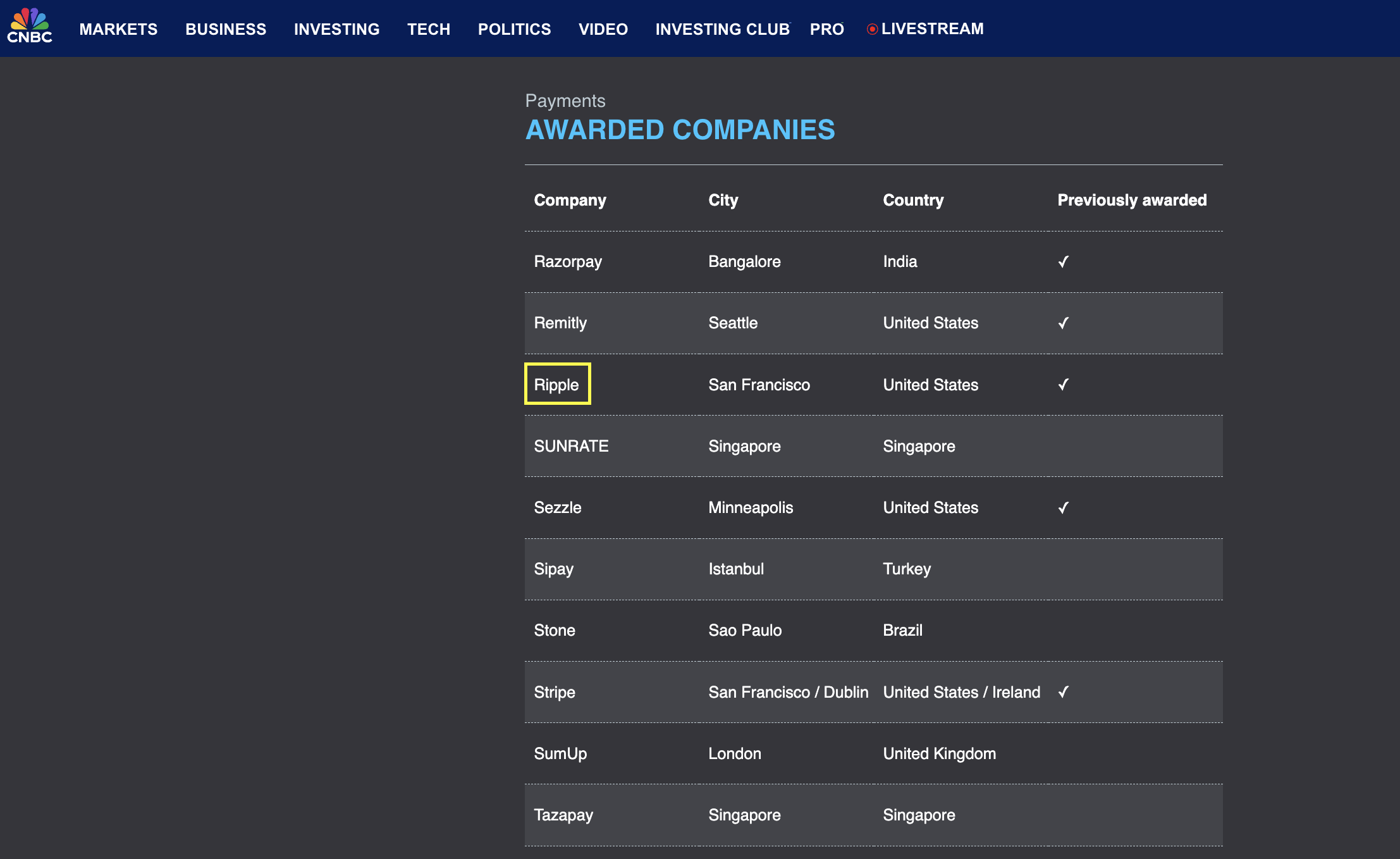

Ripple Is quietly attempting to fulfill its initial corporate purpose: transforming XRP and the XRPL into institutional-grade rails for global finance..and the story here is that it's succeeding.

Big Moves Just Dropped:

- Ripple’s enterprise-grade stablecoin RLUSD is now backed by BNY Mellon — the largest custodian bank in the world.

- RLUSD is issued under NYDFS oversight, and Ripple is applying for a national bank charter plus a Fed master account, signaling its intent to operate within the most stringent regulatory frameworks.

- RLUSD is now fully compliant under the DFSA’s regime in Dubai.

- Fiat on/off ramps are now integrated via Alchemy Pay, making stablecoin access seamless across 173 countries.

There is also no shortage of news on the infrastructure side:

- The XRPL EVM Sidechain is now live, bringing full Ethereum compatibility to XRP’s ecosystem.

- Powered by Axelar for cross-chain bridging and Grove/Pocket Network for RPC, developers now get:

- Smart contract support

- XRP as gas token

- 1K TPS and 3.4s block times

- Direct access to 6M+ XRPL wallets

Building Momentum:

Projects like Strobe, Securd, and Vertex Protocol are already deploying on the XRPL EVM, while Wormhole is integrating to supercharge multichain DeFi. Last but not least: USDC is now live on XRPL, solidifying XRP’s role in regulated digital finance.

Laying the groundwork for the Altseason

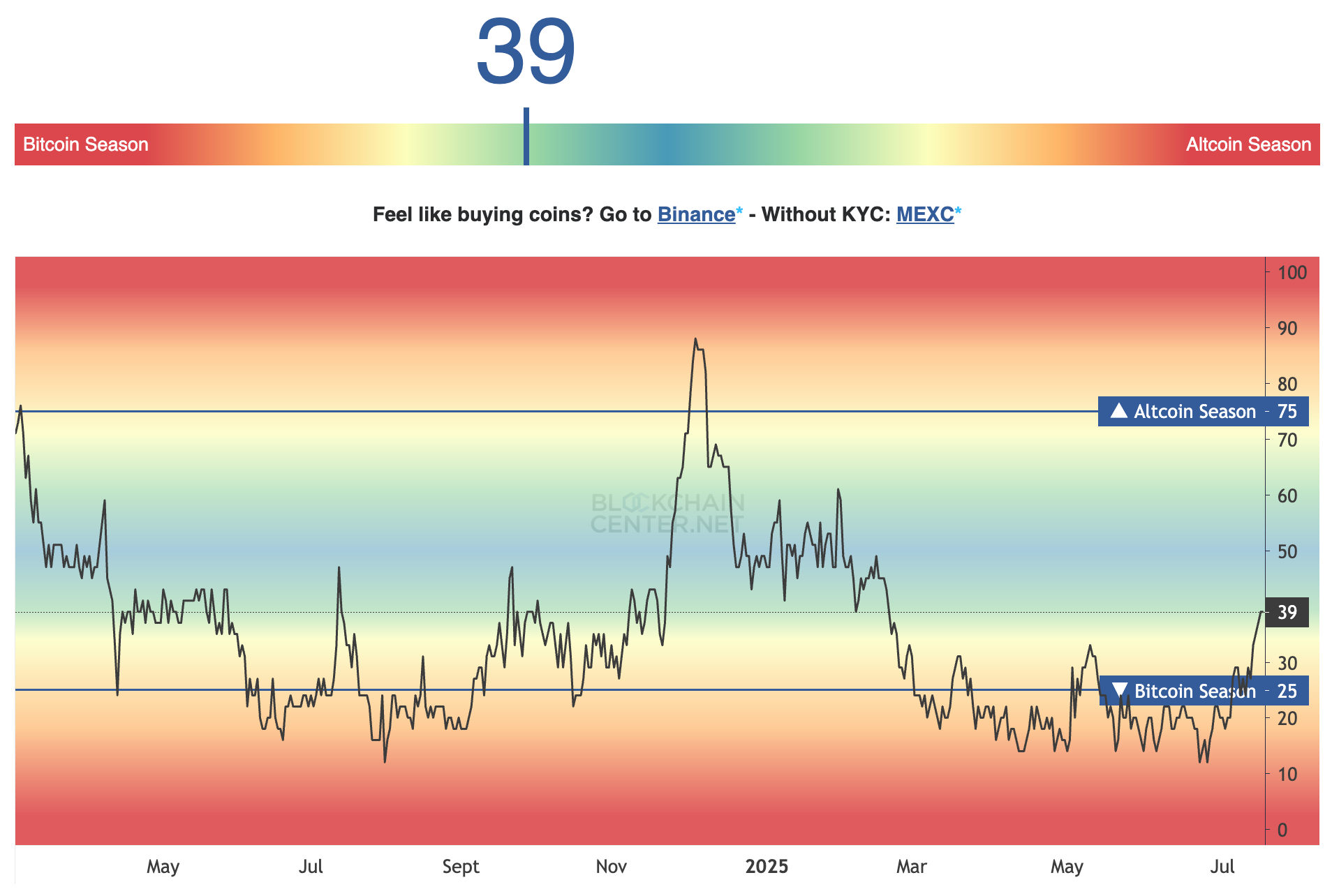

New highs in BTC followed by the rapid recovery of ETH vs. BTC outline a pattern that most snowed-in crypto investors are familiar with: the potential kickoff of altcoin season.

And signs this time are manifold:

BTC's dominance is showing signs of subsiding, and short volumes confirm this.

The Altcoin Season indicator has flared up again after months of flat encephalogram at the bottom line.

The number of ETF applications filed with the SEC is growing sharply.

Since everything is high… how much higher can we go?

This is the question on everyone’s mind as BTC prints new ATHs, altcoins ride ETF optimism, and liquidity floods back into crypto markets. On paper, valuations are a bit stretched, but momentum remains strong, macro is mixed (not outright hostile), and retails are just starting to come in.

So the real question might not be “how high” but “how FAST until gravity kicks in?”

For now, there’s fuel left in the tank. But smart money is already eyeing the exits (or at least tightening seatbelts).