Sophon Research Report

Enter Sophon: a novel L2 Hyperchain built with the zkSync stack and co-funded by Pentoshi and the ex-head of the zkSync DeFi ecosystem itself: Sebastien.

Context

Fueled by cutting-edge innovations such as AI, Blockchain, and AR/VR technology, the Global Gaming Industry is on track to exceed $280 billion in revenue by 2024. With an expected annual growth rate of nearly 9% from 2024 to 2027, it's projected to reach a staggering $360 billion by 2027.

The Web3 sector stands poised to seize this market momentum, particularly with the recent surge in quality of Web3 gaming titles like Pixel, Matr1x, and Sweat Economy, each boasting hundreds of thousands of daily unique active wallets (UAW).

In this landscape, Merit Circle emerges as an undeniable industry leader, providing essential infrastructure through Beam, and funding to some of the most popular and actively played games in the space, including Shrapnel, Big Time, Forgotten Playland and many others.

Furthermore, Matter Labs, the leading team behind the development of zkSync, is pioneering the research in the zero-knowledge (ZK) field of cryptography to potentially build the most secure and promising scaling solutions for the Ethereum main chain, known as zk-Rollups, which will enhance performance while reducing costs for all games and high-throughput dapps.

Enter Sophon: a novel L2 Hyperchain built with the zkSync stack and co-funded by Pentoshi and the ex-head of the zkSync DeFi ecosystem itself: Sebastien.

Sophon is being advised by Merit Circle to become the number one gaming and entertainment-focused chain within the zkSync ecosystem.

Sophon has also received investment and entered a partnership with Matter Labs, who will serve as their core technology providers.

This positioning will allow Sophon to easily integrate and onboard AAA titles within Merit Circle’s portfolio of games, while also leveraging the zkSync’s ecosystem and tech to deliver a very scalable, composable, and secure environment populated with a robust community of developers working within all other web3 niches on day one.

As such, in order to provide the best experience for users Sophon is committed to decentralization and democratization as core principles and for these reasons it will provide a Node Sale offering to allow broad active participation in the network to its community, distributing 20% of Total Token Supply (TTS) over Node Operators, together with the re-distribution of all Sequencer fees to incentivize a better environment for all developers and users to grow a vibrant community.

Project Overview

From the technical standpoint, Sophon is built as a modular rollup leveraging zkSync's Hyperchain technology and its designed to serve as an ecosystem for gaming, music, art, ticketing, and betting decentralized applications.

Sophon recognizes that beyond the initial hype for new technologies, long-term success is also reliant on the lasting value of the brand and the trust it builds with its users. This will become increasingly important as the technology for L2 rollups will become commoditized and widely accessible.

Sophon distinguishes itself in the growing blockchain market by prioritizing the development of a unique brand and community culture, rather than just competing through technical features or common marketing strategies.

“Sophon is where entertainment meets crypto, in a deeply thoughtful and intentional ecosystem that privileges developers and users.”

Sebastien - Sophon's CEO

The Tech Stack

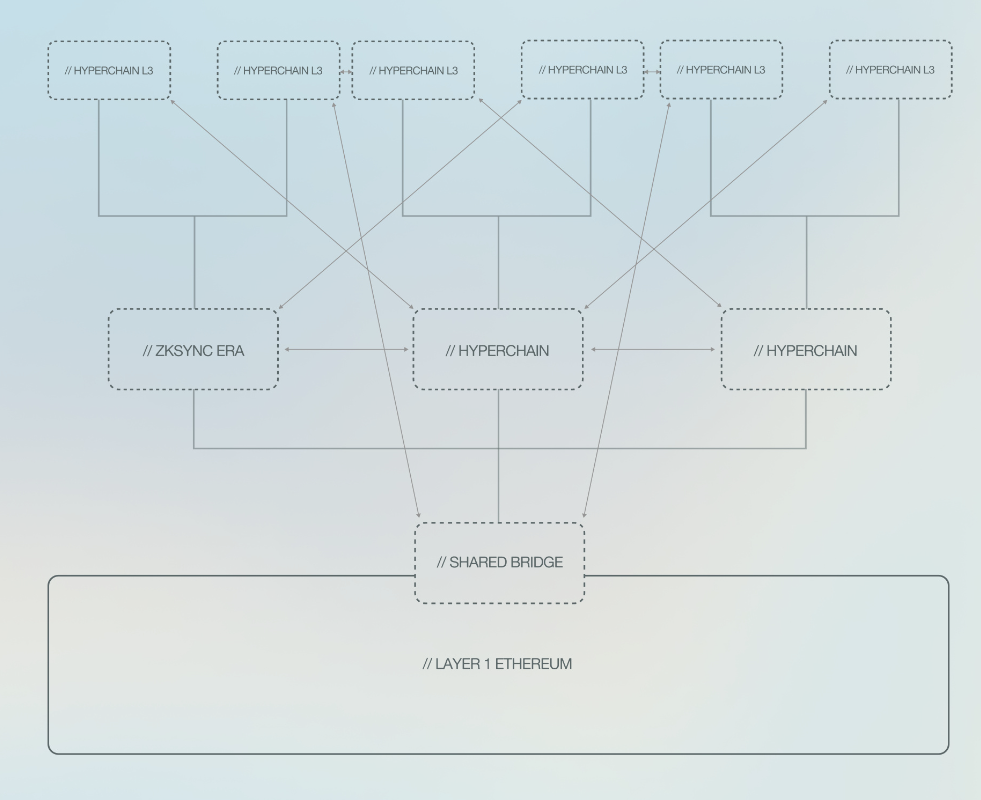

Being a Layer 2 Validium Hyperchain, Sophon will inherit full security from the Ethereum Layer 1, while potentially scaling up to thousands of transactions per second with low fees and native composability throughout the whole zkSync ecosystem.

Hyperchains are execution environments instancing the zkEVM and running in parallel to perform computation, and then settle all transactions on Layer 1, the Ethereum Mainnet through zk-proofs, also known as validity-proofs.

Hyperchains are connected in the zkSync ecosystem by Hyperbridges and the Shared Bridge, a set of smart contracts that verify Merkle proofs of the transactions between the chains. All original assets are locked in the Shared Bridge contract on the Layer 1, allowing unified liquidity to flow across the ecosystem.

Community first approach

Sophon is dedicated to preserving its distinctive appeal by meaningfully engaging with its community in ways that extend beyond traditional marketing tactics.

The sequencer, more than just a critical component of the tech stack, is also instrumental in the strategic redistribution of fees within the ecosystem to incentivize participation in the community from developers, protocols, and token holders.

To integrate transactions into its Sequencer Module, Sophon will run a Decentralized Proof of Authority (PoA) consensus algorithm.

This allows for the creation of a decentralized network of Sequencers, which will enable anyone to participate in the transaction sequencing process, ensuring a transparent and inclusive blockchain network.

Sophon is firmly committed to decentralization throughout its development process. Consequently, node operators will gradually take on more critical tasks, ranging from indexing to key aspects of the consensus process, to further decentralize the network.

Token

SOPH is the native token of Sophon, this means that fees on the hyperchain will be paid in the SOPH token.

Given Sophon's use of zk proofs and as with zkSync Era, there is a proving cost and then a transaction fee paid by users. The delta between the cost and the fee is positive, which results in a positive cash flow for the ecosystem.

Sophon will also focus on collecting and redistributing sequencer fees to token holders and protocols to promote long-term ownership and value accrual.

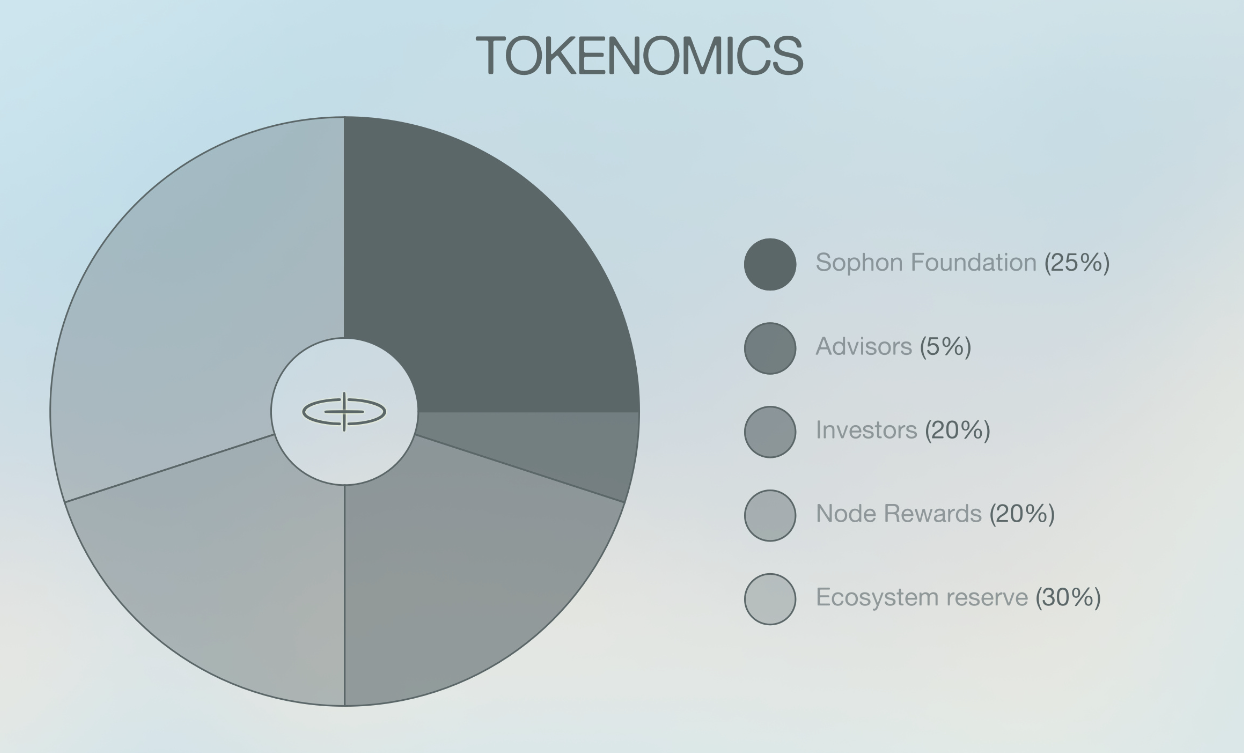

The tokenomics involve a distribution of 20% to node operators, 20% to investors, 25% to the Sophon Foundation, 30% to the ecosystem reserve, and 5% to advisors.

Vesting

Seed investors: 1y cliff; 2y linear

Team: 1y cliff; 3y linear

Ecosystem: 5y linear

Node Operators: 3y linear, rewards with 3months redeem/cliff (See the investment opportunity section)

Traction

Merit Circle/Beam:

Sophon is currently being advised by Merit Circle, which has committed to providing technical and legal support, as well as the transfer of high-throughput games to its ecosystem.

Merit Circle is a key player in the web3 gaming industry. While holding a 200M+ Treasury, its portfolio of games includes more than 50 important titles with names such as:

Big Time, Shrapnel, Heroes of Mavia, TrialXtreme, Oh Baby Games, and Forgotten Playland.

These titles can boast aggregates of millions of community members, millions of downloads from the Google and Apple Playstore, millions of views on Youtube, and thousands of $ETH in total volume traded for their NFT collections.

The collaboration with Merit Circle will provide the widest surface for Sophon to capture collaborations and become a host for the best gaming titles in the space, growing a vibrant and rich community of active users and players.

https://x.com/MeritCircle_IO/status/1783420749736210584

GuildFi

As the Gaming Superlayer bridging web2 and web3 data through Zentry, the Game of Games for the Play Economy, encompassing digital identity, assets, and activity, GuildFi is also cemented in the web3 space’s gaming niche as one of the strongest players.

With a robust treasury exceeding $100 million, and partnerships with 20+ between all the best web3 games including the likes of Axie Infinity, the Sandbox, Aperion, and Thetan Arena, GuildFi also both partnered and funded Sophon, getting aligned with the Hyperchain to bolster its adoption and provide it exposure to its community of players and network of b2b collaborations.

https://twitter.com/GuildFiGlobal/status/1768422095112077474?t=OQ8_Ehf3-v7B0lg6SpRpIg&s=19

Matter Labs/ZkSync

Matter Labs has funded Sophon and zkSync also gave Sophon a significant token grant, contingent on different milestones.

Together with Lambda Class, the leading tech provider for zkSync, now also committed to providing technical support to Sophon, all the most significant players in the zk ecosystem are signaling the strongest alignment with the Sophon Hyperchain to support it and make it the biggest gaming chain within the ZkSync space.

Dapps Pipeline

~40-50 projects already lined up, spread across basic DeFi primitives, Games, GambleFi, on-chain Casinos, AI-Compute, SocialFi, etc.

Impossible Finance

Impossible Finance has partnered with Sophon to support their Node Sale, aimed at decentralizing Node operations and aiding in building Sophon’s community.

This partnership will also provide significant funding and broad market reach.

https://x.com/impossiblefi/status/1781338332288688448

In addition

- 94k follower on Twitter

- 2m wallet sign-ups on sophon.xyz

- TVL farm campaign at launch

Investors

Sophon has received investment and formed strong Cap Table of Tier 1 investors and Angels such as:

- Paper Ventures

- Maven 11

- Spartan Group

- SevenX

- OKX Ventures

- Matter Labs

- Lambda Class

- Luca Netz

- Stani Kulechov

and many more.

Investment Opportunity

Sophon nodes will become a central component in progressing the decentralization of Sophon's infrastructure, leveraging advancements in zkSync's technology.

Node operators will initially engage in network indexing, with plans to later expand their role to include key aspects of decentralization such as consensus and proof generation.

Node operators will be rewarded with 20% of the Total Token Supply (TTS) over a period of 3 years for their contributions to the network.

The tokens will be distributed as vested $veSOPH, with the complete vesting of the tokens lasting for 3 months, early dumping will be disincentivized as follows:

- 75% penalty between 30 - 60 days

- 50% penalty between 60 - 90 days

- 0% penalty over 90

Sophon’s Node Round initial fully diluted valuation (FDV) is set at $132 million, based on a 50% participation estimate to the sale, with 200k node licenses available in total.

Here you can find here the spreadsheet with the Tier math for the Node Sale.

Team

Core Team

Seb (CEO): https://twitter.com/0xsebastiena

Sebastien is an experienced crypto-native operator and builder. Previously Head of Web3 at zkSync 2022-2024, Nervos Network 2021-2022.

Tom (CTO)

Two decades as tech leader and builder. 7+ years DeFi veteran, having founded and built some of the early products from DeFi summer and co-founder of some of the earliest DAOs in web3.

Pentoshi (CMO): https://twitter.com/Pentosh1

Mark (Lead Advisor, CEO at Merit Circle): https://twitter.com/meritcirclorr

Background in Finance - Founder of Merit Circle/Beam - the leading gaming DAO in web3.

Useful Links

- Website

- Deck (Pass: SophonFamily)

- Node Sale Deck

About Impossible Finance

Impossible is an on-chain native, research advisory firm with a DeFi launchpad and accelerator. We help projects kickstart, fundraise, scale and launch their tokens while enabling users to learn, discover and invest in high quality crypto opportunities.

Website | Twitter | Discord | Telegram | Blog

Disclaimers

Composed and presented by Impossible Finance Research Team

- Notes: DISCLAIMERS, TERMS, and RISKS

- Risk Warning: Trading and/or generally investing in any cryptocurrency involve significant risks and can result in the complete loss of your capital. You should not invest more than you can afford to lose and you should ensure that you fully understand the risks involved. Before investing, please consider your level of experience, objectives, and risk tolerance, and seek independent financial and legal advice if necessary. It is your responsibility to ascertain whether you are permitted to use the services of Impossible Finance based on the legal and regulatory requirements of your country of residence and/or applicable jurisdiction(s).

- The information provided on this memo does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such. Impossible Finance does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.