IPOR Fusion ⚛️ - Research Report

Context

In the past year, DeFi’s TVL rebounded to around $94 billion, marking a decisive shift in the adoption trend from traditional finance.

Global banks like JPMorgan, and Société Générale, alongside asset managers such as BlackRock, whose on-chain fund has surpassed $1 billion in AUM, and Franklin Templeton with $380 million in tokenized shares, have moved beyond observation into active participation and rapidly assembling internal teams, establishing trading desks, and forming custodian partnerships to integrate Web3 and DeFi technologies into their operations.

The IPOR Protocol was built on the premise that this adoption wave will be catalyzed by the growth of on-chain credit, and rate derivatives markets, thanks to the capital efficiency enabled by the programmable nature of digital money, and to the disruption of real-world-monopolies, fostering a competitive landscape of innovation.

To become the global nexus for value transactions though, DeFi must offer the robust onboarding and risk management tools that both users and institutions demand.

IPOR Derivatives and Fusion operate all around this opportunity, and in line with where the largest asset managers in the world are orienting their interest by tokenizing and now scaling their money market funds on-chain.

More specifically, Fusion is a modular on-chain asset management framework that allows the most seamless migration — thanks to it’s Python SDK that completely abstracts any Solidity proficiency, required instead by its direct competitors — and empowers digital asset managers to craft tailored, composable strategies built on top of DeFi Money Legos, allowing the deployment of secure customizable vaults — whether automated by AI or managed manually — that optimize capital efficiency, manage risk dynamically, and drive risk-adjusted returns across a diverse range of investment profiles.

IPOR Labs is also an active player in the credit and fixed-income sectors, offering the IPOR indices as public goods, and interest rate derivatives — such as swaps referencing the index.

Positioned at the forefront of this inevitable adoption trend, IPOR leverages DeFi composability and capital efficiency to unlock access to a broad spectrum of tokenized strategies, structured products, credit instruments, and leveraged yield opportunities — spanning every digital and real-world asset, to attract TradFi capital and offer transparency, security and accessibility to all its users.

Project Overview

IPOR Labs are the builders behind both the Fusion automation layer for digital asset management, IPOR indexes, and IPOR interest rate derivatives.

With IIP-34, IPOR rebrands and shifts its focus to Fusion.

Fusion is an automation-first, modular layer that enables digital asset managers to access custom-fit, composable DeFi strategies without requiring Solidity proficiency, and it provides the strongest security guarantees thanks to the adoption of the standards of ERC 4626 and OpenZeppelin’s Access Manager.

IPOR Fusion also solves the notorious conflict of interest between web3 asset management frameworks and managers by segregating strategy execution off-chain—safeguarding the manager’s hedge—while enforcing strict on-chain guardrails that transparently define approved fund flows through smart contracts, and smart contract functions whitelisting.

The value proposition of Fusion is tailored to different market participants:

- Capital Providers: Gain access to organically sourced, sustainable, DeFi yield opportunities through a suite of composable, risk-managed strategies that optimize capital efficiency.

- Curators: Benefit from a modular framework that allows for the creation and management of bespoke investment strategies. The off-chain execution model ensures that proprietary trading approaches remain confidential while still leveraging the strongest on-chain security guarantees.

- DeFi Integrations: Providing seamless composability and compatibility with a range of DeFi protocols thanks to Fusion’s compliance with ERC 4626 standards and its modular architecture.

- Distribution Partners (Wallets, etc.): Leverage Fusion vaults as plug-and-play solutions that can be integrated into existing platforms, such as wallets, Dexes, or any institutional distribution channels, to offer streamlined access to DeFi yields.

Interest rate swaps and indices will remain a core component of the protocol and will be further expanded in the coming years.

With future releases Interest rate swaps will also be integrated into Fusion vaults, such as a one-click fixed rate earn product or fixed rate borrow.

Traction

AUM:

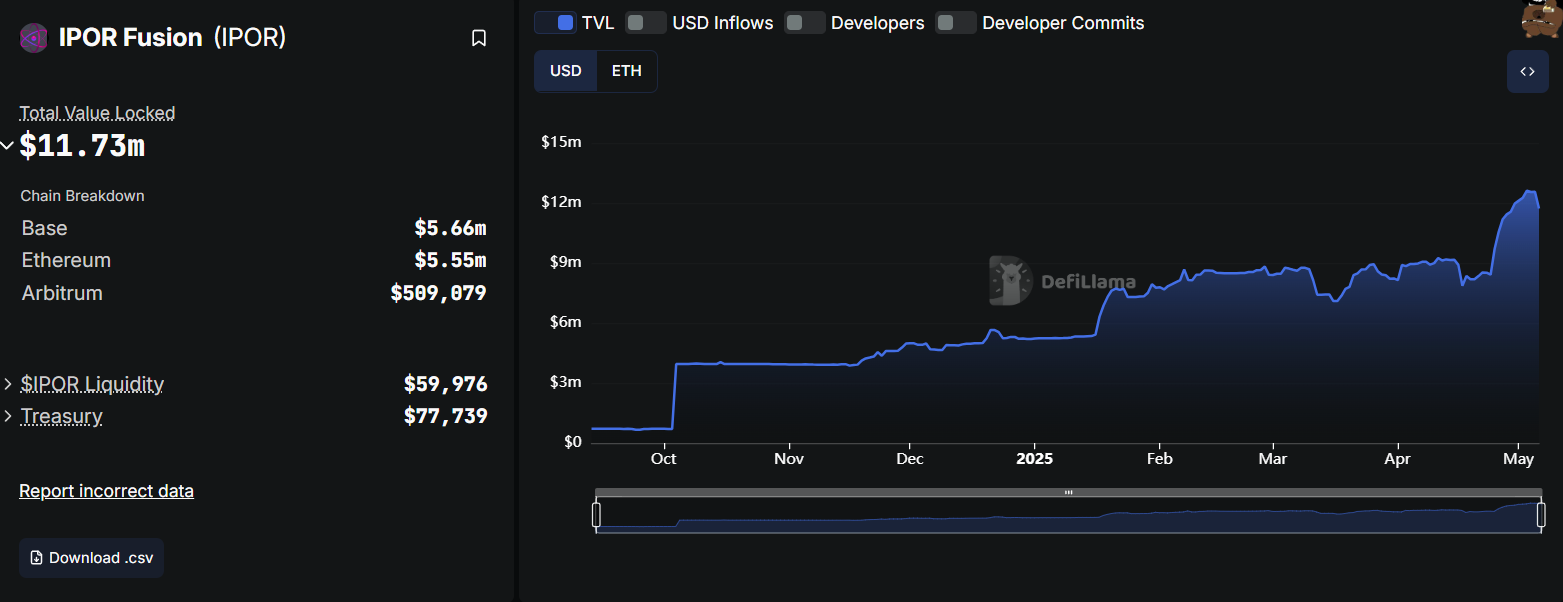

- IPOR Fusion: $11.7M TVL / $55M TVM (*) (w/ leveraged TVL in looping vaults, or Total Value Managed)

- IPOR Derivatives: $5.43M TVL

- Total: $15M TVL / $60.43M Including TVM

- $4.7B in lifetime derivatives volume

(*) Note: Fusion Vaults apply Performance fees on TVM

Integration Pipeline:

- 25+ vault integrations in the pipeline including:

- Harvest Finance 6 vaults

- Clearstar Labs 3 vaults

- Singularity vault DEX LP

- Leveraged looping Resolv USR

- Leveraged looping OpenEden cUSDO

- Reservoir rUSD/srUSD leveraged looping

- Regulated asset manager [name redacted]

- cbBTC looping and arb

- ETH+

- cbBTC multistrat

- Xerberus- Index funds

- Tau Labs

- Core stablecoin vault

- Reservoir srUSD/USDC leveraged looping points maxi vault

- PT leveraged looping vault

- IPOR DAO

- Stablecoin optimizers USDC/USDT/DAI

- Leveraged looping automated stETH/wstETH/weETH vaults

- Tanken Capital ETH vault

- Maple

- syrupUSDC leveraged looping vault, Atomist tbd

- Alphaping

- Leveraged Falcon USDC core

- Leveraged sUSDf

- Source:

DefiLlama IPOR Protocol - TVL

DefiLlama IPOR Fusion - TVL

Protocol Breakdown

The protocol is comprised of these main components:

- IPOR Fusion, the automation layer for digital asset management

- IPOR derivatives, including Interest Rate Swaps, and IPOR Indexes, acting as an on-chain benchmark reference.

- IPOR DAO, governing the whole system.

Each component is detailed in its respective section below.

Fusion - Automation Layer for Digital Asset Management

Fusion is a comprehensive DeFi aggregation, execution, and intelligence layer designed for digital asset managers, DAO Treasuries, structured products and more.

By integrating various aggregation and routing protocols into a modular smart contract layer, Fusion enables automated asset management to source and maximize yields across all decentralized finance.

This intelligence-driven engine supports all strategies such as looping, carry trades, arbitrage, leveraged farming, and passive lending, offering unparalleled flexibility and optimization for all types of DeFi participants.

Read more about Fusion’s architecture: https://blog.ipor.io/what-is-ipor-fusion-a-technical-overview-114ccd67dfcf

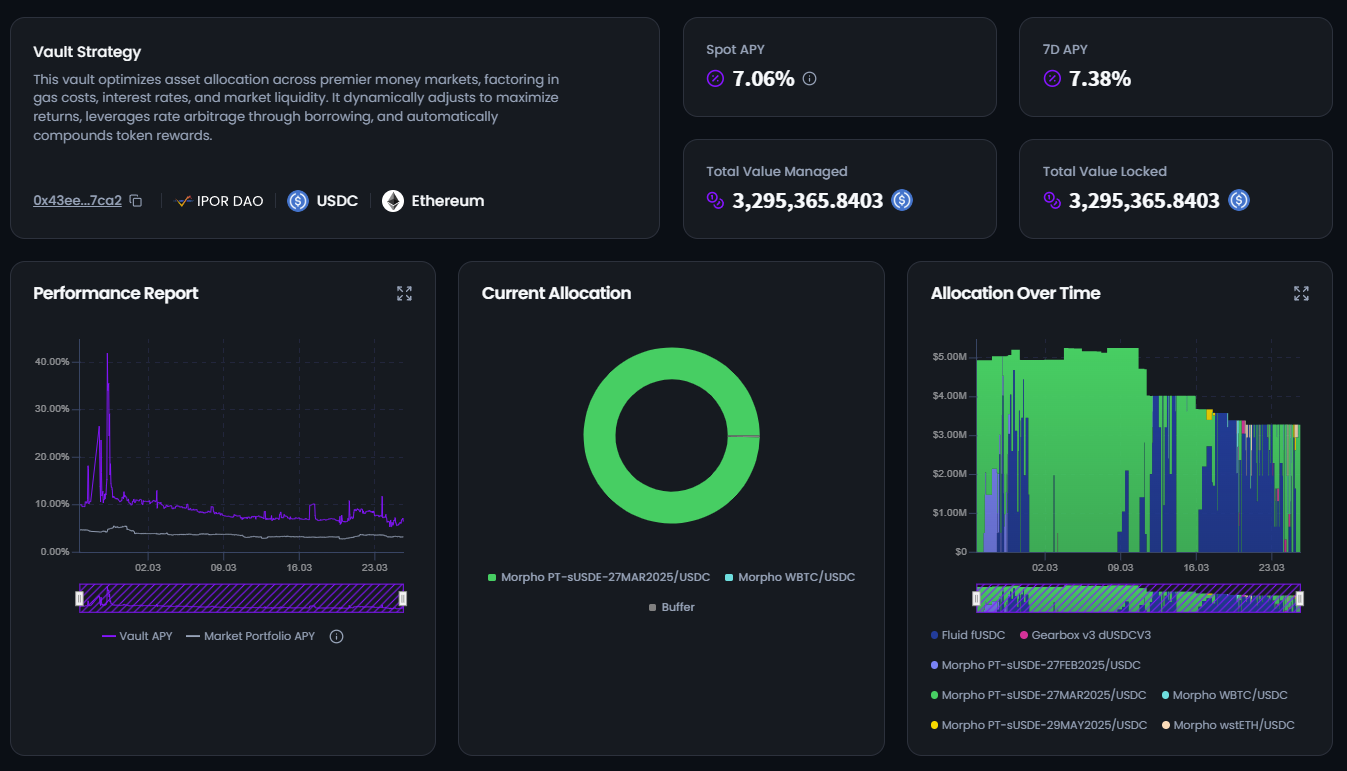

IPOR Fusion - USDC Lending Optimizer, Ethereum Mainnet

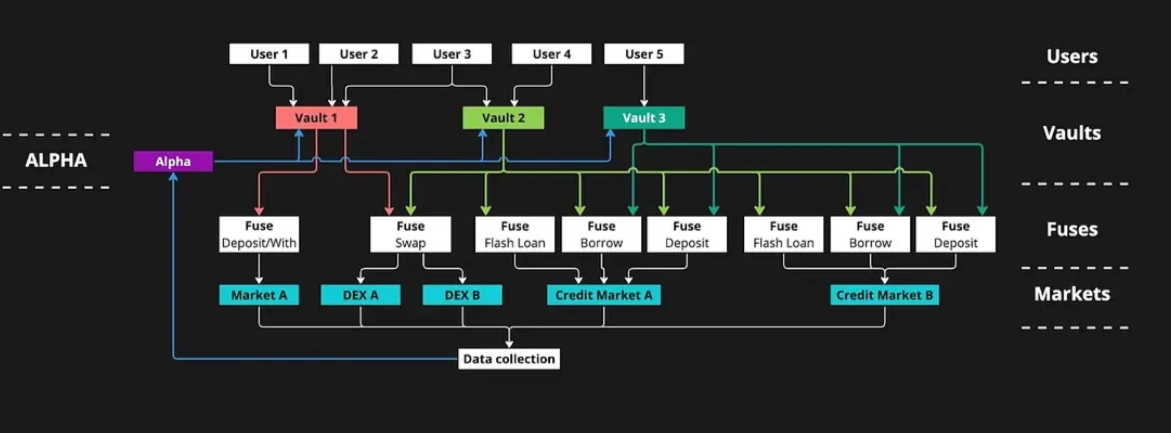

The architecture of IPOR Fusion is built upon several key components:

- Plasma Vaults: ERC-4626 compliant vaults, immutable for security reasons, that accept deposits and deploy capital across various strategies managed dynamically by Alpha Keepers (Alphas).

- Fuses: Immutable and non-upgradable smart contract connectors, or modules, that interface with external protocols, facilitating atomic actions and ensuring secure asset flows.

- Atomists: Strategists who design and curate investment strategies by selecting appropriate Fuses and configuring Plasma Vaults, tailoring risk profiles to meet specific objectives.

- Alphas: Off-chain agents or bots responsible for executing and maintaining strategy operations, optimizing asset allocation by interacting with Fuses.

Fusion - diagram of operational vaults, connected fuses and alphas

This modular architecture ensures transparency and adaptability, allowing Atomists to craft bespoke strategies that optimize capital efficiency, dynamically manage risk, and achieve risk-adjusted returns across a diverse range of investment profiles.

With Fuses clearly showing and defining what a vault can do, at the asset, action, and market levels, the Atomists are able to define the perfect walled garden for Alphas’ automation, while guaranteeing depositor transparency and security, and preserving the ability to adapt strategies to an ever-changing market.

<aside> ⚠️

It’s important to note that Fusion’s modular architecture underpins its security by isolating critical functions into discrete, immutable components.

Fuses can, in fact, be added or removed without affecting the vault's structure:

- No need to upgrade to the vault smart contract

- No need to touch the vault contract's storage

- No need to redeploy

This allows vault curators to change the strategy within the same vault without touching the data structure or vault smart contract.

Read more about Fusion’s security:

- https://blog.ipor.io/ipor-fusion-vaults-security-modularity-and-risk-management-94944e5147ad

- https://x.com/mario_ipor/status/1905332374201676003/photo/1 </aside>

On-chain vaults securely control assets while non-upgradable fuses—acting as dedicated connectors—ensure that any vulnerabilities in one module remain contained. This separation of duties means that even as strategies evolve and modules are updated or swapped, the integrity of the overall system is maintained.

Explore the existing Vault strategies on IPOR Fusion: https://app.ipor.io/fusion

Fee Structure (*)

| Management | Performance | |

|---|---|---|

| Fusion | 0.3% | 2% |

| Strategist (Atomist) | Customizable | NN |

| Automator (Alpha) | NN | Customizable |

(*) Note: Management fees are applied to TVL — i.e. user deposits — exclusively, while the Performance fee is applied to TVM as well.

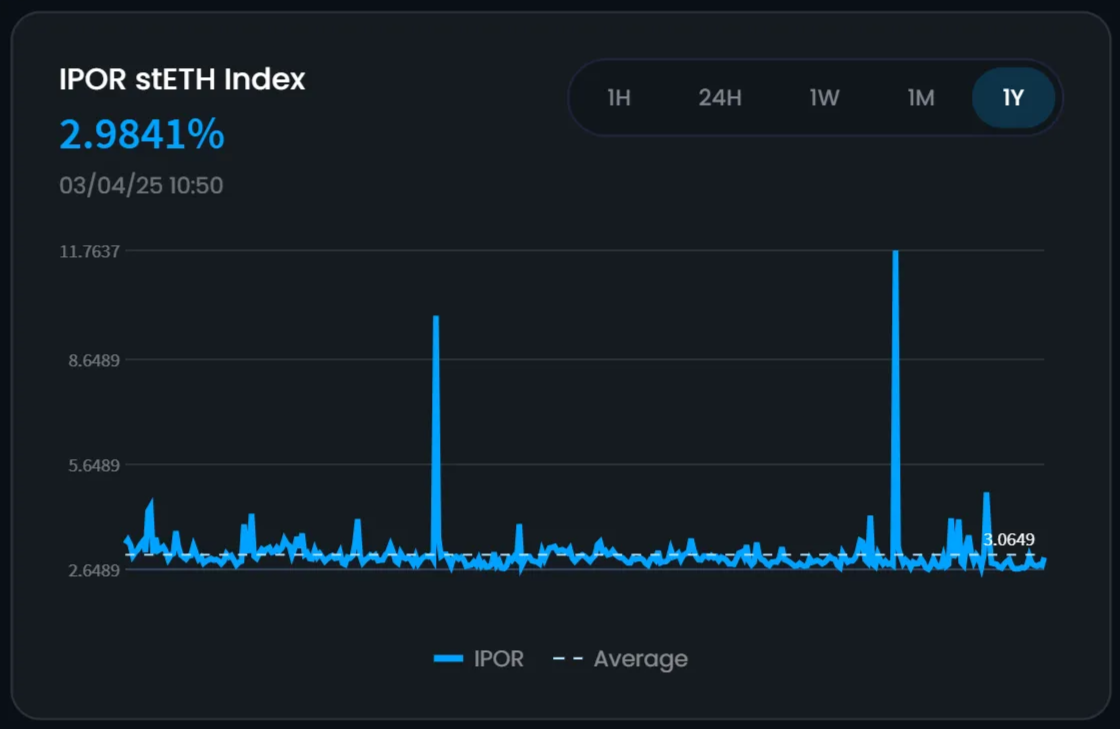

The IPOR Index

IPOR is an abbreviation for Inter Protocol Over-block Rate. It derives its name from major indices from traditional finance like the London Interbank Offered Rate (LIBOR), and the Secured Overnight Financing Rate (SOFR) and adapts it to DeFi.

The IPOR Index is a benchmark reference interest rate sourced, block-over-block, from other DeFi credit protocols and published on-chain based on the heartbeat methodology, serving as a public good upon which derivatives, financial instruments, and deals can be structured.

IPOR Derivatives - stETH stake rate

There will be multiple IPOR Indices representing the risk-free interest rate for a corresponding asset, such as IPOR USDT, IPOR USDC, IPOR DAI, IPOR ETH, and so on.

There will also be time-based rates such as IPOR USDC 1M, 3M, 6M, and so on for each asset as the yield curve develops.

The IPOR DAO governs the evolution of the indices.

Check out the method for the calculation here: https://docs.ipor.io/interest-rate-derivatives/index-calculation

Rate Swaps & the IPOR AMM

Interest Rate Derivatives are the second largest market in finance at $600T notional. Because of this, the IPOR Protocol chose to introduce its interest rate swaps (IRS) derivatives that enable participants to manage interest rate exposure by entering into contracts with its liquidity pool, and through their AMM.

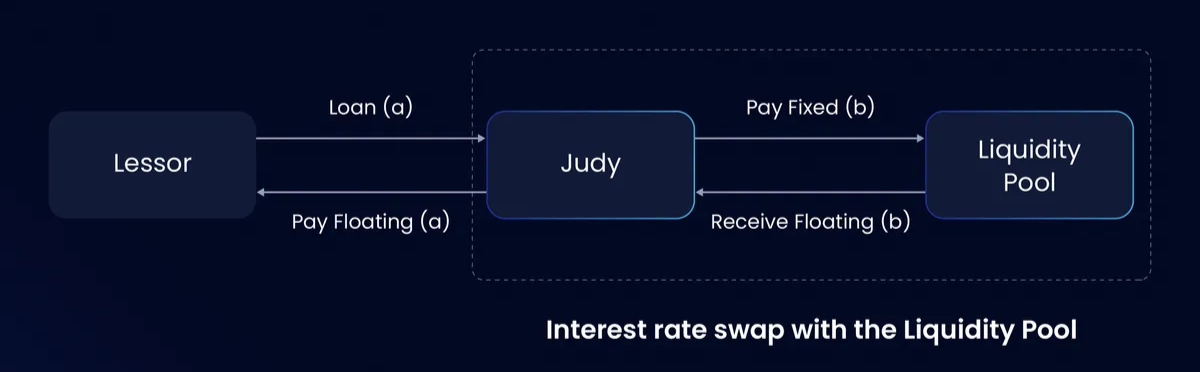

IRS with IPOR’s LP

In these swaps, a participant can choose to:

- Pay a fixed rate and receive a floating rate: The "Payer," benefits if floating rates rise above the fixed rate, as the participant receives higher floating payments while paying a predetermined fixed rate.

- Receive a fixed rate and pay a floating rate: The "Receiver," benefits if floating rates fall below the fixed rate, as the participant pays lower floating rates while receiving a consistent fixed payment.

These IRS contracts are structured over a specified notional amount and duration, allowing users to hedge against interest rate fluctuations or speculate on future rate movements. By facilitating these swaps, the IPOR Protocol aims to provide DeFi participants with tools to manage interest rate risks effectively.

IPOR’s IRSs are based on the IPOR rate and supported by the IPOR’s AMM that dynamically prices the derivatives taking into account the a number of market-driven data, as well as the current IPOR Index rate of a given asset.

Read more about the utility of IPOR’s IRSs: https://docs.ipor.io/faq/who-uses-ipor-and-for-what

Whenever the AMM’s LPs are not fully being utilized with IRSs, the IPOR protocol allocates reserves to third-party lending protocols, through Fusion, in order to maximize return for its Liquidity Providers.

Fee Structure**(*)**

| Notional | Management | Performance | |

|---|---|---|---|

| IPOR DAO | 0.10% | 1% | 10% |

(*) Note: These pools are publicly accessible; as such, any party developing on them or making deposits will be subject to the DAO’s fee structure.

Additionally, leveraged looping of ETH pools are in the pipeline, which will also underpin stake rate swaps.

Notional fees are distributed on a 50/50 basis between AMM LPs and the IPOR DAO.

IPOR DAO

The IPOR DAO is designed as a fully on-chain governance system, empowering community token holders to participate directly in decisions regarding the protocol's development, maintenance, updates, proceeds, and finances.

Participate in the IPOR DAO Governance:

The quorum for Governance proposals is set at 0.5% of the Total Token Supply.

Tokenomics

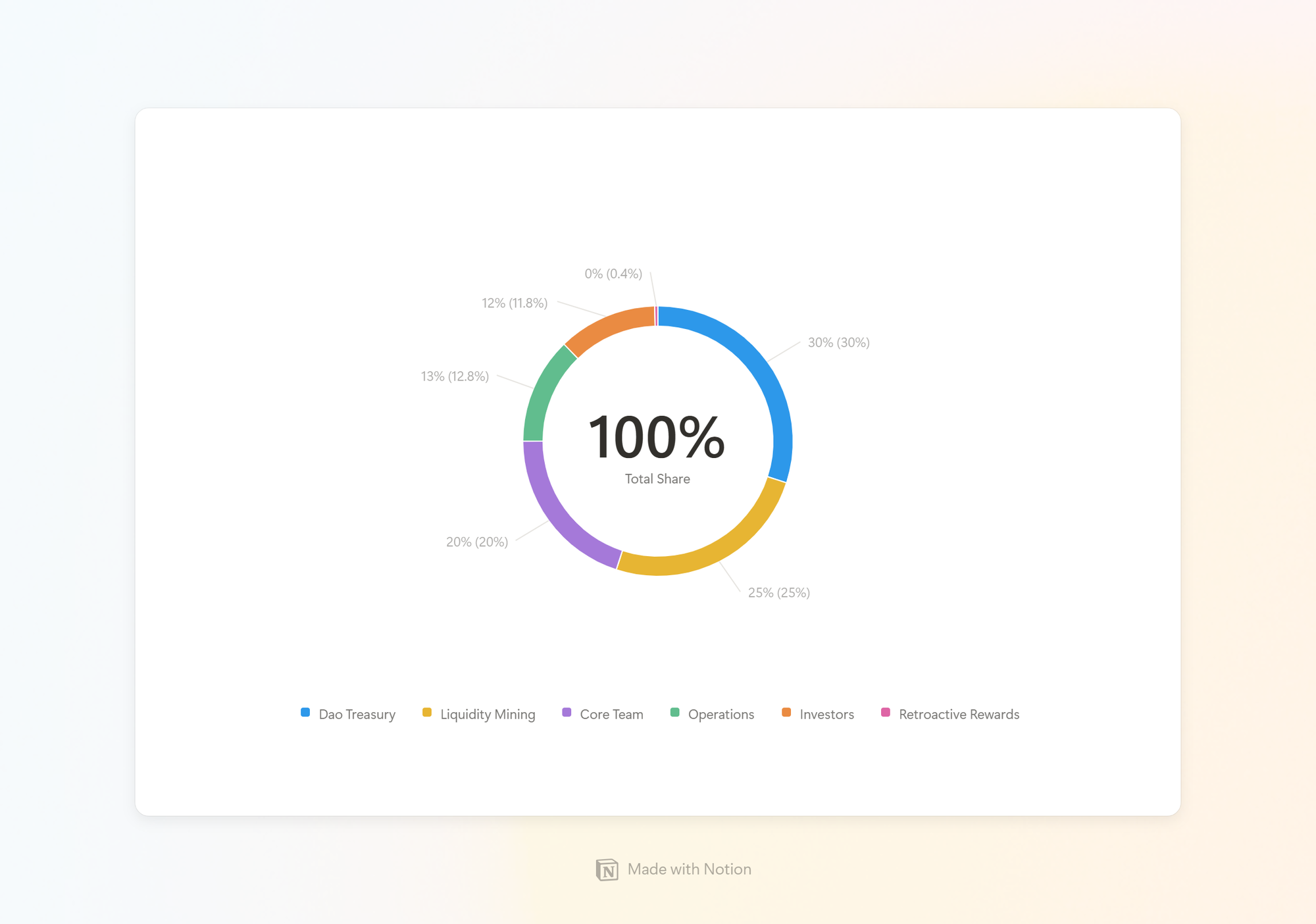

Token Allocation

| Share | Who | Vesting Details | Wallet Address |

|---|---|---|---|

| 30% | DAO Treasury | Governed by IPOR DAO | 0x558c8eb91F6fd83FC5C995572c3515E2DAF7b7e0 |

| 25% | Liquidity Mining | Emission of 1.05 tokens per block. Can be adjusted by the DAO. | 0x0b65625f905168EF24829fb625B177f83f1BFe6B |

| 12.76% | Operations | No vesting. To be used by the DAO | 0xB7bE82790d40258Fd028BEeF2f2007DC044F3459 |

| 20% | Core Team | Linear vesting over 3 years. No cliff. | 0x6f8c6Ae4e765a5d1fe07763B41c43453132C5D3d |

| 11.85% | Investors | Linear vesting over 3 years. No cliff. | Multiple vesting wallets |

| 0.39% | Retroactive Rewards | 85,200 unlocked from 18.01.2023. 305,000 vesting 6 months from the same date. | Multiple wallets |

History of Emissions Adjustments: Google Spreadsheet

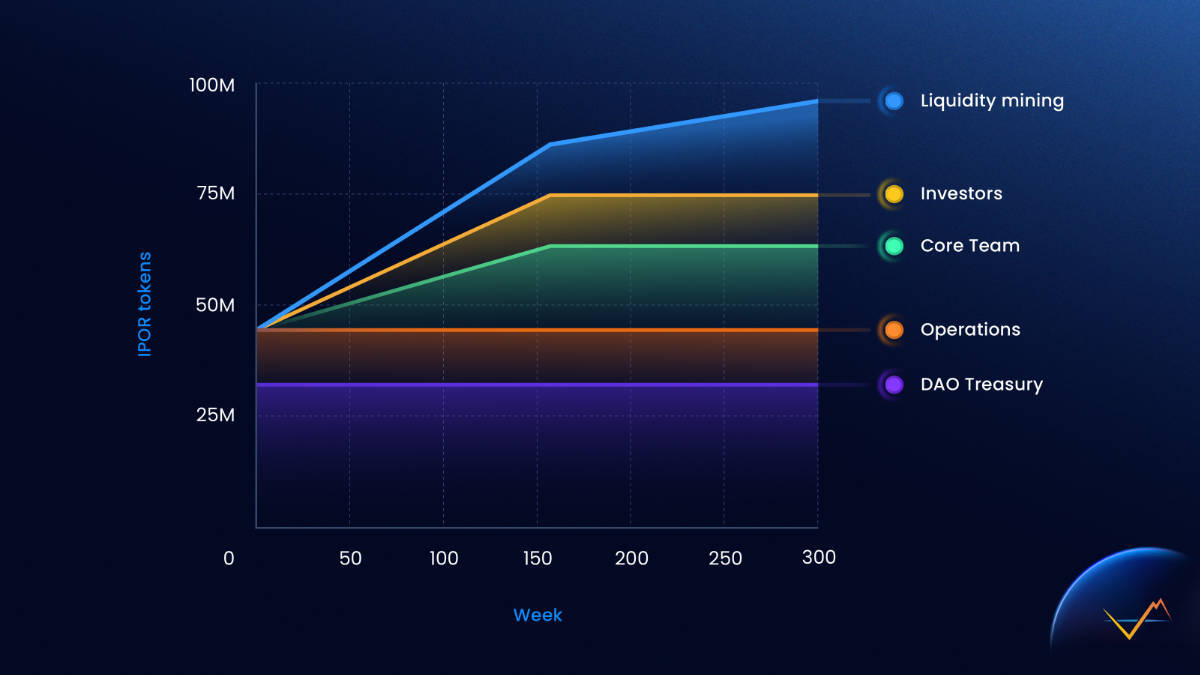

IPOR Token - Release Schedule (*)

- Total Supply: 100,000,000

- Circulating Supply: 28,568,089

IPOR Token - Release Schedule

(*) Note: We’re currently at the 122nd week of distribution

Token Utility: pwIPOR

- Power IPOR (pwIPOR) is a staked version of the IPOR token (1:1 ratio), locked for liquidity mining, voting, delegation, and future DAO-driven utilities.

- Unstaking requires a 14-day cool-off on Ethereum or 30 days on Arbitrum & Base, after which pwIPOR can be converted back to IPOR without fees.

Funding:

IPOR Labs raised 5.55 m across three rounds, with an average valuation of ~$46M.

All investors are locked with a linear release schedule of 3 years (finishing Nov 30, 2025)

Token Migration

Aligning with the launch, and the recent trend of positive growth in traction of the Fusion platform, successfully attracting both new TVL and strategy deployments, the IPOR DAO just issued a governance proposal (**IIP-35)** to take $IPOR token private, focus on rebuilding TVL and traction on Fusion, and relaunch the token as $FUSN.

- A snapshot of all IPOR token holders will be taken to determine eligibility for the FUSN airdrop. The snapshot will be taken within a maximum period of 2 weeks after the end of the voting period of IIP-35 — the determination of the exact time will be decided by IPOR Labs.

- IPOR token holders will receive FUSN tokens at a 1:1 ratio based on their IPOR holdings at the time of the snapshot.

- pwIPOR liquidity mining will be suspended after the snapshot. There is no need to unstake pwIPOR tokens. pwIPOR holders will also receive FUSN tokens on a 1:1 basis.

- The FUSN tokens will be offered in a new investment round though SAFT to investors that will be locked and subject to vesting.

- IPOR Labs team members shall also be subjected to vesting in alignment with the new investors.

- The maximum supply of FUSN will be 100M (equivalent to the IPOR token).

After the token migration and sale, the distribution of the FUSN token will look as follows(*):

(*) The numbers are based on the status at the time of writing and may differ at the time of the snapshot.

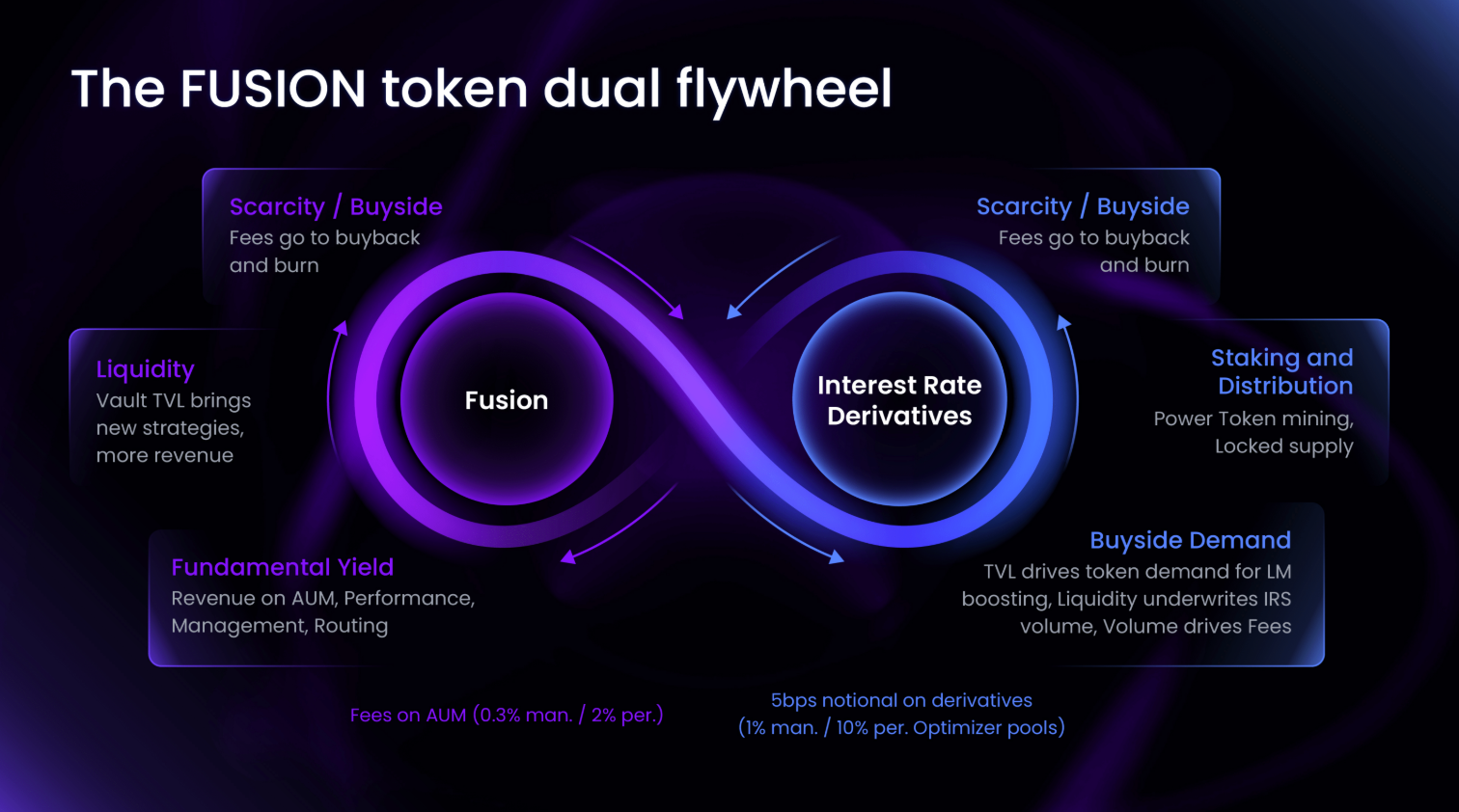

Token Utility: FUSN

- FUSN will inherit governance and Liquidity mining utility from the IPOR token

- pwFUSN will mimic previous pwIPOR utility and scope

- FUSN will also be able to be used for discount for the DAO fees applied to Fusion Vaults

- Fees will be used to Buyback & Burn, and Buyback & LP the FUSN token

GTM

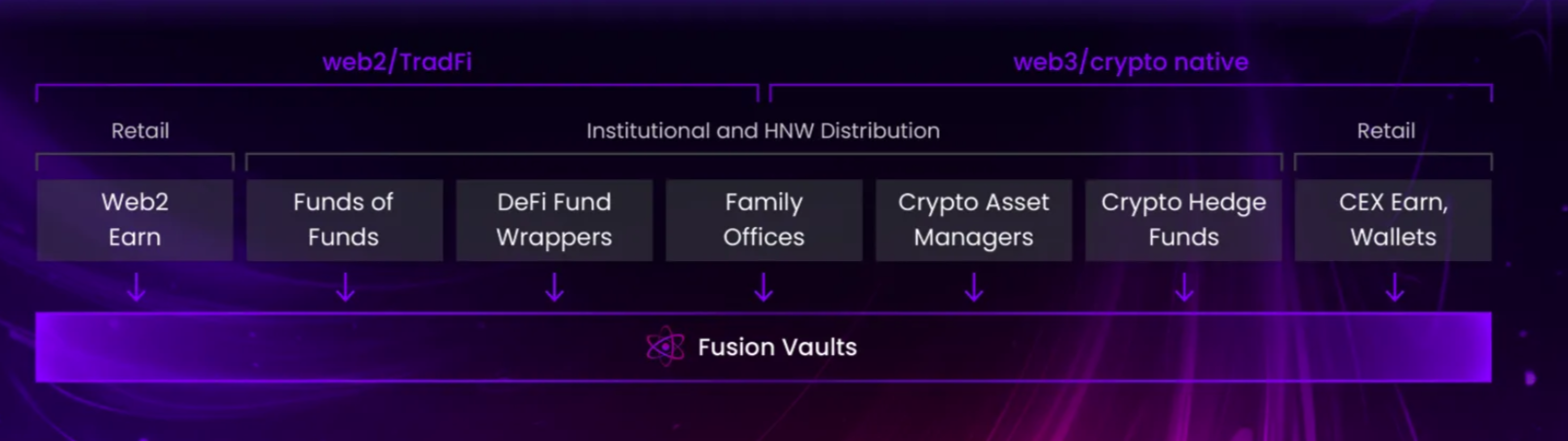

Fusion targets both traditional finance (Web2/TradFi) and crypto-native (Web3) segments:

For institutional and high-net-worth clients, Fusion unlocks DeFi yield exposure through familiar fund structures and treasury management solutions.

Fusion functions as the protocol layer, with Fusion vaults serving as tangible products. Comparable to investment funds, these vaults can be structured within legal frameworks and distributed through traditional channels to TradFi.

Meanwhile, Web3-focused funds and wallets can integrate Fusion vaults directly, powering their own earn programs with minimal friction.

Fusion - Customer base and B2B partners spectrum

- TradFi Funds: Offer exposure to DeFi-native yields to institutions, family offices and hedge funds.

- Web2 Businesses: Offer treasury management and DeFi yields to Web2 Treasuries

- Web3 Funds: Build or access strategies, customize fees and distribute products

- Web3 Protocols: Compose for additional capital efficiency gains on top of Fusion’s Vaults ****

- Web3 Wallets: Integrate Fusion to power earn programs effortlessly

Competitive Landscape

Asset Management Competition:

Yearn Finance: Yearn Finance pioneered automated yield aggregation in its v1 iteration, but its monolithic architecture and limited modularity can pose challenges when integrating new protocols. While Yearn v3 has introduced more flexibility, it still demands high-level Solidity expertise for strategy development. In contrast, IPOR Fusion allows strategists to build and run custom off-chain strategies — through the AI-ready Python SDK— without requiring advanced Solidity skills.

Veda & Sommelier: Emerging frameworks like Veda and Sommelier aim to deliver next-generation asset management tools, but they often require asset managers to share proprietary strategies on-chain, raising concerns about intellectual property and conflicts of interest. By contrast, IPOR Fusion’s off-chain Alpha layer keeps the “secret sauce” private, allowing strategists to deploy unique strategies without disclosing sensitive algorithms or losing competitive advantage.

Rate Derivatives Competition:

Pendle & Spectra: Protocols like Pendle and Spectra are key players in the DeFi rate derivative space, offering yield-stripping mechanics that require principal to be locked in PTs.

While in a stripping protocol at least one party must deposit the full notional, in IPOR’s synthetic interest rate products parties only need to post the margin and can trade on leverage (up to 1000x). This allows IPOR to deliver a more capital-efficient alternative, particularly attractive for TradFi adoption, that best aligns with the foreseeable requirements of institutional risk takers.

Team

Founders:

- CEO - Cofounder: Darren CamasDarren has been building in crypto since it was first commercially viable starting in 2011 running BD for TradeHill, at that time the #2 exchange to MTGOX. Since then has built multiple crypto projects from brokerage to payments, data to L1s, was an early advisor to Cardano in 2017, and early data infra for RWAs prior to founding IPOR Labs. His background spans exchanges, data, derivatives, and risk management. He built the IPOR Labs team from connections across multiple years in the industry with relationships spanning as long as a decade.

- CSO - Cofounder: Dimitar DinevDimitar started his career in investment banking in Shanghai before moving full time to crypto with BTC China. He has built multiple spot and derivatives exchanges, and was a VC with JRR Crypto, one of Binance’s largest angel investors. As part of JRR he advised multiple early DeFi projects starting from 2017, advising Anton Bukov before he founded 1inch. He also wrote early whitepapers on transaction fee mining before liquidity mining became prevalent. He and Darren know each other from 2018 and reconnected in 2020 during DeFi summer looking at market trends in DeFi identifying key missing pieces of the ecosystem.

- Chief Scientist: Mauricio Hernandes, PhDMauricio is a quant and royal statistician, with a PhD in computer science. He was formerly a board member at SBI Bits in 2017, the crypto subsidiary of the Japanese securities giant, and also setup their trading desk before founding Obolus, a boutique quant consulting agency. He has built a derivative DEX in DeFi prior to joining IPOR Labs but prefers building and modeling frontier markets such as interest rate derivatives for DeFi. Darren and Mau met during his time at SBI Bits in Tokyo.

Engineering Leads:

- Head of Product: Łukasz MuzykaLukasz has been building products from consumer goods to deep tech since 2011, and has been CTO for multiple venture backed startups. He founded developer education communities in Shanghai before returning to Poland as a project manager for enterprise software development. Lukasz and Darren met in Shanghai as part of the same accelerator, and was the first technical hire for IPOR Labs, building the team around his leadership.

- Lead Smart Contract: Mario SzpilerMario has more than 15 years building in enterprise software development and blockchain development. He is a mathematician by trade, capable of managing the tradeoffs of accuracy, security, and complexity within DeFi systems and solidity. Prior to joining IPOR Labs he build software in banking, finance, payments, and insurance. Mario and Lukasz met at the enterprise software development firm.

- Infra and Security: Rafał NowickiRafal has been developing more than 15 years in enterprise software development, from consulting to enterprise software development. He was an early adopter of cloud and focuses on security across all facets of the stack. Rafal and Mario have known each other and worked together across various times in their career rejoining forces at IPOR Labs.

Investment Thesis

DeFi is at a pivotal juncture: traditional finance is no longer just observing, it’s actively onboarding.

The Fusion asset management platform and IPOR rate derivatives are positioned to become a leading solution to bridge TradFi’s appetite for risk-managed yields with the flexibility and composability of DeFi.

Fusion’s permissionless and unopinionated architecture can be highly customized:

- It can power open permissionless DeFi strategies for public vaults

- or enable fully whitelisted vaults with a KYC depositor list and Fuses to permissioned markets only.

Fusion also achieves to solve the notorious conflict of interest that exists between web3 asset managers and vault protocols, whereby the asset managers are required to lose their hedge to publicly encode strategy logic in the vaults’ smart contracts.

Thanks to its modular design and the separation between off-chain execution and on-chain security guardrails to manage the flow of funds, Fusion doesn’t just provide full transparency and strong security guarantees, but it protects the hedge of fund managers, thereby streamlining adoption.

As real-world assets (RWAs) and tokenized securities increasingly move on-chain, we expect demand for stable, capital-efficient yield to soar and we believe that because of all of the above reasons, Fusion will position IPOR at the forefront of DeFi’s transition into mainstream finance.

Moreover, the IPOR protocol already secures over $14 million in unlevered TVL and $60 million in TVM, and these figures do not yet account for many of the 20+ new integrations in their pipeline, that will keep effectively leveraging the TVL up to, potentially, hundreds of millions of dollars, into what they refer to as Total Value Managed, which should be regarded as an important target KPI since the DAO is effectively earning fees (Performance) on it.

Fusion far expands IPOR’s value proposition beyond interest rate hedging and speculation by delivering an AI-ready asset management platform rich in strategies and seamlessly accessible. Its privacy-preserving design, flexible fee structure, lowered technical barriers, and powerful DeFi automation capabilities work in unison to accelerate institutional adoption, establishing Fusion as a comprehensive solution for institutions, professional asset managers, and DeFi power users alike.

Risk Evaluation & Mitigation

Security

- Example: Smart contract exploits, and unauthorized withdrawals.

- Mitigation:

- Immutable vault logic locks in security guarantees for deposited funds, making them tamper-proof even when new fuse modules are implemented as interfaces to new protocols and enable new strategies.

- Modular design isolates risk, ensuring that potential failures in upgradeable components do not compromise the overall system.

- The system has undergone multiple audits (10+) by top-tier firms such as Blocsec, Protofire, Ackee blockchain, and Zokyo

- IPOR Labs' infrastructure team includes software engineers with experience in securing core infrastructure for the banking, payments, and insurance industry.

- Vault Insurance could be added on through Nexus Mutual and other major insurance protocols protecting depositors against smart contract risk.

Governance

- Example: Delays in decision-making or ineffective adjustments to evolving risks.

- Mitigation:

- Thanks to its decentralized governance framework, the IPOR DAO always reacted swiftly enabling community-driven adjustments to risk management parameters.

- Transparent decision-making processes backed by industry-standard governance modules (e.g., Compound) reinforce trust and accountability.

Links

About IPOR

Based in Zug, Switzerland**,** IPOR Labs specializes in the development of blockchain-based interest rate derivatives, DeFi yield management, and benchmarks software.

About Impossible Finance

Impossible Finance is the go-to crypto investment platform that empowers you with high-quality, fair and accessible crypto opportunities. We simplify DeFi so you can enjoy fairer investing, cheaper trading and better yields through our accelerator, launchpad, and swap platform.

Website | Twitter | Discord | Telegram | Blog

Disclaimers

Composed and presented by Impossible Finance Research Team based on information provided by the IPOR Labs team.

- Notes: DISCLAIMERS, TERMS, and RISKS

- Risk Warning: Trading and/or generally investing in any cryptocurrency involve significant risks and can result in the complete loss of your capital. You should not invest more than you can afford to lose and you should ensure that you fully understand the risks involved. Before investing, please consider your level of experience, objectives, and risk tolerance, and seek independent financial and legal advice if necessary. It is your responsibility to ascertain whether you are permitted to use the services of Impossible Finance based on the legal and regulatory requirements of your country of residence and/or applicable jurisdiction(s).

- The information provided on this memo does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such. Impossible Finance does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

- The details provided in this document are summarized from materials provided in due diligence from the IPOR Labs team to Impossible Finance